Buying an HDB flat, be it BTO or resale, can be challenging, especially given the various criteria to meet. But all hope is not lost — having an essential occupier can help you with your HDB flat purchase.

But first, let us explain more about the essential occupier.

Who can be considered an essential occupier?

According to HDB, an essential occupier is a family member listed in the Application Form to form a family nucleus, allowing you to qualify for an eligibility scheme to purchase a flat. It can be for a new flat, like a BTO, or a resale flat.

An essential occupier can be:

- If you’re married: you, your spouse and children (if any)

- If you’re widowed, divorced or separated: you and your children under your custody

- You and your fiance/fiancee

- Orphaned siblings

Being an essential occupier is different from being an owner as they won’t have any share in the flat. But there are a few ways they can help with your HDB flat purchase. Here’s how.

Qualify an eligibility scheme to buy HDB flat

If you can’t buy an HDB flat on your own (e.g. if you’re below 35), you can add a family member as an essential occupier to qualify for a certain scheme.

Public Scheme

Applicable for: New and resale flats

If you’re widowed or divorced and have children under your custody, you won’t be able to buy a flat on your own under the Single Singapore Citizen Scheme until you turn 35.

The good news is that with the Public Scheme, you can buy a flat by listing your children as essential occupiers. As they’re underage, you won’t be able to list them as co-owners.

Learn more about the eligibility criteria for buying new flats here.

Non-Citizen Spouse Scheme

Applicable for: Resale flats

Getting married to a foreigner? Private properties aren’t your only option! As long as you’re a Singaporean and above 21, you can list your foreign spouse as an essential occupier to qualify for this scheme (since foreigners can’t own an HDB flat). Do note that your spouse will need to have a valid pass, such as a Work Pass.

An additional perk is that if your child is a Singaporean or PR, you can apply under the Public Scheme instead. Through this scheme, you’ll be able to qualify for more grants such as the Family Grant and Enhanced CPF Housing Grant. This helps you to reduce the amount to be paid upfront too.

Non-Citizen Family Scheme

Applicable for: Resale flats

Single, below 35 and don’t mind living with your family? If your family members aren’t Singaporeans or PRs, you can still list them as essential occupiers to be eligible for the Non-Citizen Family Scheme. They can be your parents and siblings, or children if you’re widowed or divorced.

Before you submit your resale flat application, make sure that at least one parent or child has a valid Long Term Visit Pass or Work Pass.

Learn more about the eligibility criteria for buying resale flats here.

Apply for a bigger unit

Not many people know this, but yes, having an essential occupier can help you get a bigger HDB flat too!

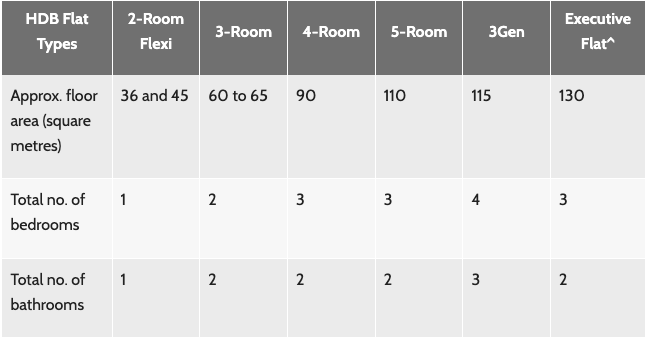

3Gen flats

Applicable for: New flats (since there are no restrictions on flat types for resale)

3Gen units are estimated to have 115 sqm of floor area — 5 sqm extra compared to 5-room units. They’re designed for bigger families, so they come with one more bedroom and bathroom.

And as the name suggests, they’re for multi-generational families. The family unit can consist of either of the following:

- Married/engaged couple and parent(s)

- Widowed/divorced with children under legal custody, care and control and parent(s)

Essentially, this means that you can list at least one Singaporean or PR parent as an essential occupier to qualify for a 3Gen flat.

If you’re applying as a couple, you’ll need to be eligible for the Public Scheme or Fiancé/Fiancée Scheme to apply for a 3Gen flat. If you’re divorced with children, you’ll need to get written approval from your ex-spouse before you can list your children in the application.

