In July and August 2023, there were eight new private residential launches and one executive condominium (EC).

On several weekends in both months, we saw the launch of two or three projects simultaneously. Most recently, on the weekend of 12-13 August, Orchard Sophia, TMW Maxwell, and The Arden commenced their sales bookings.

According to analysts, the last time there was an influx of new launch units was in November 2018 and the first half of 2021.

Ismail Gafoor, CEO of PropNex, refers to this as “choice paralysis” as “buyers are spoilt for choice in today’s market, with more than 2,500 units (excluding ECs) still unsold from recently launched projects since April.”

ERA’s CEO, Marcus Chu, also notes that “homebuyers are making their rounds to consider various options before returning to pick up a unit in the project of their choice.”

Based on Huttons’ private residential market report in Q2 of 2023, there may be up to 21 new launches with a projected 6,969 units in the second half of the year.

With many new launch options, you might wonder which new launch you should purchase.

Here’s a look at the potential capital appreciation of new launches and the profitability of similar condos around them.

New launches in July and August 2023

| Project | District | Region | Average psf price (S$) | No. of units | % of units sold (as of 13 Aug 2023) | TOP | Tenure |

| Lentor Hills Residences | 26 | OCR | 2,099 | 598 | 55.9% | 2028 | 99-year |

| The Myst | 23 | OCR | 2,069 | 408 | 31.1% | 2029 | 99-year |

| Pinetree Hill | 21 | RCR | 2,367 | 520 | 28.8% | 2027 | 99-year |

| Grand Dunman | 15 | RCR | 2,534 | 1,008 | 54.5% | 2028 | 99-year |

| The LakeGarden Residences | 22 | OCR | 2,120 | 306 | 23.2% | 2027 | 99-year |

| Altura EC | 23 | OCR | 1,433 | 360 | 61% | 2027 | 99-year |

| Orchard Sophia | 9 | CCR | 2,800 | 78 | 23% | 2027 | Freehold |

| TMW Maxwell | 2 | RCR | 3,310 | 324 | 2.2% | 2028 | 99-year |

| The Arden | 23 | OCR | 1,750 | 105 | 22.9% | 2027 | 99-year |

Data source: URA, Realis, 99.co

In July and August this year, there were five new launches in the OCR (including Altura EC), three in the RCR and one in the CCR.

Except for District 23, which has three launches (including an EC), the other projects are across different regions in Singapore. Even though there are two private condo launches in District 23, The Myst and The Arden, they are of different sizes and price points.

*For the rest of the article, we’ll only compare the private residential launches and not include Altura, as it is an EC and targets a different demographic.

Capital appreciation analysis of new launches in July and August 2023

In this segment, we’ll examine the new launch condos in the OCR and RCR regions as they form the bulk of new projects.

We’ll analyse the capital appreciation and look at the profitability of existing developments around these developments.

