One of the first things property buyers must decide on is the type of home loan to take. In Singapore, these are the two major types of property loans that banks offer: fixed rate loans and floating rate loans.

There’s no better loan per se, but depending on your personal circumstances one or the other might be a better choice. Whether you’re looking to get a green renovation loan for an eco-friendly home or a mortgage to finance your home, this guide will come in handy.

We’ll give you more info so you can make a more informed decision. Hint: it’s not just about the interest rate percentages!

Interest rates are set to rise in 2022, so act now! Refinance your home loan to secure record low mortgage rates while you still can.

Check out SmartRefi to track your mortgage against daily rates and be notified of the best times to refinance, or speak to PropertyGuru Finance mortgage experts for unbiased advice and recommendations.

Home Loans Singapore: a Brief Background

There are more than 20 bank and non-bank institutions offering property loans in Singapore, and each one tries to convince you that theirs is the best deal. Before committing to a type of home loan (and the lock-in period that comes with it), it’s worth knowing how each type of loan works and the pros and cons of each.

Think of it as buying a durian; home loans might all look the same to the uninitiated, but prise them apart and you’ll see big differences, and some might not be to your taste. So you have to do your homework to make sure you’re getting a loan that’s good for you.

Not sure how? Start by comparing interest rates on the PropertyGuru website or contact our friendly home finance advisors for help.

What Is a Fixed Home Rate Loan?

Contrary to what its name may suggest, the interest rates of a fixed home rate (FHR) loan in Singapore typically only remain fixed for two or three years.

After the fixed interest rate period is over, the interest rates for the FHR loan will be pegged to SIBOR, FDR or other reference rate determined by the bank, which may have an equal or higher interest rate than a floating rate home loan, depending on bank spread.

The bank spread is the additional percentage that the bank earns from you in addition to the cost of lending you the principal.

The typical lock-in period of an FHR loan matches the period of fixed interest rate. (We’ll explain what lock-in periods are later in the article.)

Related article: Housing Loans Guide: “Chim” Mortgage Jargon, Compiled and Explained for Beginners

Fixed Home Rate (FHR) Loan: Who Is It For?

- Homeowners with low-risk appetite in the near term

- Homeowners who want certainty in a volatile interest rate environment

- Homeowners with a tight fixed budget for a mortgage in the near term

- Homeowners who are willing to go to the effort and expense (about $3,000 worth in legal fees) to refinance their property after the fixed rate period is over

- Landlords who want to keep mortgage repayments constant for ease of financing

What Is a Floating Rate Home Loan?

A floating rate home loan implies that the interest rates of the loan are subject to periodic adjustment, the frequency of which depends on the type of floating rate home loan you take. When the interest rate changes, your monthly instalment amount may change.

In Singapore, a floating rate home loan can be either a Singapore Interbank Offered Rate (SIBOR)-based loan, Singapore Overnight Rate Average (SORA)-based loan, or a Fixed Deposit Based Rate (FDR) loan.

The lock-in period for floating rate loans is typically two years. Floating rate home loans may have more relaxed rules on partial repayment during the lock-in period.

Now, let’s talk about the types of floating rate home loans: SIBOR, SORA, and FDR home loans.

What Is a SIBOR-based Home Loan?

This is a floating rate home loan that is pegged to the Singapore Interbank Offered Rate, or SIBOR. When banks lend each other money in Singapore, they do it at the SIBOR-defined interest rate, which is set by a panel of 20 banks (minimum 12) in Singapore under The Association of Banks in Singapore (ABS) using a trimmed arithmetic mean (bell curve) method.

It may sound complicated, but such a process is certainly seen as a fairer way of determining home loans, as SIBOR is collectively set by multiple banks and typically highly correlated to interest rates set by the US Federal Reserve, which is seen as the global benchmark of interest rates.

For the property buyer, SIBOR-pegged home loans are a formula comprising of the SIBOR rates and bank spread. There are typically two types of SIBOR-pegged loans:

1-month SIBOR-based home loan

- (Bank spread + 1-month SIBOR rate)

- Rate changes every month

3-month SIBOR-based home loan

- (Bank spread + 3-month SIBOR rate)

- Rate changes every 3 months

SIBOR-based Home Loan: Who Is It For?

- Homeowners who have factored in a buffer in their housing budget for interest rate increases

- Homeowners who expect interest rates to trend down instead of up

What Are SORA-based Home Loans

In 2020, banks have begun offering SORA-pegged housing loans. SORA rates are backward-looking overnight rates. As compared to SIBOR and SOR (which are both forward-looking rates), SORA rates are considered more stable.