Jumbo flats (under Conversion Scheme)

Applicable for: Resale flats

Can’t find a jumbo flat to your liking? DIY a jumbo flat instead, through the Conversion Scheme by doing either of the following:

- Buy a 3-room or smaller flat that’s adjoined to your currently owned 3-room or smaller flat

- Buy two adjoining 3-room or smaller flats

The good thing about this scheme is that it’s not just for those who form a family nucleus with their spouse or parents. If you’re widowed or divorced, you can also apply for this scheme and list your children under your care as essential occupiers to get an HDB jumbo flat. Take note that at least one of the listed occupants is a Singaporean or PR.

Increase BTO ballot chances

Parenthood Priority Scheme (PPS)

Have a Singaporean child aged 18 and below? Or expecting to have a child? If you and your spouse are first-time buyers, you can increase your BTO chances by listing your child as an essential occupier.

Up to 30% of BTO units and 50% of SBF units are allocated under this scheme.

Third Child Priority Scheme (TCPS)

Having more children can also help with your BTO chances. If you have at least three children, you can qualify for this priority scheme. Widowed or divorced parents are also eligible as long as you have legal custody of your children.

Do note that the third child to be listed as an essential occupier must be a Singaporean born on or after 1 January 1987.

Under the TCPS, flat allocation is up to 5% of BTO and SBF units.

Assistance Scheme for Second-Timers (Divorced/Widowed Parents) (ASSIST)

For divorced parents, here’s another priority scheme to take note. If you have at least one child aged 18 or below, you can increase your BTO chances by listing them as essential occupiers.

Through ASSIST, flat allocation is up to 5% of 2-room Flexi and 3-room BTO flats in non-mature estates. This allocation is shared with the 30% quota for second-timers.

Learn more about the BTO priority schemes here.

Qualify for grants/subsidies

Family Grant

Applicable for: Resale flats

For widowed or divorced parents, you can qualify for the Family Grant by listing your children as essential occupiers to form a family nucleus. The caveat is that you’ll need to be a first-timer.

Here’s the maximum grant you can get.

| Household | 2- to 4-room resale flat | 5-room or bigger |

| SC/SC | S$50,000 | S$40,000 |

| SC/SPR | S$40,000 | S$30,000 |

Proximity Housing Grant (PHG)

Applicable for: Resale flats

Planning to live with your parents or children? Listing them as essential occupiers can help you qualify for the PHG. The maximum grant amount is S$30,000 or S$15,000 if you’re single.

Learn more about housing grants for resale flats and Proximity Housing Grant (PHG) here.

Citizen Top-Up

Applicable for: New and resale flats

This is a form of subsidy for Singaporean/PR households who have:

- Paid a premium of S$10,000 to buy a new flat from HDB

- Taken a CPF housing grant that’s S$10,000 less than SC/SC households

They can qualify for the S$10,000 subsidy if the PR owner becomes a Singaporean, or have s Singaporean child.

So if your child is Singaporean, you can list them as an essential occupier to qualify for the subsidy for the HDB flat, instead of waiting for the PR owner (whether it’s you or your spouse) to get citizenship.

Learn more about the Citizen Top-Up here.

What’s the drawback to listing your family member as an essential occupier?

The caveat is that anyone listed as an essential occupier will have to stay in the flat throughout the five-year Minimum Occupation Period (MOP). Plus, they won’t be allowed to own local or foreign property within the MOP.

So listing your child as an essential occupier can complicate things if they intend to buy a BTO or resale within five years. It’s the same with your parents. They won’t be able to buy private property within the MOP if they’re essential occupiers of an HDB flat.

Additionally, listing your spouse as an essential occupier can affect financing since only you’ll be able to use your CPF account and apply for mortgage to pay for the flat.

Or if your spouse is the sole owner and you’re an essential occupier, and in the unfortunate event that your spouse dies without a will, the flat ownership may not automatically go to you. According to the Intestate law, if you don’t have any children, you’ll only get half of the share, while the other half will go towards your spouse’s surviving parents.

Will you add an essential occupier for your HDB purchase? Let us know in the comments below.

If you found this article helpful, 99.co recommends Buying an HDB flat as a single parent in 2021: How to do it and Quick Guide to BTO and Resale HDB Grants for Couples.

Looking for a property to buy or rent? Find your dream home on Singapore’s largest property portal 99.co! If you have an interesting property-related story to share with us, drop us a message here – we’ll review it and get back to you.

The post 4 ways an essential occupier can help with your HDB BTO or resale flat purchase, grants, etc. appeared first on 99.co.