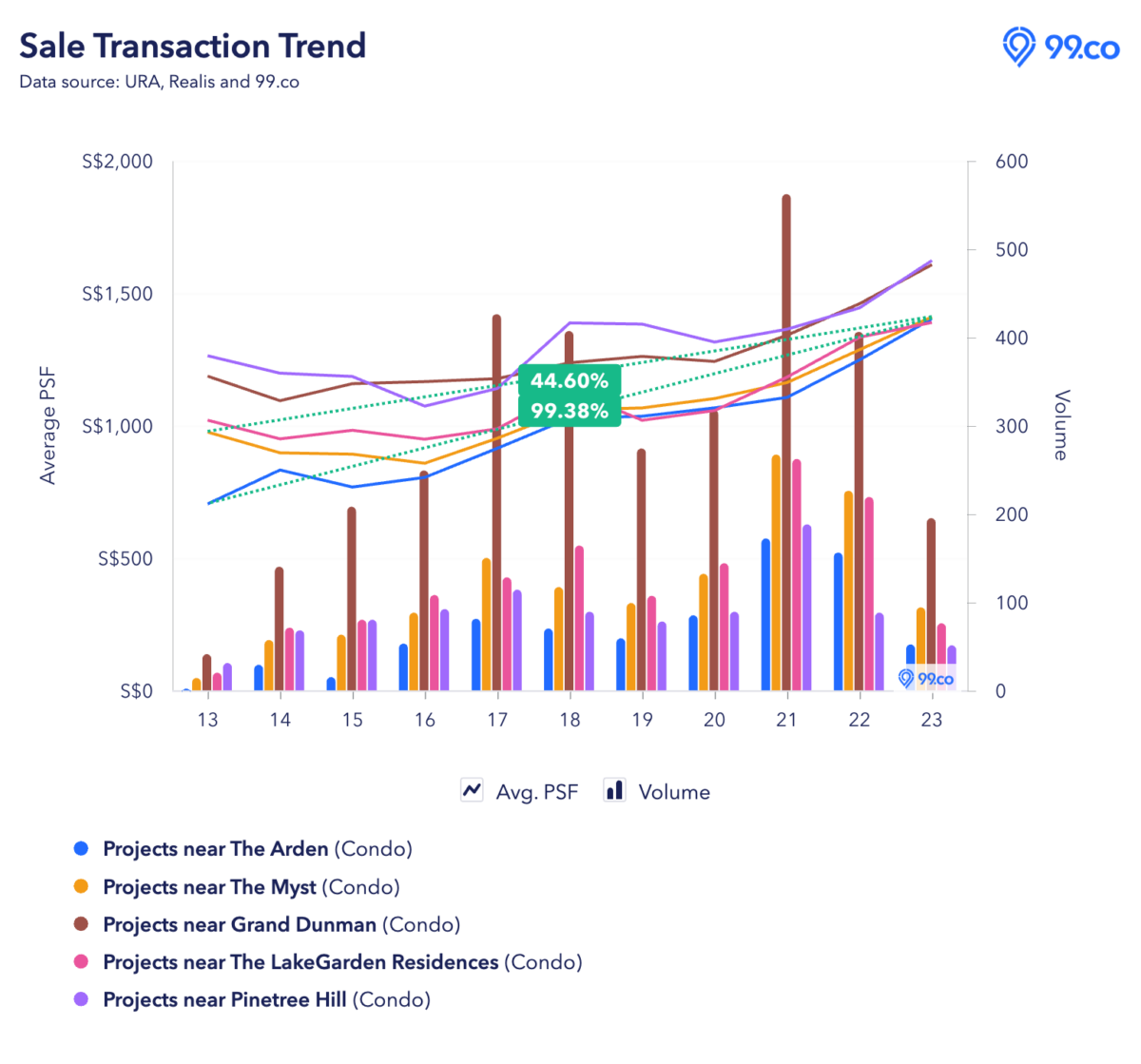

Based on 99.co’s Researcher data, resale transactions near The Arden had the highest capital appreciation rate of 99.4% over the past 10 years, followed by The Myst, with an appreciation rate of 44.6%.

Resale transactions near The LakeGarden Residences had a capital appreciation of 36.2% over the past 10 years, followed by resale transactions near Grand Dunman at 35.5%, resale transactions near Pinetree Hill at 28.5% and resale transactions near Lentor Hills Residences at 22.5% (not pictured in the graph above).

