Singapore’s property market held steady in the second quarter of 2025, with prices continuing to rise modestly despite a noticeable drop in transaction volumes. Buyers appeared more selective, and developers launched fewer new projects during the quarter – partly due to school holidays and the lead-up to the general elections.

Even so, the market wasn’t without movement. Here’s a closer look at the second quarter real estate performance and what it could signal for the months ahead.

Table of contents

- Headline figures and market overview

- Private residential properties

- Prices

- Rentals

- Launches and take-up rates

- Resale and subsale activity

- Supply completions and pipeline

- Stock and vacancy trends

- Office space second quarter performance 2025

- Retail market update

Headline figures and market overview

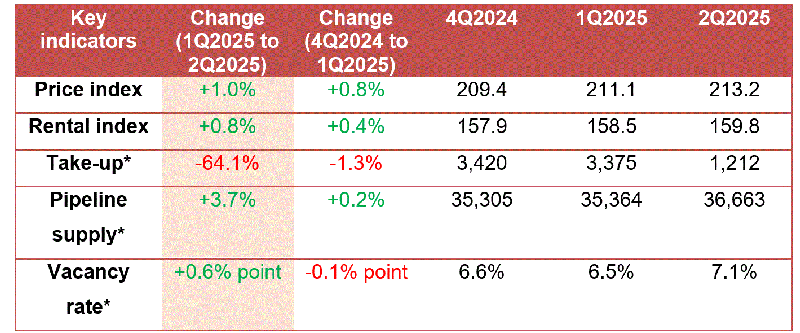

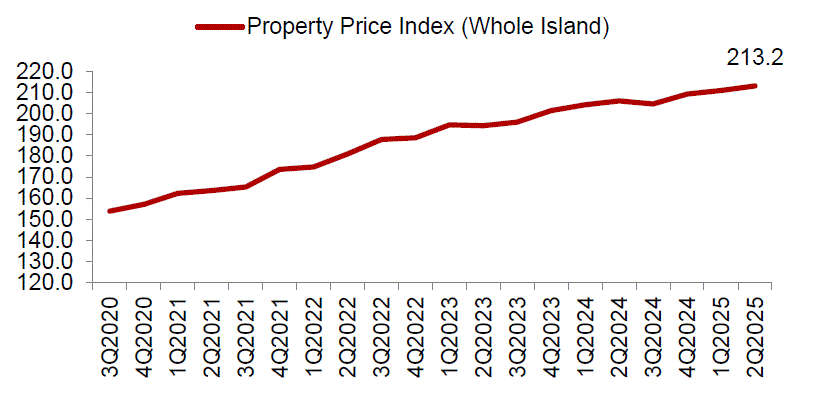

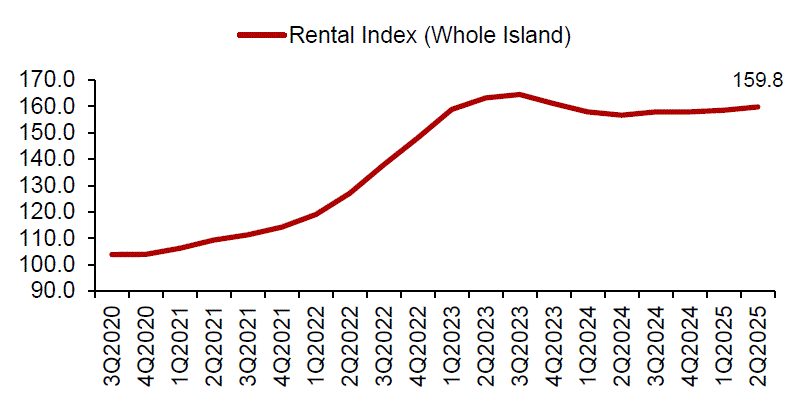

The Private Residential Price Index rose by 1.0%, slightly higher than the 0.8% increase in Q1, though still lower than the 2.3% growth seen in Q4 2024. Meanwhile, rental prices picked up, with the Residential Rental Index rising by 0.8%, doubling Q1’s growth.

Around 3,000 private residential units, including Executive Condominiums (ECs), were completed in the first half of the year. Looking ahead, you can expect about 57,000 more units to be completed in the coming years. The Government Land Sales (GLS) Confirmed List for 2025 offers around 10,000 units, a 50% increase compared to the 2021–2023 average. The government is continuing to monitor supply and demand closely, ensuring there’s enough housing and office space to meet future needs.

Economically, GDP growth is expected to slow down. At the same time, signs of weaker job demand have started to show. As a result, households like yours are being encouraged to remain careful when buying property or taking on new mortgages.

According to Marcus Chu, Chief Executive Officer (CEO) of ERA Singapore, the significant dip in transactions this quarter stemmed mainly from fewer launches and seasonal factors such as school holidays and the election period. However, strong demand from local buyers and limited completions kept prices steady.

