It’s near the end of October (Halloween, yay!), and no, it’s not time for another housing-related scare.

It’s the time when both the Urban Redevelopment Authority (URA) and Housing Development Board (HDB) release their latest quarterly data to market watchers. Here’s what some property analysts have shared so far.

Private Residential Properties

The latest 3rd Quarter 2022 data from URA has shown that the price index for private residential properties rose faster at 3.8% compared to Q2 2022 (3.5%) – a new record high last quarter.

Private Property Prices and Volume

Private property prices increased by 8.2% in the first three quarters (Jan-September) of 2022, higher than the 5.3% growth over the same period in 2021. This is despite the cooling measures introduced in December 2021.

Ms Christine Sun, Senior VP of Research & Analytics at OrangeTee & Tie, shared that Q3 2022’s growth was mainly driven by non-landed homes, which rose 4.4%, while landed home prices rose 1.6%.

“By market segment, prices rose the most in the suburbs or Outside Central Region (OCR), which increased by 7.5%. This is the steepest quarterly increase since Q3 2009 at 16.1%. Non-landed homes in the prime districts, or Core Central Region (CCR), rose 2.3% quarter-on-quarter while the city fringe or Rest of Central Region (RCR) increased 2.8%,” she said.

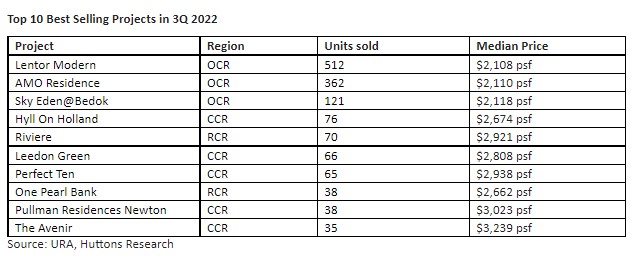

Similarly, Mr Lee Sze Teck, Senior Director of Research from Huttons Asia, shared that three major launches in the OCR – AMO Residence, Lentor Modern and Sky Eden@Bedok – are probably the drivers behind the 7.5% increase in prices. Echoing Sun, Lee said this is the fastest quarterly increase in OCR prices since Q3 2009.

“As of Q3 2022, the estimated median psf of new homes in the RCR stands at S$2,431, 13.5% lower than the median psf in the CCR. More buyers are purchasing homes in the CCR due to the narrowing price gap. Developers sold 562 units in the CCR in Q3 2022 despite launching only 240 units for sale,” Lee said.

The impact of the December 2021 cooling measures on ABSD for 2nd/subsequent home ownership and Total Debt Servicing Ratio (TDSR) may be strongly felt in sales volume. Also, Q3 2022 was when the Lunar Seventh Month happened, so there were no launches during that period.

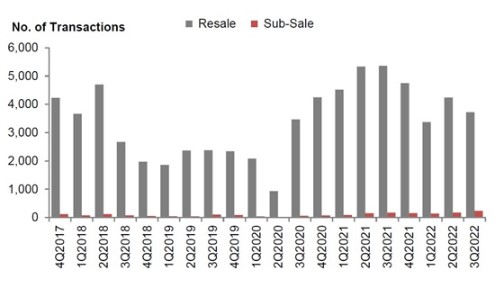

URA data shows volume declining by 9.7% from 6,811 transactions in Q2 2022 to 6,148 in Q3. This is observed for both new home sales and resales.

While new home sales (excluding ECs) dipped 8.8% from 2,397 in Q2 2022 to 2,187 units in Q3 2022, resales slipped 12.2% from 4,236 units to 3,719 units over the same period.

