August traditionally is a quieter month for rentals in Singapore due to cultural and schooling reasons, leading to lower leasing activity.

According to Mr. Luqman Hakim, Chief Data & Analytics Officer at 99.co, “This seasonal lull tends to suppress short-term price growth as demand softens temporarily. Adding to this, some tenants might be holding off renewals or new leases, anticipating an influx of new supply from projects later this year.“

Let’s break down what happened in August 2025 in both the condominium and HDB rental markets.

Table of Contents

- Condo rental market: Stable prices, lower volumes

- HDB rental market: Slight price dip with volume decline

- Market outlook

Condo rental market: Stable prices, lower volumes

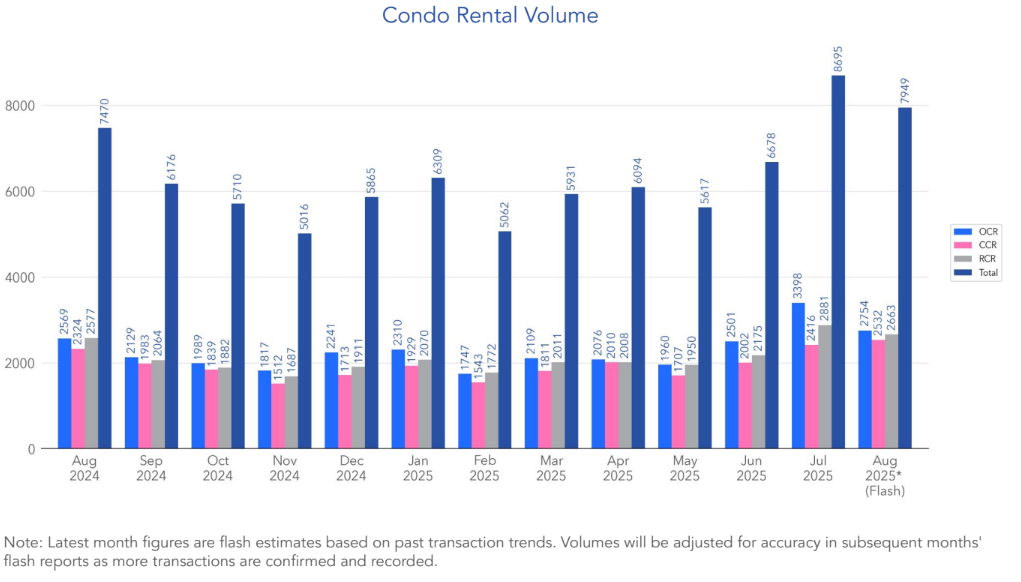

August saw stable prices for condo rentals despite lower volumes. An estimated 7,949 units were rented in August 2025, compared to 8,695 in July 2025.

However, despite the dip, rental volumes were 6.4% higher than in August 2024 and 4.7% above the 5-year August average.

