In the dynamic landscape of today’s property market, maximising profit is a priority for both home sellers and investors. Whether you’re looking to capitalise on capital appreciation or seeking lucrative investment opportunities, strategic approaches are essential to navigate the competitive real estate terrain effectively.

In this article, we’ll explore three essential factors that can drive your profit and capital gain in the current property market. These strategies have been tested on the ground and are supported by research, demonstrating the potential to yield significant gains of up to S$500,000.

Current market trends

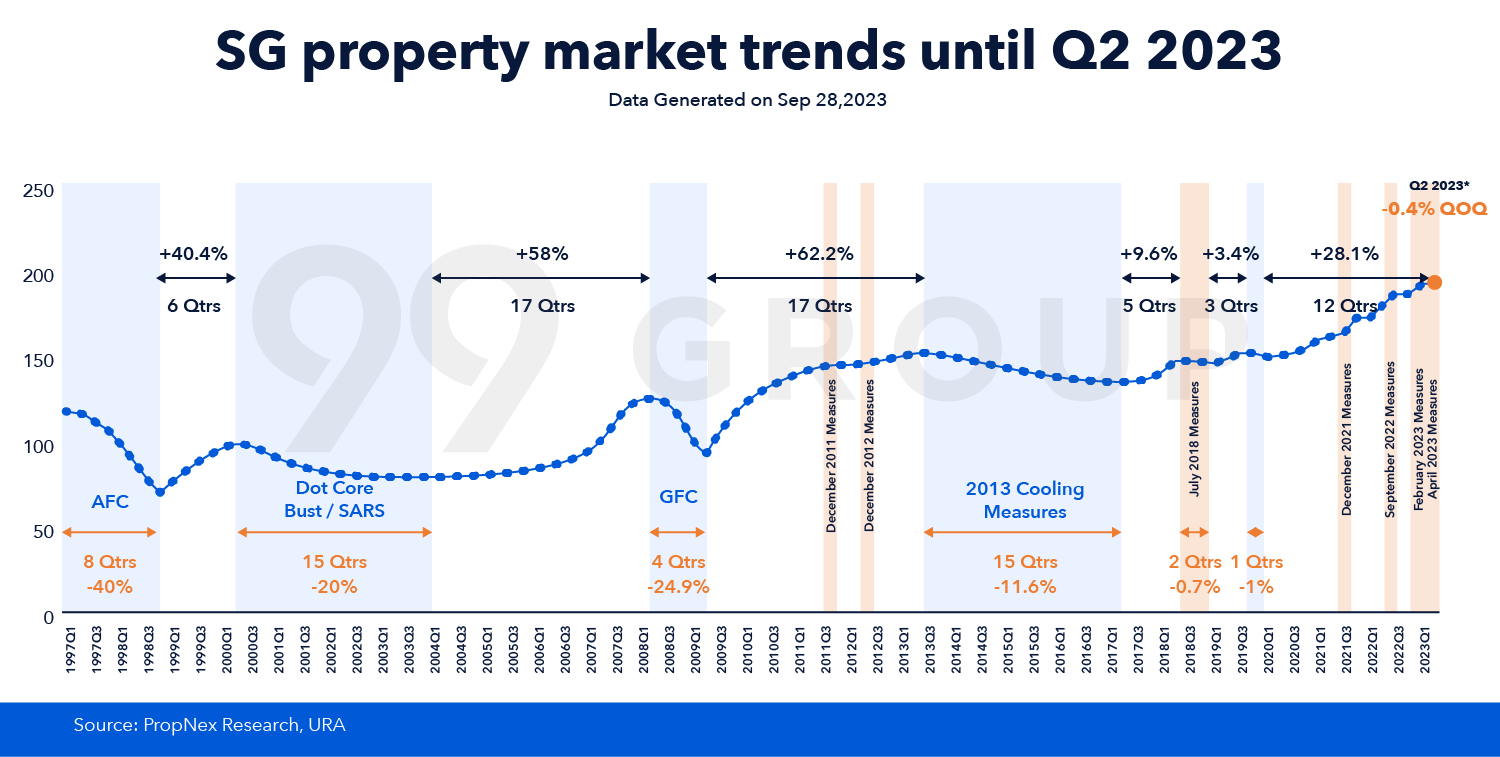

Before dipping your toes into the market, it’s crucial to first understand its previous and current trajectory.

Looking back to the period from 2013 to 2017, we witnessed a decline in market prices by 11.6% due to powerful cooling measures in 2013. Fast forward to 2023, we find ourselves amidst another peak in prices, albeit with signs of sluggish growth following a surge in market prices from 2021 to 2022.

Now, why does this matter?

