In the ever-evolving world of real estate, staying informed about current trends and expert opinions is paramount. In this report, we will delve into the highlights from August’s resale condo market, hear from experts about their insights, and explore what the future might hold for resale condos.

August resale condos 2023 highlights

August witnessed interesting shifts in resale condo prices across different regions in Singapore.

The Core Central Region (CCR) experienced a marginal decrease of 0.1%, while the Rest of Central Region (RCR) and Outside Central Region (OCR) saw prices rise by 1.3% and 1.6%, respectively.

According to the SRX price index for condo resale:

- Month-on-month, overall prices increased by 1.0% over July 2023.

- Year-on-year, overall prices surged by an impressive 7.6% over August 2022.

- Notably, all regions exhibited price increases year-on-year: CCR by 2.7%, RCR by 7.5%, and OCR by a remarkable 9.8%.

Here is a summary of the numbers:

| Region | Price change (August 2023) | Price change (YoY) |

| Core Central Region (CCR) | -0.1% | 2.7% |

| Rest of Central Region (RCR) | 1.3% | 7.5% |

| Outside Central Region (OCR) | 1.6% | 9.8% |

Read also: August 2023 sees record breaking surge in million-dollar resale flat transactions

How many resale condos were sold in August?

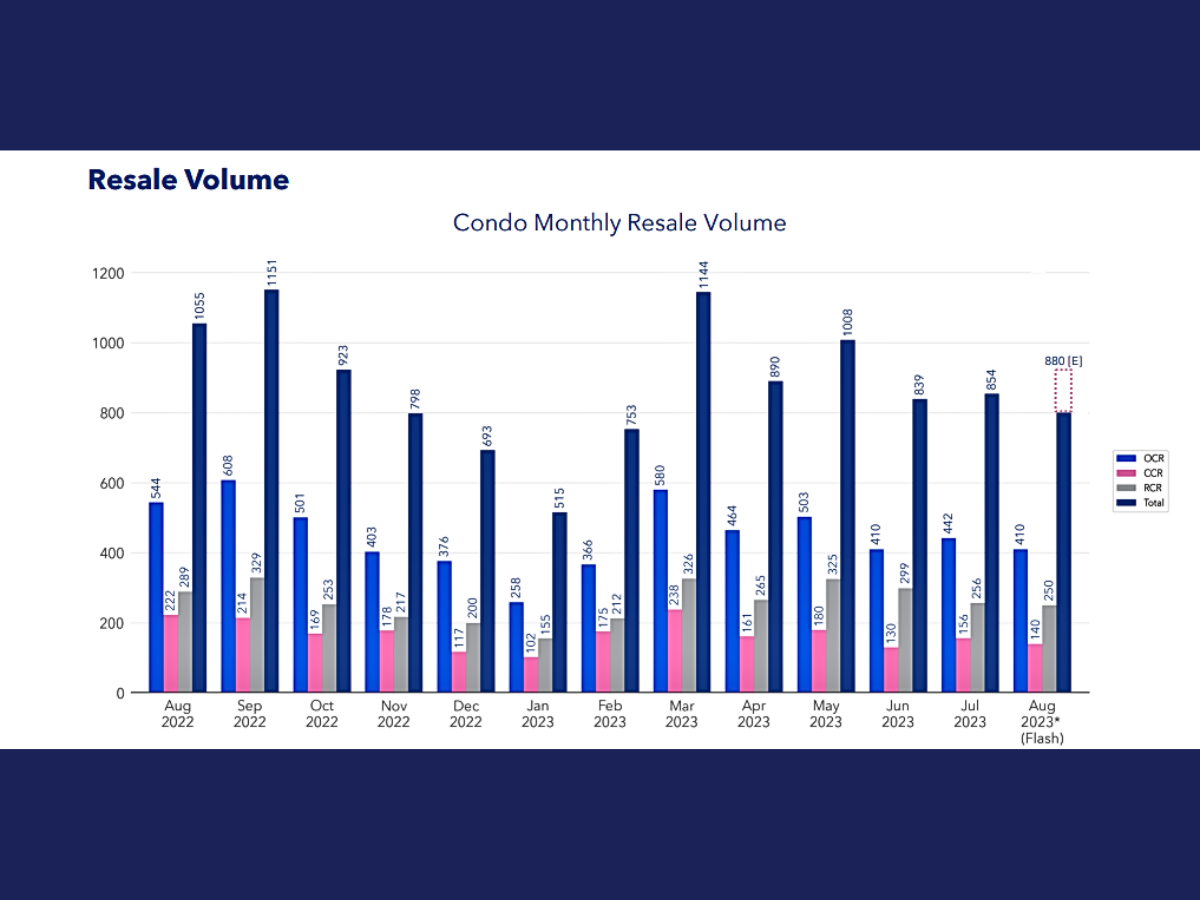

In terms of transaction volume, an estimated 880 units were resold in August 2023, reflecting a 3.0% increase from the 854 units resold in July 2023.

However, it’s crucial to note that volumes were 16.6% lower than in August 2022 and 8.3% lower than the 5-year average volumes for August. For a breakdown on the transaction volume by region, take a look at the table below.

Furthermore, the percentage of Sub Sale transactions to the total secondary sale transactions (i.e., Resale+Sub Sale) increased to 11.6% in August 2023, a 0.5% uptick from July 2023.

| Region | Percentage of Total Transaction Volume |

| Outside Central Region (OCR) | 51.2% |

| Rest of Central Region (RCR) | 31.2% |

| Core Central Region (CCR) | 17.5% |

Expert insights on market trends

Why did OCR have the highest YoY resale property price increase?

