CCR and OCR prices increase by 0.2% and 0.1% while RCR prices remain the same in February 2024

In February 2024, the SRX Price Index for Condo Resale indicated a 0.2% increase in prices for the Core Central Region (CCR) and a 0.1% increase in prices for the Outside Central Region (OCR), whereas the Rest of Central Region (RCR) prices remained the same. As a result, there was an overall 0.2% increase in prices from January 2024.

You can do a quick revision of January 2024’s condo resale market flash report findings here.

On a year-on-year basis, overall prices increased by 6.1% from February 2023. All regions saw price increases: CCR by 2.8%, RCR by 6.1%, and OCR by 7.6%.

Additional reading: Singapore’s 28 districts mapped across Core Central Region (CCR), Rest of Central Region (RCR), and Outside Central Region (OCR)

An estimated 760 units were resold in February 2024, a 1.2% increase from the 751 units resold in January 2024

Around 760 units of resale condominiums were sold, which is a 1.2% increase from the previous month’s 751 units. This volume marks a 0.9% rise from February 2023 and is 5.0% higher than the average resale rate over the past five years for the same month. This trend indicates a positive movement in the resale market.

The sales distribution for the month was: OCR – 43.8%, RCR – 35.6%, and CCR – 20.5%.

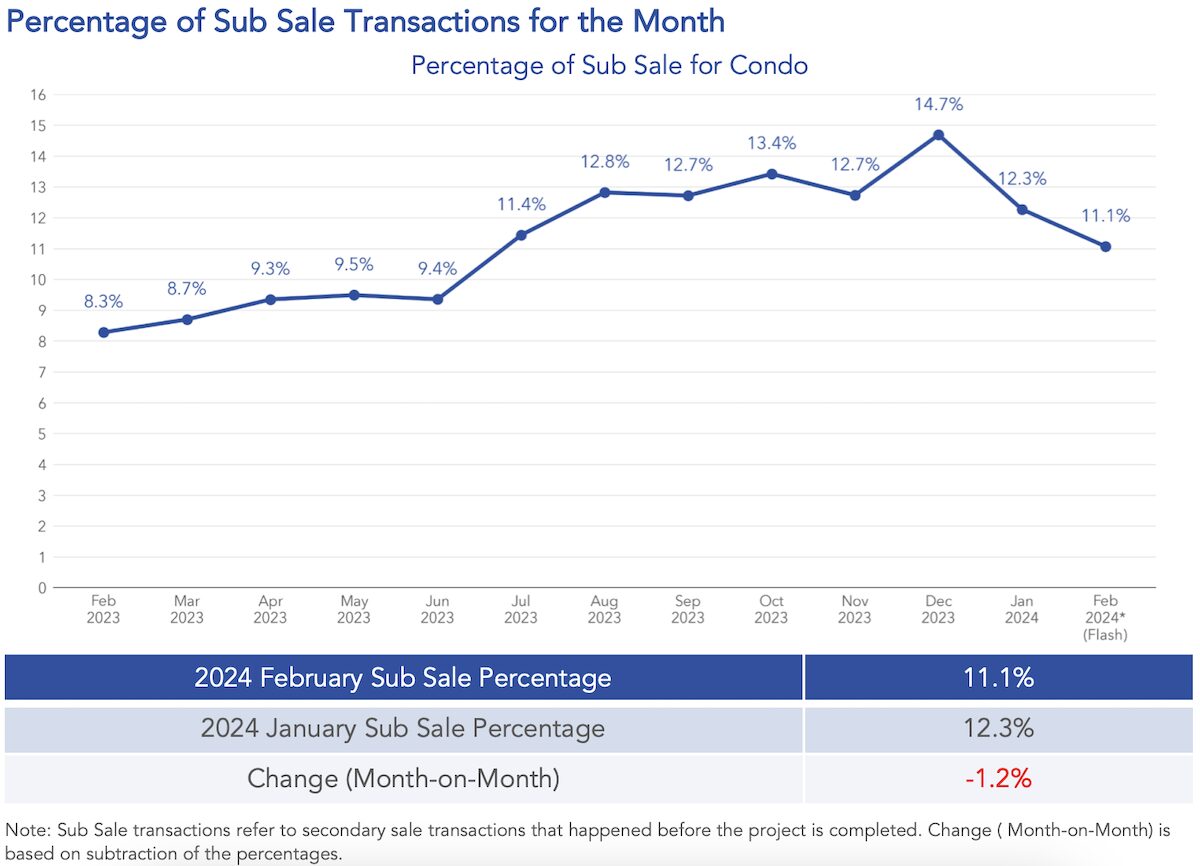

Sub Sale transactions, which represent sales of units in projects that have not yet been completed, accounted for 11.1% of the total secondary market transactions (including both resale and Sub Sale).

This figure shows a 1.2% decrease from January 2024, signifying a shift in resale and sub-sale market dynamics.

The highest transacted price for a resale unit in February is achieved at S$12,900,000 at Ardmore Park

In the Rest of Central Region (RCR), The Interlace had the highest transacted price of S$5,315,000 for a resale unit in recent real estate transactions.

More properties at The Interlace

3

4

2

2

3

2

4

4

2

2

2

2

2

2

2

2

4

3

2

2

4

4

4

3

2

2

2

2

2

2

3

2

2

2

4

4

2

2

4

4

4

4

2

2

4

4

2

2

4

4

4

4

4

3

3

3

4

4

4

4

3

3

3

4

4

4

See all For sale >

1

1

3

3

3

3

1

1

3

4

3

3

3

2

3

2

3

3

3

3

4

3

4

3

4

4

4

4

3

3

3

3

2

2

-1

0

3

4

2

2

2

2

4

4

4

3

2

2

See all For rent >

Meanwhile, Kew Green topped the OCR charts with a unit reselling for S$3,250,000.