Well, a slowdown in market growth indicates dwindling demand for home purchases, potentially resulting in reduced offers on home listings and a decline in home prices. For prospective homebuyers, this could present an opportunity for more affordable prices and less competition in the housing market.

Strategy #1: The first-mover advantage

When aiming for maximum capital appreciation, one pivotal factor to consider is the “first mover advantage,” a concept all buyers should grasp.

Essentially, this entails being among the initial buyers of a new development, such as a condominium, which can significantly impact future profits.

Read more: Is there such a thing as “first mover advantage” in property?

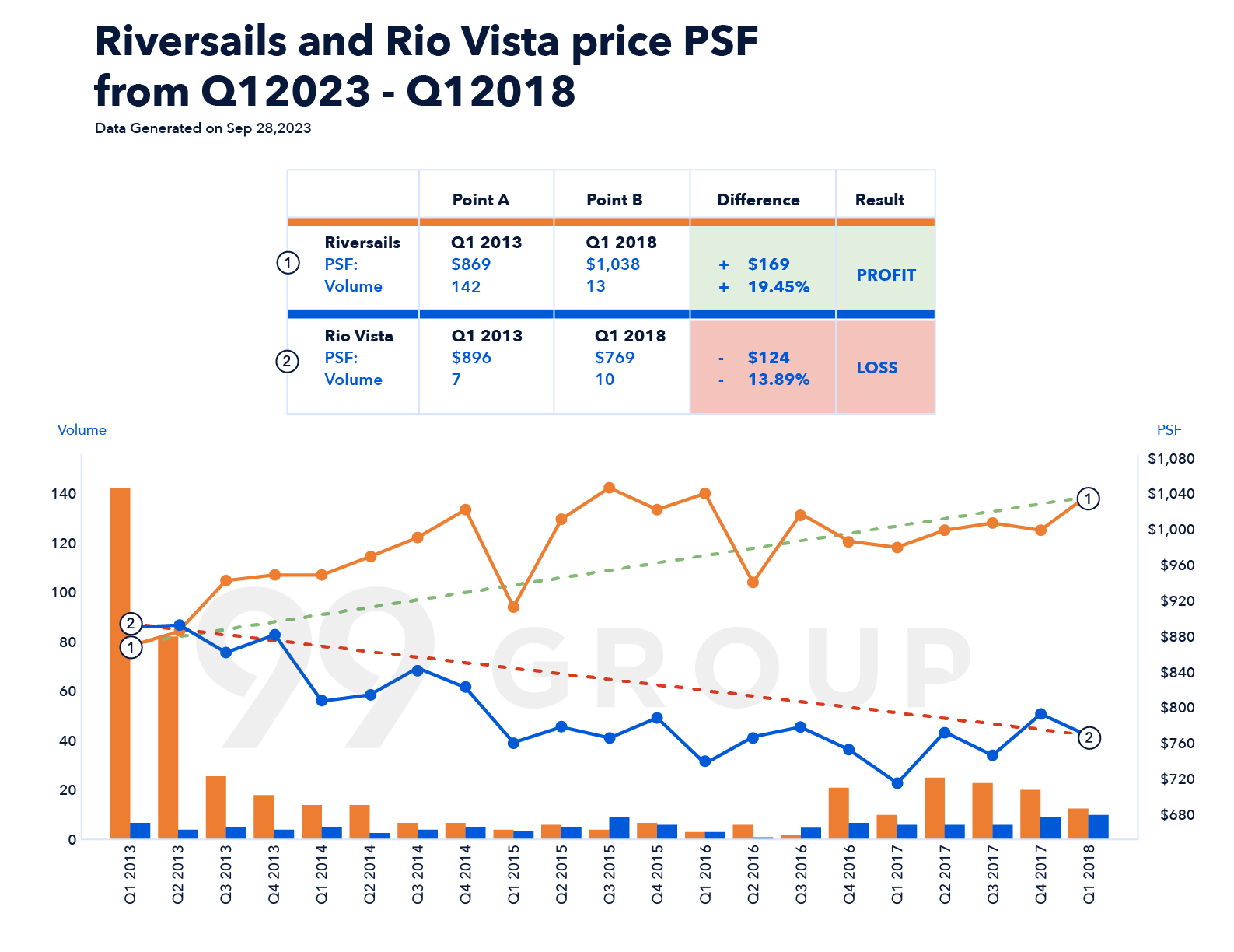

Case study: Riversails vs. Rio Vista

Data source: PropNex

Let’s compare two projects: Riversails, launched in 2012, and Rio Vista, launched in 2001. Both properties are located in the same district, mere minutes apart, and developed by reputable firms.

However, those who acted early and purchased a condo in Riversails during a market downturn in 2013, then sold it five years later after the Minimum Occupation Period (MOP), enjoyed a profit of S$169 per square foot (psf), resulting in a capital gain of 19.45%.