Private Property Rental

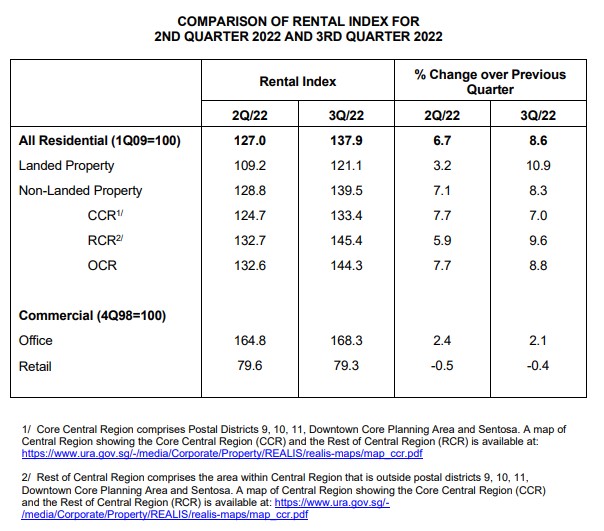

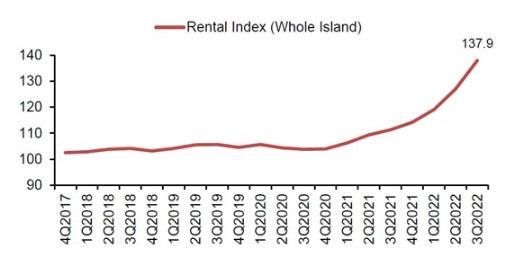

On the rental front, Sun shared that tenant budgets are stretched to new limits in Q2 2022 as rents grew at their fastest quarterly pace since Q3 2007 (11.4%).

“According to URA data, rents climbed faster by 8.6% in the third quarter of 2022 to a new high, after rising 6.7% in Q2 2022. Over the past 9 months, rents rose by 20.8%.”

Sun added that even as rents increased, rental demand rebounded in Q3, increasing 20.5% to 25,382 transactions from 21,068 units in Q2 2022. Occupancy rates also remained high at 94.3% in Q3 2022.

“Rents are rising exponentially as many landlords have increased their asking rents above market value. With demand far outstripping supply and units readily snapped up by the highest bidder, many tenants acceded to paying the higher rents.

“Tenants are signing longer leases of up to three years to secure units and lock in better rates. Rising interest rates and rampant inflation are exacerbating the situation as more landlords pass on their increased mortgage repayments and living costs to tenants.

“The escalating leasing costs are putting a squeeze on tenants’ rental affordability. Some tenants have shifted to the HDB market since rents are much cheaper,” she said.

Lee said that the 8.6% jump is the fastest pace of increase in private home rents since Q3 2007.

The return of foreign students and sustained hiring of expatriates are pushing up demand for homes in 3Q 2022. There has been some “musical chairs” movement of tenants as the rising rents have exceeded their budget and displaced some of them.

“Some of them have moved from the CCR to the RCR, while some have moved from the RCR to the OCR. This has pushed up rents in both the RCR and OCR to 9.6% and 8.8%, respectively,” he said.

Sun admitted there might not be a quick respite from the surging rents.

With more tenants signing longer lease tenures, the rental volume will fall further as fewer transactions will be recorded over time. The longer lease periods will also lead to fewer homes available for rental.

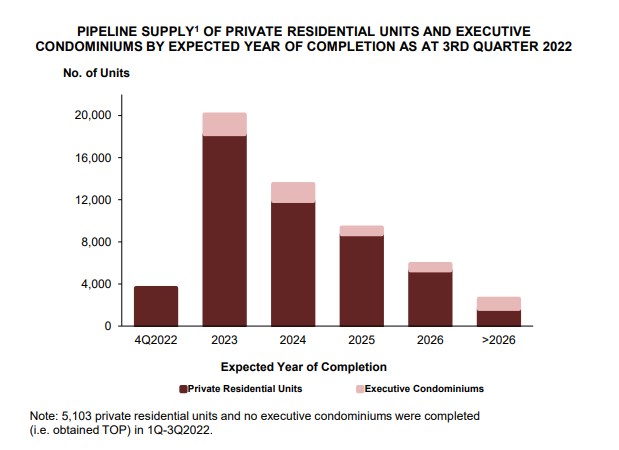

Private homeowners buying unsubsidized HDB resale flats affected by the 15-month wait-out period will rent in the interim, thus intensifying rental demand. However, more homes may be completed next year, which may slow down rental price growth from mid-2023.

Private Property Market Outlook based on URA’s Q3 2022 data

OrangeTee & Tie’s Sun summarised the outlook by sharing that with rapidly climbing interest rates, increased geopolitical tensions and recessionary risks worldwide, investors may lose confidence in equities and riskier assets. Some prefer investing in real estate, widely regarded as a safe-haven asset or a hedge against inflation.

