Flash estimates released by the Urban Redevelopment Authority (URA) and Housing and Development Board (HDB) on October 1 highlighted contrasting market performances in the third quarter of 2025. Private home prices in Singapore rose for the fourth straight quarter in Q3 2025, driven largely by a string of city-fringe and central launches. On the public housing side, HDB resale prices continued to grow at a more measured pace, marking the slowest quarterly gain in more than five years.

Table of contents

- Private residential market: CCR leads growth

- Big launches power CCR rebound

- Forecasts for the private market

- HDB resale market: Slower price growth

- More million-dollar flats, despite easing price growth

- Outlook for the HDB resale market

- What it means for buyers and sellers

Private residential market: CCR leads growth

Private home prices continued their steady climb in Q3 2025, rising 1.2% from the previous quarter, according to the URA’s flash estimates. This follows a 1.0% increase in Q2 and brings overall prices up by 3.1% so far this year — nearly double the growth seen in the same period of 2024.

In Q3 2025, non-landed private homes prices climbed by 1.1% quarter-on-quarter (QoQ), accelerating from the 0.7% increase in the previous quarter. Here’s how the different regions performed within the non-landed segment:

- Core Central Region (CCR): City homes stole the spotlight, with prices jumping 2.4%. This was the strongest growth across all regions, thanks to blockbuster launches like The Robertson Opus, UpperHouse at Orchard Boulevard, and River Green.

- Rest of Central Region (RCR): City-fringe condos made a small comeback, ticking up 0.4% after slipping in Q2. Projects like LyndenWoods and Promenade Peak helped lift sales and prices here.

- Outside Central Region (OCR): Suburban condos held steady, adding 1.0% in Q3 — almost the same pace as last quarter. Affordable mass-market launches such as Springleaf Residence and Canberra Crescent Residences kept demand strong.

Meanwhile, landed homes also stayed in demand, with prices up 1.4%. Detached houses led the charge, climbing 9% as more buyers came in. These include one big-ticket deal: a Good Class Bungalow at Chee Hoon Avenue sold for S$55 million.

With these steady gains, the private housing market looks resilient, especially with city launches doing much of the heavy lifting. The final Q3 figures will be confirmed on 24 October, but early signs already point to strong buyer confidence.

Big launches power CCR rebound

The standout story of Q3 was the rebound in the Core Central Region, thanks to a trio of major launches: The Robertson Opus, UpperHouse at Orchard Boulevard, and River Green. Together, they sold 835 new units, bringing overall CCR new home sales to about 900 units as of 21 September — the strongest quarterly showing since Q4 2010.

Read more: River Green sets 2025 sales record for CCR

In the RCR, sales were anchored by LyndenWoods and Promenade Peak, each moving 336 units. Meanwhile, in the OCR, mass-market demand was robust. The 941-unit Springleaf Residence sold an impressive 883 units (94%) since its August launch, including 92% snapped up on its first weekend. Another OCR project, Canberra Crescent Residences, sold 233 out of 376 units (62%).

| Project | Region | Units Sold | Avg. Price (PSF) |

|---|---|---|---|

| Springleaf Residence | OCR | 883 | S$2,176 |

| River Green | CCR | 464 | S$3,120 |

| Promenade Peak | RCR | 336 | S$2,969 |

| LyndenWoods | RCR | 336 | S$2,462 |

| Canberra Crescent Residences | OCR | 233 | S$1,986 |

| UpperHouse | CCR | 202 | S$3,304 |

| The Robertson Opus | CCR | 169 | S$3,356 |

| Artisan 8 | RCR | 16 | S$2,388 |

| Total | 2,639 |

In terms of affordability, about 68% of new non-landed private homes sold in Q3 2025 were priced below S$2.5 million. The largest share fell in the S$1.5 million to <S$2 million bracket (28.9%), followed by S$2 million to <S$2.5 million (19.8%).

“Buyers are increasingly focused on value, amenity, and convenience. Hence, projects that are attractively priced and have strong transport links will see more robust demand, as seen in Springleaf Residence“, Kelvin Fong, CEO of PropNex, noted.

Read more: OCR new launches drove developers’ sales surge to 9-month high in August

Forecasts for the private market

Looking forward, the momentum in the CCR is expected to continue in Q4. The upcoming Skye at Holland — the final CCR launch of the year — will offer 666 units, with 2-bedders starting from about S$1.51 million and 3-bedders from S$2.40 million. Other Q4 launches, such as Penrith (RCR), Faber Residence (OCR), and Zyon Grand (RCR) will further widen buyer options.

See the full list of new condo launches in 2025 here.

PropNex forecasts private home prices could rise 4% to 5% in 2025, close to last year’s 3.9% growth. Market support is expected from lower interest rates, strong upgrader demand, and the healthy launch pipeline.

The easing interest rate environment is a key tailwind. The US Federal Reserve has cut rates four times since March 2022, most recently in September, and the 3-Month Compounded SORA in Singapore has dropped from 3.02% at the start of the year to about 1.45% p.a. as of 1 October 2025.

HDB resale market: Slower price growth

On the HDB side, flash estimates show that resale prices continued to rise in Q3 2025, but at a much slower pace. Prices edged up 0.4% from the previous quarter, a much smaller increase compared to the QoQ increase of 0.9% in Q2.

