In my previous two articles, I covered the topics of homeownership for LBGTQ+ when they first start out in their 20s -30s, and in middle age years of 40-50s. The LGBTQ+ community has a very different life path as compared to their straight counterparts, and we have learnt that when it comes to homeownership, their options and goals are very different too. In this final part, we will look at home options for LGBTQ+ when they are planning for, or during retirement.

Like many developed first world nations, Singapore is currently facing an increasingly ageing population, caused by increased life expectancy coupled with decreasing birth rates. By 2035, it was estimated that around 32 per cent of Singaporeans will be aged 65 and above, while the median age is also expected to rise from 39.7 in 2015 to 53.4 in 2050. This demographic shift places pressure on Singaporean society as a shrinking workforce struggles to support an ageing population.

While most people could turn to their family and children for support in their later years, LGBTQ+ elders face a very different fate. They are mostly single, and if they are lucky, they may have a partner to live together with. However, without legal gay marriage in Singapore, LGBTQ+ couples have limited rights to each other’s financial and healthcare matters unless proper LPA and wills have been drafted.

When it comes to homeownership, most (LGBTQ+) people above 60 years of age will unlikely buy a new property as an investment. Be it an HDB flat or private property, if they had invested in property early when they were younger, they may be sitting on a property with good capital gains over the years. But unlike their straight counterparts who have to think about leaving behind their estate to their children, grandchildren, etc, most LGBTQ+ individuals will not be planning major legacy succession.

Retiring comfortably in Singapore is expensive, especially with the increasing cost of healthcare today. And for the elderly LGBTQ+ community, it is even more crucial to have a well thought out retirement plan that allows them to be self-sufficient, to live comfortably and have enough retirement funds to cover their living and health expenses till their final days.

Some things to consider at this stage of their life are:

- Do they want to live in their current property forever?

- Or do they want to rightsize to a smaller unit?

- Do they need to leave behind their estate (and property) to anyone after they pass away? Do they have a partner or next-of-kin to share their estate with?

- Are there ways to generate more retirement funds from the current property?

Let’s take a look at what options are there in both the public and private housing for the ageing LGBTQ+ community.

PUBLIC HOUSING (HDB)

Fortunately, our government has several housing policies to aid our senior citizens in Singapore. And for the elderly LGBTQ+, if they had leveraged on the Singapore Single Citizen or Joint Singles Scheme, they will be owning an HDB flat by the time they are in the 60s, or some might have inherited a flat from their parents.

For those who would like to remain in their current HDB flat:

Lease Buyback Scheme (LBS)

For seniors who want to remain in their existing flat, they can make use of the LBS to unlock the value of their property and receive a stream of income in their retirement years, while continuing to live in it. Under the LBS, the flat owner sells part of the flat’s lease to HDB and choose to retain the length of the lease based on the age of the youngest owner. The proceeds from selling part of the flat’s lease will be used to top up the CPF Retirement Account (RA) which is used to join CPF LIFE, which will provide a monthly income for life.

To qualify for the LBS, the following conditions must be met:

|

Criteria

|

Eligibility

|

|---|---|

|

Age

|

All owners must have reached the eligibility age (currently set at age 65) or older

|

|

Citizenship

|

At least one owner must be a Singapore Citizen

|

|

Income

|

Gross monthly household income of S$14,000 or less

|

|

Flat type

|

All flat types except short-lease flats, HUDC, and Executive Condominium units

|

|

Property Ownership

|

No concurrent ownership of second property

|

|

Minimum Occupation Period

|

All owners have been living in the flat for at least 5 years

|

|

Minimum Lease

|

At least 20 years of lease to sell to HDB

|

Subletting The Extra Rooms

Another way to supplement retirement income is to sublet any extra rooms to get some rental income. This works well for those who are living in a 4-5 rooms HDB flat with extra rooms and bigger space to be shared with someone. A typical HDB common bedroom can easily fetch about S$600-800/mth, and an ensuite master bedroom can be rented for S$900-$1100, depending on location.

That said, finding a matching tenant who is LGBTQ+ friendly is important. LGBTQ+ friendly rental is currently not common in Singapore, although there is an increasing number of LGBTQ+ individuals who are moving out of their home to seek rental housing.

Property portals like 99.co has recently introduced a ‘Diversity Friendly’ tag that property owners and agents declare their support for inclusion and diversity when creating listings on the online portal.

The tag states that all renters or buyers are welcome regardless of race, ethnicity, religion, age, gender identity, sexual orientation or physical ability. Additionally, LGBTQ+ landlords and tenants can also turn to these are two privately round Facebook groups Singapore LGBTQ Property Listing and Queer/Trans Housing Singapore for a safe space to look for matching housemates.

For those who are considering to right-size to a smaller flat.

Silver Housing Bonus (SHB)

Elderly flat owners can consider leveraging on the Silver Housing Bonus to receive some cash bonus to fund their retirement. Under the SHB scheme, elderly flat owners can supplement their retirement income if they’re selling their current flat or private property with an annual value of not more than $13,000.