In contrast, sellers in Rio Vista during the same period faced a loss of S$124 psf, equivalent to a 13.89% decrease in value.

This disparity arises from the fact that since Rio Vista’s launch in 2001, initial buyers likely sold their property after the MOP, having already benefited from any initial capital appreciation. This leaves less room for subsequent buyers to profit.

This trend is particularly noticeable in developments where early buyers experience significant capital gains during the property’s initial stages, leading to a notable gap in resale prices between initial and subsequent owners.

| Property | Original purchase price for 3-room condo | Resale price | Profit/Loss |

| Riversails | S$963,721 | S$1,151,142 | + S$187,421 |

| Rio Vista | S$990,337 | S$852,821 | – S$137,516 |

Putting these numbers together, first home-buyers who purchased a 3-bedroom condo (1,109 sqft) in Riversails for S$963,721 would have sold it for S$1,151,142, resulting in a profit of S$187,421. On the other hand, a similar unit in Rio Vista sold by a second buyer for S$990,337 would have fetched only S$852,821 upon resale.

That is a loss of S$137,516 – an amount sizable enough to purchase a car.

Check your affordability with 99.co’s affordability calculator!

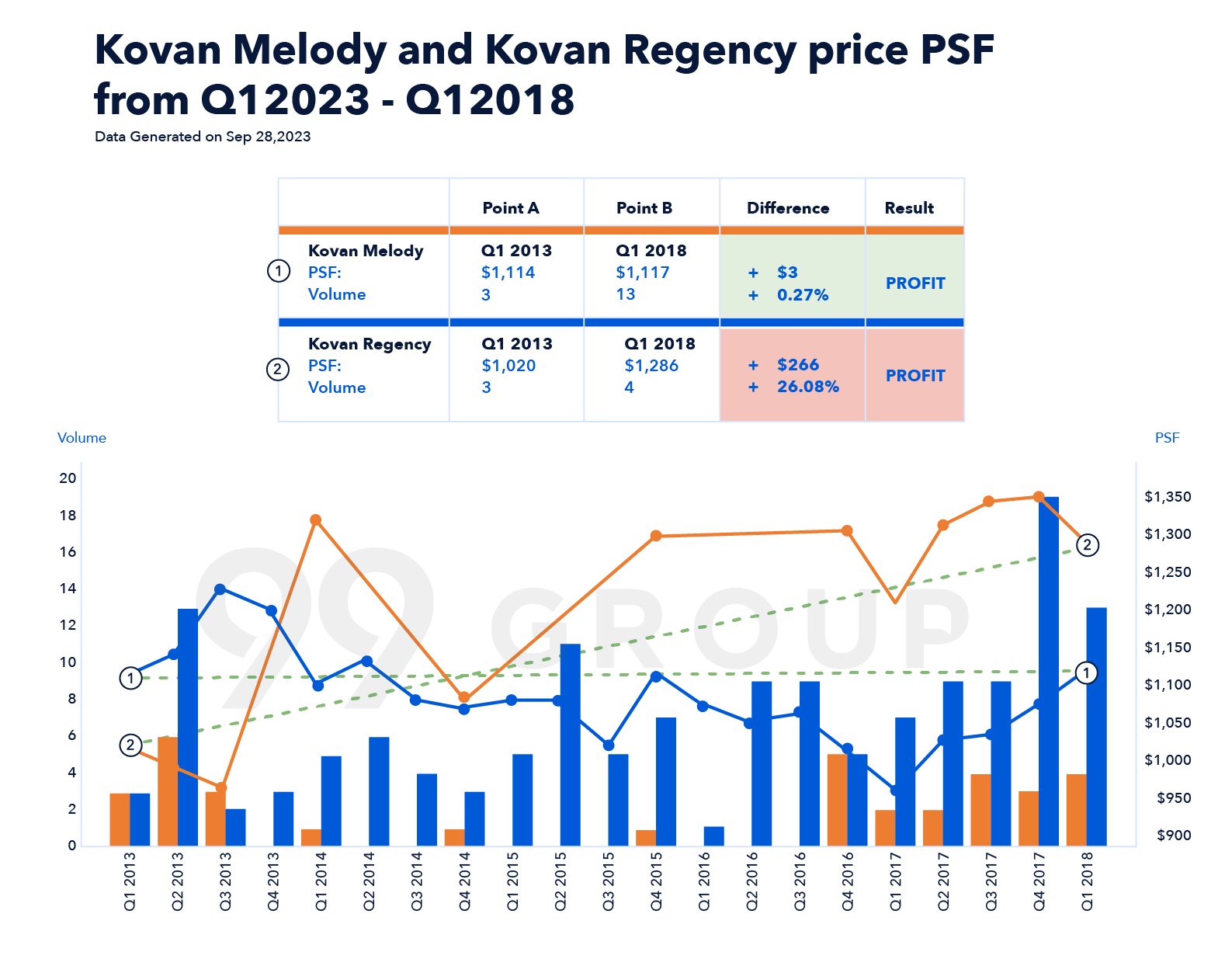

Case study: Kovan Melody vs Kovan Regency

Data source: PropNex

Another case study involves Kovan Regency, launched in 2012, and Kovan Melody, launched in 2004, once again, located just a short walk from each other. Despite their similar amenities and proximity to Kovan MRT, Kovan Regency boasted higher price growth than Kovan Melody from 2013 to 2018.

Specifically, the first movers in Kovan Regency experienced a 26.08% profit, whereas the second buyers in Kovan Melody only made a 0.27% profit.

To give you a better idea, consider a 3-bedroom unit in Kovan Regency, covering 1,130 sqft. The first mover would have bought the unit for S$1,152,600. After a 5-year period, the property would have sold for S$1,286 psf, resulting in a whopping profit of S$300,000.

Given this scenario, would you prefer being the first owner with the S$300k profit, or would you rather be paying a similar amount as a second homeowner? The answer is clear.

Looking for more properties near MRT stations? Explore 99.co’s MRT map here!

Strategy #2: Entry price

In addition to this, two other key factors have substantially enhanced my clients’ profit margins, totalling a significant S$300K to S$400K in their property investments.

The first factor to consider is the entry price, which underscores the importance of minimising investment risks while aiming to maximise returns. A good entry price is lower than the property’s current value, allowing for potential capital gains.

Case Study: The Florence Residences

Data source: PropNex

Data source: PropNex

Florence Residence, formerly known as Florence Regency, serves as a compelling illustration of the significance of entry price.

Initially sold en bloc in 2017 and transformed into The Florence Residences, this property hit the market in 2019 at a breakeven price of S$1,365 per square foot. However, amidst market uncertainties fueled by peak prices, high interest rates of 2.6%, and the aftermath of cooling measures, only 54 units were sold on the launch day.