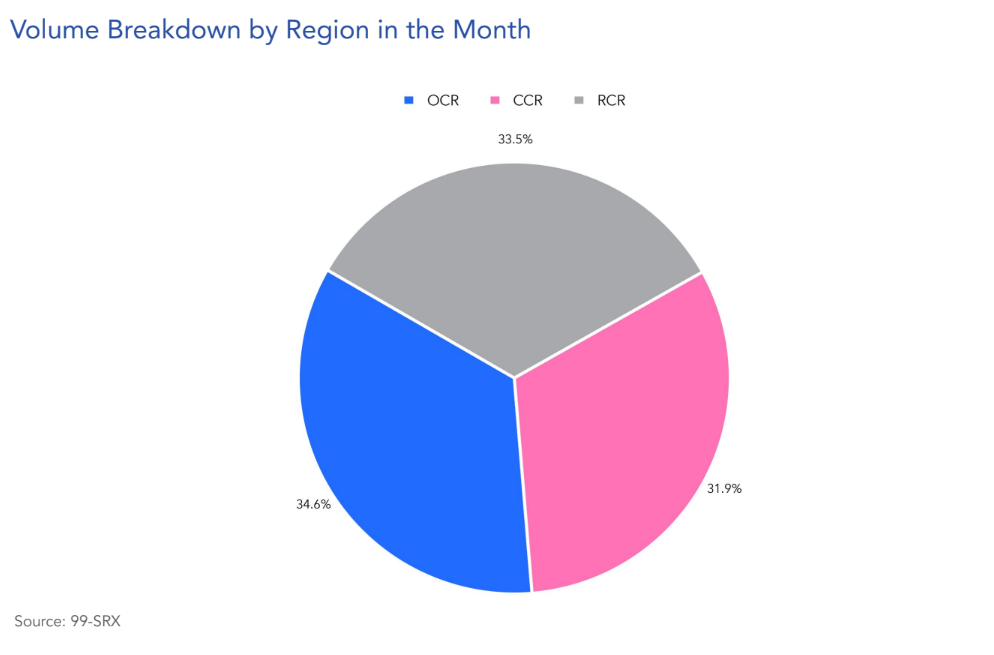

Breaking it down by region, in August 2025, 34.6% of the total condo rental volume was from Outside Central Region (OCR), 33.5% from Rest of Central Region (RCR), and 31.9% from the Core Central Region (CCR).

This relatively even spread suggests consistent demand across all areas, with OCR maintaining a marginal lead, likely driven by affordability and increasing suburban interest among tenants.

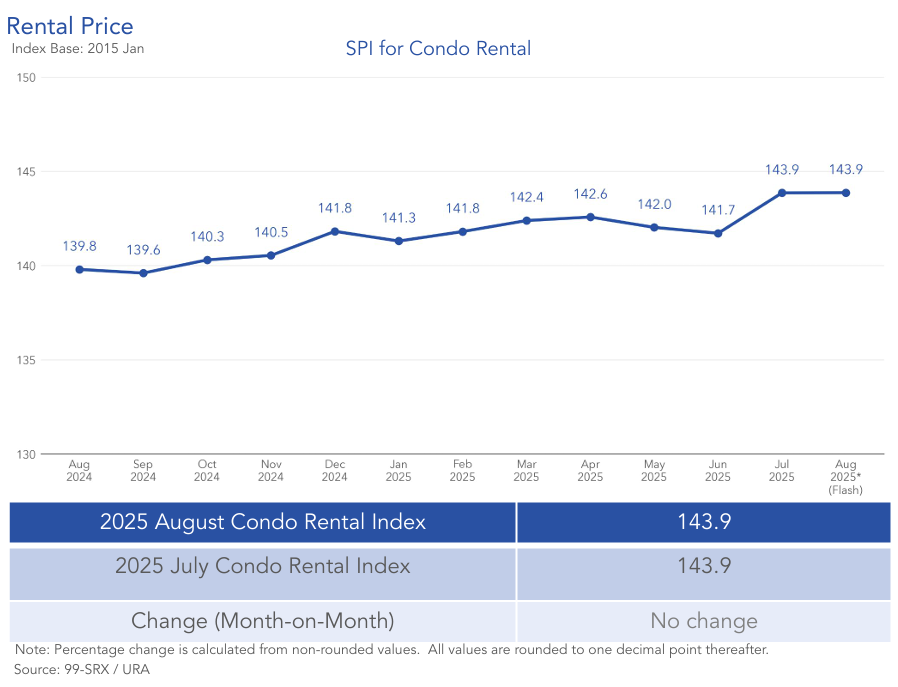

Overall, the condo rental prices remained stable, as seen above. The CCR and RCR experienced slight month-on-month rental increases of 0.4% and 0.8%, respectively, while the OCR saw a minor 0.1% dip.

On a year-on-year basis, rental prices rose by 2.9% overall, with CCR up 3.4%, RCR up 3.2%, and OCR up 2%.

