The condo resale market has been lively in July 2025, with both resale volumes and prices climbing from the past two months. If you’ve been keeping an eye on the market, you’ll notice that activity has picked up again, and buyers are moving with greater confidence. This condo resale flash report July 2025 breaks down the latest numbers, giving you a clear picture of where things stand and what’s driving these changes.

Table of contents

-

- What’s behind this surge of activity?

- Condo resale price performance

- Sales volumes and regional breakdown

- Record-high transactions across regions

- Boulevard 88 (CCR) – S$13 Million

- The Sovereign (RCR) – S$8.4 Million

- Ocean Park (OCR) – S$4.1 Million

- Median capital gains

- Median unlevered returns

What’s behind this surge of activity?

Sales volumes rose month-on-month as more buyers returned to the condo resale market. While luxury-focused districts and properties in the CBD experienced more moderate returns, areas popular with families and upgraders saw stronger momentum.

Another factor behind the 15.1% increase in resale volume compared to June could be interest rate movements. With SORA rates falling below HDB loan rates, many of you may have been motivated to lock in purchases before conditions shift again.

When comparing to last year, however, sales were 5.6% lower. This isn’t necessarily a sign of slowing demand. Instead, it reflects how July 2024 was unusually active, as a large number of MOP flats entered the resale condo market, boosting volumes. With that wave subsiding, 2025’s figures appear a little softer in comparison, even though activity remains healthy overall.

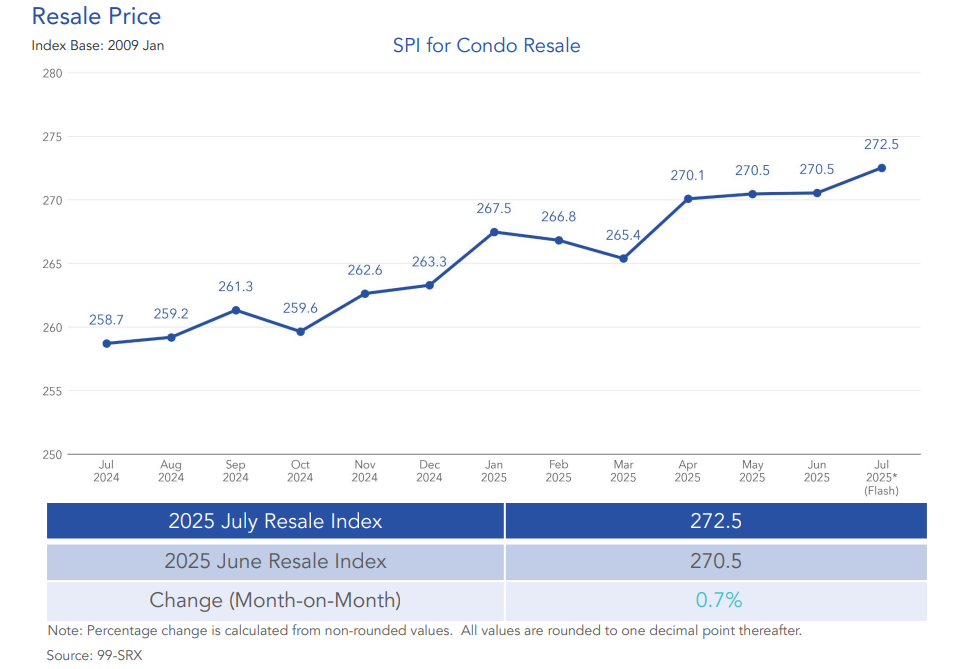

Condo resale price performance

In July 2025, price movements varied across regions. The Rest of Central Region (RCR) led the gains with a 2.1% increase, while the Outside Central Region (OCR) saw only a marginal rise of 0.1%. In contrast, the Core Central Region (CCR) slipped by 2.1%.

Looking at the bigger picture, the SRX Price Index shows that overall condo resale prices rose 0.7% month-on-month. Compared to a year ago, prices were 5.3% higher than in July 2024. Breaking this down by region, the CCR was up 2.8% year-on-year, the RCR climbed 4.4%, and the OCR posted a stronger gain of 5.3%.

