Buying a home in Asia’s hottest real estate market isn’t by any stretch an easy decision. Nor should it be, considering the umpteen factors at play – from the size of bedrooms to MRT station accessibility. Adding to this complexity, especially while buying a private condominium (or a privatized HUDC), is the ever-relevant dilemma – should you choose a freehold or a leasehold property?

Freehold properties endow their owners with perpetual ownership rights to both land and buildings. Understandably, unending possession comes at a higher cost in a city-state that is constantly battling a need for land to satisfy its growing population. But these properties remain alluring to a lot of buyers who understand that buying houses in Singapore is only going to get tougher in the years to come.

Freehold properties endow their owners with perpetual ownership rights to both land and buildings. Understandably, unending possession comes at a higher cost in a city-state that is constantly battling a need for land to satisfy its growing population. But these properties remain alluring to a lot of buyers who understand that buying houses in Singapore is only going to get tougher in the years to come.

Leasehold properties in Singapore have a predetermined lease term – most commonly 99 years. After the lease period gets over, the ownership reverts to the state unless the lease is extended, often at an additional cost decided by the Singapore Land Authority (SLA). But leasehold’s budget-friendliness, attractive locations, and other factors sometimes outweigh the guarantees freehold properties come with. Especially if your agenda isn’t to create an asset for future generations.

So how does one make a decision?

The answer lies in a complex interplay of financial considerations, personal aspirations, and market dynamics.

Freehold’s Trump Cards – Stability and Security

Freehold properties offer perpetual ownership – a big security in a fast-dwindling space like Singapore – and offer peace of mind for generations to come.

Increasing interest rates and borrowing costs, despite temporary measures by the government, makes freehold properties a substantial financial commitment. These properties, however, usually command a higher resale value due to their tenure, making them an attractive option for investors looking for long-term capital gains.

Historical data suggests that freehold properties generally experience more robust capital appreciation over the long term, making them a potentially lucrative investment. On average, freehold properties in Singapore have appreciated by 5-10% more than leasehold properties over a 10-year period (source).

Data Insight: Recent resale transaction data reveals that freehold properties tend to fetch a premium of 8-12% compared to similar-sized leasehold units in the same neighborhood.

| CAGR | Freehold | Leasehold |

| 5 years | 7.3% | 6.6% |

| 10 years | 4.0% | 3.4% |

| 15 years | 5.8% | 4.8% |

| 20 years | 6.4% | 6.7% |

Table 1. Compound annual growth rate (CAGR) of Freehold vs Leasehold. This reflects the capital preservation power of freehold over long periods of time.

Leasehold’s proposition: Affordability and Flexibility

Considering freehold properties’ limited availability in comparison to its demand, leasehold condos often emerge as the more affordable option, especially when contemplating investment in new launches. While the limited term might on paper seem like a deterrent, not everyone is concerned about staying at the same place for over 99 years. New leasehold developments frequently offer more spacious units for the same budget as freehold units, allowing buyers to enjoy a comfortable living space without compromising on size.

A comprehensive analysis of recent new condo launches reveals that leasehold units, on average, provide 20% more living space per dollar spent compared to their freehold counterparts.

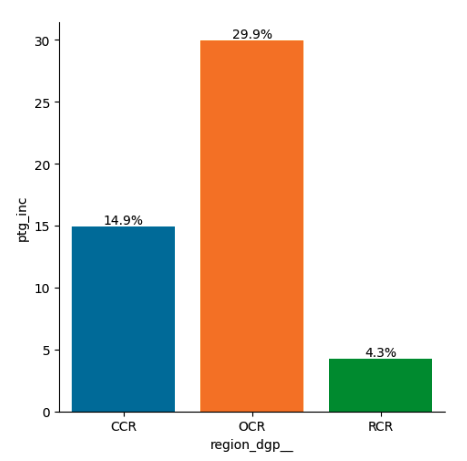

Figure X. Median percentage size increases for a leasehold property vs a freehold property. For example, for the same price per square foot of a freehold property in OCR, you could get a 30% bigger sized property at leasehold.