“Our strong household balance sheets, tight domestic labour market and sustained income growth will continue to prop up housing demand. While rising mortgage rates and prices are squeezing buyers, some will continue to purchase homes before interest rates rise further.”

She projects prices to grow between 9 and 11 per cent for the whole of this year. She also expects more rate hikes from the US Fed as inflationary pressures may not ease soon.

“For investors and landlords, surging rents are still cushioning the impact of higher mortgage payments now. If mortgage rates continue to soar and competition stiffens with more home completions next year, some landlords may face difficulty coping with the higher mortgage loans. The situation may worsen when property tax and cost of living increase further.”

With the number of launched and unsold stock in the market at 2,133 units (the lowest level since Q4 2018), Huttons’ Lee predicts that in the wake of cooling measures and year-end holidays (which start mid-November), some developers may defer private home launches to 2023. This translates to potentially slower transaction volume in Q4 2022 of between 1,000 and 1,500 units.

He projects prices to grow between 9 and 10% in 2022.

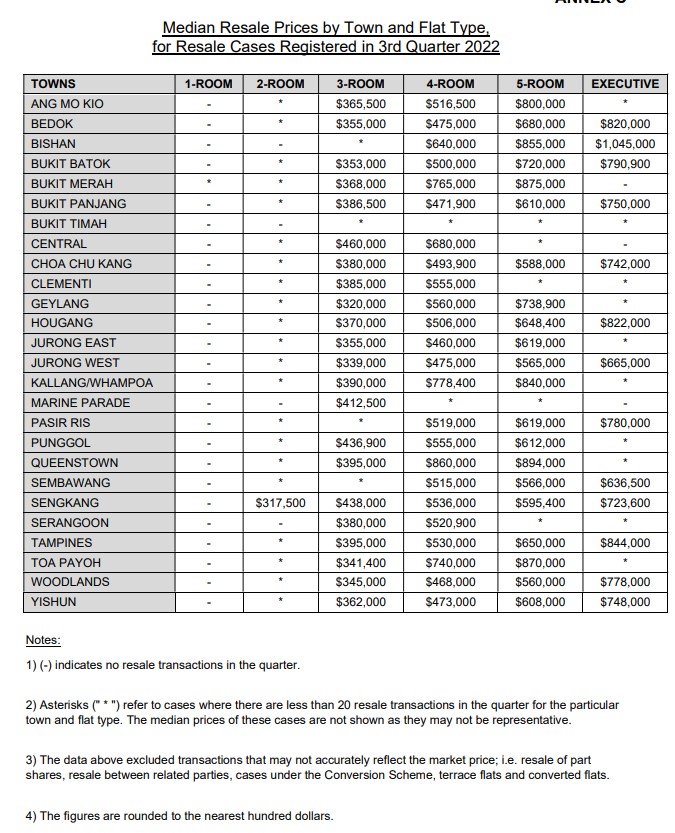

HDB Resale Prices and Volume

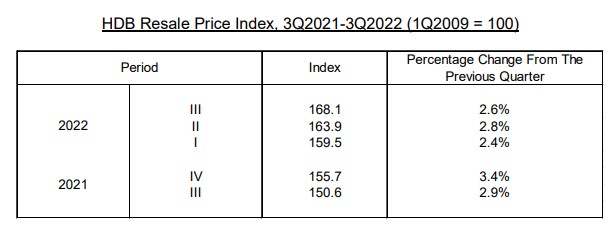

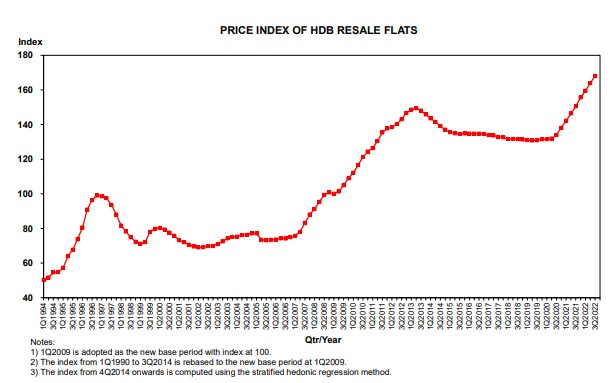

Similarly, HDB’s latest Q3 report has shown that resale prices rose by 2.6%, slightly lower than the 2.8% growth in Q2 2022.