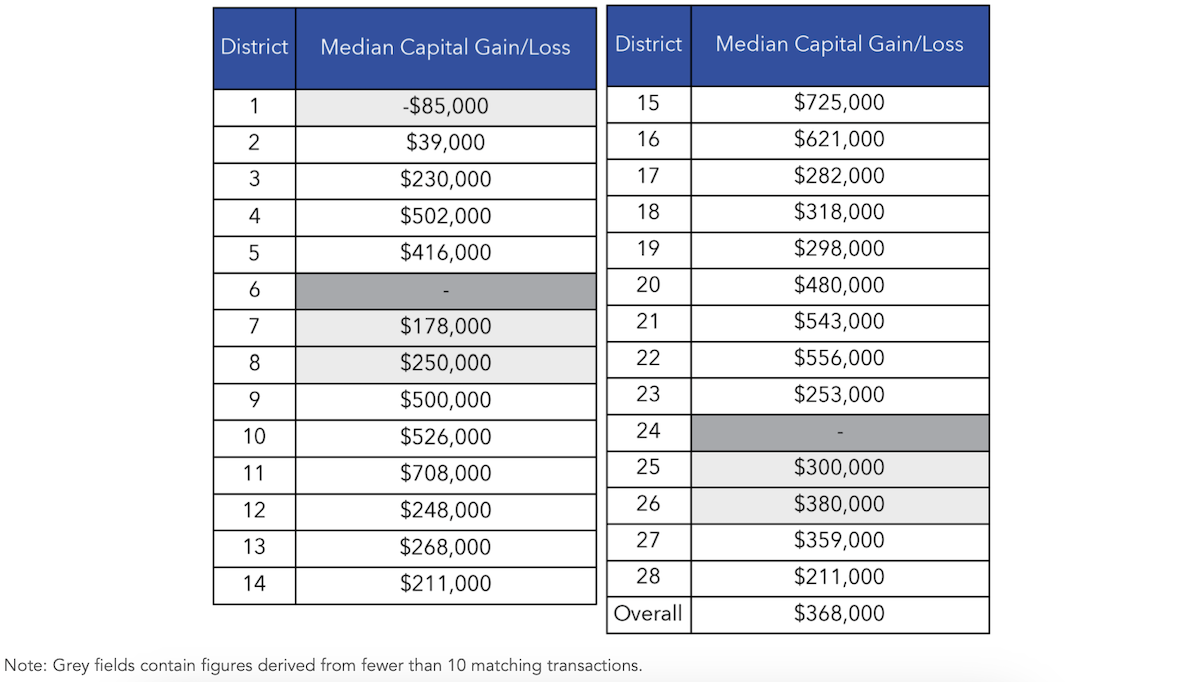

The overall median capital gain for resale condos is S$368,000 in February 2024, an increase of S$21,000 from January 2024

In District 15, which includes the East Coast and Marine Parade areas, the median capital gain is S$725,000.

Boat Quay, Raffles Place, and Marina, all in District 1, had the lowest median capital gain with a loss of S$85,000.

