Yesterday, the PUB, Singapore’s National Water Agency, released a statement on the impending rising water bill rates, and we believe it’s a topic that warrants our collective attention. Rest assured, we’re here to provide you with the information you need.

In this article, we’ll delve into the specifics of this upcoming change and how it could potentially affect both renters and those aspiring to own their homes.

So, let’s dive right in and uncover what lies ahead!

A watery dilemma

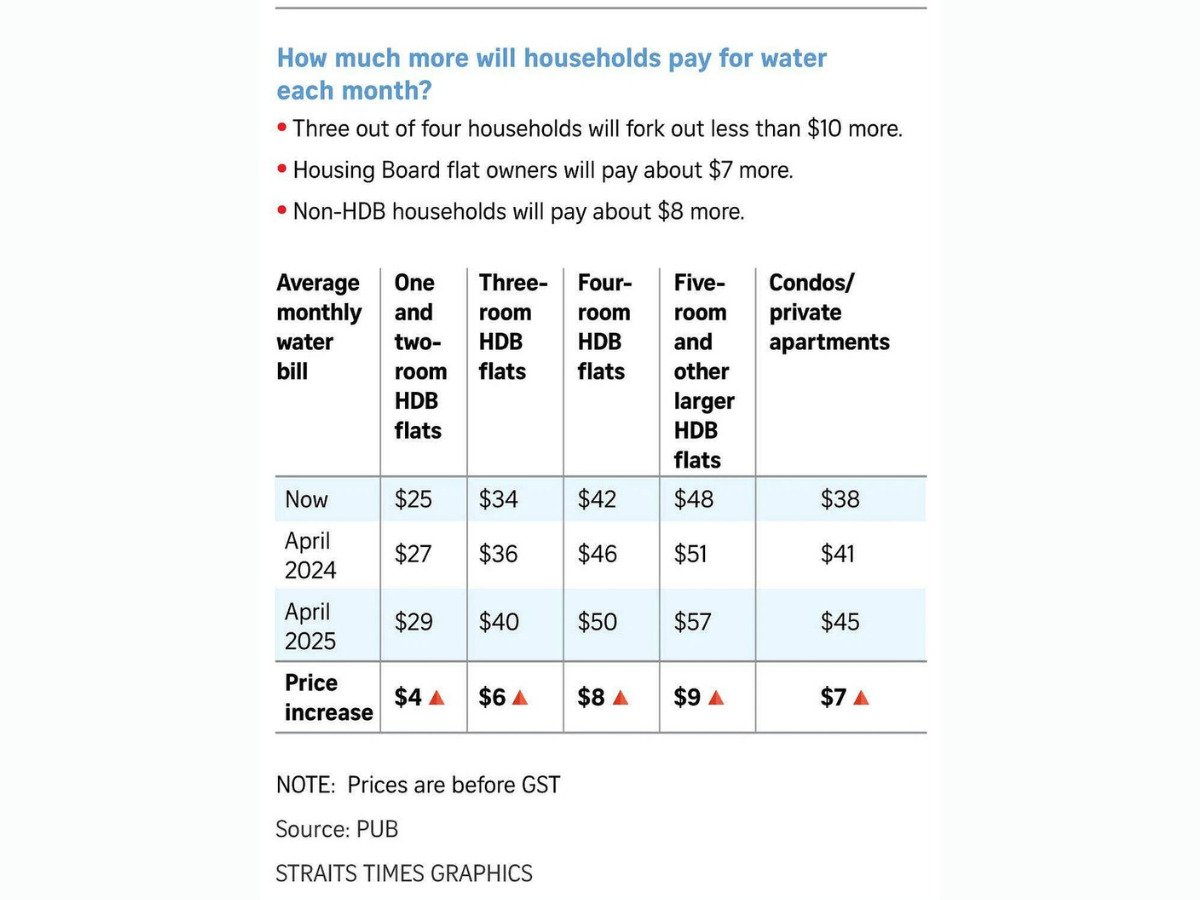

Picture this: In April 2024, your water bill will take a 20-cent leap, followed by another 30-cent surge in April 2025. It might not seem like much, but by 2025, most households will be shelling out an extra S$4 to S$9 every month for their water, excluding GST.

This 18% increase is no small change, especially considering that the last hike was back in 2017.

By 2025, every cubic metre of Newater will also cost 17 cents more, totaling S$2.50.

But fret not; this price hike will be rolled out gradually over two years, giving us all ample time to adjust our habits and embrace water conservation measures.

Read also: 5 easy ways to lower your water bill today

Why the rising water bill?

You might be wondering, “Why the sudden surge in water prices?” Well, it turns out that producing and supplying water has become increasingly expensive. With climate change on the horizon, Singapore needs to invest more in local water infrastructure, especially in resilient sources like Newater and desalinated water. Our water demand is expected to nearly double by 2065, currently sitting at around S$1.95 million cubic metres daily.

The decision to increase water prices wasn’t taken lightly, considering the rising living costs, GST hikes, and higher transport fares. Factors like soaring energy prices, construction costs, and supply chain disruptions have contributed to PUB’s operating costs exceeding its revenue.

But, here’s the silver lining: the additional revenue from the water price hike is expected to cover about one-third of its investments in the coming years.

Government initiatives

The government isn’t leaving us high and dry either. PUB is encouraging businesses to tap into the enhanced Water Efficiency Fund to adopt water-efficient technologies. Plus, one- to three-room households can snag S$50 in e-vouchers through the Climate Friendly Households Programme to invest in water-efficient shower fittings.

Lower- and middle-income households will also receive assistance. U-Save rebates will help with the latest increases in these water prices, along with subsidies and vouchers to ease the impact of public transport fare hikes.

Read also: Why buying a house in a cycling-friendly neighbourhood makes sense amidst rising transit costs

How will water price hikes impact housing affordability?

Now, let’s address the elephant in the room: how will these rising water bills affect housing affordability? Well, on the bright side, water bills only account for less than 2% of an average household’s expenditure. Most of us use less than 40 cubic metres of water each month, which isn’t much.

However, for those who exceed this limit (about 4% of homes), they’ll be charged a higher rate – 70 cents more per cubic metre or S$4.39 in total – to discourage water wastage.

Higher utility costs could indeed be on the horizon, potentially impacting homeowners and renters alike. The increase in water prices might affect property values as well, with potential buyers becoming hesitant to invest in properties with higher utility bills. This could lead to decreased demand in areas with pricier water costs, ultimately affecting property values.

Moreover, if water prices continue to rise significantly, housing affordability could be at stake. Homebuyers and renters might need to allocate more of their income toward utility bills, making it harder to manage housing expenses.

Read also: Condo and HDB rental markets dip in volumes in August 2023

Wrapping up

Alright, we’ve covered a lot of ground, and it’s clear that rising water bills can create a ripple effect in our lives, especially when it comes to housing affordability. But remember, challenges often come with opportunities. Embracing water-saving habits, exploring government assistance programs, and making conscious choices can help us navigate this watery dilemma.

So, while we face these upcoming changes, let’s also remember that as Singaporeans, we have the resilience and adaptability to thrive even in challenging times. Together, we can ensure that our homes remain not just comfortable but sustainable as well.

The post Rising water bills, rising rents: The unavoidable connection between your bills & housing affordability appeared first on .