“In the first nine months of 2022, HDB resale prices have increased by 8%. In 2021, the average quarterly price gain was around 3.2% but slowed to 2.7% in 2022,” Lee shared.

“The slower price growth indicates that the housing sector has already started to feel the effects of rising interest rates and inflation. Rising inflation will erode buyers’ affordability, especially middle- and lower-income Singaporeans, who form the bulk of purchasers. As more budget is used for necessities and daily expenditures, buyers may be less willing to pay more for their next home,” Sun said.

Looking further back, Lee said that HDB prices had gained 27.4% since the circuit breaker.

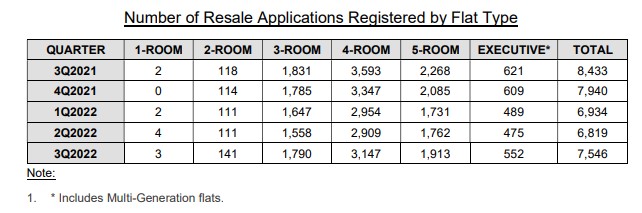

“This is an unsustainable trend and can put homes out of reach for first-time buyers. Some buyers are flushed with cash and can offer much higher prices to secure their dream home. The pandemic has increased people’s desire for more space, and there have been more transactions of larger flats in Q3 2022. These are seen as more affordable compared to private options,” he said.

According to data.gov.sg, there were 111 million dollar flat transactions in Q3 2022, 35.4% more than in Q2 2022. Lee observed that more million-dollar flats are appearing in non-mature estates, with 7 in Q3 2022 compared to 4 in the previous quarter.

“…Buyers are turning their attention to 5-room and larger flats. There were 75 transactions in Q1, 70 in Q2 and 105 in Q3. The first nine months of 2022 saw 250 5-room and larger flats sold compared to only 210 in the entire year of 2021,” Lee added.

Sun pointed to second-timers applying for Prime Location Public Housing (PLH) model flats in mature estates, where many have had a low success rate. This would, in turn, compel them to turn to the resale market.

More HDB upgraders may have bought resale flats as prices of new condominiums in suburban areas escalated beyond S$2,000 psf last quarter.

“Further, as a result of the adjustment of the BTO allocation quota to allow more first-time families and singles in non-mature estates to buy their first homes, more second-timers may have turned to the resale market to find a replacement home since they now have a lower chance of buying a BTO flat as a second-time applicant with the new rules,” Sun said.

“For instance, the 4-room PLH (Prime Location Public Housing) model flats at Alexandra Vale and Havelock Hillside during the August 2022 BTO sales launch was oversubscribed by 53 times, with more than 3,300 second-timers vying for about 65 units,” she said.