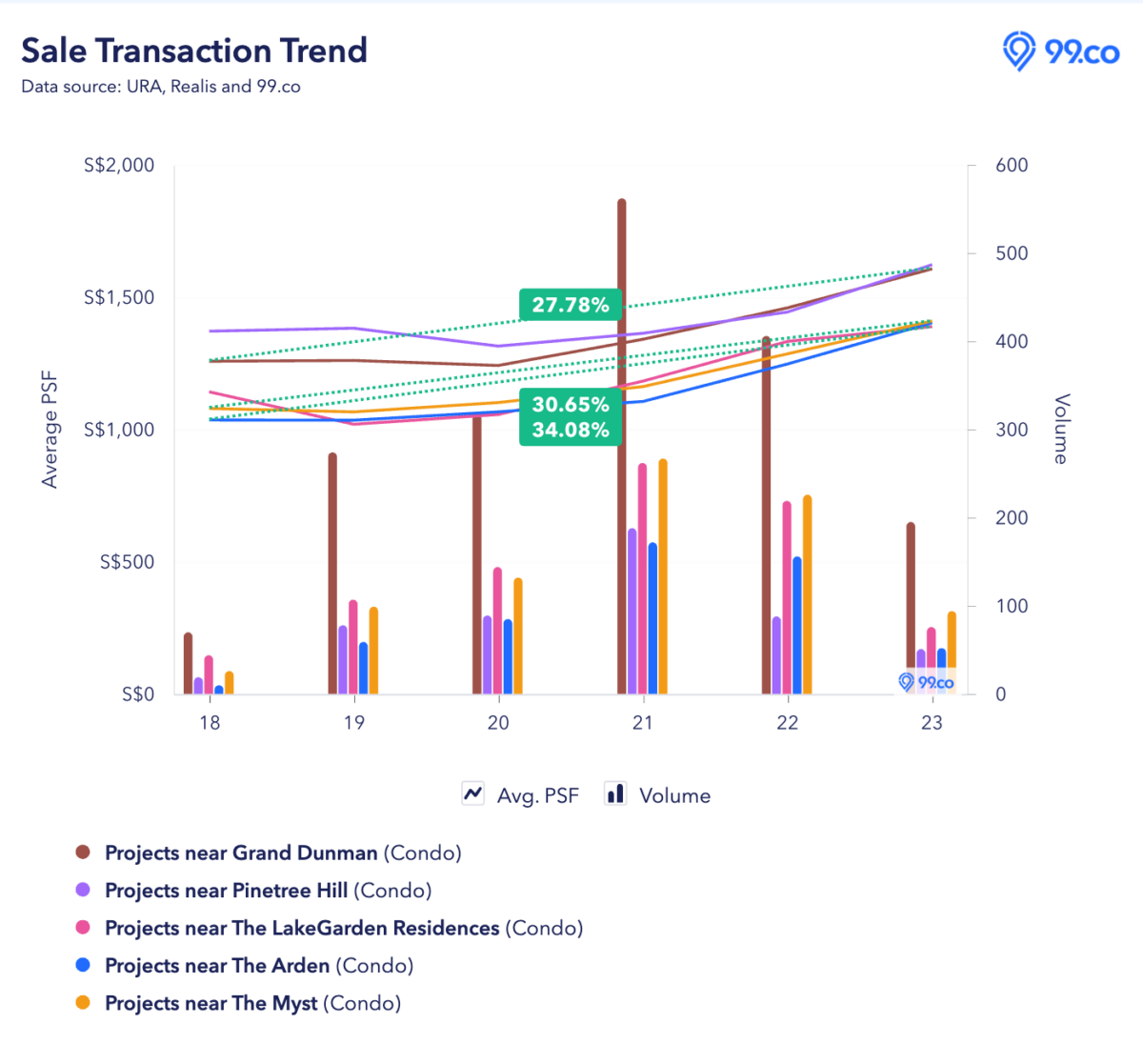

Over the past five years, resale transactions near The Arden had the highest capital appreciation of 34.08%, followed by resale transactions near The Myst at 30.65% and resale transactions near Grand Dunman at 27.78%.

In terms of volume, projects near Grand Dunman had the highest number of resale transactions, followed by projects near The Myst and projects near The LakeGarden Residences.

Profitability of resale condos near new launches

The Arden

Located in the Phoenix Road private housing estate near Choa Chu Kang and Bukit Panjang, The Arden is a 105-unit boutique development. It’s a 9-minute walk from Bukit Panjang MRT and near several malls like Junction 10 and Hillion Mall.

One of its highlights is its CoSpace concept in 3- and 4-bedroom units where buyers have flexible unit configurations.

The Arden is one of the most affordable private residential new launches this year (in terms of psf price), as units sold at an average of S$1,750 psf on its launch day.

Check out 99.co’s review of The Arden.

Resale transactions near The Arden

There were 52 resale transactions from condos within 1km of The Arden this year.

Let’s look at the resale transactions of three projects near The Arden: Hillsta (TOP: 2016), The Tennery (TOP: 2013) and Hillion Residences (TOP: 2018).

Hillsta is beside The Arden, while The Tennery and Hillion Residences are nearer to Bukit Panjang MRT. The Tennery is a mixed-use development linked to Junction 10 shopping mall, while Hillion Residences is an integrated development linked to Hillion Mall, Bukit Panjang MRT and a bus interchange.

This year, Hillsta had 7 resale transactions at an average of S$1,310 psf, The Tennery had 14 resale transactions at an average of S$1,270 psf, and Hillion Residences had 20 resale transactions at an average of S$1,713 psf.

*Note that all mentions of “seller profit” throughout this article refer to the difference between the previous owner’s purchase price and the price they sold at. It hasn’t taken into account other costs such as stamp duty, legal fees, agent’s commissions and more.