READ: Singapore’s 28 districts mapped across CCR, RCR and OCR

There are also psycho-social factors in play within this decision making matrix. The residents’ desire/need for a change after a few years weighed against the changes in what one can afford and what one finds desirable over the years lends leasehold properties an edge over the prospect of making a large investment in freehold units. The increasing trend of young Singaporeans – who aren’t eligible to buy houses – choosing to move away from their parents’ homes much before they turn 35 has made cheaper units a lucrative space for landlords looking to rent.

Source: Channel News Asia

The deciding factors

While buying a property in Singapore is no doubt a complex decision, here are a few factors worth considering while contemplating between freehold and leasehold:

- Location and cost: Does the location matter to you? Developers strategically position leasehold projects in the heart of the city with great connectivity. Great neighborhoods and easy access to all parts of the city-state is something very few people tend to overlook while buying a new house. In fact, 99.co insights show that prime locations, often associated with freehold properties, are now being tapped by developers for leasehold projects due to their popularity among buyers.

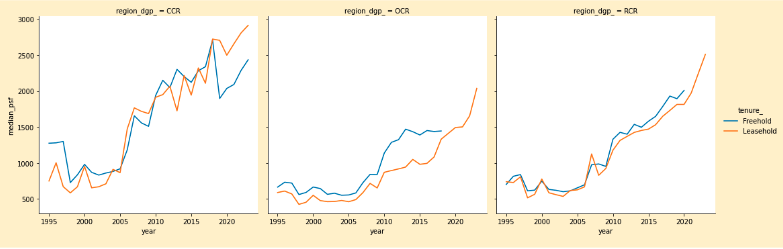

Figure 1: Freehold vs Leasehold Condo Median New Sale PSF over the years. Note that there haven’t been Freehold New Launches in OCR and RCR since 2018 and 2020 respectively. Overall, Freehold is more expensive in OCR and RCR. There is no clear winner in CCR as other hedonic factors in the luxury area come into play.

Figure 1: Freehold vs Leasehold Condo Median New Sale PSF over the years. Note that there haven’t been Freehold New Launches in OCR and RCR since 2018 and 2020 respectively. Overall, Freehold is more expensive in OCR and RCR. There is no clear winner in CCR as other hedonic factors in the luxury area come into play. - Space vs stability: What matters more to you? Spacious interiors or the knowledge that your house will remain yours forever? As shown earlier, leasehold properties offer much bigger space for the same price in the same neighborhood. If generational wealth or long-term stability is your goal, freehold properties offer a more secure foundation.

It is important to underscore that the security of freehold is also conditional. Government can potentially take up your property for development programs like the North-South Corridor or for new MRT lines. With the country battling for space, properties inevitably have that risk of one day being replaced by bigger, high-rise residential projects - Pricing: New leasehold condos often come with competitive pricing strategies and incentives such as Deferred Payment Schemes (DPS) and discounts during the launch phase. These financial perks can significantly reduce the initial financial burden for buyers. Research shows that developers are increasingly adopting innovative pricing strategies for leasehold properties, allowing buyers to enter the market at a more affordable cost per square foot. But freeholds traditionally have a higher resale value so that is something to be also kept in mind.

- Booming rental market: If you are buying a house with the intention of renting it out, then leasehold offers multiple possibilities. The rent rates continue to remain high despite some early signs of cooling which has lured a lot more landlords into the market. It doesn’t matter to the person renting the house if it is freehold or leasehold. A spacious apartment or an in-demand neighborhood is what will attract the tenants. And for the landlord looking to make quick returns, the leaseholds perhaps offer a better proposal.

- En bloc: En bloc refers to a collective sale of property units to one purchaser. It is important to note that freehold properties don’t offer immunity to these mass buyouts. According to the revised rules in 2007 by the Land Titles (Strata) Act, 80% consensus for private residential properties (10 years and older), or 90% consensus for properties (less than 10 years old) is required to get a green flag for these sales. While a group agreement usually results in a good pay-day for the owners, it leaves the dissenter with no option but to flow with the tide.

- Lease decay: The property value, at least theoretically, tends to drop drastically as the years of your lease shortens. This “lease decay”, though dependent on other factors such as location, is also a factor to be considered when making the choice between freehold and leasehold.

