Oftentimes when we talk about buying a flat from the HDB, it’s usually BTO. But it’s not the only way you can buy a flat from the public housing authority. Started in October 2009, the Sale of Balance Flats (SBF) is another mode of buying a flat from the HDB.

SBF is usually launched twice a year in May and November, at the same time as a BTO launch. However, you can only apply for either one, not both, during the same launch.

One of the main reasons why people choose to apply for SBF instead of BTO is the waiting time. BTO usually takes around three to five years. On the other hand, SBF units are either under construction or have been built. So you can move in within four years or as fast as three months.

If you find the BTO wait too long, and resale too expensive, SBF is another option to consider. But before you jump into the SBF application, here are some things to take note.

1. Some of the flats sold through SBF are old

Not all Sale of Balance Flats are under construction or leftover from past BTO sales. Flats sold under the scheme include remaining flats from Selective En Bloc Redevelopment Scheme (SERS) and those given up by owners or even repossessed by HDB. Various reasons for the latter include couples breaking up.

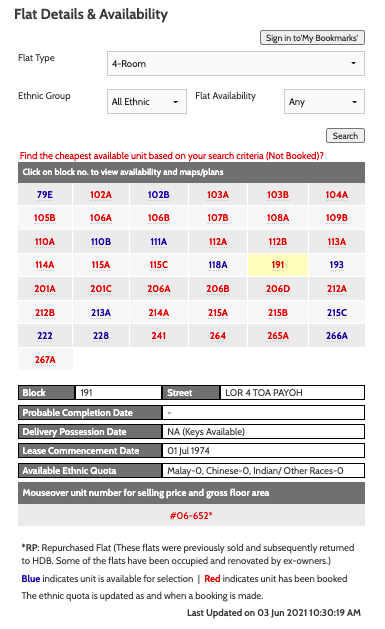

This means that for the flats that have been built, they may even be as old as 40 years old. In fact, we found a Toa Payoh flat to be nearly 47 years old when it’s put up for SBF in November 2020.

(You can read more about it in this article.)

This also means that not all flats under SBF come with a fresh lease of 99 years. So just like if you’re buying a resale flat, you’ll need to take note of the lease decay if you choose an SBF built several years ago.

But here’s the good news if you’re keen on buying an old flat for its larger size. You’ll be able to buy it through SBF at a cheaper price than through the resale market.

For instance, Toa Payoh flats (including the 47-year-old flat) put up for the November 2020 SBF had a starting price of S$220,000 (excluding grants). In comparison, we found a few flats in the same block of the same type selling for S$530,000 to S$560,000, as of writing.

2. Information about the Sale of Balance Flats is only released on the launch itself

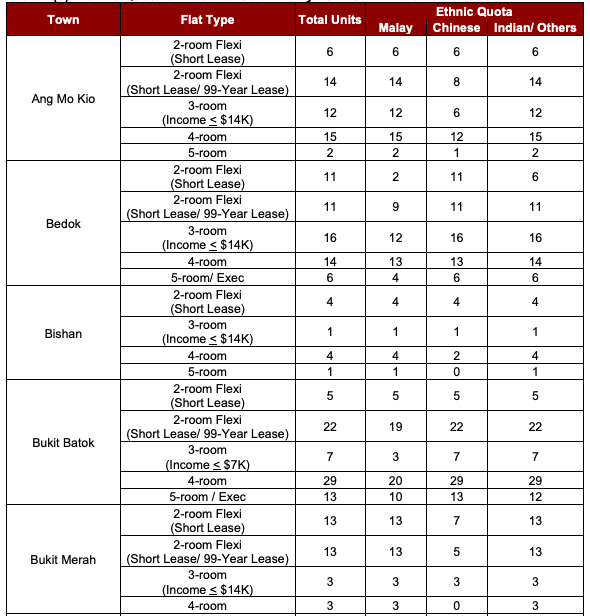

Another good thing about the Sale of Balance Flats scheme is that it doesn’t just comprise four to five locations like in a typical BTO launch. You can find flats of various types spread across the different estates in Singapore, as well as the race quota, put up for SBF.

