MND announced today that they are introducing new housing options for residents affected by the Selective En bloc Redevelopment Scheme (SERS). These additional options will be offered, starting with the Ang Mo Kio SERS.

The new housing options introduced are:

- 50-year lease replacement flat at the designated replacement site at Ang Mo Kio Drive

- Lease Buyback Scheme for the existing flat

These additional options will be offered along with the current SERS rehousing benefits. These include the following:

- Compensation for the flat based on the market value at the time of announcement

- Option to purchase a replacement flat with a fresh 99-year lease at the designated replacement site

- Option to apply for a flat elsewhere with SERS rehousing benefits through the HDB BTO or SBF exercise

- Ex-gratia payment of S$30,000 and SERS grant, on top of the flat compensation

- Option to sell the flat with SERS benefits on the open market

These new options come on the back of some residents’ concerns about having to fork out money to get a similar-sized replacement flat. Many of the residents are seniors, and given their age, they may not be able to get a housing loan to afford a new flat.

50-year lease replacement flat at the designated site

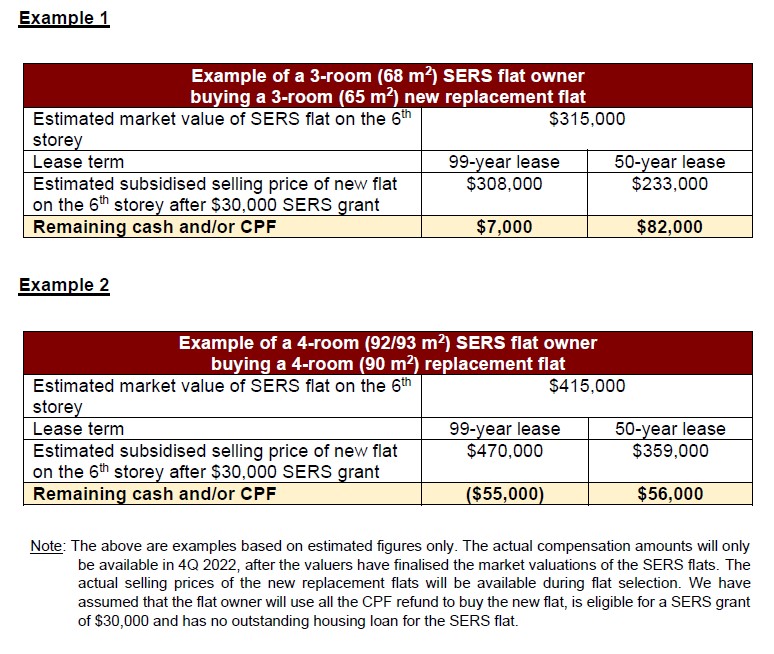

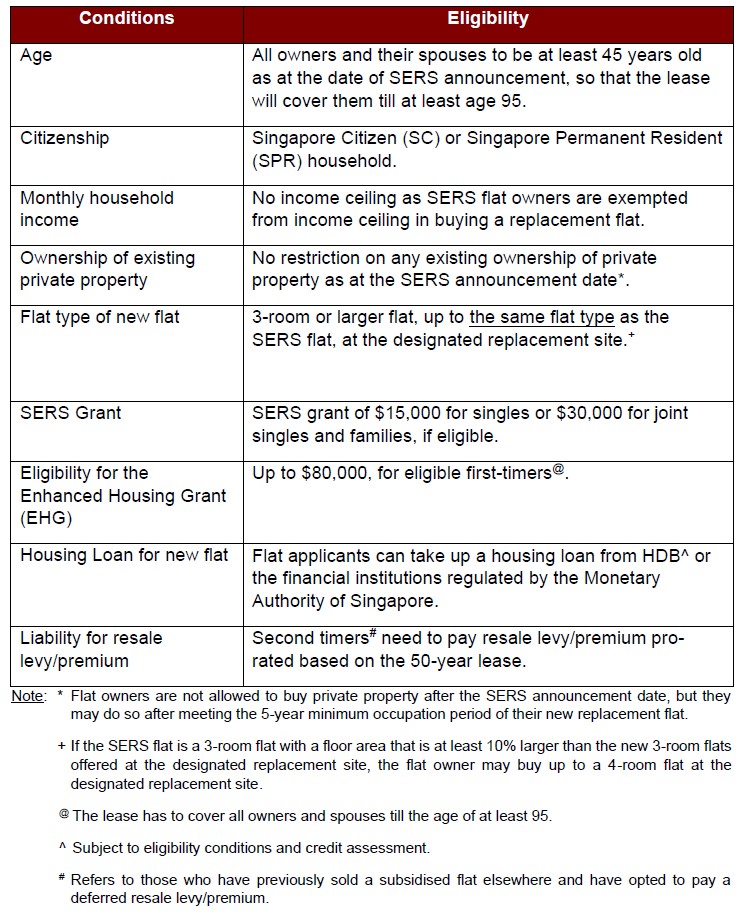

Those who are at least 45 years old can purchase a replacement flat at the designated site with either a 99-year or 50-year lease.