HDB rental market: Slight price dip with volume decline

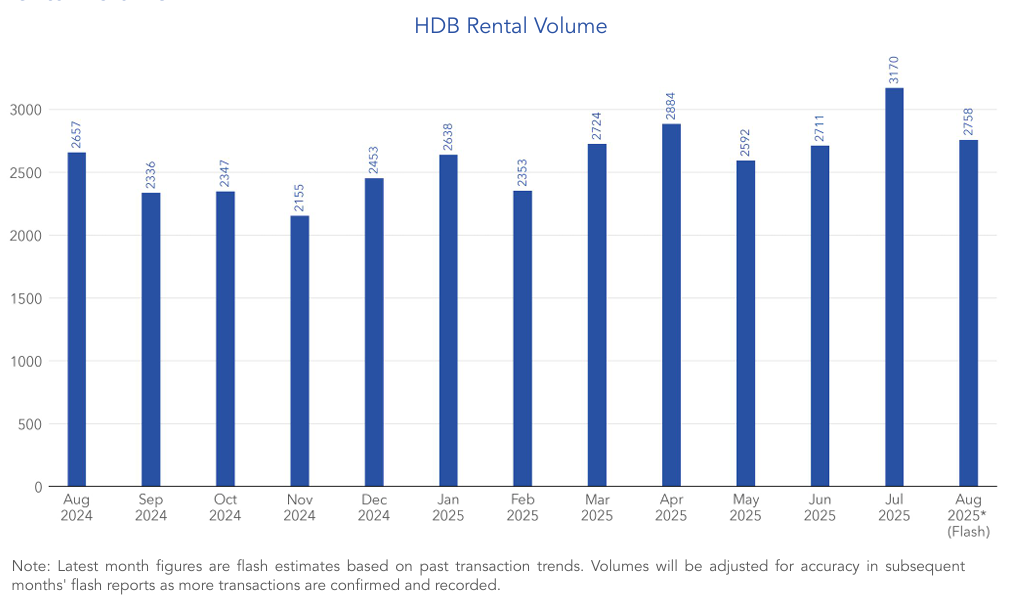

Rental volumes for HDB flats decreased by 13% month-on-month in August 2025, with an estimated 2,758 units rented compared to 3,170 in July. Despite this dip, rental volumes remained 3.8% higher year-on-year compared to August 2024, and above the five-year average for the month by 3.9%.

As per Mr. Mr. Luqman Hakim, this indicates that while there was a short-term slowdown in leasing activity, underlying demand for HDB rentals continued to grow steadily over the longer term.

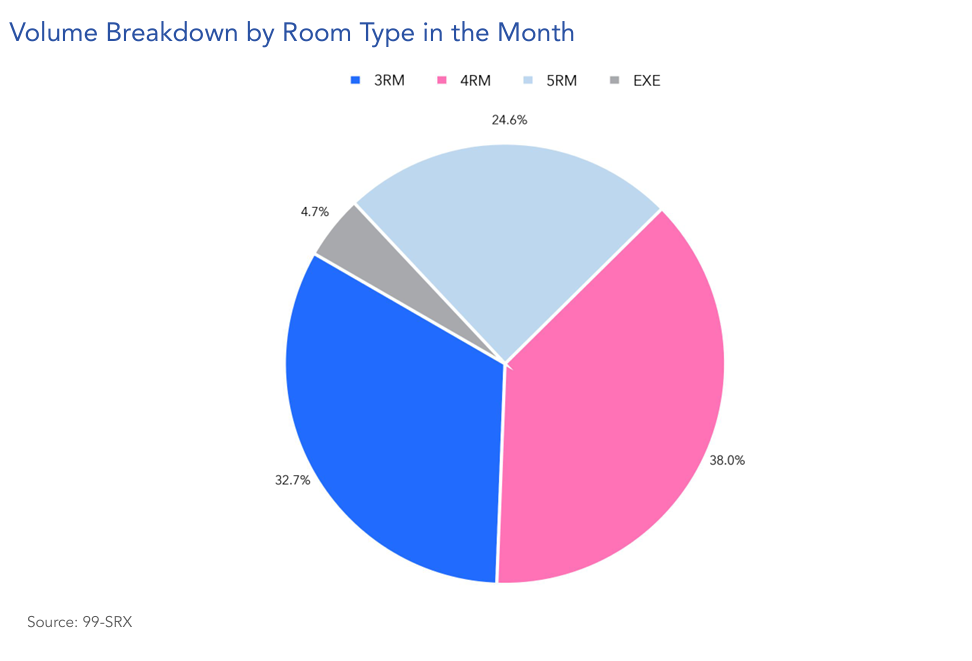

Breaking down by flat type, we see that:

- 4-room flats accounted for the largest share of rentals in August 2025 at 38%,

- 3-room flats had the second-largest share at 32.7%,

- 5-room flats accounted for 24.6% of all rentals,

- and Executive flats contributed 4.7% of the rental volume.

