In the current robust property market, we’ve heard a lot of record-breaking sales and come across news of homeowners making a profit from selling their house.

As a homeowner, it’s also time to consider whether you can sell your house at a high price and make a profit.

2 signs that your house has potential gains

1. You notice a lot of viewings at your development

Been seeing a lot of unfamiliar people accompanied by another person wearing a lanyard coming to your development? This could be a property agent bringing potential buyers to viewings, who could potentially be your new neighbours.

More importantly, this means someone in your development is selling their house. The number of people coming at different times for viewings also signals a demand for houses in the development.

2. You get many flyers from property agents asking you to sell your house

Typical flyers from property agents will usually list the recent transactions in the area. Some may also highlight the services provided, such as comparative market analysis and home staging, to help you upgrade (or right-size) and unlock your property value.

Some flyers even go as far as to tell you how much your house can be sold for, based on our sister’s brand SRX’s X-Value.

Love it or hate it, flyers like these give you an idea of the demand for houses in your area and the estimated price range buyers are willing to pay.

So if you haven’t been checking your mailbox for a very long time, perhaps it’s time to open it. And you might just find one or two flyers informing you the estimated value of your property.

How to check if you’re sitting on potential gains?

1. Use 99.co’s Property Value Tool

The first thing you want to do is to use 99.co’s Property Value Tool.

Simply key in your postal code and unit number to get an estimated property value.

Powered by SRX’s X-Value, the tool uses an automated valuation model that has access to relevant data and transactions from HDB, URA and property agencies. It also takes into account comparable attributes such as location, floor, size and age of the property.

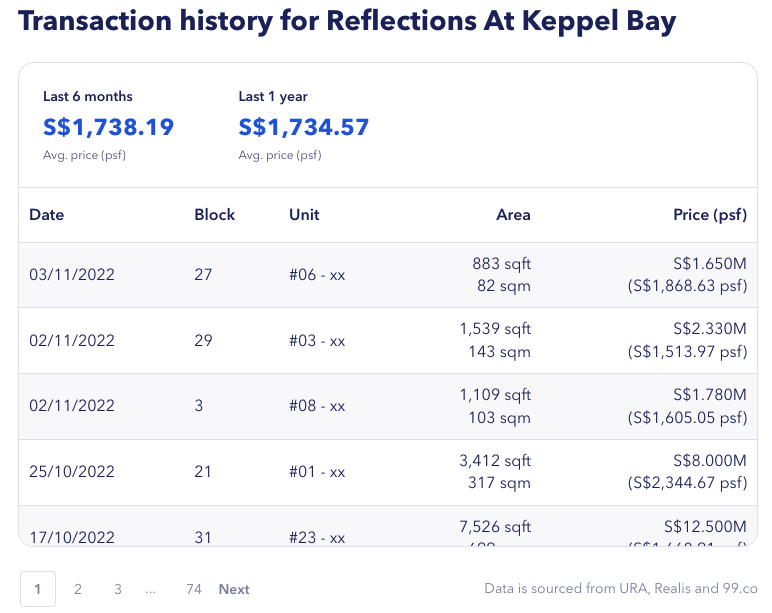

2. Check recent transactions nearby

On top of using our Property Value Tool, you may also want to check recent transactions nearby.

For HDB flats, you can check on the latest transactions via HDB’s Resale Flat Prices service.

For private properties, you can check on URA’s e-service.

Alternatively, you can view the transaction history of the respective condos on our website.

To illustrate, let’s say you own a condo with a floor area of around 1,200 sq ft in the Bright Hill area. It was built in the 2000s.

For a start, let’s look at the recent transactions of comparable condos in the area to gauge how much you could sell your property.

| Condo name | Blk and floor range | Floor area (sq ft) | Sale price | Sale date |

| Bishan Point | 11th to 15th | 1,270 | S$1.78m | Nov 2022 |

| The Gardens At Bishan | 6th to 10th | 1,227 | S$1.8m | Oct 2022 |

| The Gardens At Bishan | 1st to 5th | 1,227 | S$1.8m | Oct 2022 |

| The Gardens At Bishan | 11 to 15th | 1,206 | S$1.89m | Oct 2022 |

| The Gardens At Bishan | 6th to 10th | 1,227 | S$1.8m | Sep 2022 |

| The Gardens At Bishan | 16th to 20th | 1,206 | S$1.8m | Sep 2022 |

| The Gardens At Bishan | 11th to 15th | 1,206 | S$1.86m | Sep 2022 |

| The Gardens At Bishan | 6th to 10th | 1,227 | S$1.84m | Sep 2022 |

You also get an estimate of your property’s value with our Property Value Tool.

