July turned out to be a busy month for Singapore’s rental market, with both HDB and condo rental prices climbing alongside a surge in leasing activity. This isn’t unusual — July is typically a peak period when expatriates move here for new work assignments, and families settle before the school term begins. Add in workers whose leases expire mid-year, and you get a rental rush that pushes demand higher compared to June.

Let’s break down the trends.

Table of contents

- Condo rental market: Strong demand across all regions

- Condo rental price by region

- Condo rental activity surged in July 2025

- HDB rental market: Still the go-to for affordability

- HDB rental price by flat types

- HDB rental volumes in July 2025

- What does it mean for tenants and landlords?

Condo rental market: Strong demand across all regions

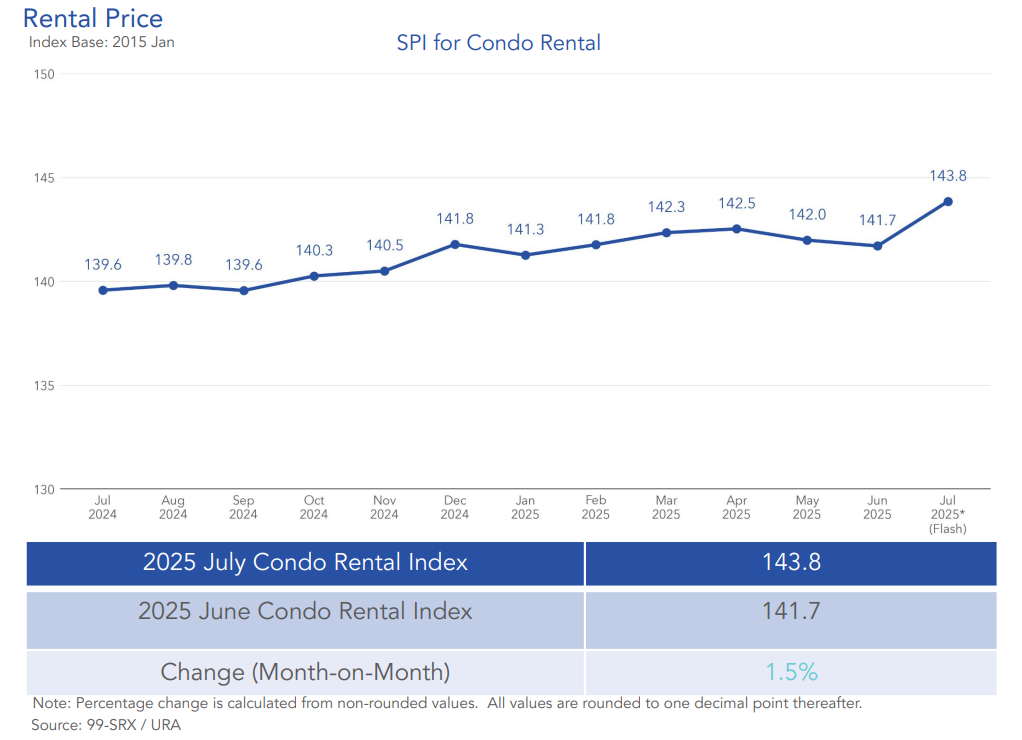

The report shows that condo rental prices continued to edge higher in July 2025, with the index rising to 143.8, up from 141.7 in June — a 1.5% month-on-month increase. These increases were recorded within all regions, with the OCR showing the strongest growth rate of 2.1%.