In the last SBF exercise in May 2021, popular estates like Bishan and Bukit Merah were included as well.

However, HDB only releases information about SBF on the launch itself. This is unlike BTO flats, in which we usually have the info on the exact location, estimated number of units and flat type three months in advance.

So this leaves you with only one week to look through the flats available through SBF and submit the application.

But the plus side is that you get more information about the flats available, right down to the block number and unit number. So you’ll be able to know which flats to avoid (such as those west-facing flats).

3. Not all SBFs are more expensive than BTO flats

The prices of SBFs have been adjusted to market rate, so they can be more expensive than BTO flats. But since they’re under HDB and subsidised by the government, they’re cheaper than resale.

For instance, in the last SBF launch in May 2021, 4-room flats in Tengah were sold starting from S$309,000. This is S$10,000 higher than the starting price for the Tengah BTO in the same launch. And we’re talking about a town that doesn’t have a single project completed yet. It’s still mostly a forest (a real one, that is).

But we’ve also seen cases where the SBFs are cheaper than the BTO flats. A case in point is the 4-room Woodlands flats put up under SBF in May 2021, which had a starting price of S$215,000. In the same launch and estate for the same flat type, HDB was selling the BTO flats S$60,000 higher starting from S$275,000.

4. It’s not easy to get an SBF

The Sale of Balance Flats scheme isn’t as popular as the BTO. After all, the typical Singaporean proposal is along the lines of “BTO ai mai?” and not “SBF ai mai?”

However, despite the “leftover” connotation SBFs have, application rates for flats under the scheme have been very high over the years. For instance, in the last SBF in May 2021, 250 applicants had balloted for five-room flats in Toa Payoh. With only five units available, this translated to 50 applicants competing for one unit.

On top of that, there’s the race quota due to the Ethnic Integration Policy (EIP). Some estates may have more flats set aside for your race. So depending on your race and the estate chosen, you may have a higher chance of securing a flat.

The good thing is that since the race quota is known, you can use it to better gauge your chances.

5. Some SBFs may be undesirable

Since some of these flats are leftovers, they can be located at undesirable locations. They may be on the lower floors, facing the rubbish dump or have an obstructed view. They may even come with inauspicious unit numbers like #04-04 (the number four sounds similar to death in Chinese) or #13-13.

Chances are, the good ones have already been snapped up by those lucky enough to get a queue number through BTO.

As for the repossessed flats, some of them may have been sold to HDB due to financial difficulties. A common issue we’ve heard new home owners face is that loan sharks would turn up to collect the previous owner’s debt.

So if you’re thinking of going for an older flat, it’s best to check out the flat and get a feel of the surroundings first. Look out for signs like newly painted walls (perhaps to cover “O$P$”) or notices on the door.

Unfortunately, unlike resale flats, you won’t be able to go on viewings to see the interior. So you won’t be able to know how much renovation is needed until you get the keys.

But you can still talk to the neighbours to find out more about the flat and its previous owner. This may also give you an idea about the upkeep of the flat.

If you’re more superstitious, you might want to dig a little deeper as well. Some flats may also have been sold to HDB due to murder or suicide.

Should you go for Sales of Balance Flats?

Sale of Balance Flats are a good option to go if the waiting time for BTO is too long. And if you’re looking for a bigger space, you might even be able to secure an older flat through the scheme.

But just like BTO, you need to be extremely lucky to secure an SBF. If you haven’t been able to get a queue number through both schemes and need a flat urgently, there are always resale flats that you can consider.

Would you apply for a Sale of Balance Flat? Let us know in the comments section below or via our Facebook post!

If you found this article helpful, 99.co recommends What you need to know about HDB’s Sale of Balance Flats (SBF) [2021 Edition] and How HDB allocates BTO and SBF flat supply.

Looking for a property to buy or rent? Find your dream home on Singapore’s largest property portal 99.co! If you have an interesting property-related story to share with us, drop us a message here – we’ll review it and get back to you.

The post 5 things you must know before you apply for a Sale of Balance Flat (SBF) appeared first on 99.co.