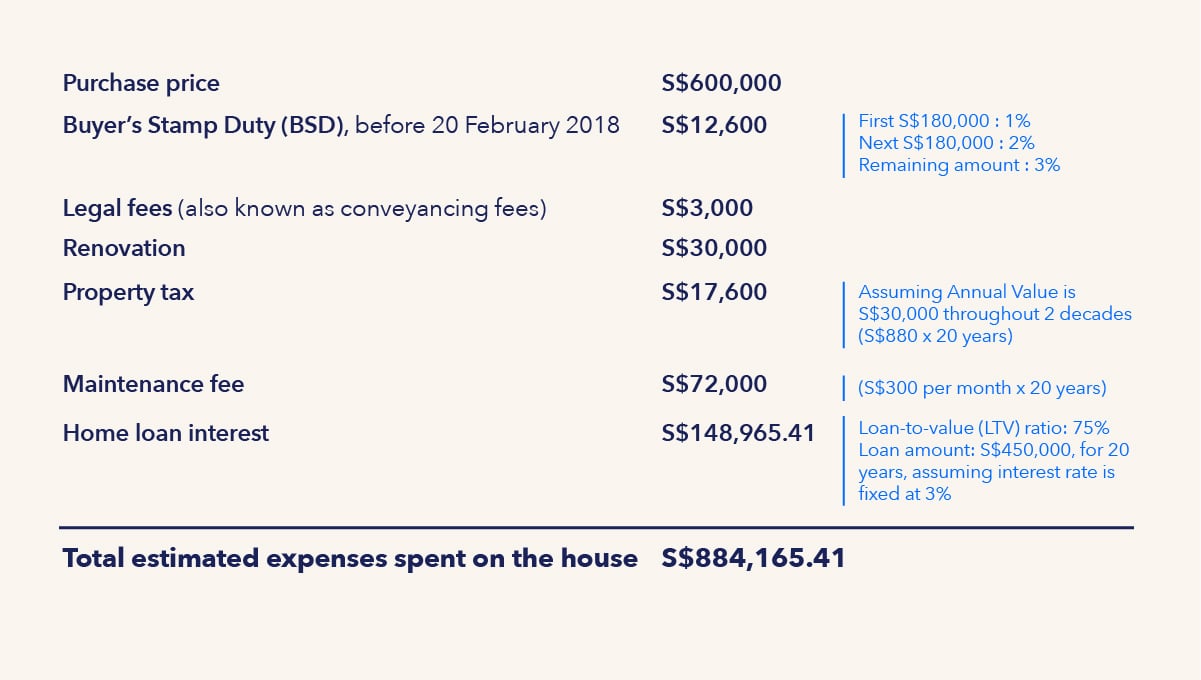

3. Calculate how much you’ve spent on the house

Based on the estimated value and the prices your neighbours have sold their houses for, it probably gets you thinking, “Woah, can I really earn that much profit?”

Let’s say you bought the unit in 2002 for S$600,000. With a selling price of S$1.8 million, you can make a capital gain of S$1.2 million.

SELLING YOUR PROPERTY? Would you like to know how much your property is worth? Or maybe you’re considering listing your property for sale? Let us know, and we’ll have a consultant reach out to you!

But wait, you’ll still need to account for other costs incurred for owning the house! Don’t just deduct the purchase price from the potential selling price to calculate your profit. That’s just paper gain.

Some of the costs you should include in your calculation are

- Buyer’s Stamp Duty (BSD)

- Legal fees (also known as conveyancing fees)

- Renovation costs

- Property tax

- Maintenance fee (or Service and Conservancy Charges for HDB flats)

- Home loan interest

Here’s an illustration of the breakdown of the estimated expenses incurred for owning the unit:

If you’re selling an HDB flat, you’ll also need to take into account the following:

- 1% property agent commission if you’ve engaged a buyer’s agent (when buying a resale flat)

- HDB upgrading costs if your block and flat went through the Lift Upgrading Programme (LUP) and/or the Home Improvement Programme (HIP)

- Resale levy if you’re buying a second subsidised HDB flat (direct from HDB, new launch EC or resale flat with subsidies) after selling this flat

Last but not least, you’ll also have to account for the 2.5% CPF accrued interest if you’ve used your CPF monies to pay your house, whether it’s downpayment, monthly instalments or HDB grants.

