Singapore’s HDB resale market posted a mixed performance in the second quarter of 2025. While prices continued to rise, the pace of growth slowed for the third consecutive quarter.

At the same time, resale volumes gained traction, reflecting steady demand, particularly for larger flats and well-located units.

Let’s break down the key trends from the data.

Table of Contents

- Price trends

- HDB resale: Q2 volumes

- Million-dollar flat transactions

- Market outlook

Price trends

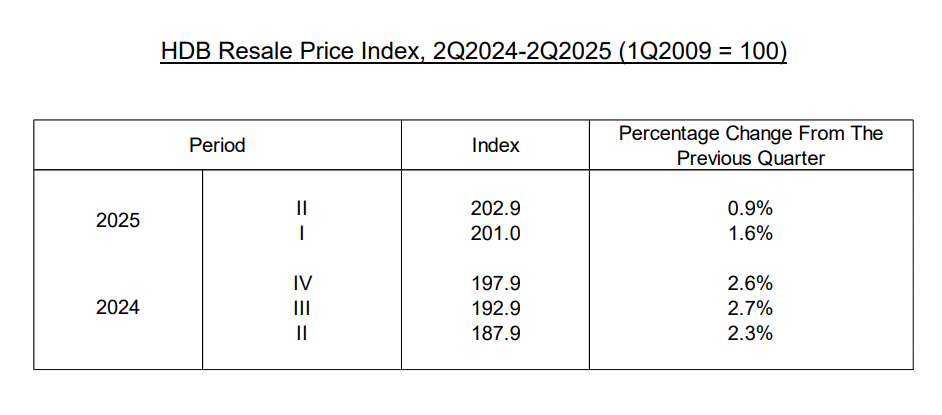

Resale prices of HDB flats rose by 0.9% quarter-on-quarter (QOQ) in Q2 2025, slowing from the 1.6% increase in Q1. This marks the smallest quarterly price growth since Q2 2020, according to data from HDB. The year-on-year (YOY) growth stood at 8.0%.

Cumulatively, the HDB Resale Price Index has increased by 2.5% in the first half of 2025, compared to a stronger 4.2% rise in the same period last year. This moderating trend is consistent with broader signals of price resistance and increased affordability concerns among buyers.

HDB Resale: Q2 volumes

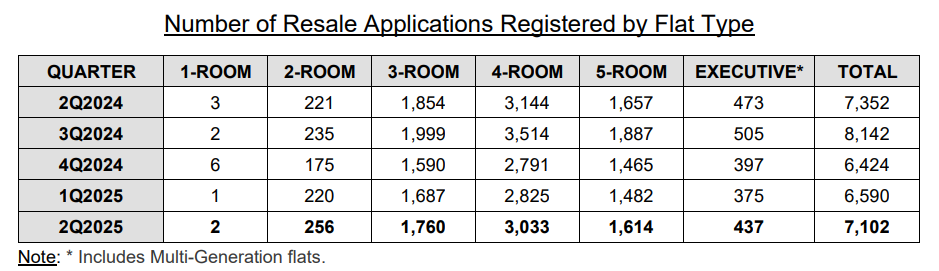

Despite slower price growth, HDB resale volumes picked up. In Q2 2025, 7,102 flats changed hands, an increase of 7.8% from the 6,590 units sold in Q1. This is also the highest resale volume recorded in three quarters.

However, compared to a year ago (Q2 2024), transactions were still down by 3.4%, indicating that while demand has recovered slightly, it hasn’t yet fully bounced back to previous highs. The total volume for 1H 2025 stands at 13,692 units, about 5% lower than the 14,420 units sold during 1H 2024.

Million-dollar flat transactions

High-value HDB transactions remained strong in Q2 2025. A total of 415 flats were resold for at least S$1 million, contributing to a 1H 2025 total of 763 million-dollar flat transactions. With 134 such units already transacted in July, the full-year record of 1,035 set in 2024 could be surpassed as early as August or September.

For the first time, median resale prices for 4-room flats in Central Area, Queenstown, and Toa Payoh crossed the S$1 million mark on a quarterly basis:

- Central Area: Median price reached S$1.2 million, driven by sales at Pinnacle@Duxton, where 11 of 20 resale deals crossed the million-dollar mark.

- Queenstown: With a median of S$1 million, demand was fuelled by 33 million-dollar resale deals, many of which were recently MOP-ed (Minimum Occupation Period) units at Strathmore Avenue and Dawson Road.

- Toa Payoh: Also reaching a S$1 million median, this was supported by resale activity at Bidadari Park Drive and Alkaff Crescent, where over one-third of 4-room units were recently MOP-ed units with more than 94 years left on their leases.

These figures underscore continued buyer willingness to pay premiums for well-located, newer, or iconic HDB properties.

Market outlook

Several upcoming BTO (Build-To-Order) and SBF (Sale of Balance Flats) launches in July and October may draw some attention away from the resale market. These include attractive offerings in mature estates such as Bukit Merah, Toa Payoh, and Simei, as well as landmark launches in Mount Pleasant and the former Keppel Club site.

Still, demand for resale flats is expected to stay resilient, especially for larger units or those in prime locations. At the same time, ongoing cooling measures [like the tighter LTV (Loan-to-Value) limits for HDB loans, currently capped at 75%] may dampen price growth.

Analysts expect HDB resale prices to rise between 4% and 5% for the full year of 2025, slower than the 9.7% surge seen in 2024. Meanwhile, total resale volume for the year is projected to range between 27,000 to 28,000 flats, signalling a stable yet more moderated HDB resale landscape ahead.

The post HDB resale market in Q2 2025: Price growth slows but activity picks up appeared first on .