Hillsta

All 7 of Hillsta’s resale transactions this year were profitable.

| Unit types | Seller profit (S$) | Years held | No. of profitable transactions | Annualised returns (%) |

| 1-bedroom | 49,000 to 128,920 | 9.1 – 10.4 | 4 | 0.8 – 1.9 |

| 2-bedroom | 101,950 to 130,000 | 4.9 – 9.8 | 2 | 1.2 – 3 |

| 3-bedroom | 170,000 | 5 | 1 | 2.7 |

The Tennery

The Tennery recorded 11 profitable transactions and 3 unprofitable transactions this year. Here’s a look at the profitable transactions.

| Unit types | Seller profit (S$) | Years held | No. of profitable transactions | Annualised returns (%) |

| 1-bedroom | -21,000 to 138,443 | 5 – 12.2 | 7 (out of 9) | 0 – 1.6 |

| 2-bedroom | -33,235 to 175,000 | 3 – 12.1 | 4 (out of 5) | 0 – 6.2 |

Hillion Residences

All 20 of Hillion Residences’ resale transactions this year were profitable.

| Unit types | Seller profit (S$) | Years held | No. of profitable transactions | Annualised returns (%) |

| 1-bedroom | 55,000 to 169,350 | 0.8 – 8.7 | 16 | 1.6 – 9.5 |

| 2-bedroom | 301,000 to 361,000 | 10 – 10.1 | 3 | 2.9 – 3.3 |

| 4-bedroom | 713,000 | 10 | 1 | 3.5 |

Of the three condos near The Arden, Hillion Residences recorded the highest number of profitable transactions this year and this could be due to its integrated development status. As it is connected to Hillion Mall and a transport hub with an MRT station and bus interchange, it is unsurprising that Hillion Residences would see a larger pool of buyers and investors.

The Myst

Located a 6-minute walk from Cashew MRT, The Myst is the other new launch in District 23 with 408 units.

Comprising two 24-storey residential towers, The Myst’s units will get unblocked views of the surrounding areas and nature reserves.

Besides boutique project Bukit 828, which will TOP in 2024, other developments around Cashew MRT are more than 15 years old.

Resale transactions near The Myst

There were 94 resale transactions from condos within 1km of The Myst this year.

We’ll look at resale transactions in Cashew Heights (TOP: 1992) and Hazel Park (TOP: 2001) as they are the closest to The Myst and Cashew MRT. Both projects have a lease of 999 years.

Cashew Heights

Cashew Heights had 11 resale transactions this year at an average of S$1,475 psf. However, we only have data for 6 transactions, which are all profitable. As it is an older project, we only have information on the sizes of the units sold but not their bedroom types.

| Unit sizes (sqft) | Seller profit (S$) | Years held | No. of profitable transactions | Annualised returns (%) |

| 1,238 | 977,000 | 26.3 | 1 | 2.8 |

| 1,647 – 1,658 | 882,000 to 1,573,888 | 8.4 – 27.2 | 5 | 4.4 – 5.7 |

Hazel Park

Hazel Park had 5 profitable resale transactions this year at an average of S$1,626 psf.

| Unit types | Seller profit (S$) | Years held | No. of profitable transactions | Annualised returns (%) |

| 2-bedroom | 983,987 | 24.2 | 1 | 4.4 |

| 3-bedroom | 813,000 to 1,248,900 | 3.1 – 23.5 | 3 | 4.1 – 15.4 |

| 4-bedroom | 1,660,836 | 23.5 | 1 | 4.4 |

One resale transaction which stood out is a 3-bedroom unit which made a profit of S$813,000 even though the holding period was only 3.1 years. This transaction had an annualised return of 15.4%.

On average, the resale transactions in both Cashew Heights and Hazel Park had longer holding periods of over 20 years. Since the opening of the Downtown line and Cashew MRT in 2015, both projects have seen a significant psf price increase.

The Downtown line had improved the transport connection from the area to the city, which could have contributed to the demand for both projects.

Grand Dunman

The 1,008-unit Grand Dunman is the first new launch condo near Dakota MRT in over 10 years and the only mega development this year. The last launch in the area was Waterbank At Dakota, which TOP-ed in 2013.

As Grand Dunman is a large development, it has the potential for a greater number of resale transactions in future compared to smaller projects. There are also several new HDB projects in the vicinity, which will form the pool of resale buyers in future.

The project is within a 10-minute drive to the CBD and near reputable schools like Kong Hwa, Chung Cheng High (Main) and Tanjong Katong Primary.

Check out 99.co’s review of Grand Dunman.

Resale transactions near Grand Dunman

There were 195 resale transactions from condos within 1km of Grand Dunman this year.

Let’s look at the resale transactions of two projects nearest to Grand Dunman and Dakota MRT, Waterbank At Dakota (TOP: 2013) and Dakota Residences (TOP: 2010).