This is now the fourth consecutive quarter of slowing growth, suggesting that the market is starting to cool slightly after two years of steady gains. Additionally, growth in Q3 2025 also represents the slowest quarterly rise in more than five years — since Q2 2020, when prices inched up just 0.3%.

In terms of sales volume, 7,157 flats changed hands in Q3 2025 (up to 29 September), slightly higher than the 7,102 transactions in Q2. This brings the total number of resale flats sold in the first nine months of the year to 20,849 units, compared to 22,562 units over the same period in 2024.

So far in 2025, resale prices have climbed by 2.9% over the first nine months, a much more moderate pace compared to the 6.9% growth over the same period in 2024. Even so, resale prices are still at record highs, supported by ongoing demand from buyers who prefer move-in-ready homes over waiting for BTO flats.

More million-dollar flats, despite easing price growth

Despite the price moderation, million-dollar HDB deals remain a fixture. Q3 continued to see a steady stream of record-setting transactions, particularly in mature estates and rare flat types such as large executive units or centrally located resale flats.

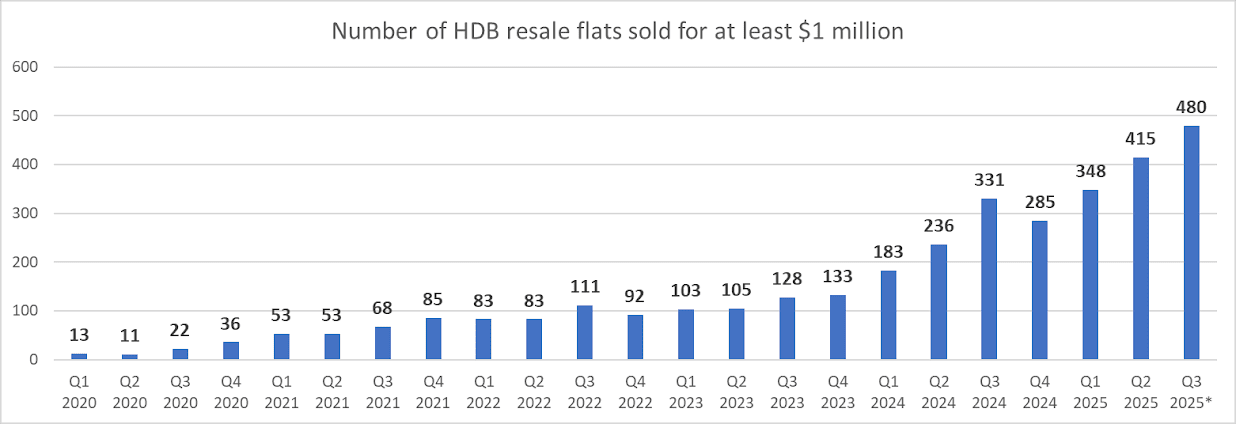

An estimated 480 resale flats were sold for at least S$1 million in Q3 2025, up from 415 in Q2. That brings the 9M 2025 tally to 1,243 such flats, already surpassing the full-year record of 1,035 in 2024. These sales made up around 6% of all resale transactions in the first nine months of this year.

According to PropNex, the million-dollar deals in Q3 2025 comprised one 3-room terrace, 204 4-room units, 172 5-room units, 102 executive flats, and one multi-gen flat. Towns with the highest sales were Toa Payoh (92 units), Bukit Merah (61 units), and Kallang Whampoa (40 units).

The persistence of million-dollar flats highlights the uneven nature of the market: while the overall pace of growth is slowing, desirable units with unique attributes such as size, location, or scarcity, remain in high demand.

Outlook for the HDB resale market

The steady supply of new flats through Build-to-Order (BTO) and Sale of Balance Flats (SBF) launches is helping to stabilise the market by giving buyers more alternatives, especially in a year with relatively few flats reaching their Minimum Occupation Period (MOP). Only 8,000 units will MOP in 2025, which limits resale stock.

Read more: HDB BTO MOP 2025 & 2026 – Best picks within a 10-minute walk to MRT & LRT stations

That said, demand for well-located flats — especially those near MRT stations, in central towns, on high floors, or with larger layouts and longer leases — is expected to remain strong.

The government is also reviewing the household income ceiling for BTO applications, which could shift some demand from resale flats back to new launches. This, together with the ongoing 15-month wait-out period policy, may keep overall price growth moderate.

What it means for buyers and sellers

Q3 2025 painted a nuanced picture of Singapore’s housing market. The private sector, led by the CCR, is showing fresh strength after a muted period, while the HDB resale market is entering a phase of moderation. Together, they reflect a market that is neither overheated nor collapsing, but rather recalibrating to new realities of affordability, demand, and supply.

For buyers, the trends highlight shifting affordability thresholds. HDB upgraders who once looked to the OCR for affordable entry into private housing are now facing higher barriers, as OCR prices have inched up and new launches are priced above S$2,000 psf. Meanwhile, wealthier buyers are gravitating back towards CCR properties, which are perceived as relative bargains compared to global benchmarks.

The remainder of 2025 will see several notable private launches, particularly in central districts. This pipeline is likely to sustain buyer interest, though the market will remain sensitive to pricing strategies. In the HDB segment, upcoming October BTO exercises could further ease pressure on resale flats, offering more choices for first-timers. That said, sellers in the resale market may need to temper expectations. While million-dollar deals remain possible, the pool of buyers willing to stretch budgets is expected to be smaller.

The post Q3 2025 flash estimate: Private market resilience meets HDB price moderation appeared first on .