This is for seniors who desire to move out of their current flat and purchase a 3-room flat or smaller. Successful applicants can receive up to S$30,000 cash bonus when they top up the proceeds into their CPF Retirement Account (RA), and join CPF LIFE.

You are eligible for the SHB if you meet the following criteria:

|

Criteria

|

Eligibility

|

|

Age, Citizenship

|

At least one owner is a Singapore Citizen aged 55 or above

|

|

Income

|

Gross monthly household income is within $14,000

|

|

Existing Property

|

|

|

Property You Are Buying

|

|

|

Timeframe between the Housing Transactions

|

Booking of new HDB flat, or application to buy resale flat must be:

|

|

Timeframe to Submit Application

|

Application must be submitted within one year from date of completion of the second housing transaction (sale or purchase)

|

BTO – 2 Room Flexi short lease

- For seniors who wish to rightsize to a smaller unit, there is also the option of buying a 2-room Flexi Short Lease from HDB under the BTO scheme. Under this scheme, elderly citizens have the flexibility of choosing the length of lease on their 2-room flat, based on their age, needs, and preferences. If they are aged 55 and above, they can take up a lease of between 15 and 45 years in 5-year increments, as long as it covers them up to the age of at least 95 years.

- A typical 2-room Flexi flat is about 46 sqm (495 square feet) and comes with 1 bedroom. They are designed to be fully functional to meet the needs for basic furniture placement and comply with Universal Design requirements. Elderly buyers of these flats can also opt for the Optional Component package, which includes a folding door among other senior-friendly fittings. And thanks to the Senior Priority Scheme, at least 40% (minimum of 100 units) of the two-room Flexi flats are reserved for seniors.

- For those opting for this option, it is good to know if the Silver Housing Bonus applies if they meet the eligibility criteria. On top of that, if the senior buyer is a first-time buyer from HDB or has never received any HDB Housing grant before, they may still qualify to get additional grants during this purchase.

Community Care Apartments (CCA)

- In recent years, the MND, MOH and HDB have jointly launched another housing option for seniors called the Community Care Apartment. It integrates senior-friendly housing with care services that can be scaled according to care needs and social activities to support seniors to age independently in their silver years within the community. The first Community Care Apartments was launched in the BTO Feb 2021 and located in Bukit Batok. This is the first housing development of the HDB under the Assisted Living concept. Here, seniors purchase an HDB flat with a basic service package that includes proper care and assistance with activities of daily living. In line with the Enhancement for Active Seniors (EASE) programme, the community care apartments and other types of studio apartments for seniors can be installed with senior-friendly features such as grabs bars, ramps, and slip-resistant flooring. This is to ensure the safety and comfort of the elderly residents as they go through their day-to-day activities.

- The price for CCA ranges between S$40,000 for a 15-year lease to S$65,000 for a 35-year lease. These are required to be paid fully with cash or with funds from the senior’s Central Provident Fund (CPF).

PRIVATE HOUSING

For the LGBTQ+ elders who could afford private housing earlier, they will likely see good paper gains on their property value over the years.

However, due to the high value of private properties, many seniors will have their assets locked in the property, leaving them “asset-rich, but cash-poor”. Additionally, some of them might have used up a significant portion of their CPF to fund the property thus reducing the amount they have in their CPF Retirement Account for retirement.

It is very important for LGBTQ+ seniors to plan their retirement carefully to have enough liquid assets to support living and healthcare in their twilight years. As most LGBTQ+ will not have dependents to pass on their legacy, it will make little sense to lock a large part of their assets in property instead of having more cash to enhance their retirement lifestyle.

