For most of us, adulting is hard. And it gets even more daunting when it’s time to buy a house.

Given the high cost of housing in Singapore, most of us would go for an HDB flat as our first home.

On the other hand, since HDB flats are a form of public housing, there are many criteria and conditions to meet before you’re eligible to buy one. And understanding these conditions and navigating the buying process can be a little tough, especially if you’re buying a home for the first time.

With that, 99.co answers some commonly asked questions about one’s eligibility to buy an HDB flat.

Eligibility to buy an HDB flat

1. Can I buy an HDB flat by myself even though I’m married?

Technically, you cannot buy an HDB flat by yourself as a married person. You’ll need to form a family nucleus with your spouse in order to be eligible to buy public housing.

Your spouse can either be listed as a co-owner or an essential occupier (i.e. core occupier). The main difference between these two is that as an essential occupier, your spouse won’t have any interest in the flat.

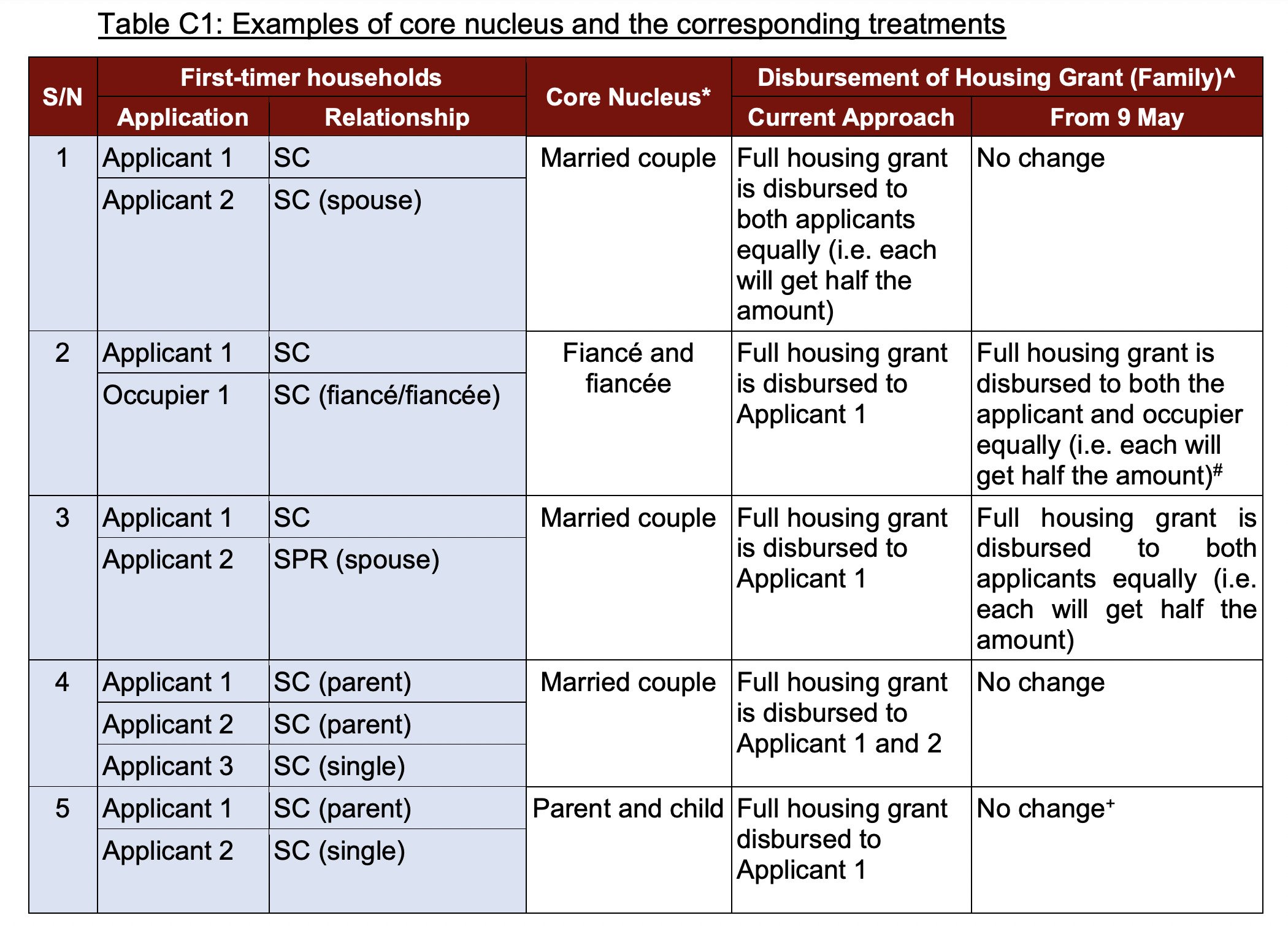

Another thing to note is that HDB recently introduced some changes that affect the essential occupier. From 9 May 2023 onwards, those listed as essential occupiers will also receive a share of the housing grant. But they won’t be able to use it for the flat purchase unless they’re listed as a co-owner.

On top of that, just like the co-owner, the essential occupier will be considered a second-timer for their next HDB flat purchase. But this rule excludes cases where the essential occupier is a child. We’ll explain more on that later.

2. I have a property overseas. Can I buy an HDB flat?

No, as long as you have a property in Singapore or overseas, you’re not allowed to buy an HDB flat. You’ll have to sell it and wait for a certain number of months, depending on whether you’re buying from HDB or the resale market.

If you plan to buy a non-subsidised HDB resale flat (i.e. no grants, except the Proximity Housing Grant), you need to wait for 15 months before you can apply for the HDB Flat Eligibility Letter (HFE).

The wait is double at 30 months (before you can apply for the HFE letter) if you plan to buy from HDB (through BTO, SBF or open booking) or the resale market with CPF housing grants. This waiting period is also applicable if you wish to qualify for the HDB housing loan.

The exception to this rule is if you’re a senior citizen aged 55 and above looking to downgrade from a private residential property. This is on the condition that you plan to either buy one of the following:

- From HDB: A short-lease 2-room Flexi flat or Community Care Apartment

- From the resale market: 4-room flat or smaller, without CPF housing grants (excluding Proximity Housing Grant if you’re eligible)

After the completion of the flat purchase (i.e. when you get the keys to your new flat), you’ll have to dispose of the house within six months.

HDB flats for sale

2

2

2

1

1

2

2

2

2

1

1

1

2

2

2

1

2

2

1

1

1

1

2

2

2

1

1

1

1

1

2

1

1

1

1

1

2

2

1

1

1

1

1

1

1

1

1

1

1

2

1

1

1

2

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

See all 2-room >

2

2

2

2

2

2

2

2

2

2

2

1

2

2

3

2

2

2

3

2

2

2

3

2

2

2

3

2

2

2

2

2

3

2

3

2

3

2

2

1

3

2

2

1

2

2

2

2

2

2

3

2

3

2

3

2

3

1

2

2

3

2

2

2

3

2

3

2

2

1

See all 3-room >

3

2

3

2

3

2

3

3

2

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

4

3

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

1

See all 4-room >

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

4

2

4

2

3

2

3

2

3

2

3

2

4

2

3

2

3

2

3

2

4

2

3

2

3

2

3

2

3

2

4

2

3

2

3

2

3

2

3

2

3

2

4

2

4

2

3

2

See all 5-room >

4

3

4

2

6

2

4

3

6

2

4

3

4

3

5

3

4

3

3

2

4

3

3

3

4

2

6

2

4

4

4

2

3

3

4

2

4

2

3

2

4

2

4

2

3

3

4

2

4

2

4

2

4

4

4

2

3

2

4

3

4

2

3

3

5

3

4

3

4

2

See all Executive >

3. Can I apply for BTO or SBF during the MOP?

As an owner or essential occupier of an HDB flat, you face a few restrictions during the Minimum Occupation Period (MOP). The commonly known ones include physically occupying the flat and not owning other residential properties during the MOP.

Another condition is that you’re not allowed to apply for a new flat from HDB. This allows the housing board to better prioritise the limited housing supply to those who do not have an HDB flat yet.

After all, the main purpose of HDB flats is to be a roof over residents’ heads, with the MOP implemented to ensure that it’s for long-term living and not for property speculation.

Find out more on what you can do after the MOP here.

4. Will my BTO or SBF ballot chances be affected if I have submitted an Intent To Buy a resale flat?

Do note that from 9 May 2023 onwards, the Intent To Buy has been replaced by the HDB Flat Eligibility (HFE) letter. If you have a valid Intent To Buy and a valid HDB Loan Eligibility (HLE) letter, you won’t have to apply for the HFE letter.