The dominance of 3- and 4-room flats reflects ongoing strong demand from families and mid-sized households who form the majority of HDB tenants.

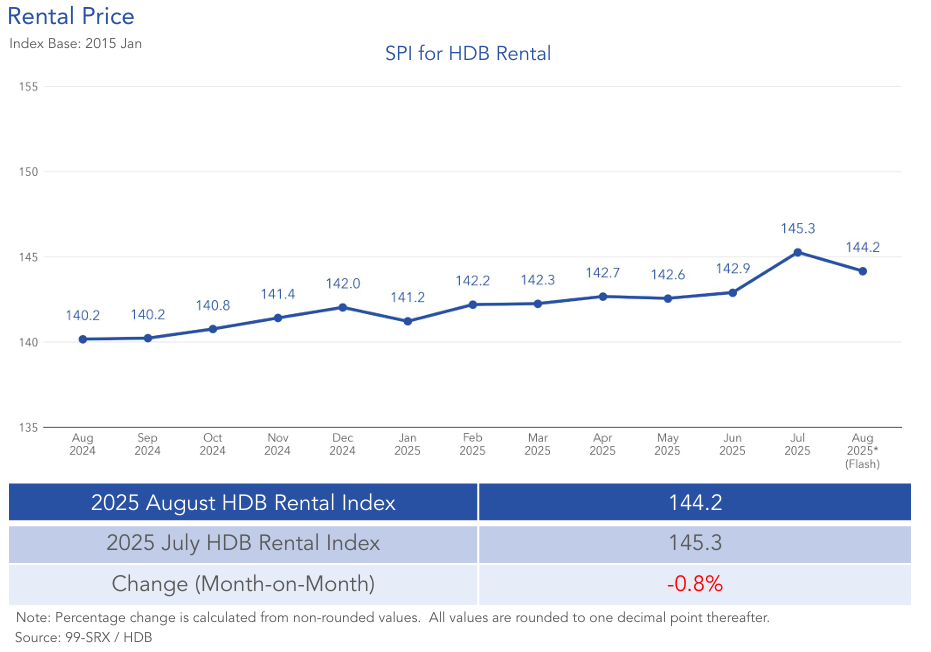

HDB rental prices saw a slight month-on-month decline of 0.8% last month. The seasonal lull and potential increase in available flats raises supply-side pressure, which can weigh on monthly rent prices, and the market is reflecting this temporary softening.

