HFE, which stands for HDB Flat Eligibility, is a new acronym to add to your HDB playbook.

Previously, when it comes to buying an HDB flat, your eligibility to buy, receive HDB grants and take up the HDB housing loan are assessed at different stages.

The good news is that you can now look forward to a more streamlined process. Come 9 May 2023, you’ll just need to apply for the HDB Flat Eligibility (HFE) letter. With this new process, your eligibility on these three aspects will just be assessed once.

It will also replace the HDB Loan Eligibility (HLE) letter, which you’ll need when you book a flat (for a new flat like a BTO) or before you get an Option to Purchase (for a resale flat).

What you can see from the HDB Flat Eligibility (HFE) letter

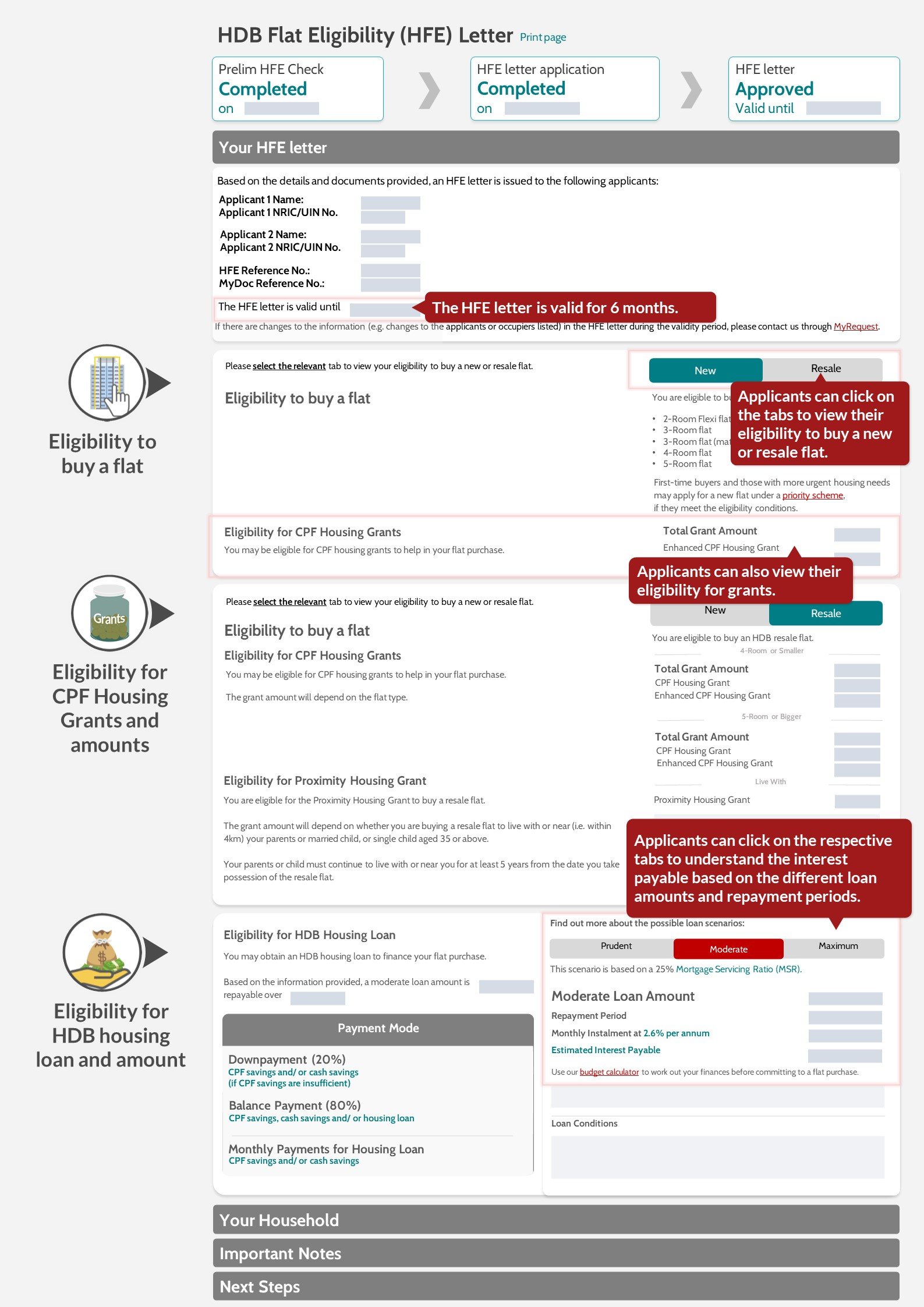

The HDB Flat Eligibility (HFE) letter will inform you on your eligibility:

- To buy a new and/or resale flat

- Receive CPF grants, including the amount

- Get HDB housing loan, including the loan amount

And for second-timers, HDB will inform you at this stage on the resale levy to pay if you’re eligible to buy a second subsidised flat.

Here are instances in which you have to pay the resale levy.

| First HDB flat | Second HDB flat | Need to pay resale levy? |

| BTO/ SBF/ open booking | BTO/ SBF/ open booking | Yes |

| BTO/ SBF/ open booking | New launch EC | Yes |

| Resale flat with grants | BTO/ SBF/ open booking | Yes |

| New launch EC | BTO/ SBF/ open booking | Yes |

When to apply for the HDB Flat Eligibility (HFE) letter

Since the application for the HDB Flat Eligibility (HFE) letter assesses your eligibility to buy an HDB flat, you need to apply for it at the early stage of your home-buying journey.

Here’s when you need to apply for the HDB HFE letter:

| When to apply | |

| New HDB flat (i.e. BTO, SBF or open booking) | Before BTO, SBF sales launch or open booking |

| Resale flat |

|

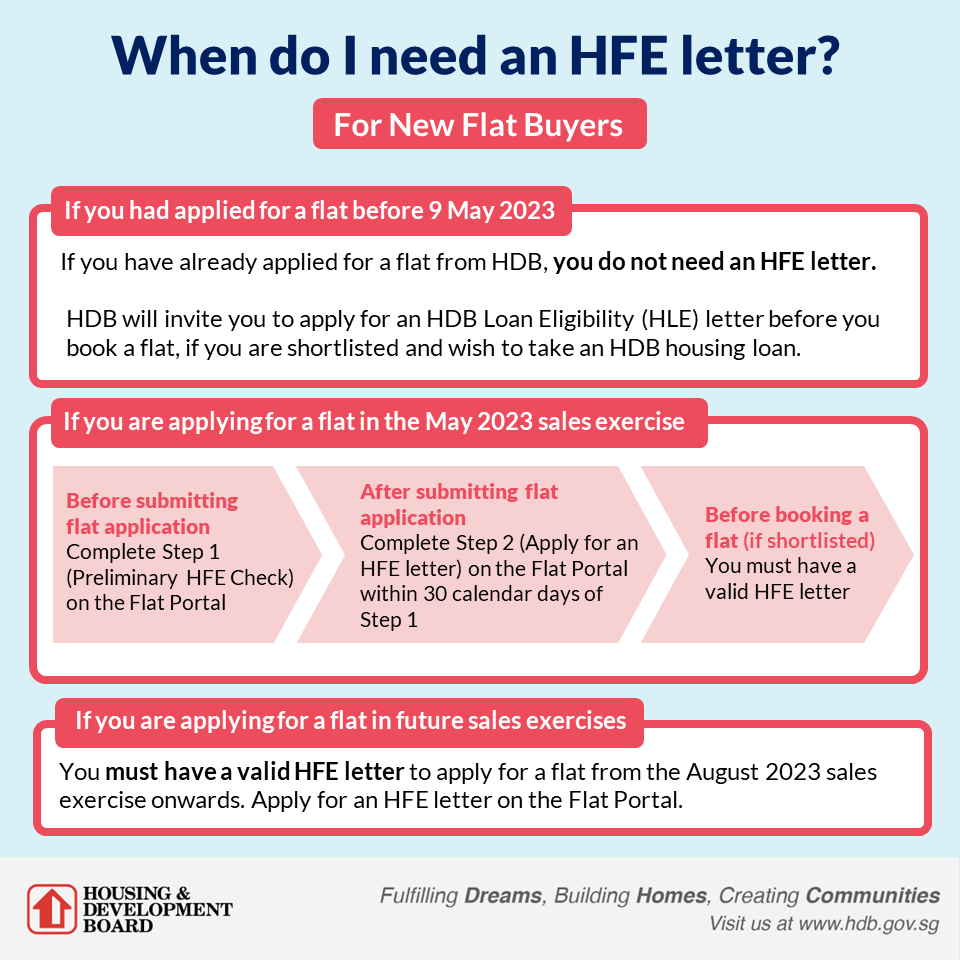

With these changes, there will be transitionary arrangements on this.