Eugene Lim, Key Executive Officer at ERA, sheds light on this stating, “Buyers in the OCR who intend to occupy their purchased units may be reluctant to wait 3-4 years for completion, especially if they face Additional Buyer’s Stamp Duty (ABSD) obligations due to not selling their current property. Consequently, many are turning their attention to the resale market. Furthermore, the limited availability of only five new launches in the OCR from January to August 2023 has constrained buyers’ options.”

Adding to this perspective, Christine Sun from Orange Tree suggests that the uptick in OCR prices may be attributed to an increasing number of condos obtaining Temporary Occupation Permits (TOP) in recent months. Newer condos typically command higher prices in the market.

Alan Cheong from Savills highlights another crucial factor behind the surge in OCR prices – new launch prices in the region. The fact that new condos in the OCR are selling for more than S$2,000 per square foot (psf) gives sellers confidence that they can ask for higher prices. Even though sellers are asking for a lot, most are still charging less than S$2,000 psf, which makes buyers feel like they’re getting a good deal.

Why were more than half of the resale condos sold in August from OCR?

Experts explain that aspiring upgraders seeking affordable options are left with little choice but to head to OCR due to rising prices in other segments, especially in the RCR.

Why were there lower resale condo transactions in August 2023 compared to August 2022?

Experts attribute the decline in resale condo volume to a range of factors. One key contributor is the implementation of a new pricing regime, coupled with the potential impact of economic headwinds.

An intriguing observation is the timing of the Hungry Ghost Month. In 2022, it commenced on July 29th and concluded a month later, while in 2023, it began on August 16th. Alan suggests that this variance in timing may have influenced the number of closed resale condo deals during the month.

Christine underscores the significance of high interest rates and government cooling measures, identifying them as factors responsible for the deceleration in sales. She also warns of the possibility of an extended market slowdown.

Eugene highlights the emergence of new sale and sub-sale properties as a pivotal factor in the decline of resale condos. He notes, “Between January and August 2023, there have been 13 new home project launches, prompting prospective buyers to weigh their choices between new launches and resale units. These new homes offer flexibility with the Progressive Payment Scheme, allowing payments to align with construction stages and potentially reducing initial monthly loan installments.” With a slate of upcoming launches expected in the final quarter of 2023, Eugene anticipates prospective buyers taking more time to deliberate their property purchases.

Furthermore, Eugene points out that the sub-sale option has become increasingly attractive to buyers seeking new homes without the waiting period. This trend is chiefly driven by a surge in projects, including mega-developments with over 1,000 units, such as Treasure at Tampines, Florence Residence, and Avenue South Residences. These mega-developments are on track to achieve TOP by the end of 2023.

Properties for you

Highest transacted price for August resale condos

August witnessed the highest transacted price of S$11,000,000 for a resale unit at 3 Orchard By-The-Park. In the Rest of Central Region (RCR), a unit at Aalto commanded an impressive S$6,300,000, while in the Outside Central Region (OCR), a unit at Kensington Park Condominium changed hands for S$3,260,000.

Alongside the luxury condo’s prime location and the influence of a renowned architect on its design, Eugene provides a more detailed breakdown behind the unit’s price point.

He highlights that the 2,830 sqft unit was valued at S$3,886 per square foot. By scrutinizing data from the past two years, it becomes evident that there have been seven transactions involving units ranging from 2,500 to 3,000 square feet, with prices falling between S$3,780 and S$4,000 per square foot. As such, the unit’s S$11 million transaction aligns with the fair market value.

Besides Orchard By-The-Park, top transactions in August included a S$10.7 million unit and a S$9.4 million unit at Bishopsgate Residences. “All three units were bought by Chinese PRs”, says Mark Yip, CEO, Huttons Asia.

Properties for you

Median capital gain and unlevered return for resale condos

The overall median capital gain for resale condos in August 2023 was S$311,000, a notable increase of S$11,000 from July 2023.

Among districts, District 20 (Ang Mo Kio, Bishan, Thomson) boasted the highest median capital gain at S$638,000, while District 2 (Chinatown, Tanjong Pagar) recorded the lowest at S$90,000.

In terms of the median unlevered return, it stood at an impressive 27.5% in August 2023, with District 20 leading again at 52.1% and District 2 lagging at 13.8%.

Future trends

Despite the increasing number of new options, there continues to be strong demand for resale condominiums for several compelling reasons. Resale units are typically more spacious and come with more attractive price tags, making them particularly appealing to buyers seeking both extra room and better deals.

However, experts caution that in the short term, resale condo sales may be subdued until new developments achieve Certificate of Statutory Completion (CSC). Besides, we might also see trends of homeowners choosing to retain their units for personal use or rental income instead of selling. Additionally, the high cost of replacing these properties, influenced by the elevated prices of new homes, could also dissuade potential sellers.

Wrapping up

In conclusion, August 2023 brought about intriguing trends in the resale condo market, with varying price movements across regions and expert insights shedding light on the factors behind these trends.

While OCR continues to shine, the overall market grapples with shifting dynamics influenced by economic factors and government measures. Investors can find solace in the substantial capital gains and returns, but the future remains uncertain, with some experts predicting a more tempered market.

Staying informed about these trends and expert opinions is essential for anyone looking to navigate this dynamic and ever-changing real estate landscape.

The post August resale condo 2023: Price fluctuations, expert opinions & market outlook appeared first on .