The latest cooling measures on 27 April 2023 had the biggest impact on foreign buyers, who saw their ABSD (additional buyer’s stamp duty) rates double, from 30% to 60%. Some new launch condos, like Newport Residences, postponed their launch after the cooling measures were imposed.

But Blossoms by the Park, another new launch condo, decided to proceed with its sales launch despite the cooling measures. And it seems like the developer’s decision paid off, as it sold almost 75% of its units (205 out of 275 units), which is also the highest take-up rate for new launches this year.

We analyse why some new launch condos are still most likely to do well despite the latest cooling measures. (We’ll use multiple examples from Blossoms by the Park and other new launches).

Profile of target buyers

The cooling measures aimed to dissuade local and foreign investment and prioritise housing for owner-occupiers. Hence, if a new launch is targeted at first-time Singaporean buyers and homeowners, it’s unlikely that its sales would be affected by the cooling measures.

This was the case for Blossoms by the Park, where about 96% of buyers were Singaporeans and permanent residents (according to the developer). Mark Yip, CEO of Huttons Asia, attributes the positive sales to the count of properties owned by buyers, “Huttons estimated that more than 90% were first-time buyers hence unaffected by the cooling measures.”

The profile of target buyers of new launches is also tied to its location. On Blossoms by the Park’s sales, Marcus Chu, CEO of ERA Realty Network, says, “Typically, more than 80% of the homebuyers in the RCR are Singaporeans; and they may not be affected or too affected by the recent increase in ABSD rates.”

Based on caveats from URA Realis in Q1 of 2023, the proportion of foreign buyers in the CCR was 15.6% compared to 5.7% in the RCR and 2.4% in the OCR.

This might explain why Newport Residences, located in the CCR, decided to hold off on its launch. But we foresee that new launches in the OCR and RCR will proceed with their previews as planned.

Low supply of new launches

If a new launch is in an area with a low supply of new condos in recent years, it has a better chance of doing well.

Blossoms by the Park launched two years after One-North Eden, which sold 85% of its units during the launch weekend and is already fully sold. Before that, there had been no new launches since 2009, when One-North Residences was completed. Hence, Blossoms will fill the supply gap of condos in the one-north area.

We also saw high take-up rates of new launches in 2022 in areas with a low supply of private condos. These included Lentor Modern (84%), AMO Residence (98%) and Sky Eden@Bedok (75%), all of which broke the price benchmark of S$2,000 psf for new launches in the OCR. These projects were also the first new launch in their respective neighbourhoods in more than 8 years.

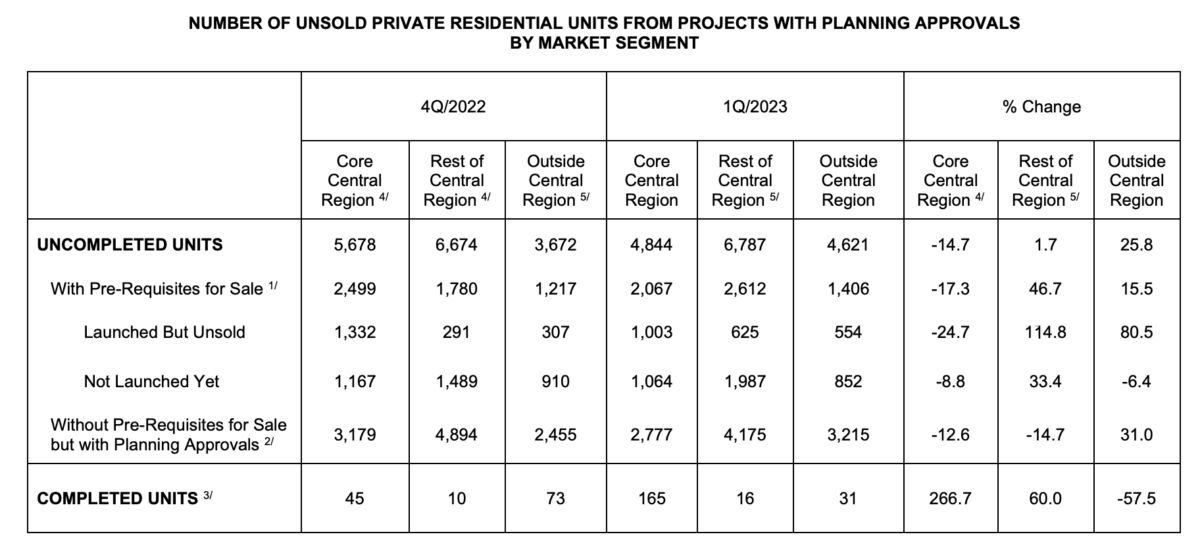

Based on URA’s real estate statistics in Q1 of 2023, the CCR had the highest supply of uncompleted units, which have launched but are unsold, at 1,003 units. In the same period, the RCR had a supply of 625 units, while the OCR had 554 units.

