If there’s one thing you can bank on in our country, it’s that the housing market will always be a hot topic. Whether it’s the ongoing HDB BTO exercise (best of luck to all applicants!), the buzz around million-dollar property transactions, or, as highlighted in this article, the recent dip in HDB resale prices, the real estate sector never fails to captivate.

Today, we take a look at September’s HDB resale market, peeling back the layers to understand the reasons behind its fluctuations and unveiling the future trends that lie ahead.

The TL;DR version of HDB resale prices in September

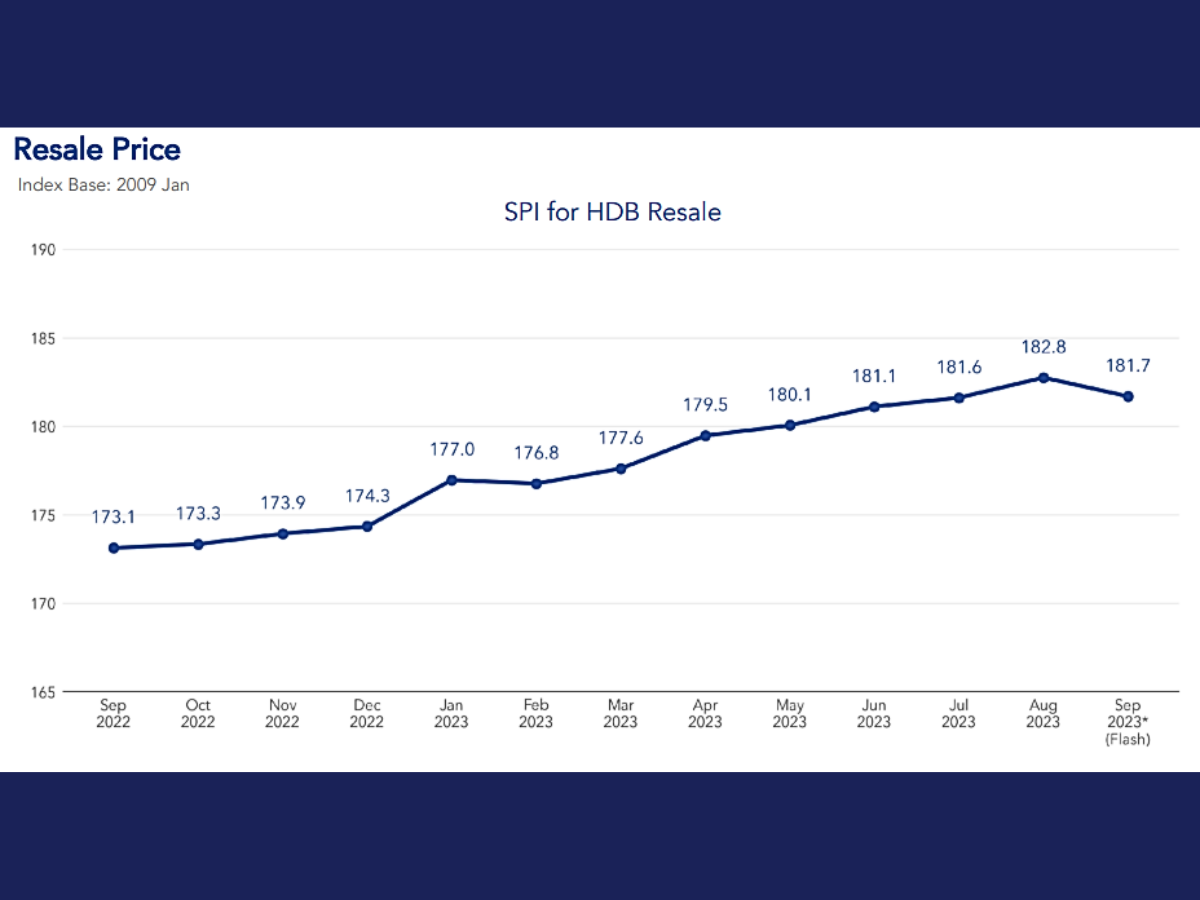

According to Mr. Luqman Hakim, Chief Data & Analytics Officer at 99.co, September witnessed a dip in HDB resale prices, marking the first decline after six consecutive months of growth.