Making an informed choice

The freehold vs. leasehold dilemma is here to stay even if it might change in form as and when the government makes amendments. There is no one-size-fits-all solution to this unique real estate challenge in Singapore. It demands a thorough assessment of your circumstances, goals, and risk tolerance.

While security and stability remain highly in demand, people are also becoming more aware that their well-being is connected to the physical and urban environment they live in. Singapore is an island close to 730 km square in size – constraints of land space and natural resources will only worsen in the future.

The government is trying to optimize land use and increase economic potential which has resulted in an urban environment with a high population density of over 8500 per sq kilometer. Numerous studies show how these tightly packed living spaces and their by-products – such as low quality of exposure to the sky or increased traffic noise – can have negative psychological impact on the people.

Source: Science Direct

Source: Wikipedia

So it is not entirely surprising that the “quality of life” these properties offer is slowly becoming an important factor for a country whose median age is above 40 years old.

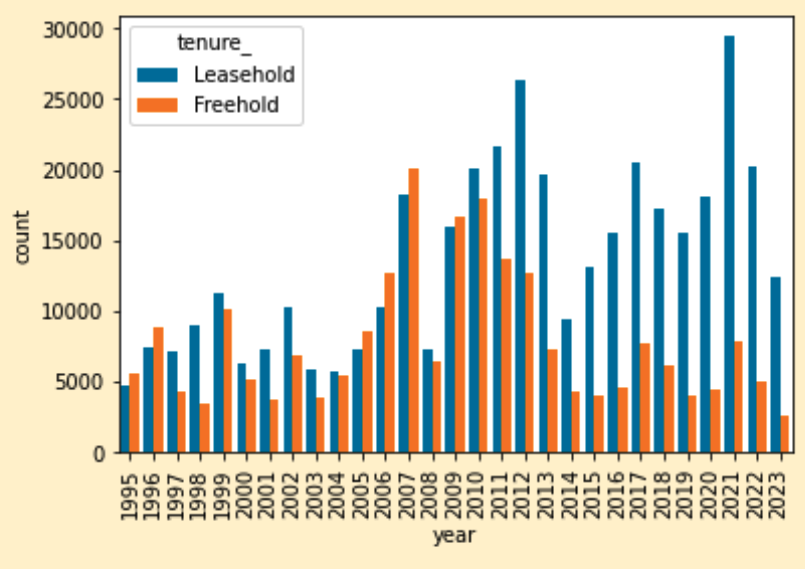

It is interesting to observe that (as shown in graph) that the number of freehold transactions have been markedly lower compared to leasehold transactions since 2010 owing to the limited amount of freehold land available in Singapore and government attempts to cool the property market. Demand for investment-grade, cheaper properties prompted a shift towards leasehold properties.

Eventually, the decision comes down to what you seek most in the property. This along with market conditions should dictate your final decision while also keeping an eye out for opportune moments that come with new launches.

Here are three steps to help you in the process:

Assessment: Conduct a meticulous evaluation of your financial objectives, lifestyle preferences, and long-term plans.

Planning: Chart a comprehensive real estate roadmap that considers short, medium, and long-term aspirations.

Risk Awareness: Educate yourself about the risks associated with leasehold properties and weigh them against the benefits.

Good luck with your property hunting!

Summary

| Leasehold | Freehold | |

| Price | Often cheaper when compared to Freehold on the same attributes | More expensive |

| Lease Decay | Subjected to lease decay. Value gets diminished towards the end of the lease. | Not subjected to lease decay. Value is preserved throughout its lifetime and may appreciate as land gets scarce in Singapore. |

| Price Growth | Usually rises faster after Launch but will stabilize and then decay over time | Usually rises slower than Leasehold but holds value well over time. |

| Asset Progression Strategy | More preferred property type at the start of asset progression because of its lower price. | More preferred at the middle or later part of asset progression for capital preservation and appreciation. |

| Availability (General) | Common | Rare |

| Availability at New Launches | Common | Rare. The past few years have seen FH projects launched only in CCR |

| Average Size | 20% more for the same price (avg) | Usually lesser than a leasehold property going for the same price in the neighborhood |

This article was contributed by Shervonne Ang. For more questions on this topic, you may reach out to her at +65 8685 8118.

The post Freehold vs Leasehold: Making an informed (data-driven) choice appeared first on .