Oftentimes, we read about new launch condos with take-up rates of 90 to 100% of total units sold within the first week or two of launch – if not within a day or two. There are many reasons for their popularity: lower quantum, location, developer cred, attractive psf pricing, lifestyle promise, etc.

However, we also know that a large proportion of these condos comprises one- and two-bedroom apartments, which make them ideal for property investors looking to purchase a 2nd or 3rd property for higher rental yield. It’s probably a slam dunk if the project is near a major transportation hub, amenities, business parks and offices.

Most tenants aren’t bothered if the project is near a cemetery or prison complex, as long as there’s no noise, pollution or disruptions to their lifestyles.

So it would be great to revisit some of these past launches and see how their “sold-out” units performed in the rental and resale market since then.

The Inflora

Tripartite Developers’ The Inflora sold nearly two-thirds (at least 250) of its 396 units on the first day of launch in October 2013.

Located at Flora Drive, Pasir Ris, the 99-year leasehold project was developed by a consortium that included Hong Leong Holdings, City Developments and TID (JV between Hong Leong and Japanese developer Mitsui Fudosan). It TOPed in 2017.

The first-day sale was a welcome relief to marketing agents then.

One reason for the concern was that The Inflora was located near Changi Prison Complex, which might make marketability a challenge to some buyers. However, landlords know this wouldn’t be a problem for short- to mid-term tenants, especially those working at SATS Maintenance and Inflight Catering Centre (which have offices nearby) and Changi Airport.

What’s of greater concern was this: MAS had just introduced the Total Debt Servicing Ratio (TDSR) on 29 June 2013. Set at a threshold of 60% then, the TDSR would have given prospective homebuyers pause as it may affect their ability to secure a home loan (if they have many other debts to service).

But based on the turnout, that didn’t seem to be the case.

With all 128 one-bedroom and 136 two-bedroom units selling out on Day 1, one reason was that the psf prices were attractive. For instance, a 474 sqft one-bedder was going for S$455,500 (S$960 psf). Contrast that with D’nest, another 99-year leasehold condo in Pasir Ris, which was selling its 484 sqft one-bedder at around S$1,041 psf that same period.

If we look at how well the one- and two-bedroom “sold out” units at The Inflora have performed after nine years, the average psf price for one-bedroom units has done well, rising 23.16% from S$1,005 psf to S$1,238 psf. Even during COVID in 2020 and 2021, one-bedders stayed above the S$1,000 psf mark, registering its most recent lowest at S$1,114 in 2019.

For the two-bedroom units, the story’s different. The average psf price has increased by a much lower 5.10% from S$948 to now S$996. For investors, it doesn’t look like a good time to sell their 2-bedders anytime yet, so what can they do?

If we look at the past rental transaction trends of both room types at The Inflora, the average rental prices of 2-bedders at The Inflora have surged 24.30% since 2016 – outpacing one-bedders.

This could mean that demand for 2-bedroom apartments for rent are higher compared to 1-bedders but there is a much lower supply (judging by the volume) between the two unit types. So if you’re a 2-bedroom owner at The Inflora, it’s probably better to rent it out.

–

–

–

The Hillford

The 281-unit Hillford at Jalan Jurong Kechil, Upper Bukit Timah, launched in January 2014.

It sold out within five hours on its first day – quite a feat for the first 60-year leasehold private condo of its kind. Labelled as a retirement resort, it saw overwhelming demand from investors – both young and old.

Prices at the launch started from S$388k (S$975 psf) for a 398-sqft one-bedroom unit and from S$648k (S$986 psf) for a 657-sqft two-bedroom dual-key unit. The development was meant to also include medical clinics and communal living facilities since URA had wanted the site to be a private retirement housing project.

When The Hillford site was released in 2008, it had no takers initially (one reason being it was more for a retirement community and that connotation may not sit well for developers). However, in 2012, the site was released with special conditions, where developers can offer 30-, 45- and 60-year lease options.

Developer World Class Land beat 22 other rivals to clinch the tender with a S$73.8m bid. When the condo was completed in 2017, its unique selling points included a 24-hour concierge service, full-time resort manager and elderly-friendly features like emergency alarm systems and non-slip flooring.