Essentially, both the Intent To Buy and the HFE letter serve the same purpose of informing you of your eligibility on the following:

- Buying a resale flat (HFE also covers eligibility to buy a flat from HDB)

- Receiving housing grants

- Getting HDB loan

It’s not an approval from HDB to buy a resale flat. So submitting an Intent To Buy or applying for the HFE letter does not affect your BTO or SBF ballot chances.

You can read more about it from HDB’s website.

5. I’m planning to buy a BTO flat with my son and list him as an essential occupier. Will he be considered a first-timer or second-timer when he gets a BTO flat when he’s married?

As mentioned above, from 9 May 2023 onwards, essential occupiers are considered second-timers. An exception to this is parent-child households buying an HDB flat.

Regardless of the child being listed as a co-applicant or essential occupier to buy an HDB flat with a parent, the child won’t be considered to have enjoyed a housing subsidy this time. So he or she will be considered a first-timer the next time he or she buys an HDB flat with his or her future spouse.

See the table above for more info on this.

Buying an HDB flat with a PR or foreigner

1. I’m married to a foreigner. Can I buy an HDB flat?

Yes, as a Singaporean, you can buy an HDB flat with your foreign spouse. Note that the eligibility criteria are a little stricter if you buy from HDB (i.e. BTO, SBF or open booking).

Here’s a summary on the main differences in the eligibility criteria between buying from HDB versus the resale market.

| Buying from HDB (BTO, SBF or open booking) | Buying from the resale market | |

| Age of SC | At least 35 years old | At least 21 years old |

| Flat type | 2-room Flexi flat in a non-mature estate | All flat types (except 3Gen flats and PLH flats) |

| Resident status of foreign spouse | A valid Visit Pass or Work Pass (of any validity period) at the time of flat application | If you’re at least 21 years old:

Your spouse must have a valid Long Term Visit Pass or Work Pass of at least 6 months from the date of issue at the time of resale application If you’re at least 35 years old: Your spouse must have a valid Visit Pass or Work Pass (of any validity period) at the time of resale application |

If you have a child with Singapore citizenship or PR, you can list them as an essential occupier to form a core family nucleus. This will also be similar to an SC/SC or SC/PR couple buying an HDB flat, which means you face less restrictions in buying a flat.

| Buying from HDB (BTO, SBF or open booking) | Buying from the resale market | |

| Age | At least 21 years old | At least 21 years old |

| Flat type | Up to a 5-room flat | All flat types (except 3Gen flats) |

2. I’m a PR and I bought an HDB flat with my SC spouse. Will the grant amount be affected if I get Singapore citizenship?

You may be able to get S$10,000 under the Citizen Top-Up, if you have:

- Paid a premium of S$10,000 when you bought the flat from HDB (BTO, SBF or open booking)

- Taken a CPF housing grant that was S$10,000 lesser than what an SC/SC household would get when you bought a resale flat, DBSS or Executive Condo (EC).

The grant will be credited to your CPF Ordinary Account to be used to pay for the flat.

To qualify for this, you’ll need to apply within six months of getting your citizenship.

Read more about it here.

3. I’m a Singaporean. Can I buy an HDB flat with my parent who’s a foreigner?

Yes, as a Singaporean aged at least 21 years old, you can buy an HDB flat (except 3Gen flats and PLH flats) from the resale market with a parent who’s not an SC or PR. You will need to list them in your application.

On top of that, they must have a valid Long Term Visit Pass or Work Pass for at least six months at the time of the resale flat application.

For instance, if the pass was issued in May 2023, the earliest you can submit your resale application would be six months later, which is in November 2023.

As an essential occupier listed in the application, your parent must also not have any interest in any local or overseas private property. They’ll have to sell any house owned at least 15 months before you can apply for the HFE letter.

Planning to sell your HDB flat? Let us help you get the right price by connecting you with a premier property agent.

If you found this article helpful, 99.co recommends Deciding between HDB loan vs bank loan? Here’s a quick reference and 3-room, 4-room or 5-room HDB flat: Which property has the highest appreciation?

The post FAQs: “Can I BTO during MOP?” – Commonly asked questions about buying HDB flat eligibility appeared first on .