If there continues to be a dwindling supply of units in the RCR and OCR, new launches in both regions are most likely to see higher take-up rates than those in the CCR.

Attractive launch price

In the wake of rising interest rates, inflation and GST hikes, buyers are increasingly more cautious in purchasing their homes. Price is an important factor in swaying their decision.

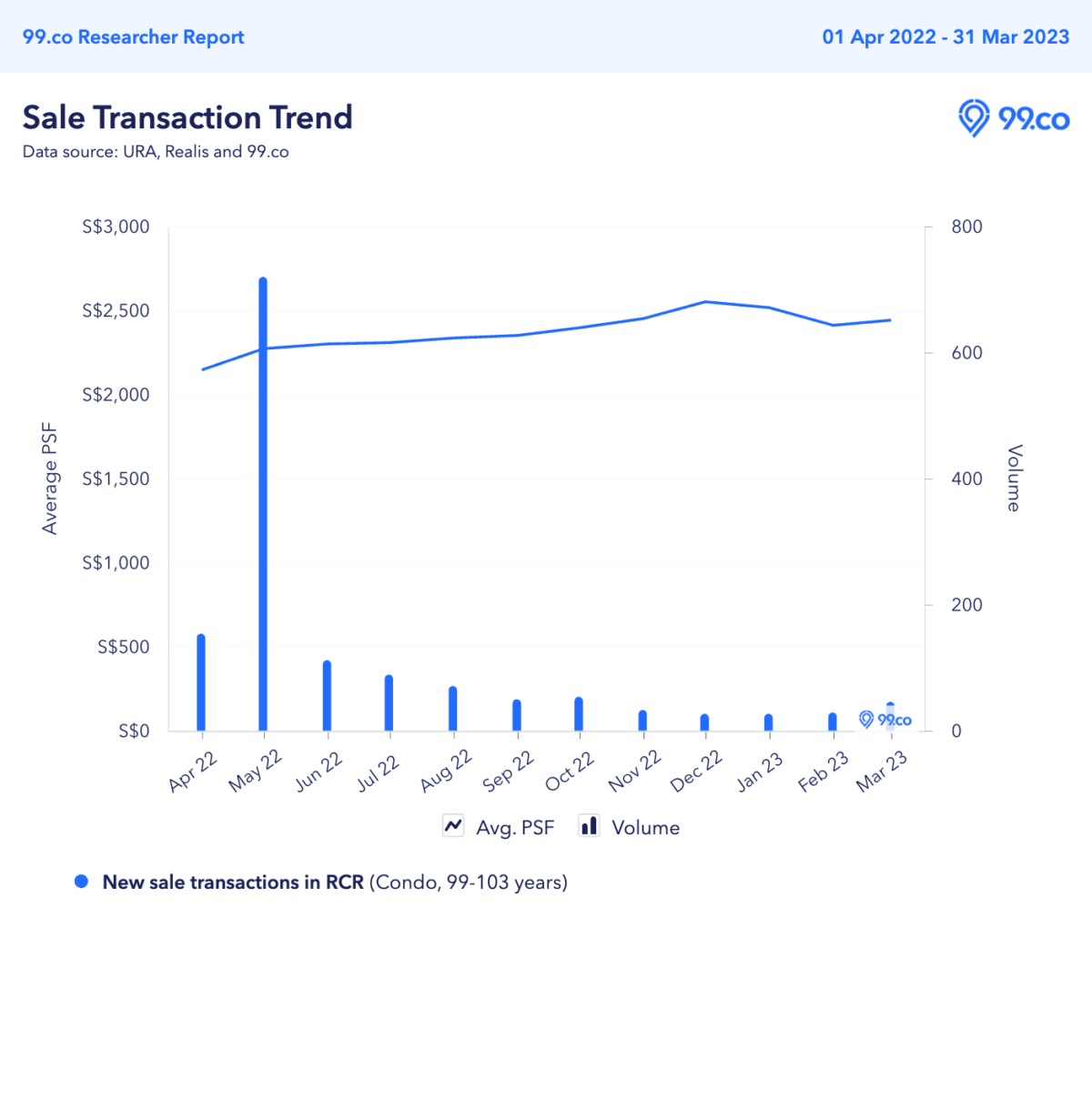

According to Ismail Gafoor, CEO of PropNex, Blossoms by the Park’s launch price starting from S$2,183 psf is “sensitive pricing in today’s market for an RCR development.” The project had an average psf price of S$2,434.