Since the start of the year, Waterbank At Dakota had 19 resale transactions at an average of S$1,784 psf, while Dakota Residences had 12 resale transactions at an average of S$1,696 psf. All the transactions were profitable.

Here’s the breakdown of resale transactions in both projects.

Waterbank At Dakota

| Unit types | Seller profit (S$) | Years held | No. of profitable transactions | Annualised returns (%) |

| 1-bedroom | 5,000 to 429,000 | 5 – 13.1 | 8 | 0.2 – 3.3 |

| 2-bedroom | 328,000 | 5 | 1 | 4.5 |

| 3-bedroom | 369,000 to 1,014,000 | 4.4 – 12.8 | 9 | 2 – 7.9 |

Dakota Residences

| Unit types | Seller profit (S$) | Years held | No. of profitable transactions | Annualised returns (%) |

| 2-bedroom | 200,000 to 855,000 | 3.2 – 13.6 | 5 | 2.5 – 5.2 |

| 3-bedroom | 510,000 to 1,010,000 | 7.9 – 13.5 | 4 | 2.5 – 4.4 |

| 4-bedroom | 1,183,440 to 1,257,090 | 12.5 – 14.7 | 3 | 3.4 – 4 |

The LakeGarden Residences

A redevelopment of the former Lakeside Apartments, The LakeGarden Residences is Jurong’s first new launch in 7 years.

The 306-unit development is part of Jurong Lake District’s transformation into a key commercial and lifestyle hub, boosting the project’s potential capital appreciation. 75% of the development’s units will enjoy unblocked views of Jurong Lake Gardens.

Resale transactions near The LakeGarden Residences

As The LakeGarden Residences’ immediate area doesn’t have any resale transactions this year, we’ll look at resale transactions in two projects, Lake Grande (TOP: 2020) and Lakeville (TOP: 2018).

Both projects are nearer to Lakeside MRT. Although there are other projects in the area, we’ve chosen Lake Grande and Lakeville as these are the newest developments.

Check out 99.co’s review of The LakeGarden Residences.

Lake Grande

Lake Grande had 10 resale transactions this year at an average of S$1,682 psf, all of which were profitable.

| Unit types | Seller profit (S$) | Years held | No. of profitable transactions | Annualised returns (%) |

| 1-bedroom | 180,000 | 6.7 | 1 | 4.2 |

| 2-bedroom | 175,000 to 315,000 | 4.9 – 6.7 | 8 | 2.9 – 4.6 |

| 5-bedroom | 413,000 | 5.4 | 1 | 4.1 |

Lakeville

Lakeville had 14 resale transactions this year at an average of S$1,618 psf. However, we only have data for 10 transactions, and they were all profitable.

| Unit types | Seller profit (S$) | Years held | No. of profitable transactions | Annualised returns (%) |

| 1-bedroom | 114,000 to 118,790 | 8 – 8.5 | 2 | 1.7 – 1.9 |

| 2-bedroom | 127,500 to 223,000 | 8.1 – 8.9 | 5 | 1.6 – 2.8 |

| 3-bedroom | 331,712 to 496,835 | 6.9 – 7 | 2 | 3.7 – 4.5 |

| 4-bedroom | 653,123 | 6.5 | 1 | 5.7 |

Pinetree Hill

Pinetree Hill is the first major condo launch in the Mount Sinai and Ulu Pandan neighbourhood in 14 years. The last project was The Trizon, which TOP-ed in 2012.

Located at the former Nexus International School site, Pinetree Hill has 520 units, many of which will get unblocked views of Clementi Forest. It is also within 1km of Henry Park Primary.

Check out 99.co’s review of Pinetree Hill.

Resale transactions near Pinetree Hill

There were 51 resale transactions from condos in the Ulu Pandan area this year.

Most of the developments in Pinetree Hill’s surrounding area are older, so we’ll look at the resale transactions of The Trizon (TOP: 2012) and The Marbella (TOP: 2005), which are the newest projects.

However, as both projects are freehold developments, we’ll also look at Astor Green, a 99-year project which TOP-ed in 1995.

