In this edition of Condo Cash or Crash, we’re heading to River Valley, where The Avenir has just set two very different records within weeks of each other. One seller walked away with a massive profit, while another suffered the project’s biggest recorded loss. Together, these transactions highlight how timing can make or break a deal, even within the same luxury development.

Table of contents

- 4-bedder at The Avenir was sold for S$9.3 million

- S$1.4 million profit: The highest capital gain in The Avenir

- Meanwhile, another 4-bedder was sold at a S$1.06 million loss

- Project overview: GuocoLand’s upscale condo at River Valley Close

4-bedder at The Avenir was sold for S$9.3 million

A freehold 4-bedroom unit at The Avenir in River Valley changed hands through a subsale transaction in August 2025. The 2,411-sqft unit, located on the 30th floor, fetched a price of S$9.3 million or S$3,857 psf. This psf figure was significantly above the project’s current average of S$3,461 psf, meaning the buyer paid around a 11.4% premium to secure the unit.

While The Avenir has reached its Temporary Occupation Permit (TOP) in 2025, the project has not received its Certificate of Statutory Completion (CSC) yet. Resale transactions under this period are still considered as subsales.

The most expensive unit ever transacted at The Avenir

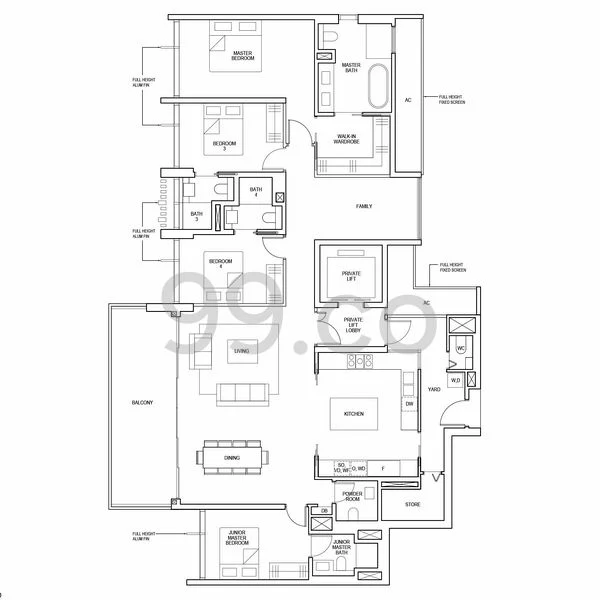

At S$9.3 million (S$3,857 psf), this is the most expensive unit ever sold in The Avenir, both in terms of total quantum and psf. The 2,411-sqft, 4-bedder layout is the project’s largest, and it comes with private lift access, a sizeable living room, dining space for a ten-seater, and a spacious kitchen with an island counter.

Typically, smaller units command higher psf rates, but The Avenir’s luxury positioning flips this trend, allowing even its larger layouts to reach record-setting psf prices. Looking specifically at this unit type, URA’s caveat data (including both new and sub sales) shows past transactions averaging S$8.04 million or S$3,337 psf. In comparison, this latest subsale deal was closed at about 15.6% higher than the segment’s average.

Don’t guess your selling price – know it. Use 99.co’s Property Value Tool for a fast, reliable estimate in under a minute, with up to 98% accuracy.

Other freehold 4-bedder resale deals in District 9

Around the time of the subsale transaction, freehold 4-bedroom units in District 9 (Orchard/River Valley) were changing hands at an average of S$2,879 psf in the resale market. It means that the 4-bedder at The Avenir achieved about 34% premium above this district-wide average.

By way of comparison, a similar 2,411-sqft 4-bedder at 111 Emerald Hill was sold in the same month for just S$5.65 million (S$2,343 psf). Meanwhile, at Scotts Highpark, a larger 3,466-sqft unit changed hands for S$7.4 million (S$2,135 psf). Both of these projects are freehold but notably older, having received TOP in 2012 and 2009, respectively. The differences in age and branding help explain why The Avenir’s unit commanded a far higher premium.

S$1.4 million profit: The highest capital gain in The Avenir

On the seller’s end, this subsale deal in August 2025 resulted in a capital gain of S$1.4 million after a 5-year holding period. The unit was first purchased in August 2020 directly from the developer for S$7.893 million (S$3,274 psf). That entry point was slightly lower than the unit-type average of S$3,289 psf but still above the overall project average of S$3,106 psf at the time.

In other words, the seller entered at a 5.4% premium relative to the project’s overall 2020 average but secured a slightly better deal compared to other buyers of the same 4-bedder layout. By 2025, this decision paid off handsomely, as their subsale exit now marks the most profitable sale ever recorded at The Avenir.

Subsale transaction history within the project

As of August 2025, The Avenir has recorded 4 subsale deals in the year, averaging S$3,219 psf. These involved two 4-bedders, one 2-bedder, and one 1-bedder.

Looking at the project’s history since launch, there have only been 10 subsale transactions in total, versus 340 new sales, according to URA’s caveat data. This means just 2.9% of buyers chose to exit via subsale, with their units fetching S$3,364 psf on average.

| Date | Price (S$) | PSF (S$) | Area (sqft) | Floor Level |

| Aug-25 | 9,300,000 | 3,857 | 2,411 | 26 to 30 |

| Jul-25 | 6,900,000 | 2,862 | 2,411 | 11 to 15 |

| Mar-25 | 2,700,000 | 3,258 | 829 | 01 to 05 |

| Feb-25 | 1,560,000 | 2,899 | 538 | 01 to 05 |

| Dec-24 | 3,700,000 | 3,243 | 1,141 | 01 to 05 |

| Nov-24 | 3,488,000 | 3,057 | 1,141 | 01 to 05 |

| Oct-24 | 2,850,000 | 3,439 | 829 | 11 to 15 |

| Jun-24 | 8,888,000 | 3,686 | 2,411 | 26 to 30 |

| Nov-23 | 8,600,000 | 3,567 | 2,411 | 31 to 35 |

| Oct-23 | 7,800,000 | 3,774 | 2,067 | 36 to 40 |

Among these, the 2,411-sqft 4-bedder unit type has seen 4 subsale transactions altogether, averaging S$8.422 million or S$3,493 psf. The August 2025 deal, at S$9.3 million, was priced nearly S$1 million higher than this segment’s historical average.

