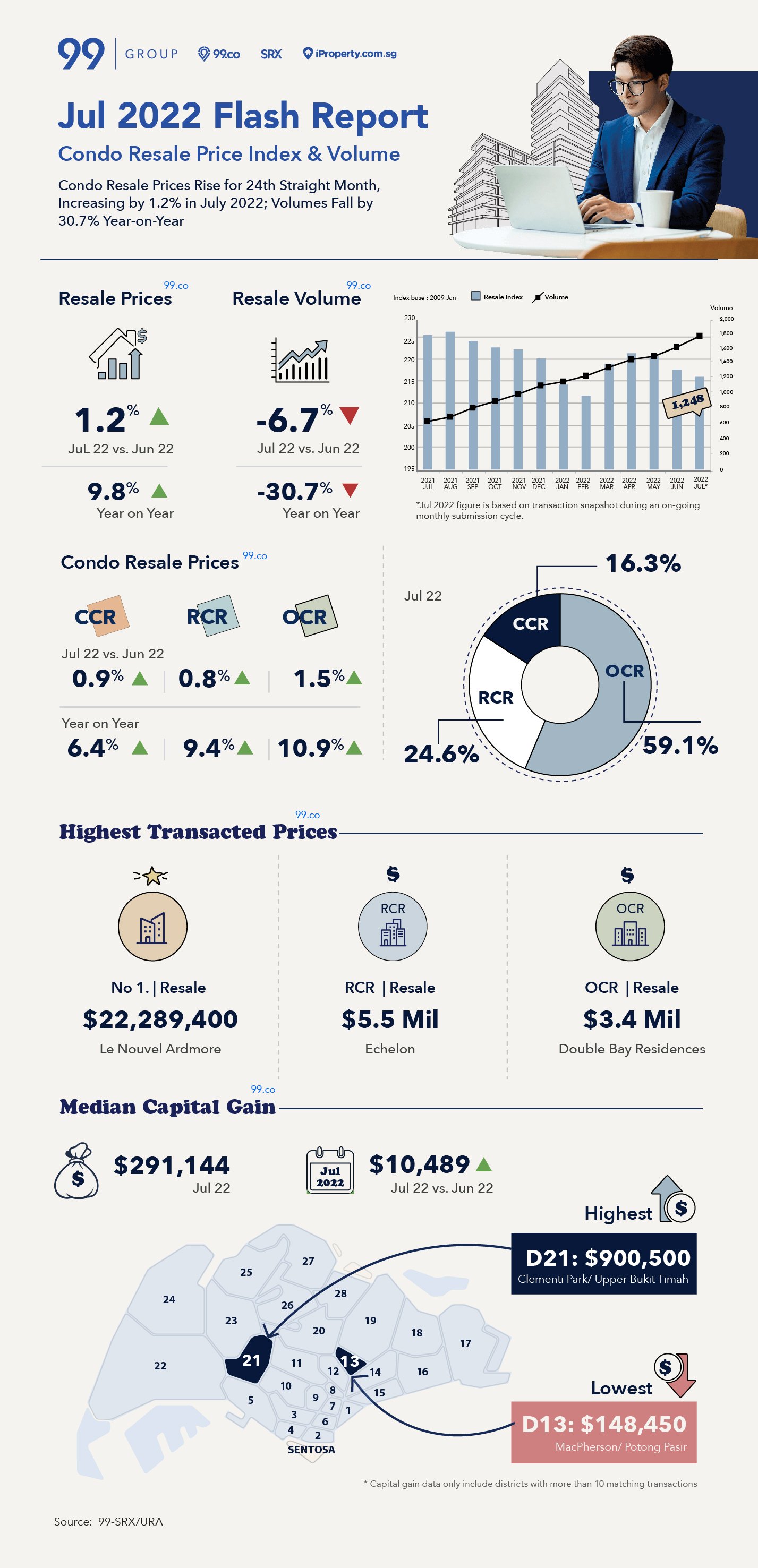

Condo resale volume has dropped by 6.7% in July, despite a month-on-month price increase of 1.2%. As reported in the flash report by 99.co and SRX on the condo resale market in July 2022, condo sales have dropped by 30.7% year-on-year.

In particular, condo resale volume has been on the downtrend since April. Possible reasons for this include a wait-and-see approach by HDB upgraders and condo buyers as prices are rising, and upcoming new launch condo projects such as AMO Residence and Enchante.

Rising US interest rates and mortgage interest rates may also have dampened demand from some buyers. Some may opt for public housing instead due to accessibility to the HDB concessionary home loan, which has a fixed interest rate of 2.6%.

On the supply side, owners may have chosen to hold on to their properties and continue renting them out, given the robust rental market.

According to Christine Sun, Senior Vice President of Research and Analytics at OrangeTee & Tie, another possible reason for the lower demand is a mismatch in price expectations between buyers and sellers.

“As overall prices have already risen for 24 consecutive months, which is quite a long time, and there are rising uncertainties surrounding the global economies and increasing interest rates, some buyers may not be willing to match some sellers’ asking prices. On the other hand, sellers have no pressure to cut prices. Some sellers still expect prices to rise further, given the robust housing demand from HDB upgraders and supply lag in the suburbs.”

Increase in median capital gain

Among all the districts, District 21 (Clementi, Upper Bukit Timah) saw the highest median capital gain at S$900,500, as well as unlevered and levered returns of 78.5% and 237.8%, respectively.

Sun noted that some districts have seen their median capital gains increase substantially since the runup in home prices over the past year.

For instance, a year ago in July 2021, the median capital gain for District 21 was S$435,000. Likewise, District 11, which posted the highest median capital gain last month at S$800,000, saw an increase from S$208,000 in July 2021.

Sun added that this trend is observed in the OCR where supply is tight. OCR districts with a substantial increase in median capital gain include District 23 (Bukit Batok, Bukit Panjang, Choa Chu Kang) at 175.2%, District 27 (Sembawang, Yishun) at 116.9% and District 19 (Hougang, Punggol, Sengkang) at 70.8%.

What do you think of the drop in condo resale volume? Let us know in the comments section below.

If you found this article helpful, 99.co recommends Public outcry over Orto leisure park and Kampung Kampus moving out of its site to make way for housing and After 4 years, couple puts Art Deco, black-and-white-themed apartment at Sophia Road for sale.

The post Condo resale volume dropped for the 3rd straight month, prices increase 1.2% in July 2022 appeared first on .