In this edition of Condo Cash or Crash series, we turn the spotlight to Sentosa Cove’s Turquoise condominium — a luxury waterfront project that saw two major unprofitable transactions in September 2025. Together, these sales amounted to over S$5 million in total losses, making them the most significant resale setbacks of the month. What went wrong for these sellers, and what does this mean for Sentosa’s high-end market moving forward?

Table of contents

- Unprofitable condo sales at Turquoise in September

- A 4-bedder was sold at a loss of S$2.925 million

- S$2.2 million capital loss on a larger 2,562-sqft unit

- Property transactions at Turquoise in 2025

- Sentosa Cove’s Turquoise condo price analysis

- Price trends over the last 5 years in Turquoise against Sentosa condos

- The current most expensive condo in Sentosa

- Turquoise / Seascape / Marina Collection

Unprofitable condo sales at Turquoise in September

Turquoise, located along Cove Drive in Sentosa within the Core Central Region (CCR), is a 99-year leasehold condominium that obtained its Temporary Occupation Permit (TOP) in 2010. That makes it 15 years old today, with a remaining lease of approximately 81 years since its land lease began in 2007.

Developed by Ho Bee Land, this 6-storey development features 91 exclusive homes consisting mainly of 3- and 4-bedroom units, alongside duplex penthouses. Most homes range from 2,088 to 3,746 square feet (sqft), each complemented by full condominium facilities. Fronting the tranquil waterway, Turquoise also stands out with 21 private berths — a rare luxury even among Sentosa Cove residences.

In September, two 4-bedroom units at this high-end development recorded substantial losses of S$2.925 million and S$2.2 million, respectively. These sales not only topped the list of the month’s most unprofitable condo transactions but also reflect the long-term price stagnation of Sentosa’s leasehold market since the last decade.

Let’s take a closer look at each sale.

A 4-bedder was sold at a loss of S$2.925 million

On 8 September 2025, a 4-bedroom unit at Turquoise changed hands for S$3.298 million, translating to S$1,374 per square foot (psf). This 2,400-sqft apartment on the fourth floor sold well below the current average of comparable developments in Sentosa.

Don’t guess your selling price – know it. Use

99.co’s Property Value Tool

for a fast, reliable estimate in under a minute, with up to 98% accuracy.

When compared against the average price of S$1,709 psf for leasehold condos in Sentosa, the buyer paid roughly 19.6% less. Narrowing the comparison to the 4-bedroom units nearby, which average S$1,622 psf, the buyer’s purchase price was still about 15.3% lower.

The 2,400-sqft layout is the smallest 4-bedder at Turquoise. However, it is still notably more spacious compared to the 4-bedders offered at some projects in the area. The Berth By The Cove, for instance, has 4-bedders that measure just 1,884 sqft.

| Transaction Date | Price (S$) | PSF (S$) | Type |

|---|---|---|---|

| 02 Nov 2007 | 6,223,490 | 2,593 | New Sale |

| 08 Sep 2025 | 3,298,000 | 1,374 | Resale |

On the seller’s end, this resale resulted in a S$2.925 million loss after nearly 18 years of ownership. The seller had originally bought the unit from developer Ho Bee Land in November 2007 for S$6.223 million (S$2,593 psf) — slightly above the project’s average price that month (S$2,586 psf). Over 15 new units were sold during November, just one month after the project officially hit the market in October 2007.

Unfortunately, entering the market during the launch hype did not play out well for the seller. The following years saw government cooling measures reshape the property landscape, especially for luxury homes.

Property cooling measures in 2013

The increase in the Additional Buyer’s Stamp Duty (ABSD), coupled with the Total Debt Servicing Ratio (TDSR) introduced in 2013, made high-end properties much harder to purchase. ABSD raised upfront costs for foreigners, permanent residents, and even Singaporeans buying second homes, while TDSR limited loan repayments to 60% of monthly income.

These rules sharply reduced speculative buying and curbed foreign investment, resulting in muted demand for prime homes in Sentosa Cove. Consequently, many luxury condos, including Turquoise, saw their resale values stagnate or decline over the decade.

S$2.2 million capital loss on a larger 2,562-sqft unit

The second unprofitable transaction in September involved a larger 2,562-sqft ground-floor unit. Originally bought via sub-sale in 2010 for S$6 million (S$2,342 psf), it was resold in September 2025 for S$3.8 million (S$1,483 psf) — a S$2.2 million Crash after 15 years.