Condo rental price by region

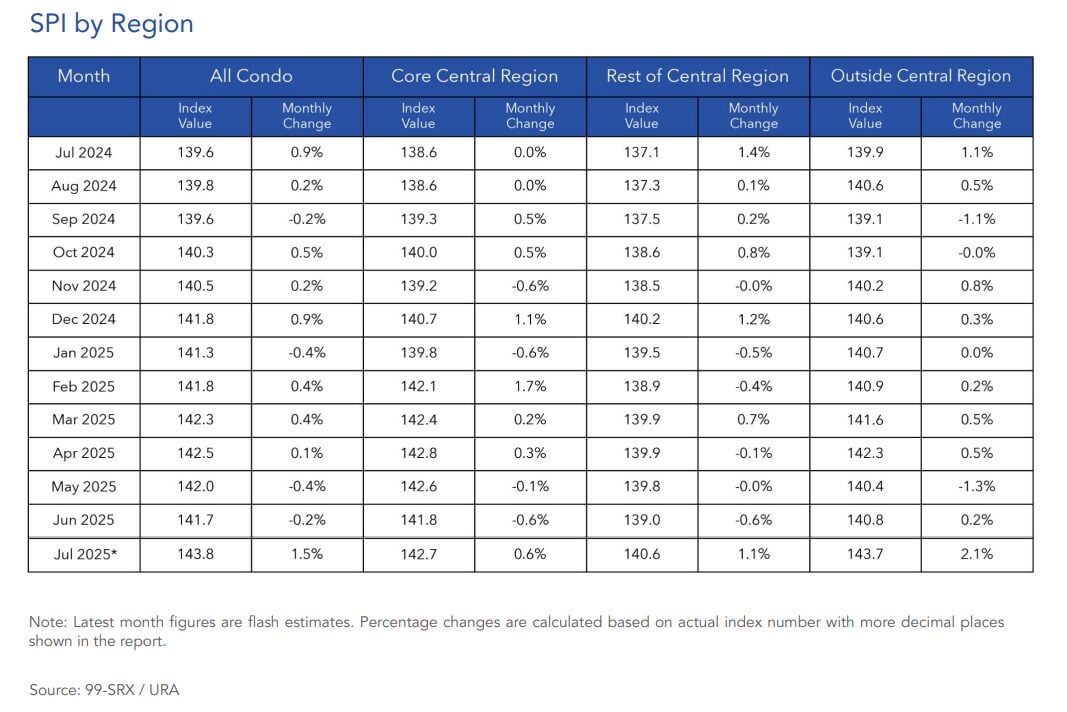

- Core Central Region (CCR): Tenants typically pay the highest rents here, driven by proximity to Orchard Road, CBD, and prime expat enclaves. While the exact median values were not displayed in the summary, the steady 0.6% increase reflects ongoing demand from expatriates with housing allowances.

- Rest of Central Region (RCR): Rental prices rose 1.1%, supported by popular city-fringe areas like Queenstown, Geylang, and Kallang. These neighbourhoods remain attractive for tenants seeking central convenience at a slightly lower cost than CCR.

- Outside Central Region (OCR): Suburban locations saw the largest increase at 2.1%, showing that many tenants are now gravitating to more spacious suburban condos in areas such as Tampines, Jurong, and Woodlands.

On a year-on-year basis, condo rents were 3.1% higher than in July 2024, with CCR, RCR, and OCR showing gains of 3%, 2.5%, and 2.7% respectively.