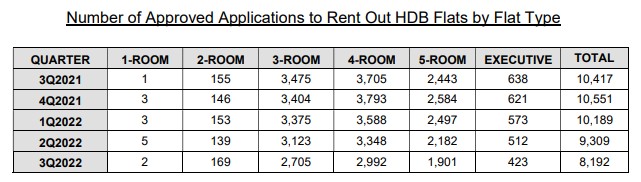

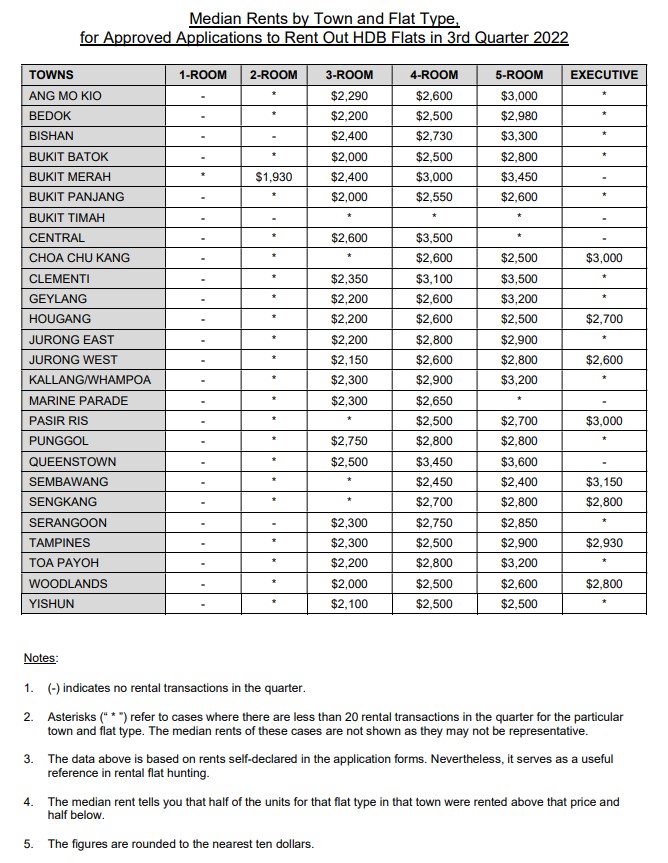

HDB Rental Market

According to Sun, approved applications to rent out HDB flats dipped by 12% for a 3rd consecutive quarter – from 9,309 units in Q2 2022 to 8,192 units in Q3. Year-on-year, HDB rental volume declined 21.4% from 10,417 units in Q3 2021.

The lower supply of available HDB flats available for rent may also contribute to higher HDB rental prices.