Based on 99.co’s Researcher data, the average psf price of new sale transactions of 99-103-year projects in the RCR was around S$2,442 in March 2023 (before the launch of Blossoms). This meant that Blossoms by the Park’s average psf price were generally lower than the average for the RCR.

If we look at other new launches in recent years, there were similar cases of attractively priced new launches having a high take-up rate. For instance, Jervois Mansion had starting psf prices of around S$2,200, while average psf prices of new sale condos in the area were around S$2,700 to S$2,900 a few months before its launch.

But it’s not just an attractive price that matters. Buyers will be more assured if their monthly mortgage payments are within reach.

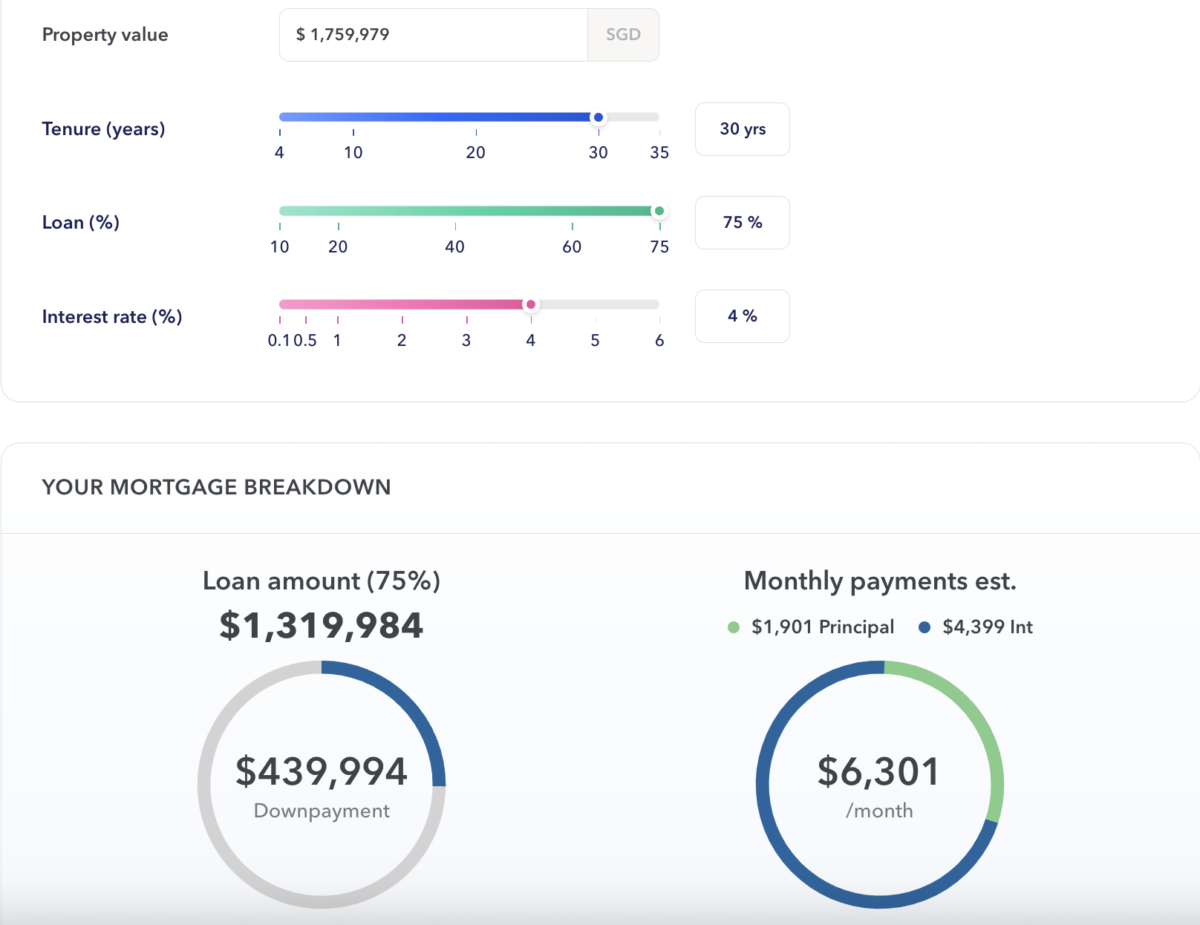

Blossoms by the Park sold out its 1-bedroom + Study, 2-bedroom and 2-bedroom + Study units. The average quantum for its 2-bedroom unit is S$1,662,750, and S$1,759,979 for its 2-bedroom + Study units.