Private residential properties

Prices

When it comes to the private property second quarter performance 2025, prices rose overall by 1.0%. Landed homes saw a strong 2.2% increase, driven by a wave of Good Class Bungalow (GCB) sales. In fact, 11 GCB deals worth more than S$300 million were closed, compared to just two in Q1.

For non-landed homes, prices went up by 0.7%. Within the Core Central Region (CCR), there was a 3.0% jump. This was thanks to high-end project launches such as 21 Anderson, where five units sold for a median of S$4,811 psf, and Skywaters Residences, which saw a unit go for S$5,841 psf. July launches also performed well, with UPPERHOUSE at Orchard Boulevard and The Robertson Opus showing strong buyer interest. Notably, local buyers continued to dominate the CCR market, even with lower foreign participation.

Mr. Wong Xian Yang, Head of Research, Singapore & SEA at Cushman & Wakefield observed that the CCR segment may be gaining momentum again after years of slow growth, with its price gap over other regions narrowing significantly over the past decade.

In contrast, the Rest of Central Region (RCR) saw prices dip by 1.1%, despite new launches like Amber House, Arina East Residences, Bloomsbury Residences, and One Marina Gardens. Still, certain projects performed well. One Marina Gardens sold 479 units at a median of S$2,950 psf, while Bloomsbury Residences and The Hill @ one-north saw median prices around S$2,470 to S$2,490 psf. Developers adjusted prices to stay competitive, which could lead to new benchmarks, especially in fringe CCR-RCR locations.

The Outside Central Region (OCR) experienced a 1.1% price increase, driven mostly by resale demand, since there were no new launches in the quarter.

Rentals

Rentals continued to rise, showing a 0.8% increase overall. Non-landed rentals also rose by 0.8%. The CCR led the charge with a 1.8% increase, while RCR rentals remained flat. OCR rentals edged up just 0.1%. For landed homes, rents rose by 0.7%, higher than the 0.3% gain in Q1.

Launches and take-up rates

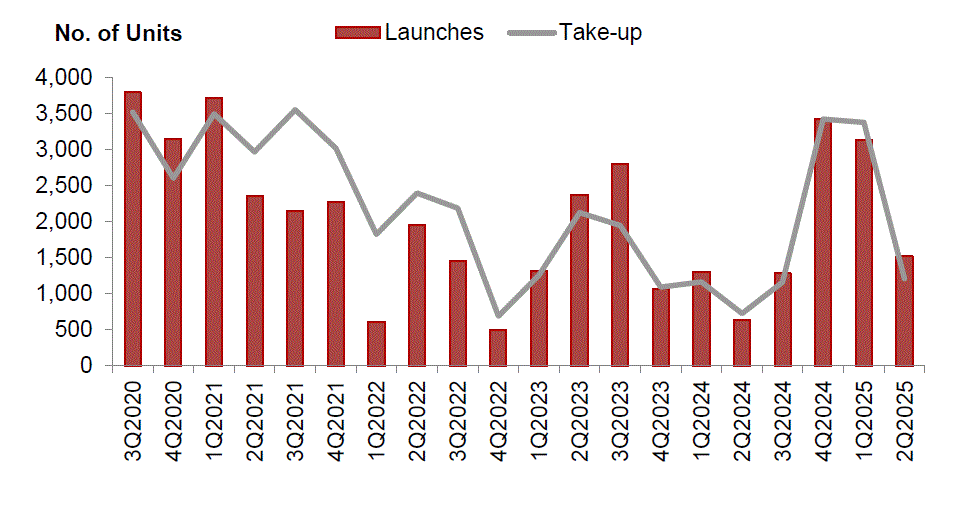

New launch second quarter performance 2025 saw fewer activities. Developers launched just 1,520 units, excluding ECs, compared to 3,139 in the first quarter. Sales followed the same trend, dropping to 1,212 units from 3,375. No new ECs were launched in Q2, and only 149 units were sold, down from 830 in Q1.

Marcus Chu noted that buyer momentum is expected to return in Q3 with 10 new launches lined up, potentially releasing 4,500 units.