In the illustration above, we assume that you didn’t use your CPF monies to pay for your house.

Do note that the accrued interest goes back into your CPF account, and can still be used to pay for your next property purchase.

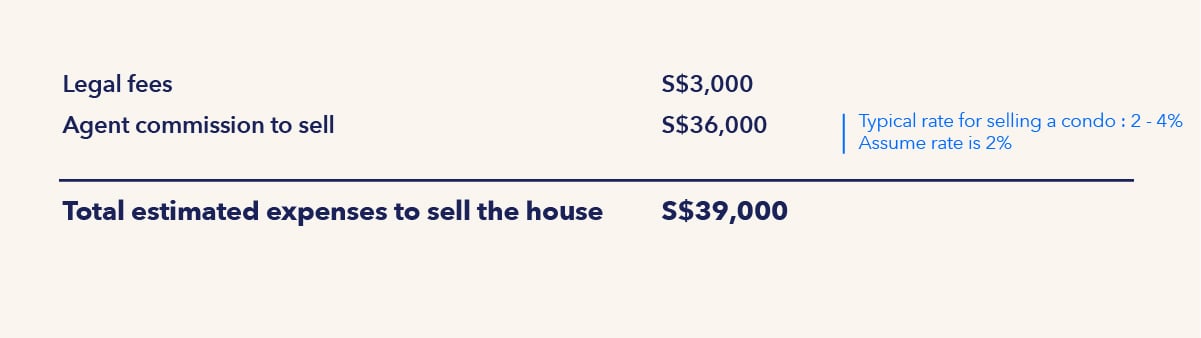

4. Calculate how much you’ll need to spend to sell the house

Don’t forget to consider how much you’ll need to spend to sell the house too! This is mainly the conveyancing fees and property agent commission.

Here’s an illustration of the estimated expenses to sell the house:

If you sell within three years, you’ll also need to consider the Seller’s Stamp Duty. It’s not applicable in this illustration because the holding period is 20 years.

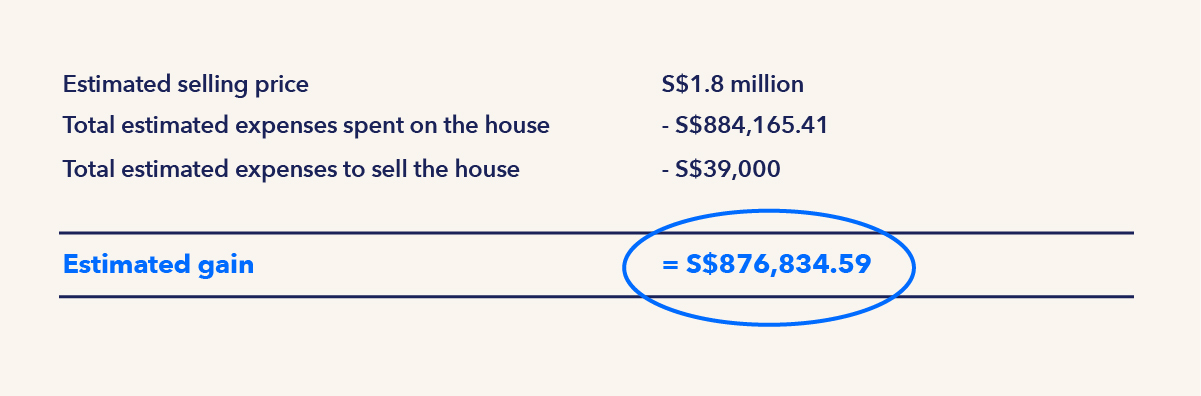

How much you’ll gain from selling the house

By deducting these expenses, you can then find out how much you’ll gain from selling the house.

Here’s an example of the calculation to get the estimated gain:

Given the current hot property market, it’s timely to look into the recent transactions nearby and consider selling it to unlock the gains, especially if you have owned it for at least 10 years.

As we’ve shown in an earlier article on capital gains made by homeowners in November, 20 of the 30 sellers who held onto their properties for more than 10 years realised triple-digit-percentage gains. Depending on your needs, the capital gain can be used to upgrade or right-size.

Thinking of selling your house? Let us know in the comments section below or get in touch with a property consultant.

If you found this article helpful, 99.co recommends Reflections At Keppel Bay unit sold S$6.6m higher in just over a year and Top districts with the most profitable sales (for HDB, condo and landed) in the last 5 years.

The post 6 signs and steps to find out if your house has unrealised gains appeared first on .