This decline can be attributed to increased competition from upcoming BTO launches in October and December, coupled with concerns regarding high interest rates and inflation.

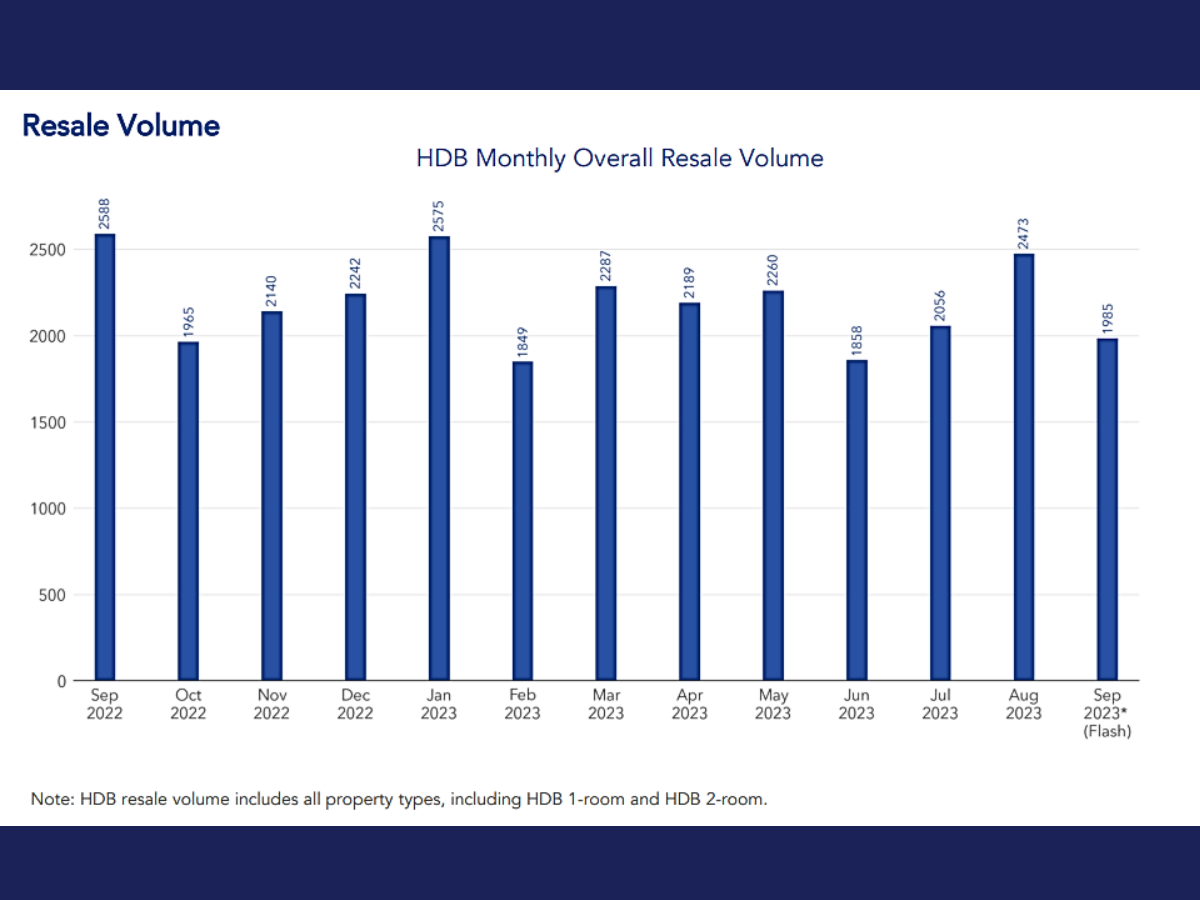

Consequently, the demand for resale properties waned, resulting in a 19.7% decrease in resale volume.

However, it’s worth noting that despite this dip, the proportion of million-dollar transactions, though slightly lower than the previous month, remained stable.

A deeper dive into the numbers

In September 2023, HDB resale prices took a slight hit, dropping by 0.6% compared to August 2023. The decline was more pronounced in Non-Mature Estates, which saw a decrease of 0.9%, while Mature Estates experienced a milder drop of 0.4%.