The shorter lease option is available for those who buy a 3-room or larger new flat (up to the same flat type as their SERS flat) at the SERS replacement sites.

This gives those who do not require a longer lease a more affordable option while ensuring that the lease will be able to cover the buyer up to age 95.

Not only that, there’s a potential monetary upside as well.

For example, if a SERS flat owner living in an existing 3-room SERS flat (68 sqm) buys a 3-room (65 sqm) new replacement flat on a 50-year lease, the owner can potentially nett himself or herself some cash and/or CPF proceeds with the estimated market value of the SERS flat.

At the same time, these flats can be resold on the open market with the remaining lease or rented out after the five-year Minimum Occupation Period (MOP) has ended. The rooms can also be rented out during the MOP.

This is unlike the short-lease 2-room Flexi flats that HDB currently offers through the BTO and SBF exercises, which cannot be resold on the resale market.

Here are the eligibility and lease conditions for the purchase of a 3-room or larger new replacement flat on a 50-year lease:

Source: HDB

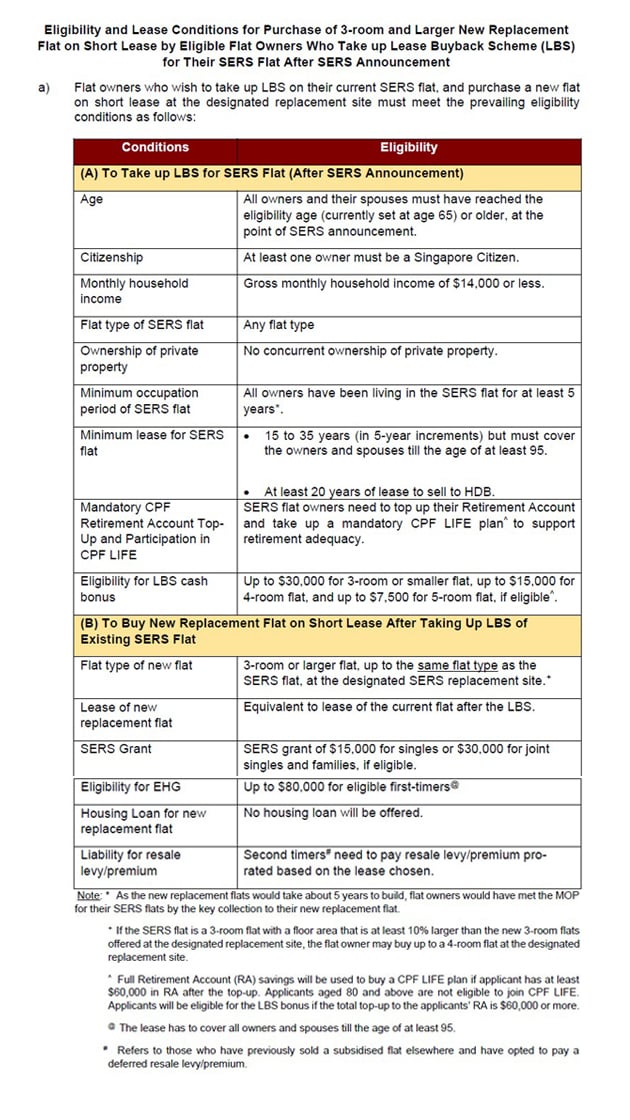

Lease Buyback Scheme (LBS) for senior flat owners

Currently, the Lease Buyback Scheme allows seniors aged 65 and above to sell part of the flat’s lease back to HDB. They will be able to retain the length of the lease based on the age of the youngest owner.

This allows them to monetise their flat while continuing to live in it. The proceeds from selling part of the lease will be used to top up their CPF Retirement Account (RA). The CPF RA savings can then be used to join CPF Life which will provide a monthly payout for life.

The owner(s) will also enjoy an LBS cash bonus of up to S$30,000/S$15,000 (3-room or smaller/4-room respectively) for the CPF RA top-up.

With this option, the market compensation for the lease of the SERS flat retained under LBS can then be used to buy an equivalent replacement flat of the same lease length and up to the same flat type.

Note that previously, SERS flat owners could no longer apply for LBS after their flat had been announced for SERS, so this is definitely a new change for senior flat owners affected by SERS.

So with this scheme, senior flat owners can:

- First, take up LBS for their existing SERS flat (after SERS announcement). Part of the proceeds from this will be used to top up their CPF RAs and purchase CPF Life.

- Then, with the remaining compensation, buy a new replacement flat on an equivalent lease of their SERS flat

Here are the eligibility and lease conditions for this option:

With Lease Buyback Scheme, owners will not be able to resell their new short-lease flats in the open market (since their leases are sold back to HDB).

They are also not allowed to rent out the entire flat except for spare rooms. They can however invest in private property after MOP.

What do you think of these new options? Let us know in the comments section below.

If you found this article helpful, 99.co recommends No more early MOP for SERS replacement flat owners, starting with AMK SERS and 40% of invited applicants decline BTOs; first-timers stand good chance of booking a flat.

The post New housing options for SERS flat owners: 50-year lease replacement flat, Lease Buyback Scheme appeared first on .