Properties in District 1

4

4

2

2

1

1

2

2

1

1

4

4

1

1

4

5

1

1

1

1

3

2

2

2

1

1

2

2

1

1

1

1

3

3

5

4

0

1

1

1

2

2

3

3

2

1

3

2

2

2

1

1

5

5

4

4

5

4

1

1

1

1

1

4

3

2

1

3

3

See all For sale >

0

1

1

1

3

3

1

1

1

1

2

2

1

1

3

3

2

2

4

4

1

1

2

1

2

2

1

1

1

1

4

3

2

2

2

2

2

2

3

2

3

2

5

6

4

3

3

3

3

2

1

1

2

2

1

1

1

1

2

2

-1

2

1

1

1

3

2

1

1

See all For rent >

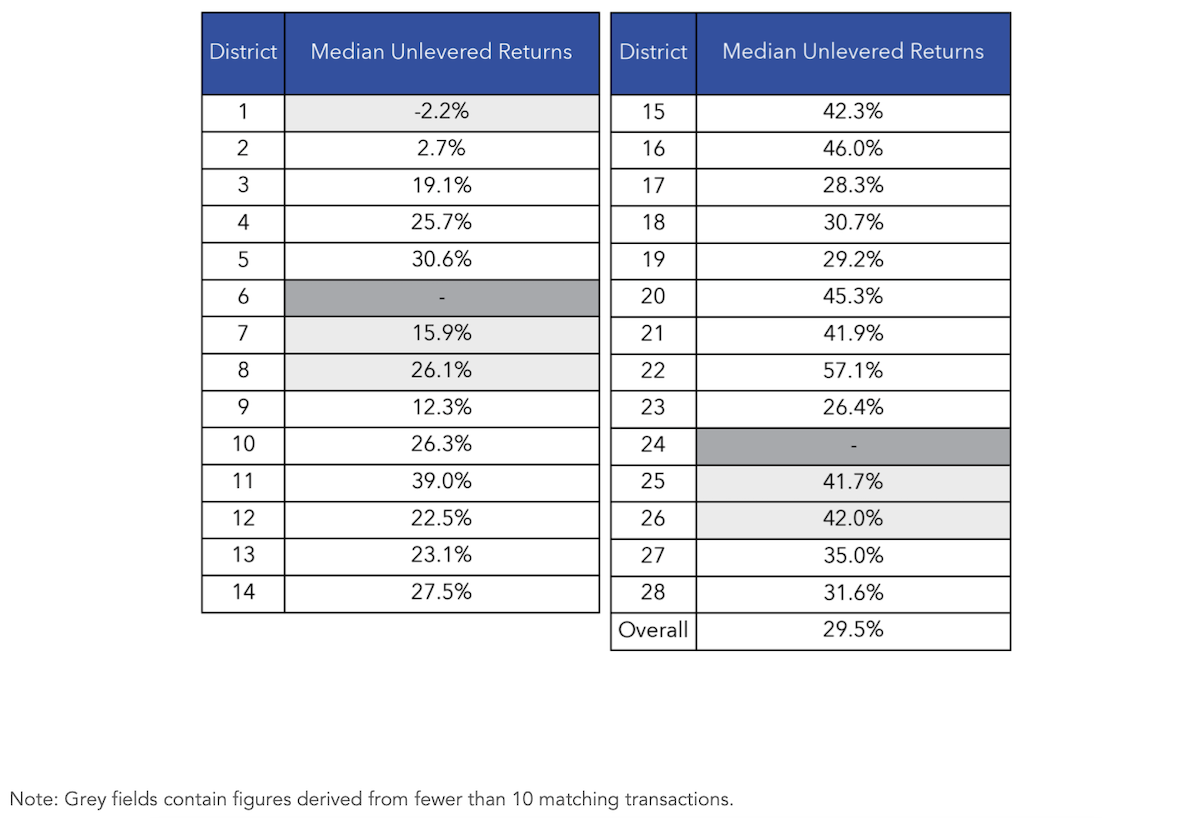

The overall median unlevered return for resale condos is 29.5% in February 2024

In District 22, which covers Boon Lay, Jurong, and Tuas, the median unlevered return for condominium resale units stands at 57.1%.

District 1, which comprises the areas of Boat Quay, Raffles Place, and Marina, had the lowest median unlevered return. This marked a decrease of 2.2%. The figures were calculated by comparing the current transacted price with the previous transacted price of the same unit. This ensured accuracy in calculating capital gains and returns.

To maintain statistical significance and reliability in the findings, we excluded districts with less than 10 matching transactions from the ranking.

Conclusion

Both CCR and the OCR experienced a modest increase in resale prices, while the RCR remained stable. These trends suggest that the market is showing signs of steady growth, which is further supported by the year-on-year overall price increase of 6.1%. This increase highlights a robust demand across all regions.

The sales volume has increased to 760 units, which is a 1.2% increase from January. This is a significant improvement compared to previous years. It indicates that buyers are gaining confidence and the resale market is becoming more active. However, there seems to be a complex relationship between resale and sub-sale market transactions. It is noteworthy that there has been a slight decrease in sub-sale transactions. This suggests that several factors influence buyers’ choices and investment strategies.