Transitionary arrangement for new flats (eg. BTO, SBF or open booking)

If you’ve applied for a flat via BTO, Sale of Balance Flats (SBF) or open booking before 9 May 2023, you don’t need to apply for the HFE letter.

If you’re shortlisted to book a flat, HDB will invite you to apply for the HDB Loan Eligibility (HLE) letter if you’d like to take an HDB housing loan. You need this letter before you can book a flat.

May 2023 BTO and SBF sales exercise

From the May 2023 launch onwards, you need to get the HFE letter. More specifically, you need to complete a preliminary HFE check to get a preliminary HFE assessment (more on this later) before you can submit a BTO application.

So if you’re looking to apply for the May 2023 BTO and SBF, you might want to complete this from 9 May onwards, before the sales exercise starts this month (which can happen anytime soon).

After completing the preliminary check, you need to apply for the HFE letter within 30 days and submit supporting documents to HDB. You will need this HFE letter before you can book a flat.

Sales exercises thereafter (eg. Aug 2023 BTO, open booking)

For future sales exercise after the May 2023 BTO and SBF launches, you will have to apply for an HFE letter before you can apply for a flat.

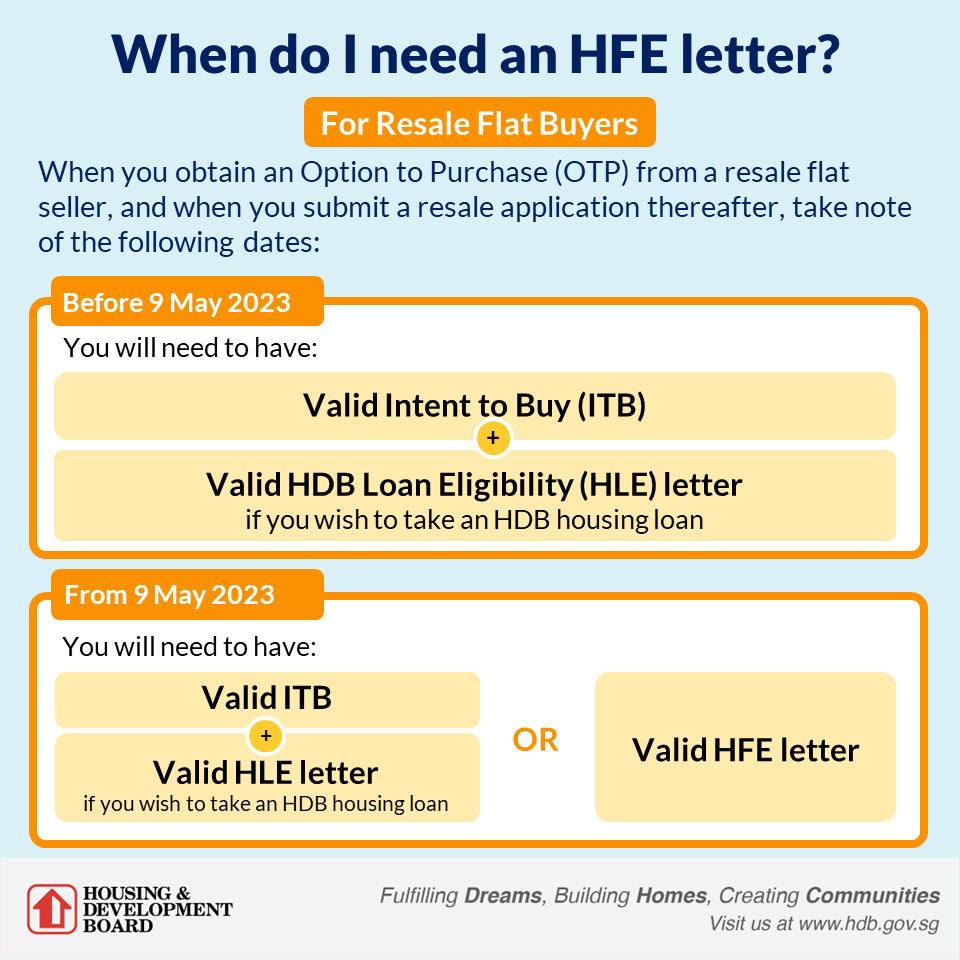

Transitionary arrangement for resale flats

From now till 8 May 2023, you can still register an Intent to Buy or apply for an HLE letter. Since the Intent to Buy is valid for a year, while the HLE letter is valid for six months.

After 9 May 2023, whether or not you need to apply for the HFE letter depends on whether you have a valid Intent to Buy and the HLE letter.

If you have a valid Intent to Buy

You don’t need to apply for the HFE letter if you already have a valid HLE letter.

Otherwise, if you’re taking an HDB loan, you need to apply for the HFE letter before getting the Option to Purchase (OTP) from the seller.

| Have a valid HLE letter? | Yes | No |

| Next steps | Can proceed to get OTP from seller and submit the resale application | If taking HDB loan: apply for HFE letter before getting OTP from seller and submitting the resale application

If taking bank loan or not taking any loan: can proceed to get OTP from seller and submit the resale application |

(We break down the pros and cons of taking an HDB loan vs bank loan here.)

If you plan on taking a bank loan instead, you’ll have to apply for the In-Principle Approval (IPA), which can be done within the HDB Flat Portal from 9 May onwards. This is provided you’re applying from either of the following banks and financial institutions:

- DBS

- OCBC

- UOB

- Maybank