The Trizon

The Trizon only saw 4 transactions this year, which were all profitable. These had an average price of S$2,057 psf.

| Unit types | Seller profit (S$) | Years held | No. of profitable transactions | Annualised returns (%) |

| 2-bedroom | 370,000 to 620,000 | 4.8 – 5.6 | 2 | 4 – 5.3 |

| 3-bedroom | 1,441,300 | 13.2 | 1 | 3.2 |

| 4-bedroom | 962,244 | 10 | 1 | 2.7 |

The Marbella

The Marbella had 7 resale transactions this year at an average of S$2,147 psf, all profitable.

| Unit types | Seller profit (S$) | Years held | No. of profitable transactions | Annualised returns (%) |

| 2-bedroom | 780,000 | 6.8 | 1 | 6.3 |

| 3-bedroom | 769,000 to 2,470,000 | 10.7 – 19 | 4 | 3.2 – 6.7 |

| 4-bedroom | 2,205,000 to 2,517,000 | 18 – 18.1 | 2 | 5.8 – 6.3 |

Notably, The Marbella recorded two 3-bedroom and two 4-bedroom transactions with a capital gain of over S$2 million. These transactions had a holding period of 18 to 19 years.

Astor Green

Astor Green had 6 profitable transactions this year at an average of S$1,393 psf.

| Unit types | Seller profit (S$) | Years held | No. of profitable transactions | Annualised returns (%) |

| 2-bedroom | 210,000 to 580,000 | 8.1 – 12.5 | 4 | 1.6 – 6.1 |

| 3-bedroom | 515,000 to 695,000 | 10.8 – 12.6 | 2 | 2.8 – 3.3 |

Although Astor Green is a 99-year leasehold project, it still fares well compared to The Trizon and The Marbella.

Lentor Hills Residences

Located a 5-minute walk from Lentor MRT, Lentor Hills Residences is the second new launch in the area after Lentor Modern. The area will see around 7 new launches from government land sales (GLS) tenders.

Lentor Hills Residences is near popular schools like Anderson Primary and CHIJ St. Nicholas Girls’ School.

Check out 99.co’s review of Lentor Hills Residences.

Resale transactions near Lentor Hills Residences

This year, the Lentor/Yio Chu Kang area only saw 29 resale transactions this year.

We’ll look at Seasons Park and Castle Green, as they had the most resale transactions this year. Both projects TOP-ed in 1997 and have a 99-year lease.

Seasons Park

Seasons Park had 13 resale transactions this year at an average of S$1,049 psf, all profitable.

| Unit types | Seller profit (S$) | Years held | No. of profitable transactions | Annualised returns (%) |

| 1-bedroom | 330,000 | 3 | 1 | 10.5 |

| 2-bedroom | 232,000 to 610,000 | 4.9 – 13.2 | 5 | 2.9 – 5 |

| 3-bedroom | 255,000 to 628,857 | 10.3 – 26.9 | 6 | 1.8 – 4.6 |

One 1-bedroom resale transaction stood out as it had a profit of S$330,000 for a holding period of just 3 years and an annualised return of 10.5%. This might be due to the lack of supply of 1-bedroom units in the area. It’s the only 1-bedroom resale transaction in the area this year.

However, new launches like Lentor Hills Residences and Lentor Modern are expected to increase the supply of 1-bedroom units in the area.

Castle Green

Castle Green had 4 resale transactions this year at an average of S$1,166 psf, all were profitable. Interestingly, all of them were 3-bedroom units.

| Unit types | Seller profit (S$) | Years held | No. of profitable transactions | Annualised returns (%) |

| 3-bedroom | 390,000 to 677,000 | 5 – 28 | 4 | 2.9 – 7.3 |

Other factors affecting resale prospects of new launches

While looking at capital appreciation and profitability of neighbouring developments might give us some idea of the resale prospects of new launches, there are other factors to consider.

Capital appreciation of new launches might be significantly impacted by developments based on the URA master plan. This includes new amenities, shopping malls and train stations among others.

For instance, some new launches, like Lentor Hills Residences and The LakeGarden Residences are in areas that will see massive growth in the next few years. These are the Lentor estate and Jurong Lake District.

Similarly, The Arden and The Myst might benefit from developments in neighbouring estates like Tengah.

The profitability of condos also depends on a few factors, like supply and demand of specific unit types, unit layouts and sizes, tenure and holding periods.

The location of a unit in the development can affect its profitability too. This refers to whether it’s on a low or high floor, a stack with good views, etc.

If you plan to buy a new launch and sell it for a profit in the future, we hope we’ve given you a better idea of which development suits you best.

–

–

Looking to sell your house and buy a new launch condo? Let us help you by connecting you with a property agent.

If you found this article helpful, 99.co recommends a Full list of new launch condos (with unsold units) approaching their developer ABSD deadlines in 2023/2024 and When did the psf price for new launch condos widen from resale, and why?

The post Analysis: Potential capital appreciation and profitability of new launches in Jul-Aug 2023 appeared first on .