It is worth noting the unusually high prices that have been paid for properties in prime locations such as Ardmore Park and The Interlace. This serves to highlight not only the high value placed on luxury and strategically located properties but also reflects the diversity of buyer preferences and the resilience of high-end market segments. On the other hand, the differing median capital gains and unlevered returns across various districts indicate the diversity of market performance. Some areas have experienced significant gains while others have faced challenges.

The given patterns highlight the liveliness of Singapore’s resale market for condominiums. This market is characterised by differences among various regions, changing investment dynamics, and the enduring attraction of prime real estate. Looking ahead, these trends provide useful information for investors, homebuyers, and policymakers, indicating a cautiously optimistic view of Singapore’s real estate industry.

The above comments were taken and rephrased from the February 2024 Condo Resale Market Flash Report. All comments are attributed to Chief Data Officer Mr Luqman Hakim.

Disclaimer: This information is intended solely for general informational purposes. 99.co makes no claims or guarantees regarding the accuracy, completeness, or suitability of the information, including, but not limited to, any assertion or assurance regarding its appropriateness for any specific purpose, to the maximum extent allowed by law. Despite all efforts to ensure that the information presented in this article is current, reliable, and comprehensive at the time of publication, it should not be used as the sole basis for making financial, investment, real estate, or legal decisions. Furthermore, this information is not a replacement for professional advice tailored to your unique personal circumstances, and we disclaim any responsibility for decisions made using this information.

The post Condo sales hold steady in February despite CNY; prices on the rise appeared first on .