In the recent edition of Condo Cash or Crash, we covered how a unit in Marina Bay Residences changed hands at a staggering S$3.227 million loss in August. It was not only the most unprofitable condo resale of the month but also the biggest ever seen in that project. Barely a month later, another record has surfaced nearby. This time, Marina One Residences is in the spotlight, with a seller letting go of their 4-bedroom unit at a S$1.154 million loss.

Table of contents

- Marina One Residences’ 4-bedder sold for S$4.26M

- First million-dollar loss at Marina One Residences

- Unprofitable transaction history within the project

- Silver lining: CCR condo units now have OCR prices

Marina One Residences’ 4-bedder sold for S$4.26M

On 3 September 2025, a 4-bedroom unit at Marina One Residences officially changed hands. The 2,250-sqft apartment on the 5th floor was sold for S$4.26 million (S$1,894 psf), a figure that sits noticeably below the current average price of the project. The buyer secured this 4-bedder at about 10% below Marina One’s average of S$2,104 psf.

Compared to the broader District 1 (Marina/Boat Quay/Raffles) resale market, where leasehold units averaged S$1,956 psf this year, the purchase price also came in at around 3% lower.

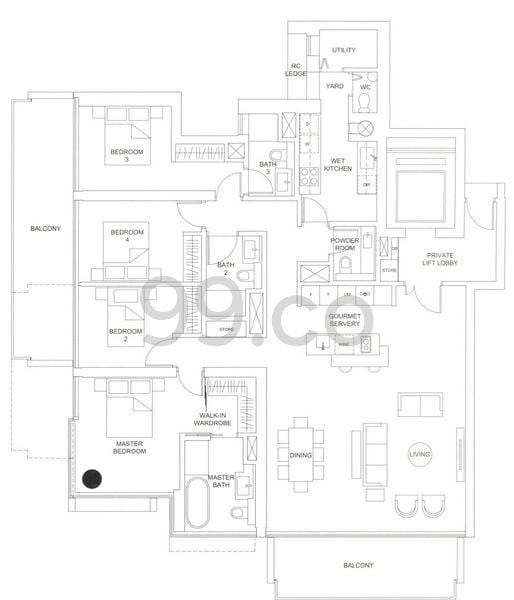

The 2,250-sqft layout is among the most generous in Marina One Residences, second only to the sprawling penthouses. These 4-bedders are designed with private lift access, expansive balconies, dual ensuite bedrooms, separate wet and dry kitchens, and even a powder room — features that tend to attract large families or buyers seeking space and exclusivity. For some, this combination is rare in newer Core Central Region (CCR) projects, where layouts have generally been shrinking over the years.

Looking more narrowly at this unit type, similar 4-bedders in Marina One have averaged S$2,197 psf in 2025. By comparison, the latest buyer secured their unit at roughly 14% below that average.

First million-dollar loss at Marina One Residences

This latest resale transaction, of course, resulted in a hefty loss for the seller. It marked the biggest loss ever recorded within this relatively new project in Marina Bay. Marina One Residences is a 99-year leasehold development that obtained its Temporary Occupation Permit (TOP) in 2018. Since its lease began in 2011, the project currently has about 85 years remaining.

Don’t guess your selling price – know it. Use 99.co’s Property Value Tool for a fast, reliable estimate in under a minute, with up to 98% accuracy.

The seller in this September resale transaction parted with their 4-bedroom unit after seven years of ownership, incurring a S$1.154 million loss. They had originally purchased the property from the developer in 2018 for S$5.415 million (S$2,406 psf). At that point, their entry price was already 5% below the project’s average of S$2,539 psf. However, 2018 also happened to be the year Marina One hit its price peak since the initial launch in 2014.

For more context, similar 4-bedroom units sold at an average of S$2,657 psf that year. This means the seller had entered at about 9% below the other 4-bedder buyers in 2018. Even with this lower-than-average entry price, the eventual exit still resulted in the project’s first seven-figure capital loss.

Unprofitable transaction history within the project

Looking at Marina One’s wider resale history, 43 transactions have ended in losses since 2018, while 21 sales were still profitable — the highest gain being S$567,450.

This latest S$1.154 million loss marks the 15th unprofitable sale of 2025 within the project. Notably, earlier this year in May, another 4-bedroom unit with a similar layout resold for S$6.4 million (S$2,844 psf). Despite achieving a much higher psf, the seller still booked a S$700K loss after holding the property for eight years. Unfortunately for them, they entered in 2017, just one year before prices peaked at Marina One.