- Hong Leong Finance

- Sing Investments & Finance

If you don’t have a valid Intent to Buy

You will need to apply for the HFE letter before getting an OTP from the seller and submit the resale application.

How to apply for the HDB Flat Eligibility (HFE) letter

There are two steps to this, which you have to complete within 30 days of each other.

Step 1: Preliminary HFE check

First, you need to log in to the HDB Flat Portal with your Singpass. The portal will retrieve personal details from Myinfo. At this stage you’ll also need to declare information such as your household income and whether you own any private properties.

(Note that you’re not allowed to own a private property when you buy an HDB flat. You’ll have to dispose of it 15 months before buying a resale flat, or 30 months before buying a new flat from HDB.)

HDB will then provide an instant preliminary overview of your eligibility to buy a flat, receive CPF grants and take an HDB loan.

If you wish to proceed with buying an HDB flat, you’ll need to go to the next step, which is to apply for the HFE letter. You can do this straight after, or later (within 30 days).

Step 2: Apply for HFE letter

At this stage, all applicants and occupiers need to log in to HDB Flat Portal with Singpass to retrieve personal details from Myinfo and fill up the application.

This means if you’re applying for a 3Gen flat in the May 2023 Bedok BTO (you need to list at least one Singaporean or PR parent as an essential occupier), you need to get your parent(s) to log in to Singpass to fill up the application as well.

At this stage, you may need to upload supporting documents.

HDB will inform you of your eligibility to buy a new flat or resale flat, amount of CPF grants and HDB housing loan within 21 working days.

You’ll be notified of this via SMS when it’s ready. Like the old HLE letter, the HFE letter will be valid for six months.

Here’s how the HDB HFE letter looks like:

HDB expects the HFE letter processing time to be longer during the month of a sales launch (i.e. February, May, August and November for BTO). So if you’re set on buying a BTO flat once the location details are out, you might want to apply for the HFE letter early.

Planning to sell your HDB flat? Let us help you get the right price by connecting you with a premier property agent.

If you found this article helpful, 99.co recommends Sale of Balance Flats 2023, What you need to know about HDB’s Sale of Balance Flats (SBF) in 2023 and 14 affordable properties within 1km of top primary schools in Singapore.

The post HFE (HDB Flat Eligibility) letter: What is it and how to apply appeared first on .