This shows that while luxury homes in the CCR softened slightly on a monthly basis, they still posted positive gains compared to last year. Meanwhile, the city-fringe and suburban regions continued to shine, as affordability and strong upgrader demand supported prices.

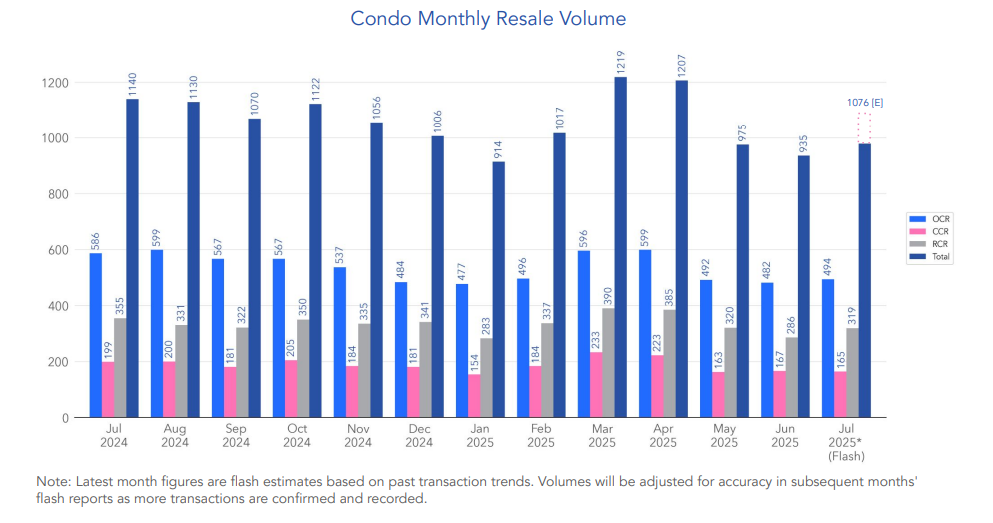

Sales volumes and regional breakdown

An estimated 1,076 resale units changed hands in July 2025. This was a 15.1% increase from June’s 935 units. However, volumes were 5.6% lower year-on-year compared to July 2024. Still, the numbers were stable when measured against the five-year average for the month.

Looking at where buyers are purchasing, it seems that 50.5% of resale transactions came from the OCR, 32.6% were from the RCR, and 16.9% were from the CCR. This distribution highlights the strong role of affordability and family-oriented locations in driving sales.

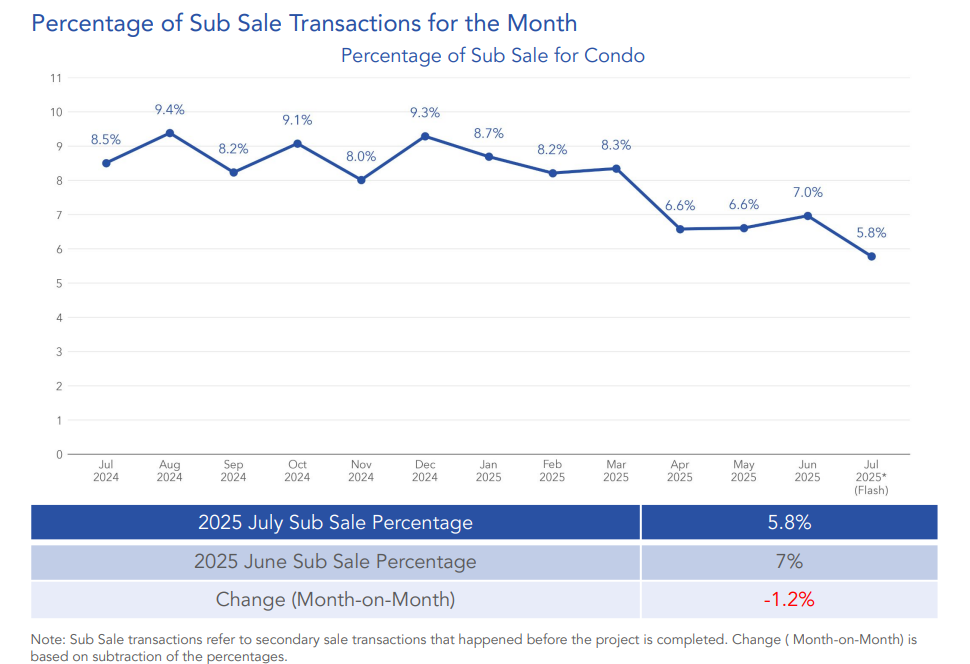

Sub-sale transactions made up 5.8% of total secondary sales in July 2025, a slight drop from June. Sub-sales refer to sales made before a project is completed. The decline here suggests that more buyers are focusing on completed resale condos instead of units still under construction.