Condo rental activity surged in July 2025

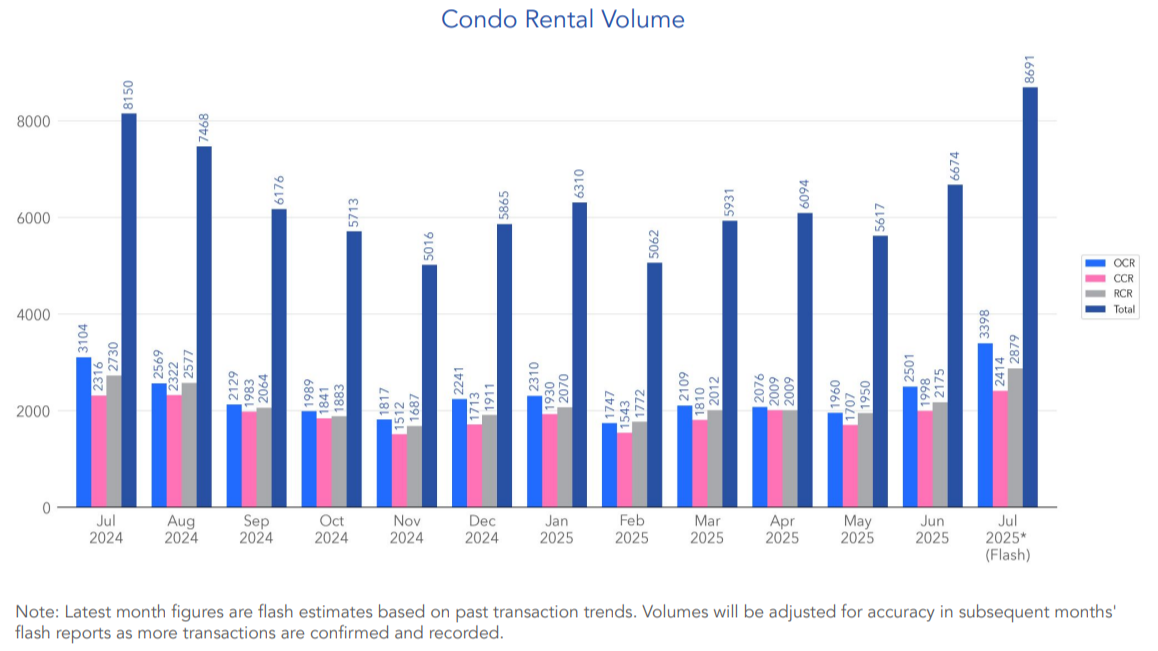

The bigger story lies in the rental volumes. Leasing activity spiked by 30.2% month-on-month, with an estimated 8,691 units rented in July, compared to 6,674 in June. This wasn’t just seasonal demand — volumes were also 6.6% higher than last year and 10.6% above the five-year average for July.

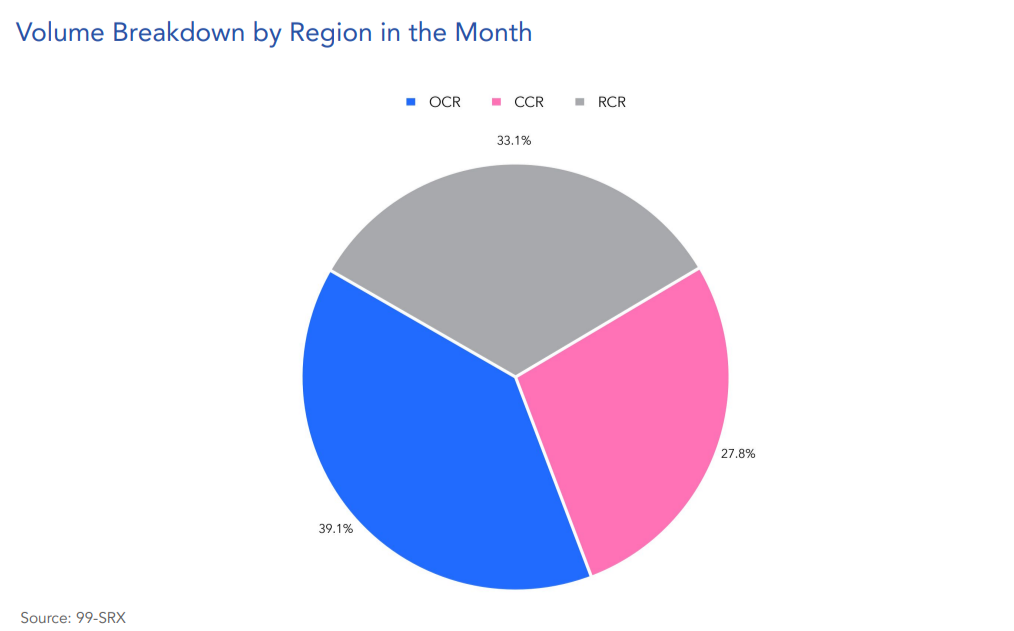

Looking at market share, the OCR led with 39.1% of rentals, followed by RCR (33.1%) and CCR (27.8%). This distribution highlights a strong shift toward more affordable suburban locations, where larger units can often be rented for the same price as smaller central apartments.