Biggest annual loss: S$562K in 1.5 years

Although the most recent resale set the record for the largest absolute loss, the sharpest annualised hit at Marina One happened back in March 2023. A smaller 4-bedder, spanning 2,045 sqft, was sold for S$5.8 million (S$2,836 psf). This transaction cost the seller a S$562K loss after holding the property for one and a half years.

The seller had entered in 2021, during a recovery phase after prices softened from their 2018 peak. But by early 2023, values had slipped again by about 6.5%, cutting short any chance of a rebound.

This underscores how vulnerable short-term owners can be in volatile markets like Marina Bay. Unlike suburban projects that often see more stable demand from local owner-occupiers, CCR developments tend to be more sensitive to macroeconomic shifts, foreign buyer sentiment, and government cooling measures. Entering at the wrong point in the cycle can quickly translate into losses if the holding horizon is too short.

Silver lining: CCR condo units now have OCR prices

For buyers, however, today’s prices at Marina One may look more attractive than they have in years. Many believe that entering at a lower price point improves the potential for future appreciation, while others simply see it as a chance to secure a home that might have been out of reach at peak pricing.

Since its launch in 2014, prices at this Marina Bay condo have slipped by about 6% overall. The project peaked in 2018 at S$2,539 psf, and values have since fallen by roughly 17%, bringing the 2025 average down to S$2,104 psf as of September.

At this level, Marina One units are priced on par with, or even below, new Outside Central Region (OCR) launches. For instance, Parktown Residence in Tampines debuted at S$2,360 psf earlier this year, while ELTA entered at S$2,537 psf. More recently, Springleaf Residence in Upper Thomson averaged S$2,175 psf on its launch weekend — still higher than Marina One’s current average despite being outside the central region.

This means buyers today are effectively able to secure a CCR address at OCR-level prices. For those who value city living, that’s a proposition not often seen.

Beyond pricing, Marina One has enduring qualities that bolster its positioning. The development is anchored by its iconic 65,000-sqft Green Heart, a lush garden oasis in the middle of Marina Bay’s skyscrapers. Residents enjoy comprehensive upscale facilities, while having direct access to a retail podium filled with dining and F&B outlets.

Add to that its unmatched connectivity with three MRT stations nearby — Marina Bay, Downtown, and Shenton Way — and the project continues to offer a lifestyle that blends convenience, greenery, and prestige in the heart of Singapore’s financial hub.

Readily available units at Marina One Residences

For buyers considering Marina One today, the resale market offers a wide spectrum of choices — from compact 1-bedders to expansive penthouses. Active listings on 99.co currently start at around S$1.3 million for 1-bedroom units, while larger 2-bedders range from S$1.5 million to S$3.5 million.

One example is this 753-sqft, 2-bedroom unit priced at S$1.78 million (S$2,364 psf). The apartment is partially furnished, newly renovated with modern fittings, and located on a high floor with an improved balcony view. At this price, it comes in about 12% cheaper than the average 2-bedder in District 1 currently listed on 99.co.

For those who prefer more space but still affordable units, the 2-bedroom plus study layout spans 1,141 sqft and is typically listed starting at S$2.5 million (S$2,191 psf). This configuration suits small families or professionals who need a dedicated home office. One such unit on the market we found has been fully renovated, sits on a very high floor, and offers panoramic city and sea views.

At the upper end, Marina One caters to the ultra-luxury segment. A 7,459-sqft penthouse — among the rarest in the development — is asking S$16.8 million (S$2,253 psf). It comes with four ensuite bedrooms, a private swimming pool, a jacuzzi, and expansive living and dining areas, all framed by unobstructed views of Marina Bay and the city skyline.

See other available units at Marina One Residences here.

Wrapping up

While the headlines may paint Marina One Residences as a place of hefty capital losses, they also highlight a shift that buyers might welcome: entry prices in one of Singapore’s most iconic CCR projects have come down to levels once unthinkable. For those who have been eyeing Marina Bay living but were priced out years ago, today’s softer market could provide that long-awaited opening.

Enjoying this in-depth analysis? 99.co Condo Cash or Crash covers monthly notable transactions in Singapore’s private property market.

The post Another Marina Bay condo saw record capital loss at S$1.154 million appeared first on .