When you take up a mortgage, there are many documents to read and lots of paperwork to sign. But while it may be tempting to gloss over them in the interest of time, it actually pays to be more diligent in this department – in other words, read the fine print (or the home loan fact sheet, in this case).

In 2012, the Monetary Authority of Singapore (MAS) made a mandatory requirement for financial institutions to provide and explain a residential property loan fact sheet to borrowers before giving them a home loan. The home loan fact sheet contains concise information that can help you decide whether to get a loan or not from a specific provider, as well as information about how mortgage repayments can change depending on interest rate adjustments.

If you’re looking to buy a home, perhaps for the first time, or at least the first time after 2012, this article will help you understand some of the things you may encounter in the fact sheet that every lender will be showing you when you shop for a mortgage. As an example, we’ll be using this sample residential property loans fact sheet template, issued by the Monetary Authority of Singapore (MAS).

Each bank will do up their own factsheet, but by and large the information they present will be similar to this sample template.

Here’s a quick run-through of the fact sheet.

Want to save more on your home loan? Compare the best mortgage rates on PropertyGuru Finance, or contact us for more personalised advice and recommendations:

Home Loan Fact Sheet: Explained by Section

A home loan fact sheet provides key information that borrowers need to know, such as the loan amount, residential property loan tenure, repayment schedule, and more, broken down in detail for fuller transparency.

A typical fact sheet will cover six areas, which we’ll describe below.

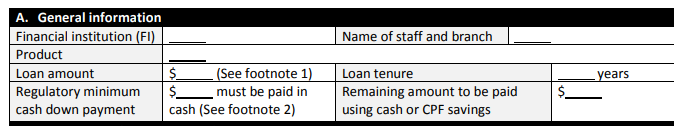

Section A: General Information

The first section of the home loan fact sheet will come to you filled out with the basic information about the mortgage offered to you or that you’re applying for. It will also have the name of the bank or financial institution, the bank’s staff and branch, the loan tenure, the minimum cash downpayment required, and the remaining downpayment that can be paid using either your CPF savings, cash or both.

These are the basic parameters of the mortgage you’re applying for, or enquiring about.

Section B: Description of Interest Rates for Loan and Repayment Details

This section focuses on the key figures, durations, and percentages that you will want to know about in your loan, because they turn into dollars and cents over time. Here are some of the key highlights you will find yourself looking out for in this section:

Lock-in period

The lock-in period refers to the number of years you will be “locked in” to the mortgage and not allowed to redeem the loan or refinance, dating from the date of the first loan disbursement. It helps to ensure that the bank would receive a fair financial return from the amount they’ll allow you to borrow. There are several rules attached to the lock-in period (for example, paying for penalties if you choose to refinance or sell your property before the lock-in period ends) and this will tell you how long you will be subject to these restrictions.

Repayment schedule and estimated payments

The repayment schedule lays out the projected loan interest rates for the life of the home loan, and the changes in your monthly repayments and total repayment based on reference rate (e.g., SIBOR, SORA), spread (the amount you have to pay the bank on top of the reference rates) and the principal amount.

As its name suggests, the repayment schedule lays out how your loan will be repaid, and by how much, over time.

A typical fact sheet repayment schedule will cover your mortgage up to the end of your lock-in period. It will declare the interest rates charged during and after the lock-in period, as well as how that interest rate is calculated, including the benchmark rate (such as SIBOR, SORA, or an internal rate) that it takes reference from. It will also detail any anticipated changes in monthly instalments over this period.

For those most concerned about long-term cost, this section of the factsheet also simplifies matters by showing you how much you would be estimated to pay back for every $1 you borrow.

Interest rate schedule

In the event that the lender projects changes to the interest rate spread (the amount added on to the reference rate) or the reference rate itself (if they have the authority to do so unilaterally, such as in the case of internal fixed deposit rates), they will declare it here to give you an idea of how the interest rate may change subsequently.