HDB rental market: Still the go-to for affordability

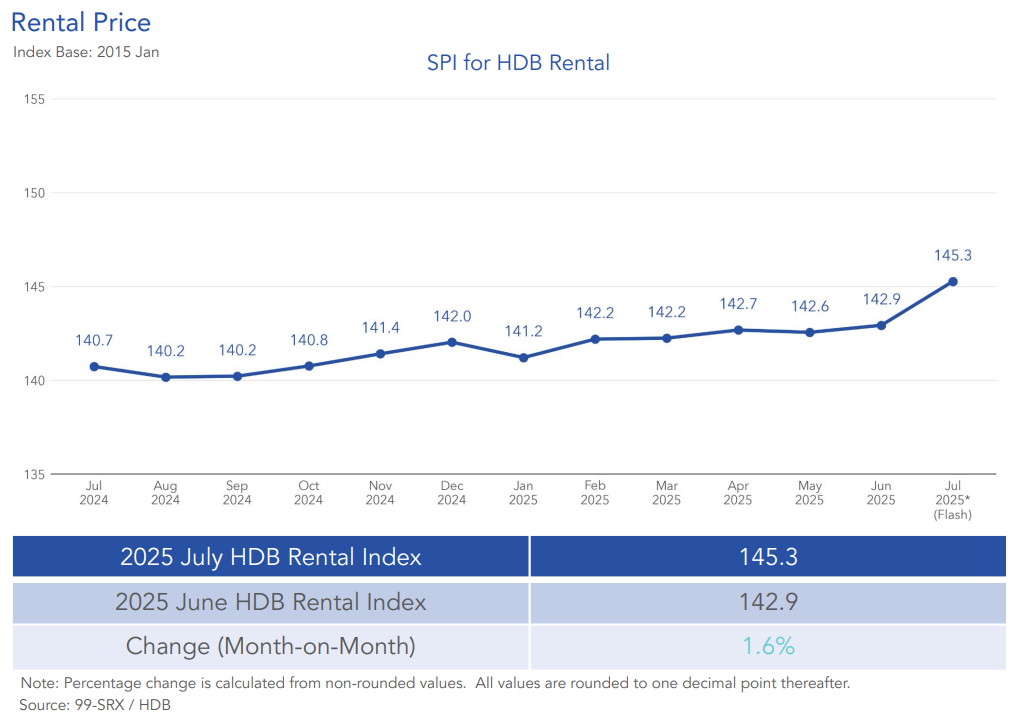

Rental prices for HDB flats also continued their climb. The HDB Rental Index rose to 145.3 in July, up from 142.9 in June. This translates to a 1.6% month-on-month increase. The rental prices rose across both estate categories:

- Mature estates: Up 1.8% month-on-month, with year-on-year rent price higher by 3.5%. These estates, including towns like Ang Mo Kio, Toa Payoh, and Queenstown, remain popular with families who want access to established amenities.

- Non-Mature estates: Up 1.3% month-on-month, with year-on-year rents up 2.8%. These newer towns, like Punggol, continue to draw younger tenants who prefer newer flats at slightly lower prices.