Meanwhile, another 4-bedder was sold at a S$1.06 million loss

Not all sellers at The Avenir have been as fortunate. Interestingly, the same unit type is also responsible for the most unprofitable condo transaction within the development. Just a month earlier in July 2025, another 2,411-sqft unit was sold for only S$6.9 million (S$2,862 psf). This was around 18.1% below the average psf for this unit type (S$3,493 psf).

That exit saddled the seller with a loss of S$1.06 million after holding the unit for 3.5 years. Since the holding period is more than 3 years, there was no payable Seller’s Stamp Duty (SSD). The Crash would have been more severe for the seller if it had been.

Read more: Selling your condo before TOP? Here’s what you should know about sub-sale and SSD

They originally purchased the unit in November 2021 from the developer for S$7.96 million or S$3,302 psf. At the time, this was 5.2% above the project-wide average of S$3,138 psf, though it was slightly below the 4-bedder segment’s average of S$3,324 psf.

Sold low, but still higher than the market’s average

Despite the lower entry point, this July seller still exited at a massive S$1 million loss. Interestingly, even at a loss, it was still 15.4% higher than District 9’s average of S$2,479 psf that month for similar 4-bedroom units.

This highlights that the sale was likely a fire sale, where the seller was under pressure to offload quickly — possibly due to liquidity needs, portfolio restructuring, or personal circumstances. Such urgency often forces sellers to accept below-market offers relative to their entry price. However, the fact that the unit still fetched well above District 9’s average underlines The Avenir’s strong positioning in the luxury segment.

Project overview: GuocoLand’s upscale condo at River Valley Close

Launched in 2020, The Avenir has built a reputation as one of River Valley’s most prestigious freehold condos. With 376 units housed in two 36-storey towers, the development caters especially well to families thanks to its large and practical 3- and 4-bedroom layouts.

The site is the former Pacific Mansion, which was acquired en bloc for S$980 million in 2018 by a consortium of GuocoLand, Hong Leong Holdings, and Hong Realty. Despite its relatively modest land size of 129,000 sqft, about 75% of the grounds are dedicated to landscaping and facilities.

These include a tennis court, swimming pool, and the standout Grand Lawn, a rare luxury at a time when many projects are shrinking their open, green spaces.

Both residential towers are elevated over 10 metres above ground level, giving residents a sense of exclusivity and access to rooftop gardens with sweeping city views.

Location review

The Avenir’s prime River Valley address is one of its strongest selling points, offering residents a blend of convenience, lifestyle, and prestige that few neighbourhoods in Singapore can match.

Public transport connectivity is a highlight here. The condo is just a 5-minute walk from Great World MRT Station on the Thomson-East Coast Line. In addition, Somerset MRT Station on the North-South Line is less than a 15-minute walk away, giving residents multiple MRT options within close proximity.

Daily conveniences are well covered. Great World City mall is nearby, offering a Cold Storage supermarket, an array of dining choices, and retail shops. For variety, residents can also head to Robertson Quay, known for its riverside cafes, wine bars, and restaurants. The vibrant Orchard Road shopping belt is only a bit further down the road.

On top of these, having River Valley Primary School right next door is a major advantage for families with young children.

Read more: Why living within 1km of a primary school is such a big deal in Singapore

For those who drive, accessibility is seamless. River Valley Close links directly to River Valley Road, which connects to major arteries like Havelock Road, Clemenceau Avenue, and the CTE. This makes it easy to reach the CBD in under 10 minutes, with Orchard and Marina Bay just a short drive away.

Neighbourhood transformation

Looking ahead, River Valley and Orchard are also set to benefit from ongoing URA rejuvenation plans that will strengthen their appeal over the long term. Orchard Road, in particular, is being repositioned as a lifestyle destination beyond just retail, with new green corridors, family-friendly attractions, and cultural nodes in the works.

At the same time, the Singapore River rejuvenation project aims to create more vibrant public spaces, better connectivity, and lifestyle nodes along Robertson Quay, Clarke Quay, and Boat Quay. For residents of The Avenir, this means even greater access to riverside leisure options just a short stroll away.

Adding to the vibrancy, the neighbourhood is also welcoming new residential launches like the 99-year leasehold Promenade Peak and River Green, which will bring fresh housing options and further energise the River Valley area. While these new projects add future competition, they also underline the continued demand and confidence in this district as a prime residential address.

Read more: Two more River Valley new launches enter the market, with prices from S$1.2M

Wrapping up

These transformation efforts, coupled with the already limited supply of freehold luxury condos in District 9, suggest that The Avenir is well-positioned to maintain its premium status. Buyers today aren’t just purchasing a home — they’re buying into a central district that continues to evolve with new amenities, lifestyle offerings, and long-term growth potential.

However, the contrasting outcomes in the recent subsale transactions remind us that even in highly sought-after freehold projects, results can vary sharply depending on when you buy, the price you enter at, and your ability to hold for the right moment to sell.

Enjoying this in-depth analysis? 99.co Condo Cash or Crash covers monthly notable transactions in Singapore’s private property market.

The post River Valley condo subsale gained the seller a S$1.4M record profit appeared first on .