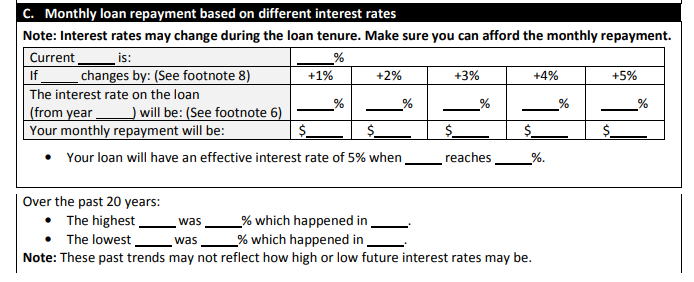

Section C: Monthly Loan Repayment Based on Different Interest Rates

In this section, the bank provides an interest rate sensitivity analysis.

Home loan interest rates may vary throughout the loan tenure so be sure that you prepare beforehand to afford possible adjustments. Although no one can predict how interest rates will ultimately fluctuate, this section lays out how your instalments may change in case of different levels of interest rate increase.

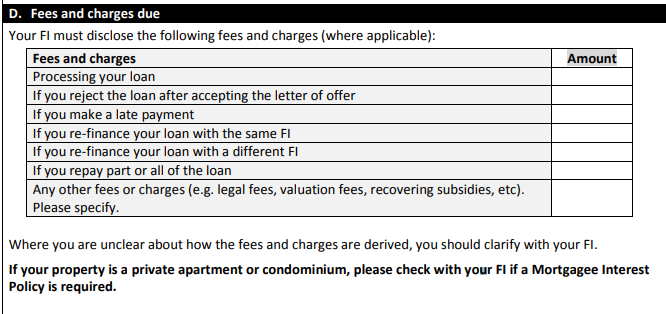

Section D: Fees and Charges Due

This part of the fact sheet details other fees and charges that you also need to be aware of when buying a home in Singapore aside from your loan repayments. These could include items such as the following:

- Loan processing fees

- Loan rejection fees upon accepting letter of offer

- Late payment charges

- Refinancing charges with the same financial institution

- Refinancing charges with a different financial institution

- Charges for repaying a part of the loan or the loan in full

- Other fees or charges (i.e. legal dues, recovering subsidies, valuation fees, etc.)

If you’re planning to pre-pay sums during your loan tenure in order to reduce interest rate, for example, it would be important to take careful note of this section.

Section E: Footnotes

In this section, you’ll find certain explanations regarding changes in loan amounts and cash down payments based on the Loan-to-Value (LTV) ratio, and valuation prices. You may also find notes that provide further explanations and conditions regarding some technical terms above, such as reference rates, lock-in periods, SIBOR, SOR and more.

Section F: Important Notes

Finally, the last section of the home loan fact sheet contains additional information and reminders about your home loan and the homebuying process as a whole. For instance, this section contains information about using your CPF savings to pay for your monthly repayments, as well as some steps you can take if you miss a monthly repayment. It also provides reminders on how you can avoid such situations.

Be Sure to Read Your Home Loan Fact Sheet Carefully

As you can see, there is a lot of information in this plain document!

Before signing on the dotted line, you should always go through the fact sheet to ensure that you know what you’re agreeing to, and to be sure that this is really the right mortgage for you. If something isn’t clear, whether it’s about the figures or a technical term, don’t hesitate to approach a bank representative for clarifications and keep them in check throughout the entire process.

Alternatively, you may reach out to PropertyGuru Finance’s home loan advisors if you need help interpreting some information on the fact sheet, or if you need help in finding the right mortgage for you. Our experts have years of experience in the mortgage realm so they can easily help you analyse your situation and provide solutions based on your needs and goals.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyGuru will endeavour to update the website as needed. However, information can change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyGuru does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyGuru, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.More FAQs on Home Loan Fact Sheets

What is Loan Fact Sheet?

The residential property loans fact sheet is a compulsory document mandated by the MAS. It contains important information about your home loan.

What Would A Client Expect to Find in A Home Loan Key Facts Sheet?

There are six main sections: general information, description of interest rates for loan and repayment details, monthly loan repayment based on different interest rates, fees and charges due, foornotes and important notes.

How Do I Choose A Home Loan Tenure?

This depends on your financial situation and priorities. Generally, a longer tenure would mean paying higher interest costs but lower monthly repayments. It’s best to speak with a home loan advisor if you’re unsure.

Which Bank is Best for Housing Loan?

There is no single best bank for home loans. The answer will depend on the current packages available, your unique financial situation and personal preferences. We recommend you speak with a home loan advisor if you’re unsure.