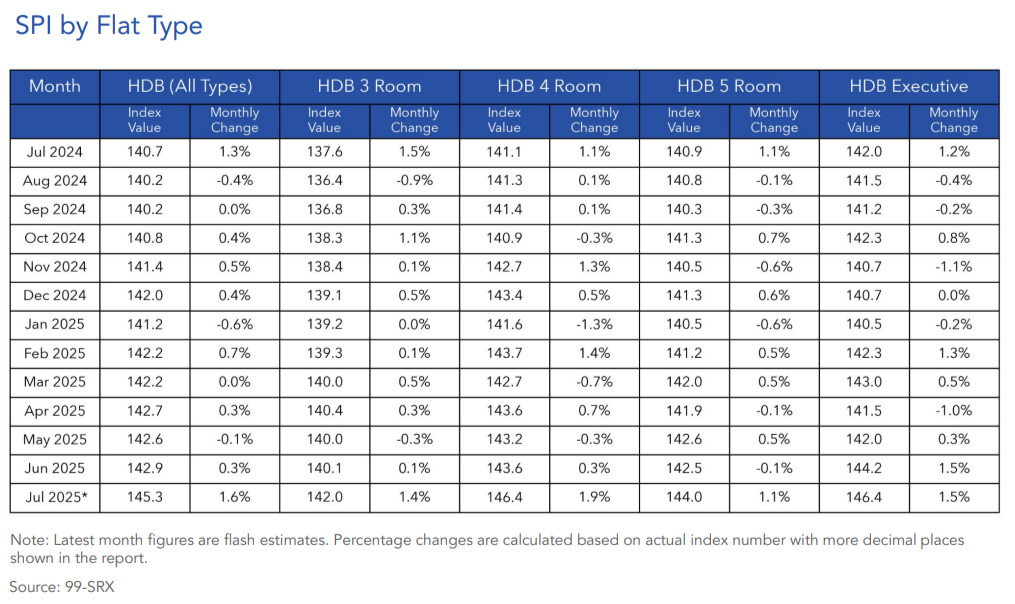

Compared to a year ago, HDB rental prices were 3.2% higher overall. All flat types recorded both month-on-month and year-on-year gains. Here’s the breakdown:

HDB rental price by flat types

3-room flats (up 1.4% MoM, 3.2% YoY)

Smaller 3-room flats remain a vital option for singles, young couples, and retirees who prefer a compact space. With rents rising steadily, it reflects demand from tenants who are priced out of larger flats or private apartments but still want a home in convenient locations. Mature towns with strong transport links, such as Toa Payoh or Queenstown, are especially popular for this flat type.

4-room flats (up 1.9% MoM, 3.7% YoY)

These flats saw the strongest rent increases in July and now make up the largest share of all HDB rentals at 38.3%. They are the “sweet spot” for families — large enough to provide three bedrooms yet still within a reasonable budget compared to 5-room or Executive flats. The consistent year-on-year growth shows just how much families and even some expatriates rely on 4-room flats as a practical housing alternative.

5-room flats (up 1.1% MoM, 2.2% YoY)

Rental growth for 5-room flats was more subdued compared to smaller flats. While they offer more living space, the higher monthly rent often puts them out of reach for smaller households. Demand is strongest among multi-generational families or tenants who share the unit with multiple occupants to split costs. The slower pace of rent increases suggests that affordability limits are capping how much tenants are willing to pay.

Executive flats (up 1.5% MoM, 3.1% YoY)

These larger units, which often feature additional space like a study or larger living area, cater to bigger families and sometimes groups of co-tenants. Although they make up only 6.2% of HDB rental transactions this month, rents are still inching up as households who need more room have limited options outside of the private market.