Eventually, SIBOR and SOR will be phased out.

Related article: SIBOR vs SOR vs SORA: What Do These Rates Mean for Your Home Loans?

What Is a Fixed Deposit Based Rate (FDR) Home Loan?

Another type of floating rate home loan is the FDR home loan. This loan is pegged to the lender bank’s fixed deposit rates with a bank spread. Interest rates for FDR loans may change at any time at the lender bank’s discretion (with a 30-day advance notice period).

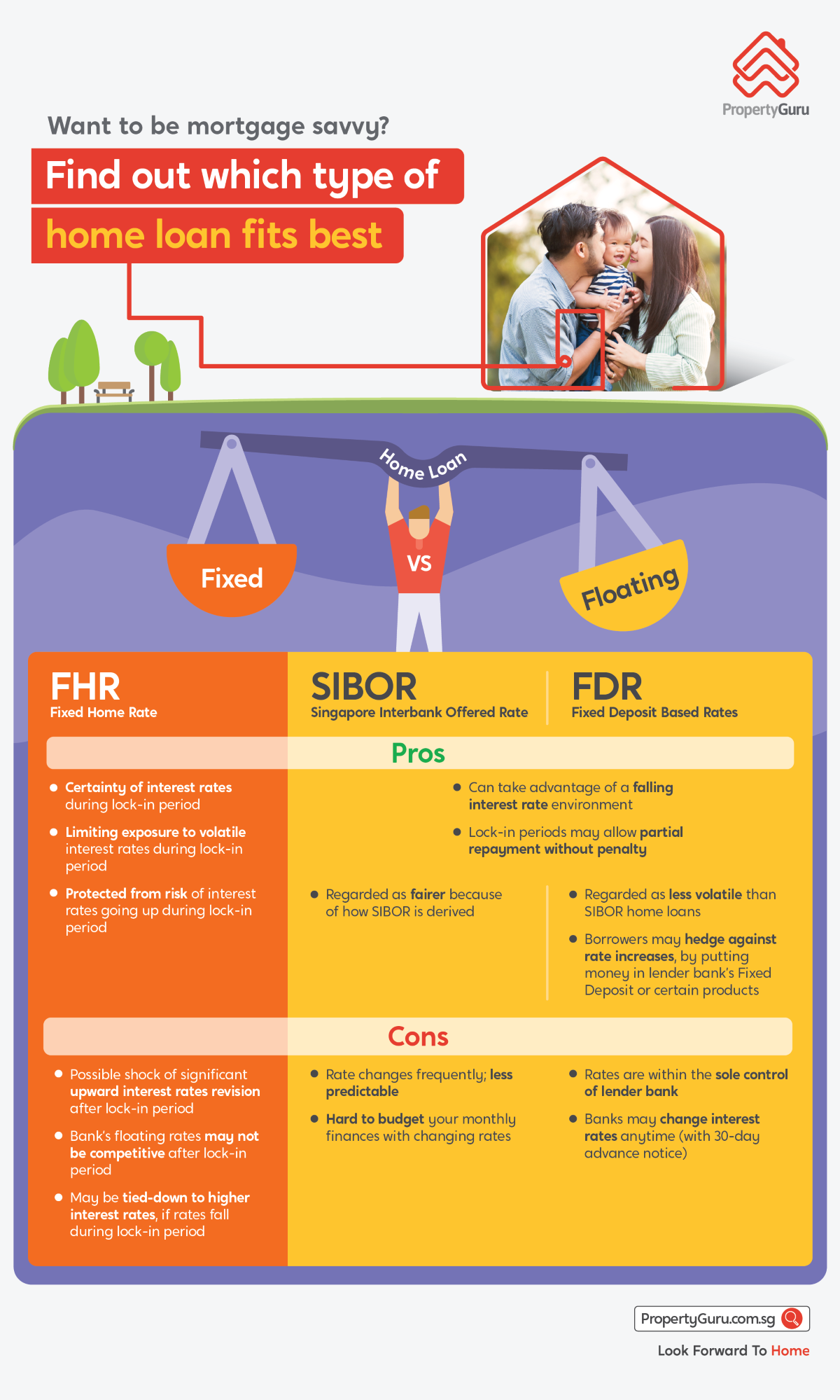

The below rundown on the pros and cons of each type of home loan may help you make a better decision:

Below are some homeowner scenarios to help you choose the type of home loan suited to you.

FDR-based Home Loan: Who Is It For?