When examining specific room types, 3 Room flats saw a slight price increase, whereas 4 Room flats prices declined. The dip continued with 5 Room flats and was most notable in Executive flats.

The table below takes a closer look at the resale prices for room types:

| Room type | Price change (%) |

| 3 Room | +0.6% |

| 4 Room | -0.9% |

| 5 Room | -0.3% |

| Executive | -2.1% |

HDB resale volumes drop as well

Breaking down the figures further, 1,985 HDB resale flats changed hands in September 2023, reflecting a 19.7% decrease from the previous month. HDB 4 Room units accounted for the majority of those transactions.

Non-Mature Estates dominated the market, contributing 59.9% of the resale volume for the month.

Comparing this data to the previous year, there was a notable drop of 23.3% in resale volume.

Million-dollar transactions

September recorded 42 HDB resale flats changing hands for at least S$1,000,000, a decrease from August’s 54 transactions. These million-dollar flat sales represented 2.1% of the total resale volumes in September.

Noteworthy transactions included seven units in Toa Payoh, six in both Bukit Merah and Bishan, and scattered transactions across various estates, indicating a diverse market for high-value transactions.

The standout sales for the month? An executive maisonette in Bishan that closed at an impressive S$1,450,000. This transaction managed to set the record for not only Bishan, but also all executive properties in Singapore.

In Non-Mature Estates, a 5 Room flat at Punggol Field fetched the highest price, reaching S$1,150,000.

Read more: HDB maisonette sets new record for Bishan & executives at S$1.45M

Properties for you

2

2

3

2

3

2

2

2

2

2

3

2

3

3

2

2

2

2

2

2

3

2

4

3

4

4

1

1

2

2

1

1

2

2

1

1

1

1

3

2

2

2

2

2

2

1

4

2

-1

1

3

2

-1

4

3

-1

2

1

2

1

-1

-1

2

2

4

3

See all Toa Payoh >

2

2

3

4

1

1

3

2

2

2

2

2

3

3

5

4

3

2

3

3

3

2

2

2

2

2

3

2

2

2

2

2

2

2

2

2

3

2

2

1

2

2

4

4

2

2

5

5

3

2

3

3

3

3

3

2

2

2

3

3

3

3

1

1

1

1

3

2

3

2

See all Bukit Merah >

3

2

2

2

2

2

3

3

2

2

3

3

3

2

4

3

5

5

3

2

2

2

2

2

4

3

4

4

3

2

3

2

2

2

3

2

4

2

1

1

3

2

1

1

3

2

-1

-1

3

3

4

3

4

3

4

4

2

3

2

3

-1

1

1

-1

2

3

See all Bishan >

Future trends: What’s on the horizon?

Looking ahead, analysts anticipate a moderate rise in HDB resale prices for the remainder of 2023.

The completion of more BTO flats and private homes is expected to boost the supply of resale flats, thereby mitigating the upward pressure on prices.

Additionally, concerns regarding affordability echo through the predictions of these experts. Singapore, like many other global economies, has been impacted by inflation and rising interest rates. These economic realities have dampened buyers’ purchasing power, prompting a more discerning approach. Prospective buyers are becoming increasingly price-conscious, navigating their choices carefully in light of their financial capacities.

Furthermore, housing policies have played a significant role in shaping market dynamics. The reclassification of flats into Standard, Plus, or Prime categories has introduced a new paradigm.

The Plus category, offering enhanced subsidies but with tighter resale conditions, has notably impacted million-dollar flat transactions. Particularly in mature estates, where demand for such premium properties remains robust, these policy shifts have influenced buyer behavior.

Consequently, the housing landscape is evolving, redefining what buyers can expect in terms of both choices and affordability.

Read more: New HDB BTO classification: Know the difference between Standard, Plus, and Prime flats

Wrapping up

September’s dip in HDB resale prices serves as a testament to the dynamic nature of the real estate market. As we move forward into the remainder of 2023, keeping an eye on these evolving trends will undoubtedly be key for both buyers and sellers in the HDB resale market.

The post “Price pressures expected till end 2023”: HDB resale prices drop for the first time since February appeared first on .