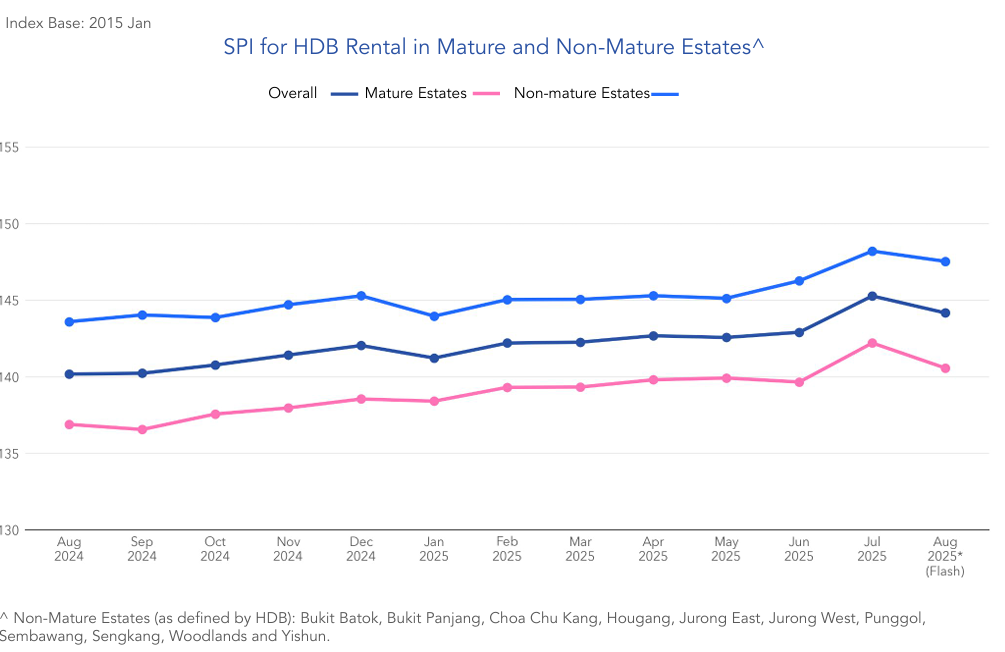

The decrease was more pronounced in Mature estates, where rents fell by 1.1%, compared to a smaller 0.4% dip in Non-Mature estates.

Despite these short-term price adjustments, year-on-year rental prices remained positive. Overall, HDB rents were up 2.8% compared to August 2024. Both Mature and Non-Mature Estates experienced equal year-on-year rental growth of 2.7%.

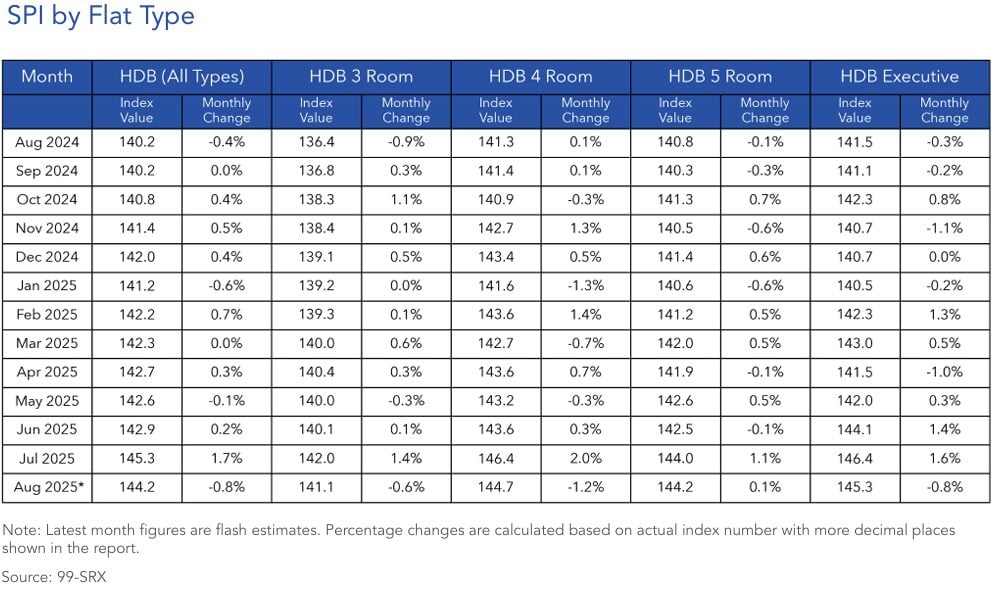

By flat type, rental prices for 3-room, 4-room, and Executive flats decreased by 0.6%, 1.2%, and 0.8%, respectively, while 5-room flats bucked the trend with a marginal 0.1% increase.

All flat types also recorded year-on-year price increases, led by 3-room flats with a 3.4% rise, followed by Executive flats at 2.7%, and 4-room and 5-room flats both up by 2.4%.

Market outlook

While leasing volumes for both condos and HDB flats show typical seasonal moderation, the broader picture reflects steady demand and price stability across the board. The balanced spread of condo rentals across core and suburban regions highlights diverse tenant preferences, while sustained year-on-year growth in HDB rents underscores ongoing demand amidst controlled supply.

Looking forward, the upcoming wave of new housing supply slated for late 2025 will be a key factor to watch. It could provide tenants with more choices to upgrade, and moderate rental growth, while landlords may face heightened competition. For tenants and landlords alike, staying informed about these evolving dynamics will be crucial to making savvy housing decisions as the market shifts from seasonal pause into renewed activity.

The post Seasonal slowdown in condo and HDB rentals in August; prices hold steady year-on-year appeared first on .