Let’s say a dual-income no kids (DINK) household wants to live in a 2-bedroom + Study near their workplace at one-north. Based on 99.co’s Mortgage Calculator, the downpayment for their 2-bedroom + Study unit will be S$439,994, while the monthly payments are around S$6,301. Taking TDSR of 55%*, the total monthly household income needed is around S$11,456 (S$5,728 per person).

Singapore’s median household income in 2022 was S$10,099. Hence, the average prices for Blossoms by the Park’s 2-bedroom + Study unit would seem reasonable for a significant group of first-time buyers.

*This assumes a full financing loan of 75%, with a 30-year tenure and a 4% interest rate per annum. For illustration purposes, there are no other loans to service, including property loans, car loans, personal loans and student loans.

Location and convenience

With or without cooling measures, a good location is one major factor for the popularity of condos. This includes proximity to an MRT station, amenities like shopping malls and/or good schools.

Blossoms by the Park is a 3-minute walk to Buona Vista MRT interchange, malls like The Star Vista and the one-north tech hub. Hence, it’s attractive for both owner-occupiers and investors.

Similarly, Sceneca Residence, which launched in January, also appeals to both groups. The mixed-use development linked to Tanah Merah MRT has sold over 60% of its units. All its 1 and 2-bedroom units were fully sold during the launch weekend.

In the past two years, integrated developments like Lentor Modern, Piccadilly Grand, Canninghill Piers and Pasir Ris 8 also had high take-up rates. Based on OrangeTee & Tie’s Research & Analytics Market Watcher series report in August 2022, buyers don’t mind paying up to 27% more for integrated developments in the OCR. Not only are these developments convenient for owner-occupiers, but they also have long-term investment benefits.

So there’s a likelihood that integrated developments will continue to see healthy take-up rates this year. However, we feel they will still need to be sensitively priced to attract buyers. Two upcoming integrated developments are The Reserve Residences in Beauty World and the Tampines Ave 11 GLS site which will be connected to Tampines North MRT station.

Availability of dual-key units

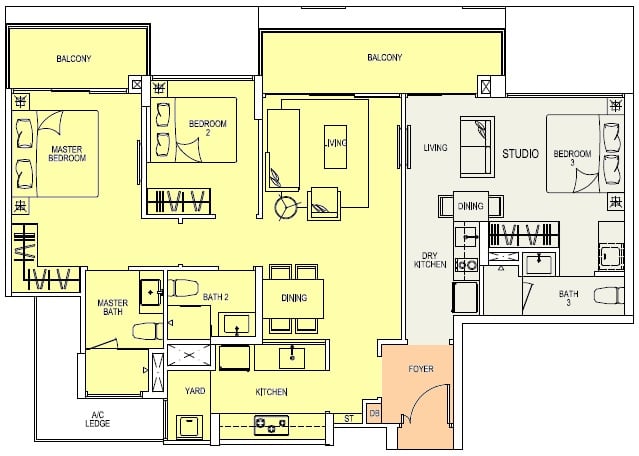

With the increase in ABSD rates, one trend that might be making a comeback is dual-key units. While this doesn’t directly cause a high overall take-up rate, new launches offering these units will appeal to prospective investors who want to avoid paying ABSD.

Dual-key units comprise a larger main unit and a smaller studio unit sharing a foyer and address. Hence, there’s no ABSD payable as it’s legally considered one unit.

According to PropNex CEO Ismail Gafoor, nearly 70% of 3-bedroom units at Blossoms by the Park were sold during its launch, including the dual-key units.

With the ABSD hikes, a dual-key unit seems more favourable for couples or small families who want a side income from rental but don’t want to incur ABSD for buying an additional unit.

Investors might also consider a dual-key unit as they can get a healthy rental yield from both “units”.

We’ve also seen cases where foreigners buy units in bulk, usually for large multi-generational families. Hence, dual-key units might help soften the blow for the amount of ABSD incurred in these instances (although we think it wouldn’t matter much to the super-rich).

The latest cooling measures are expected to dampen property investment from local and foreign buyers. But many property analysts have expressed that it won’t necessarily lower property prices significantly as there’s still generally a low supply of new launches. For now, it remains to be seen what other measures the government will adopt to cool the private property market.

Do you have plans to sell your current home and move to a new launch condo? Let us connect you with a property consultant.

If you found this article helpful, 99.co recommends Singapore ranks No. 1 in the world for highest stamp duty rates on foreigners buying homes and 6 new launch condos to look forward to in Q2 of 2023.

The post Why some new launches will still do well despite the latest cooling measures appeared first on .