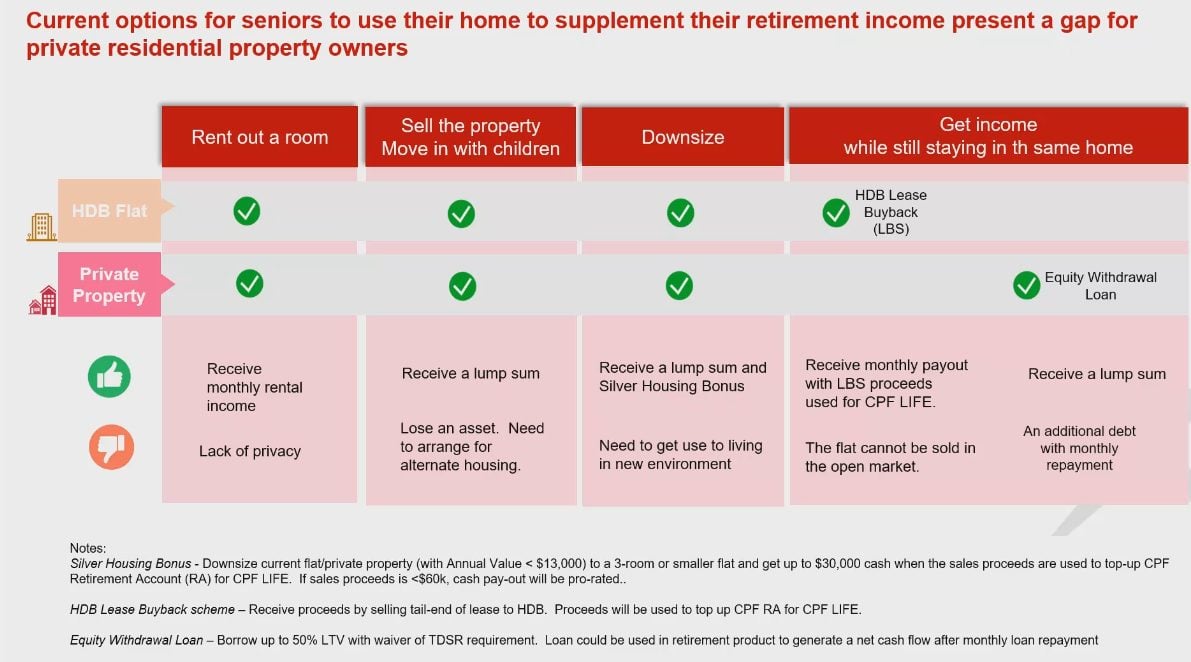

Although our government does not extend the HDB senior housing schemes to private property, there are some similar financial products in the market that private property owners can consider.

Reverse Mortgage

A reverse mortgage is essentially a secured loan against a property that enables a homeowner to access the equity in the property without having to sell it.

In layman terms, a reverse mortgage allows a homeowner to receive monthly payments (like an annuity) which is actually the money they have in the property’s value. At the end of the loan, the borrower will need to pay back the full amount he’s received, with interest; this is usually done by selling the house to repay the loan.

The concept of a reverse mortgage is common in many developed countries but commercial reverse mortgages in Singapore were only introduced by the local insurance co-operative (NTUC Income) in 1997, followed by some local banks.

However, the demand for it has not been good, perhaps because people have the traditional mentality of leaving their property to their loved ones after they passed away, and the idea of a reverse mortgage makes them fear losing the property.

Nevertheless, the features of a reverse mortgage can be very attractive for LGBTQ+ seniors who do not worry about legacy and could benefit from the additional retirement funds to live a more fruitful life.

DBS Home Equity Income Loan (DBS EIL)

Launched in Aug 2021 jointly by DBS and the CPF Board, the DBS EIL is a form of reverse mortgage that allows seniors to borrow against their fully-paid private residential property to top up their CPF Retirement Sums which will be used for the CPF LIFE scheme, allowing them to receive monthly payouts to supplement their retirement funds for as long as they live.

DBS EIL is available to Singapore citizens and permanent residents aged 65 to 79, and who own and live in a fully paid up private residential property in Singapore. Designed with comprehensive safeguards to protect borrowers’ interests, DBS EIL aims to help seniors unlock the value of their housing assets while being able to continue living in their homes.

Key features and benefits include:

- Loan period of up to 30 years – till the customer (or youngest borrower in the case of a joint loan) reaches 95 years old.

- Fixed interest rate of 2.88% p.a. throughout the loan period

- No monthly loan repayments, with the loan amount and accrued interest payable only at loan maturity

- The long loan period also means that customers retain the flexibility to sell their property anytime if they so wish, and to repay the loan without a penalty fee

- If there is an early termination of the loan (such as borrowers passing on during the loan period) or if borrowers outlive the loan, DBS will further commit to not repossessing the property until after it exhausts all other mutually acceptable options with the borrower or their estate.

In summary, the LGBTQ+ community should plan for different life stages as they grow older, and make mid and long term plans so that they are able to retire comfortably without worry.

There are plenty of housing options for LGBTQ+ seniors and ways to increase their retirement fund. However, the important point is to start early and invest in a home earlier in life – instead of overspending on rental.

Contrary to what many think, buying a place in Singapore is not impossible, they can seek advice from an LGBTQ+ affirming realtor or financial adviser to help work out a plan to buy an HDB flat or invest in a private property. Remember this, a property asset will always be a good source of retirement funds in the silver years.

About the Author

William Tan is a licensed realtor with a speciality in servicing the LGBTQ+ community. He is also the co-founder of Prident, a non-profit LGBTQ+ professional collective aimed at helping the community on economic wellbeing issues. William regularly writes and runs webinars to share his knowledge on property investment for LGBTQ+ and has been featured in EdgeProp Singapore, The Edge, Stacked Home, Esquire magazine and The Financial Coconut podcast. He has helped many LGBTQ+ clients with their property portfolio – market to sell, buy and rent properties. He also runs an online LGBTQ+ Clinic to answer private questions from the community.

Read more on PRIDENT here.

–

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post LGBTQ+ Guide: Home ownership for LGBTQ+ seniors appeared first on 99.co.