- Homeowners who want a sense of control, as FDR home loans let them undertake a hedging strategy to minimise interest rate volatility

What Is a Lock-in Period?

The lock-in period restricts you from partial/full prepayment of your home loan. Refinancing (see next point) is considered a full prepayment of your existing home loan.

If you choose to refinance your home loan before the lock-in period ends, you may have to pay a hefty partial/full prepayment penalty, which is typically 1.5% of your outstanding principal.

If you’ve received legal subsidies taking the home loan, the bank will also likely require you to refund the amount if you refinance your home loan during the lock-in period.

Understanding Home Loan Refinancing: What Is Refinancing?

Simply put, home loan refinancing is moving your loan to a competitor lender (e.g. switching your home loan from Bank A to Bank B). Homeowners typically refinance their home loan when they are out of their lock-in period and the other lender offers a better interest rate.

Related articles:

- Refinancing Your Home Loan: 3 Steps to Identify the Right Time

- Refinancing HDB Loan Singapore: 5 Steps On How You Can Calculate On Your Own

Home loan refinancing incurs a legal conveyancing fee, so homeowners need to factor that into the equation. That said, lenders may entice homeowners with legal fee subsidies, subject to the borrower fulfilling the new loan’s lock-in period.

However, don’t count on home loan refinancing to reduce your interest rates, for the following reasons:

- You have to pay legal fees when refinancing your loan (about $3,000)

- Refinancing is subject to approval based on financing rules that could change over time (e.g. loan-to-value ratio)

- Refinancing is subject to approval based on the borrower’s financial status at the time of refinancing

- Refinancing is subject to approval based on the refinancing amount

Alternatively, you can talk to your bank about repricing your loan, which means starting on a new mortgage with the same lender at better rates, but with a renewed lock-in period.

Not sure when to refinance your home loan? Use our SmartRefi tool.

SmartRefi helps you track your existing mortgage and compares it against the interest rates of applicable loan packages from the major banks in Singapore. It’ll determine your estimated net potential savings and notify you of suitable refinance housing loan recommendations.

If you are ready to refinance your loan, SmartRefi’s Switch Alert will let you lock in your savings through PropertyGuru Finance’s mortgage experts. Then, our experts will process your loan. It’s that easy!

What Are Promotional Rates for When You Refinance Home Loans?

A promotional home loan interest rate is a limited-time rate that is lower than the rate for the remaining tenure of the loan. If you are taking a home loan with a promotional rate, ensure you know how much your monthly repayments will increase when the promotional period is over.

Related article: What Does Home Loan Refinancing in Singapore Mean? A 5 Step Guide on Refinancing

Other Questions to Ask Before Deciding on Which Home Loan to Take

It’ll also be useful to ask your bank/lender to explain:

- How the reference rate is derived

- How often the interest rate may be reset

- Under what circumstances the rate is changed

- What special features, if any, apply and if these will be removed or amended later

Once you’ve got that down, the next step is to find out about the legal process of buying property.

Thinking of getting a bank home loan? Compare the best mortgage rates on PropertyGuru Finance, or contact us for more personalised advice and recommendations:

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyGuru will endeavour to update the website as needed. However, information can change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyGuru does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyGuru, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.

More FAQs about Fixed vs Floating Rate Home Loans And Home Loan Refinancing

Should I Take Floating or Fixed Home Loan?

Pick a loan based on your current financial needs and ability to tolerate floating interest rate fluctuations. And even after you’ve made your choice, you can refinance!

What Is the Difference Between Floating Rate and Fixed Rate?

Floating rate loans have interest rates pegged to a reference rate such as SIBOR or SORA. Fixed rates remain unchanging for a set period.

Will Home Loan Interest Rates Go Down in 2021?

Interest rates are at historically low levels but are gradually increasing over the course of 2021. While we can’t say whether this will remain a trend, you should monitor rates closely and be prudent with your property purchases.

Can You Refinance Your Home Loan with the Same Bank?

No. This will be called repricing. Home loan refinancing is when you switch to another bank.

When Should I Refinance My HDB Loan?

You can refinance HDB loans any time, but most HDB homeowners refinance after 4 to 5 years. This is after they have paid off at least 25% of the property’s value/price so that they would not need to pay any more cash.

Is There Any Lock-In Period for HDB Loan?

Unlike bank loans, HDB loans do not have any lock-in period. You are free to redeem it or refinance your loan at any time.

How Long Does It Take for A HDB Loan Refinance to Go Through?

How long HDB refinancing takes may depend on the volume of applications received by the bank, as well as their individual processing times. However, it generally takes 4 to 6 weeks to complete.