HDB rental volumes in July 2025

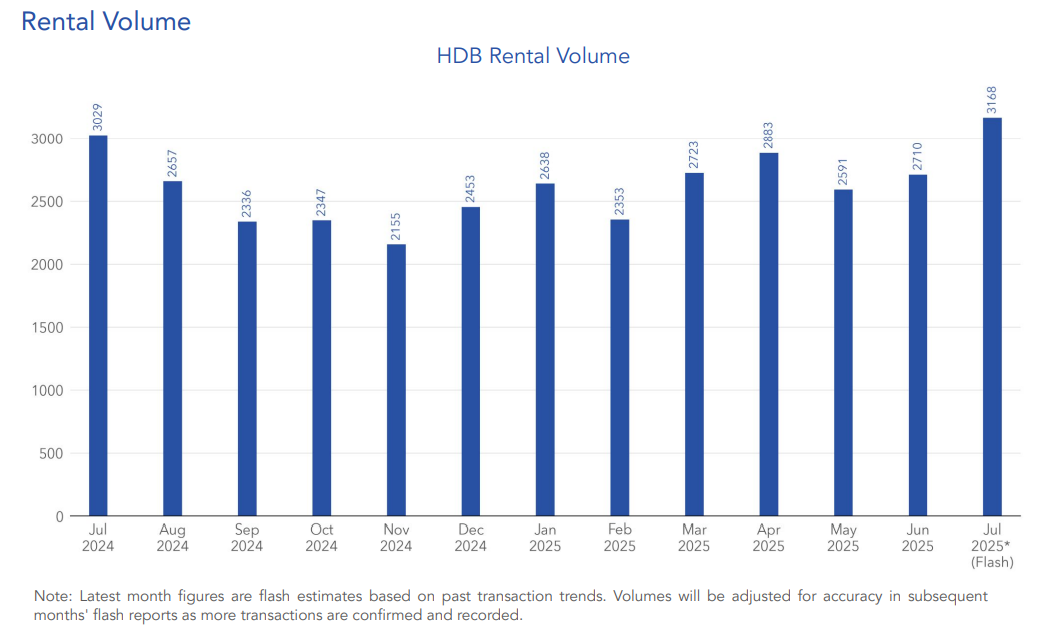

Leasing activity was equally robust. HDB rental volumes rose 16.9% month-on-month, with about 3,168 flats rented in July versus 2,710 in June. Compared to a year ago, volumes were up 4.6% and also 2.9% higher than the five-year July average.

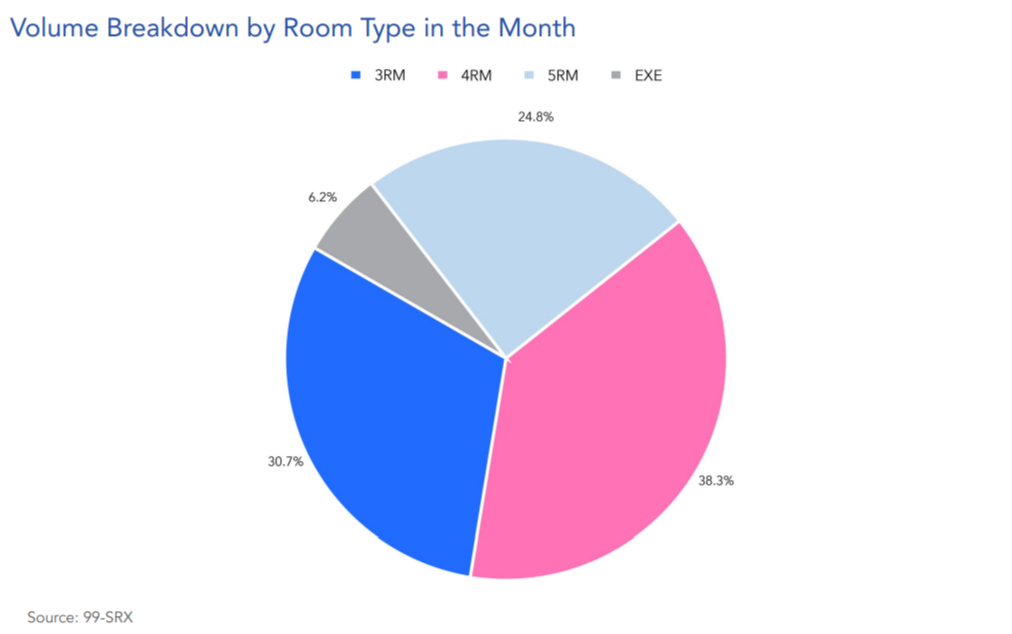

Breaking down the total rentals by flat type:

- 3-room flats: 30.7%

- 4-room flats: 38.3%

- 5-room flats: 24.8%

- Executive flats: 6.2%

The dominance of 4-room flats suggests that many families are prioritising a balance between affordability and sufficient space.

What does it mean for tenants and landlords?

With prices trending upward and demand running high, landlords are in a stronger position to negotiate. Tenants, however, may need to brace for higher rents, particularly in the OCR, where demand is pushing up prices fastest.

Still, HDB rentals remain a critical safety net for those squeezed out of the private market. Even with rising rental prices, they continue to provide relatively more affordable housing options. As we move into the later months of 2025, the question will be whether this momentum carries forward or if July’s spike will taper off once the seasonal demand passes.

The post Tenants pay more in July 2025: HDB and condo rental prices both on the rise appeared first on .