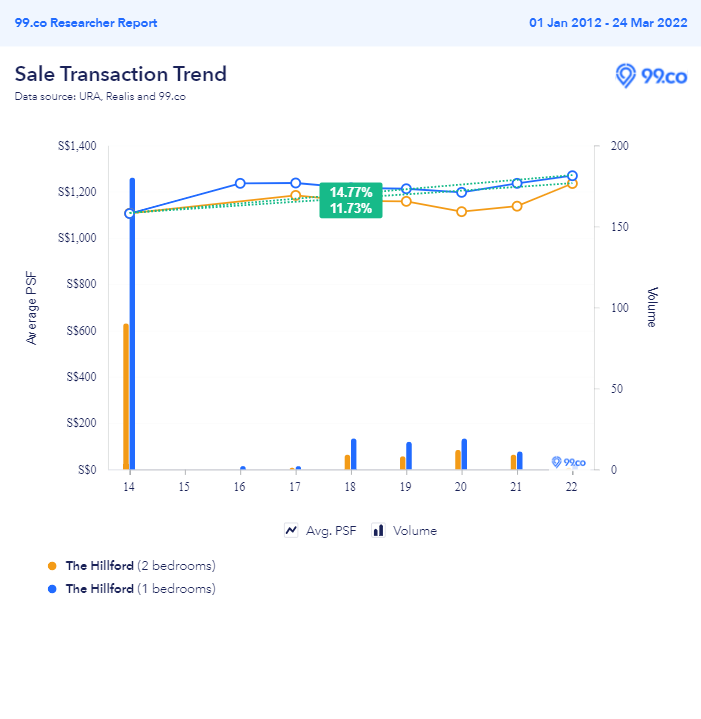

Following its launch, the average psf pricing for its one- and two-bedroom units have remained steady over the past eight years. One-bedders registered slightly higher growth at 14.77% from S$1,106 to S$1,269. Two-bedders saw an 11.73% growth from S$1,106 to S$1,235.

As these unit types are usually rented out, the 2-bedders have seen their average rental price appreciation staying flat compared to their 1-bedder counterparts. In other words, as recent as just the past two months, tenants are willing to pay near-equal rental price for a smaller 1-bedder at The Hillford as they would a 2-bedder!

So, not only are 1-bedder-owning landlords seeing better resale value on their apartments but rental prospects as well.

–

–

–

J Gateway

Launched in July 2013, J Gateway was another popular condo development that almost sold out on its launch day.

According to media reports, about 1,400 blank cheques were placed with developer MCL Land the day before launch and 1,500 people turned up for balloting. That’s quite a crowd, considering the new TDSR restrictions just kicked in on 29 June that year.

Before the end of the first day, 736 of the 738-unit condominium was snapped up. One-bedders were sold at S$1,573 psf, while four-bedders went for S$1,400 psf.

Many of the homebuyers were people who lived in the Jurong East neighbourhood and were drawn to J Gateway because it was right next to Jurong East MRT and bus interchange. It was also a short walking distance to malls like JEM, Westgate, Big Box, IMM and JCube.

As it was near the International Business Park, J Gateway buyers saw the rental potential as well. There was also the initial promise of the High-Speed Rail (HSR) terminal with Malaysia.

But how has it performed since then? In the nine years since its 2013 launch, J Gateway’s one-bedroom units have seen their average psf price rise 18.04% from S$1,573 to S$1,857 psf. Two-bedrooms did better, with a 27.31% rise in average psf pricing from S$1,476 to S$1,879. This was followed by three-bedroom apartments, rising 22.88% from S$1,445 to S$1,776.

But how has it performed since then? In the nine years since its 2013 launch, J Gateway’s one-bedroom units have seen their average psf price rise 18.04% from S$1,573 to S$1,857 psf. Two-bedrooms did better, with a 27.31% rise in average psf pricing from S$1,476 to S$1,879. This was followed by three-bedroom apartments, rising 22.88% from S$1,445 to S$1,776.

The lowest 13.19% rise came from four-bedroom apartments, from S$1,400 to S$1,580 in 2021.

Barring COVID, the lower transaction volume could also be a sign that most J Gateway owners are holding onto their units long term due to the potential developments in Jurong East (and nearby Jurong Lake District). For example, no one yet knows what’s to become of the former Jurong Country Club 67-hectare land after it was purchased to make way for the now-shelved HSR terminal.

Another cluster of condos? A mixed-use shopping mall-residential-cum-theme park? More HDB flats? Your guess is as good as ours.

One thing’s for sure, the ever-increasing average rental prices over the past five years show how popular J Gateway is as a rental haven. While 1- and 2-bedroom units remained popular in volume, it is the 3-bedroom unit that commanded the most appreciation in rent (increasing 39.03% to S$4,400 a month).

This is followed by 2-bedroom units (28.62%), 4-bedroom units (20.67%) and 1-bedroom units (19.63%).

–

–

Clearly, our condo examples with sold-out launches have commanded higher resale values over time – most in double-digit growths as of today.

The 2-bedroom unit type at The Inflora seems to be an exception, with an average psf price appreciation of 5% compared to its one-bedroom counterpart. With its lower sales volume and higher rental appreciation, it could mean two-bedder landlords are holding out longer than one-bedroom owners before reselling.

If you’re the owner of a 1-bedroom apartment at The Hillford, you’re having the best of both worlds. Not only is your average psf pricing growth higher than a 2-bedder, but your average rent is also almost equal to a 2-bedroom apartment.

For J Gateway, it’s clear 2-bedroom and 3-bedroom investors are in their very own sweet spots – with a 27.31% and 22.88% average psf price appreciation, respectively (if they want to sell), and a 28.62% and 39.03% increase in rent (if they prefer to lease out their apartments).

–

Which other new launch condos with fast take-up rates have performed well in the resale market? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, check out Family sold Pinnacle@Duxton 5-roomer to be closer to Bukit Timah schools and 5 unexpected mistakes homebuyers make when buying a condo.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebook community page! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post Do new launch condos with fast take-up rates perform just as well in the resale market? appeared first on 99.co.