Despite this, buyers who secured units at the breakeven price during the initial launch in 2019 benefited from lower entry prices compared to those who made purchases in subsequent years, when the offer was no longer available.

This resulted in significant disparities in profits between these two groups.

For example, when comparing units of the same size (915 sqft) bought in 2019 versus 2021, those who leveraged the lower breakeven prices in 2019 paid approximately S$1,232,000, whereas those who bought in 2021 paid anywhere between S$1,640,000 to S$1,719,000 for the same unit.

This translates to almost a S$500K difference in purchase prices, highlighting the significance of buying at prices close to developer breakeven levels for maximising potential profits.

With these substantial profits in hand, those who secured their units at lower entry prices back in 2019 are now well-positioned to reinvest in their next property asset.

Strategy #3: Exit strategy

Besides finding the perfect entry price, your exit strategy is vital for maximising real estate investment profits. Strategically planning your exit ensures optimal returns on your investment when you decide to part ways with a property.

Case Study: The Florence Residences

The announcement of the future interchange at Hougang MRT as part of the Cross Island Line (CRL) presents a lucrative opportunity for Florence Residences’ unit holders.

Connecting major hubs like Jurong District, Changi, and Punggol, the CRL will significantly benefit residents in this area – particularly Florence Residences, given its proximity to the future Cross Island Line MRT entrance.

Anticipated improvements in connectivity and accessibility are poised to drive up demand and property prices in the area.

Moreover, nearby newly MOP-ed 4-room HDBs are already fetching an average of S$700,000, while 5-room HDBs are selling for around S$850,000 on average. These potential buyer demographics are likely to consider Florence Residences upon its TOP this year.

That said, if you intend to sell and profit from your unit in The Florence Residences, capitalising on this current heightened demand would be the optimal exit strategy.

Read more: The future of property in Punggol and Pasir Ris: How the new MRT extension could reshape real estate demand

Wrapping up

By understanding and implementing these three essential strategies – the first-mover advantage, entry price analysis, and effective exit planning – you can maximise your profits in Singapore’s property market.

Whether you’re a home seller or investor, navigating the real estate landscape with strategic approaches can ensure lucrative returns on your property investments.

Remember, buying a property should be a safe and profitable endeavour, and with the right strategies, you can achieve your financial goals in today’s competitive property market.

This article was contributed by Lizzy Zhou. For more questions on this topic, you may reach out to her at +65 8925 9929.

The post 3 Proven strategies to maximise your profit in today’s property market (with case studies) appeared first on .