Record-high transactions across regions

While overall numbers give one perspective, some standout transactions show the continued appetite for luxury and unique homes.

Boulevard 88 (CCR) – S$13 Million

The priciest resale transaction in July 2025 was a S$13 million unit at Boulevard 88 in the Core Central Region. This project consists of two 28-storey towers designed by Moshe Safdie, featuring high-end interiors and generous layouts. Unit types include 2-bedroom apartments with study areas, spacious 3- and 4-bedroom options, and expansive penthouses reaching over 6,000 square feet.

Boulevard 88 sits along Orchard Boulevard, close to Orchard MRT and the upcoming Thomson-East Coast Line station. You’ll also find major shopping spots like ION Orchard and Tanglin Mall nearby, along with top schools within easy reach. Residents enjoy premium facilities such as infinity pools, a rooftop Sky Boulevard deck, a Sky Gym, and concierge services.

The Sovereign (RCR) – S$8.4 Million

In the Rest of Central Region, the highest resale price was S$8.4 million for a unit at The Sovereign. Completed in 1993, this single 30-storey tower offers just 87 units, each ranging from 2,600 to 3,300 square feet. With large balconies and open views, many units enjoy a connection to the nearby coastline.

The development is only a short walk from Tanjong Katong MRT (Downtown Line) and is close to lifestyle spots like East Coast Park, Parkway Parade, and Katong eateries. Despite being over three decades old, The Sovereign remains sought after for its spacious layouts and comprehensive condo facilities, including tennis and squash courts, a swimming pool, and 24-hour security.

Ocean Park (OCR) – S$4.1 Million

In the Outside Central Region, Ocean Park recorded the highest resale at S$4.1 million. This development has 304 units across a 30-storey tower, offering a mix of 2- and 3-bedroom units, maisonettes, and penthouses.

Located along East Coast Road, Ocean Park combines suburban living with quick access to East Coast Park and the sea. Connectivity is supported by expressways such as the ECP and MCE, while Marine Parade MRT and Eunos MRT are not far away. Residents benefit from a clubhouse, gym, BBQ area, and plenty of recreational facilities.

Median capital gains

Resale condo sellers in July 2025 saw a median capital gain of S$371,000, slightly lower by S$4,000 compared to June.

By district:

- District 11 (Newton / Novena) posted the highest gains, with a median of S$767,000.

- District 1 (Boat Quay / Raffles Place / Marina) had the lowest, with a small decline of S$50,000.

This reflects how family-friendly areas with strong amenities continue to see robust demand, while some CBD-centric properties are adjusting to more moderate resale conditions.

Median unlevered returns

The overall median unlevered return was 31% in July 2025. This return is calculated by comparing the resale price with the previous purchase price of the same unit.

By district:

- District 20 (Ang Mo Kio / Bishan / Thomson) led the way with returns of 46%.

- District 1 (Boat Quay / Raffles Place / Marina) posted the lowest at -3.8%.

Districts with fewer than 10 resale transactions were not included in these rankings. The numbers highlight how well-established suburban and city-fringe locations remain attractive to both upgraders and long-term investors.

Wrapping up

The condo resale flash report July 2025 shows that the market is holding steady with healthy growth in both prices and volumes. More buyers are re-entering, affordability continues to drive activity in OCR and RCR, and luxury homes in CCR are still drawing high-value deals, even if at a slower pace.

For you as a buyer, this means that opportunities remain across all regions depending on your budget and lifestyle needs. And if you’re selling, capital gains remain strong in many districts, especially those with mature amenities and family appeal.

The post Condo resale volumes jump 15.1% in July 2025, with prices up 0.7% appeared first on .