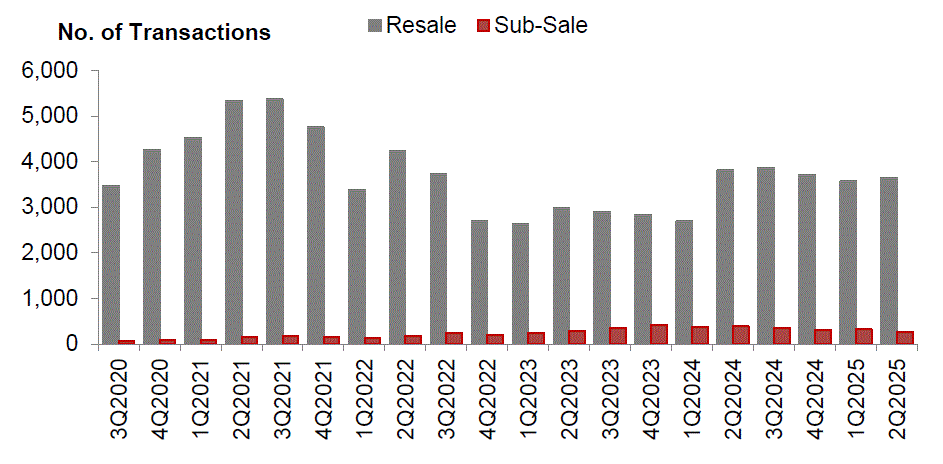

Resale and subsale activity

Resales played a bigger role this quarter. With 3,647 resale transactions completed, they made up 71.1% of all sales, up from 49.1% in Q1. The subsale second quarter performance 2025 showed a decline in activity. Only 269 subsale transactions were recorded, compared to 321 in Q1. However, subsales formed a slightly higher percentage of total sales at 5.2%, as overall transactions fell.

Mr. Wong Xian Yang observed that resales have become more appealing to buyers due to their value proposition, especially with rising rents and interest rates.

Supply completions and pipeline

In Q2, about 980 units were completed, bringing the H1 total to 2,968 units. For the rest of 2025 and beyond, the pipeline remains strong. The GLS Confirmed List for 2025 features 9,755 units. Recent bids, such as S$1,410 psf ppr for Dunearn Road and S$1,132 psf ppr for Lakeside Drive, suggest that developers are feeling more confident.

You’ll find over 41,000 units in the pipeline, including ECs, with about 20,000 still unsold. Over the next 1 to 2 years, around 35,500 units could be completed. For the years 2025–2027, about 22,700 units are expected, and another 34,300 may come after 2028.

Still, developers are expected to stay cautious with land acquisitions due to tight margins and construction costs, noted Mr. Wong Xian Yang.

Stock and vacancy trends

The number of completed private homes rose by 273 units in Q2. However, occupied units dropped by 2,585, pushing the vacancy rate up to 7.1%. The CCR had the highest vacancy at 10.7%, followed by the RCR at 7.2% and the OCR at 5.6%.

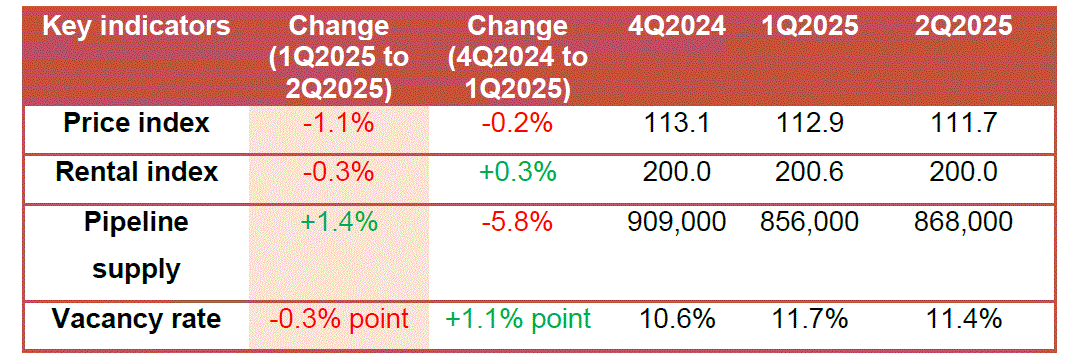

Office space second quarter performance 2025

The office space second quarter performance 2025 reflected a small dip in both prices and rents. Prices dropped by 1.1%, while rentals edged down by 0.3%. The office supply pipeline grew slightly to 868,000 sqm GFA. Meanwhile, occupied space increased by 9,000 sqm, even as total stock fell. This brought vacancy down to 11.4%, from 11.7% in Q1.

According to Mr. Wong Xian Yang, landlords of older buildings are now more flexible with lease terms, and relocation activity remains low as businesses try to reduce capital spending. However, prime office demand remains stable with limited new supply ahead.

Retail market update

Retail space showed subtle improvements. Prices rose by 0.1%, and rentals picked up by 0.9%, recovering from a 0.5% dip in Q1. Supply in the pipeline also increased marginally. Still, occupied space shrank by 16,000 sqm, raising the vacancy rate to 7.1%.

Mr. Wong Xian Yang also noted continued resilience in suburban retail, with lifestyle and F&B brands expanding. Prime mall units are still attracting strong leasing demand, despite broader operating challenges.

Final thoughts

All in all, the second quarter real estate performance paints a mixed yet steady picture. If you’re planning your next move, it’s clear that understanding trends by segment – whether it’s private property, office, or retail – is more important than ever. With price changes, shifting buyer demands, and new launches on the horizon, keeping informed puts you a step ahead.

The post Private home prices up 1% in Q2 2025 as CCR leads growth appeared first on .