Following the increase in interest rates, the authorities have introduced a few cooling measures effective today (30 September 2022) to restrict borrowing by home buyers.

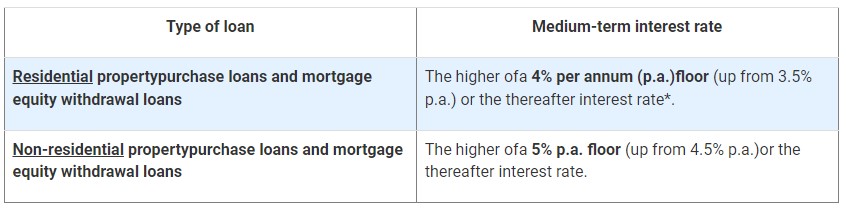

The main measure is the increase in the medium-term interest rate floor (also known as the stress-test interest rate) to compute the Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR).

The TDSR limits the monthly debt obligation that you can take. It includes all types of loans, such as credit card debt, car loans and property loans. The TDSR is currently at 55%.

Like the TDSR, the MSR limits the monthly loan amount that you can take, but it is only for the housing loan of an HDB flat or an Executive Condo. The MSR is currently at 30%.

The stress-test interest rate for bank loans has now been raised from 3.5% to 4% per annum. At the same time, the stress-test interest rate of 3% has been introduced for HDB loans.

These stress-test interest rates are not the actual interest rates of your home loan, so they don’t translate to the interest you’ll need to pay. Instead, they are used to calculate the maximum loan amount that you can borrow. So with the increase in the stress-test interest rates, financing from the bank or HDB will be lower.

On top of that, the loan-to-value (LTV) ratio limit for HDB loans has been decreased from 85% to 80%, reducing the amount you can borrow if you take an HDB loan.

This is to ensure prudence in borrowing for your property purchase, as interest rates are set to increase further in the coming months.

Reduced affordability

The impact of the two measures is that the home loan amount you can borrow will be lower, whether you’re buying an HDB flat or a private property.

We illustrate how they will affect home affordability.

Buying an HDB flat

Let’s say you and your partner have a combined income of S$6,600. Without the 3% stress-test, you could afford an HDB resale flat priced at S$540,000. This is also the median price of an HDB resale flat in September 2022.

Assuming you take an HDB loan with a 25-year tenure, you may no longer be able to afford this flat due to the 3% stress-test interest rate.

| Estimated max loan amount | Estimated max price of HDB flat | Estimated monthly instalment (at 2.6%) | |

| Stress-test interest rate of 2.6% | S$436,441.00 | S$545,551 | S$1,980 |

| Stress-test interest rate of 3% | S$417,535.00 | S$521,919 | S$1,894 |

| % change | -4.3% | -4.3% | -4.3% |

This is unless you’re eligible for resale grants, such as the Family Grant, Enhanced CPF Housing Grant and Proximity Housing Grant (PHG), to reduce the amount you need to borrow.

Otherwise, you will need to:

- Lower your debt obligations

- Increase your income

- Increase your downpayment

- Purchase a cheaper property

In this table, we break down how much your affordability is reduced based on the different monthly household income levels, if you’re taking an HDB loan.

| Household monthly income | S$4,000 | S$6,000 | S$8,000 | S$10,000 |

| Price of HDB flat you can previously afford (2.6% interest rate)* | S$330,638 | S$495,956 | S$661,274 | S$826,593 |

| Price of HDB flat you can now afford (3% interest rate)* | S$316,315 | S$474,473 | S$632,629 | S$790,786 |

| % change | -4.3% | -4.3% | -4.3% | -4.3% |

*Source: 99.co data team. Assumptions: HDB loan with a tenure of 25 years, LTV of 80% and MSR of 30%, without grants, and any other mortgage and debt obligations.

How much you can afford to pay for an HDB flat is even lower if you decide to take a bank loan.

| Household monthly income | S$4,000 | S$6,000 | S$8,000 | S$10,000 |

| Price of HDB flat you can previously afford (3.5% interest rate)* | $319,601 | $479,403 | $639,203 | $799,004 |

| Price of HDB flat you can now afford (4% interest rate)* | $303,124 | $454,685 | $606,248 | $757,809 |

| % change | -5.2% | -5.2% | -5.2% | -5.2% |

*Source: 99.co data team. Assumptions: HDB loan with a tenure of 25 years, LTV of 75% and MSR of 30%, without grants, and any other mortgage and debt obligations.

Buying a private property

Let’s say you and your partner have a combined income of S$8,500. Previously, you could afford a resale condo at S$1,380,000. This is the median price of a resale condo in September 2022.

With the increased stress-test interest rate to 4% for a bank loan, you would no longer be able to afford the resale condo with a 30-year home loan.

| Estimated max loan amount | Estimated max price of condo | Estimated monthly instalment (at 2.75%) | |

| Stress-test interest rate of 3.5% | S$1,041,099 | S$1,388,132 | S$4,250 |

| Stress-test interest rate of 4% | S$979,231 | S$1,305,641 | S$3,998 |

| % change | -5.9% | -5.9% | -5.9% |

That is, unless you decide to do one of the actions above, such as lowering your debt obligations or purchasing a cheaper home.

Here’s how much your affordability is reduced based on the different monthly household income levels, if you’re buying a condo.

| Household monthly income | S$14,000 | S$16,000 | S$18,000 | S$20,000 |

| Price of condo you can previously afford (3.5% interest rate)* | S$2,286,335 | S$2,612,955 | S$2,939,573 | S$3,266,193 |

| Price of condo you can now afford (4% interest rate)* | S$2,150,469 | S$2,457,679 | S$2,764,888 | S$3,072,099 |

| % change | -5.9% | -5.9% | -5.9% | -5.9% |

*Source: 99.co data team. Assumptions: Bank loan with a tenure of 30 years, LTV of 75% and TDSR of 55%, without any other mortgage and debt obligations.

Speak to 99.co’s mortgage broker to find out more on which home loan is best for you.

What do you think of the increase in the stress-test interest rates? Let us know in the comments section below.

If you found this article helpful, 99.co recommends New property cooling measures (September 2022): Borrowing restrictions and lower LTV limit to affect home loan applicants and private-to-HDB resale flat buyers and Here’s why you should take a fixed rate home loan.

The post Here’s how much the new stress-test interest rates will affect home affordability appeared first on .