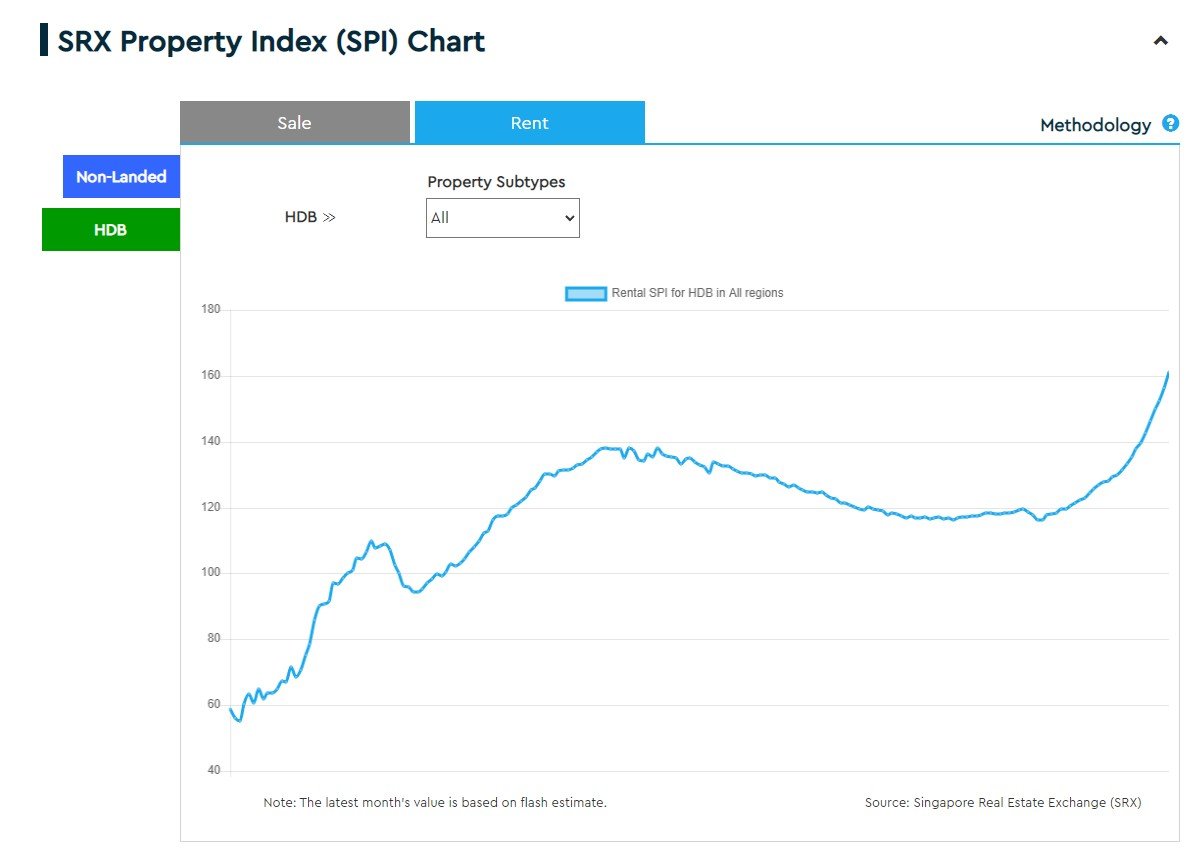

“Rents hit a new record high last quarter, climbing by 7.5% quarter-on-quarter, according to the SRX Rental Index. In the first nine months of 2022, rents surged 20.9%.

Rents have jumped substantially in recent months as many landlords have increased their rents in anticipation of more interest rate hikes which will translate to higher mortgage repayments. Currently, many landlords are still able to cope with the rising interest rates as they have passed on the additional costs to their tenants.

Sun shared that landlords may raise rents further with higher property taxes and possibly higher costs of living next year.

The 15-month wait-out period for private homeowners purchasing HDB resale flats may lead to more people renting in the interim. The increased demand will inevitably drive rents higher next year.

HDB Property Market Outlook based on HDB’s Q3 2022 data

Huttons’ Lee believes HDB resale prices will likely moderate in Q4 in the wake of the 30 September cooling measures.

“Private property owners (PPO) will now need to sell off their private property and wait 15 months before they can buy an HDB resale flat. This effectively cuts off the demand from PPOs and ex-PPOs.

For seniors 55 years old and above, they may still purchase a 4-room and smaller HDB flat without restrictions. Some demand may flow to the 4-room flats and push up prices.

“Currently, the average price growth from Q2 2020 to Q3 2022 for 3-room, 4-room, 5-room and executive flats is 2.0%, 1.7%, 1.9% and 2.5%, respectively. There has been a sale of a 4-room flat at Pinnacle@Duxton for S$1.37 million in October, making it the most expensive 4-room flat in Singapore to date. A 5-room flat at The Peak@Toa Payoh was sold for S$1.38 million in Oct 2022, breaking the record to become the most expensive 5-room flat in the DBSS project.”

“The largest ever BTO launch in November may draw some demand away from the resale market. Prices are likely to moderate from 1.0% to 2.0% in Q4 2022, giving rise to a full-year price gain of less than 10%.

“There is a good mix across mature and non-mature estates and may draw demand from the resale market. There are a few prime sites in November that could be PLH – one in Kallang/Whampoa, one along Queensway and one at Ghim Moh,” Lee added.

Despite the moderation in prices, Lee said there should be little impact on HDB resale volume. As of Q3 2022, HDB resale volume is estimated at 21,999 units, with an estimate of 6,500 and 7,000 in Q4 2022. Across the year, this would place the total volume at around 28,000 units.

Even with cooling measures in place, Sun predicts that the HDB resale market will continue to be attractive in the long term.

She noted past trends indicate that our property market is highly resilient and usually rebounds within six months of a cooling measure.

“Some astute buyers may seize the opportunity to snag a unit when the market takes a breather. With many private homeowners exiting the market and prices possibly cooling for large flats, some upgraders and first-time buyers may take the opportunity to scoop a bigger home in the secondary market now. These people were previously priced out of the market as they lacked the finances to compete with cash-rich private homeowners.”

Sun anticipates resale prices to grow by 9 to 11% this year, lower than the 12.7% in 2021. The total number of sales transactions will similarly be lower at 26,500 to 28,000 units compared to the 31,017 transactions last year.

–

What are your thoughts on the URA and HDB Q3 2022 findings? Let us know in the comments section below.

If you found this article helpful, 99.co recommends 1,001-sqft Pinnacle@Duxton flat sold for S$1.37m at record S$1,369 psf – most expensive 4-room HDB resale in Singapore and 3 things to know about the latest Ulu Pandan BTO flats.

The post Latest Q3 2022 property stats: Condo and HDB rents up 20.8-20.9% over past 9 months, +7.5-8.6% this quarter appeared first on .