The 2010 buyer likely acquired the property during what appeared to be a fire sale. At that time, Sentosa’s market was near its peak, with many owners exiting at high profits. The sub-sale at Turquoise was an exception, already showing a S$594,770 loss compared to its original 2007 price.

| Transaction Date | Price (S$) | PSF (S$) | Type |

|---|---|---|---|

| 02 Nov 2007 | 6,594,770 | 2,574 | New Sale |

| 15 Sep 2010 | 6,000,000 | 2,342 | Sub Sale |

| 08 Sep 2025 | 3,800,000 | 1,483 | Resale |

However, at S$6 million or S$2,342 psf, the 2010 sub-sale price was still above the average price for leasehold condos in Sentosa at the time — approximately 3% higher. It goes to show just how highly priced the project was during the initial launch.

While the 2025 seller did enter at a way lower point compared to those who entered during launch, it wasn’t enough to withstand the market slowdown that followed. Since the 2013 cooling measures, prices for leasehold condos in Sentosa have dropped by around 21% as of October 2025.

Property transactions at Turquoise in 2025

According to URA caveat data, Turquoise recorded five transactions so far in 2025. Four of these resulted in million-dollar losses. Before September’s two unprofitable resales, earlier losses were seen in June and August.

In August, a 3-bedroom 2,088-sqft unit changed hands for S$3.1 million, losing S$2.357 million. Two months earlier, a 2,497-sqft 4-bedder sold for S$3.5 million, marking a hefty S$3.129 million capital loss — the largest for Turquoise this year.

| Transaction Date | Area (sqft) | Price (S$) | PSF (S$) | Loss (S$) | Years Held |

|---|---|---|---|---|---|

| 13 May | 2,497 | 3,051,000 | 1,222 | N/A | N/A |

| 26 Jun | 2,497 | 3,500,000 | 1,402 | 3,129,280 | 17.5 |

| 05 Aug | 2,088 | 3,100,000 | 1,485 | 2,357,270 | 17.7 |

| 08 Sep | 2,400 | 3,298,000 | 1,374 | 2,925,490 | 17.8 |

| 08 Sep | 2,562 | 3,800,000 | 1,483 | 2,200,000 | 14.9 |

Despite these recent losses, the frequency of transactions in 2025 suggests renewed buyer interest. It is potentially driven by the perception that prices have bottomed out. In contrast with this year’s tally, which can still go up, Turquoise saw only four transactions each in 2024 and 2023. The renewed activity in 2025 might be a sign of opportunistic buyers entering the market amid lower price levels.

Sentosa Cove’s Turquoise condo price analysis

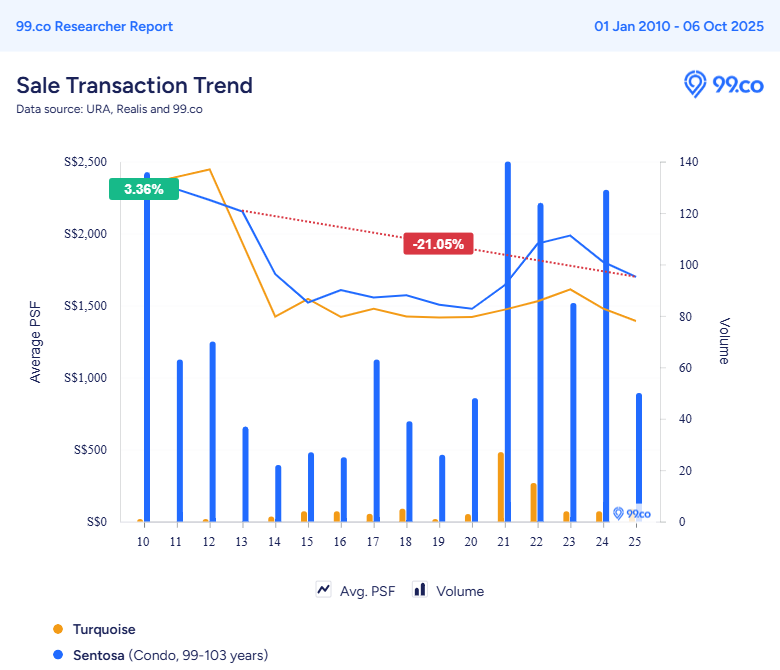

Turquoise’s busiest year was during the launch in 2007, when over 40 units were sold at an average of S$2,601 psf. The project peaked in 2008 at S$2,658 psf before prices plunged by about 42% between 2012 and 2014, reaching S$1,423 psf, after cooling measures were announced in 2013.

Price trends over the last 5 years in Turquoise against Sentosa condos

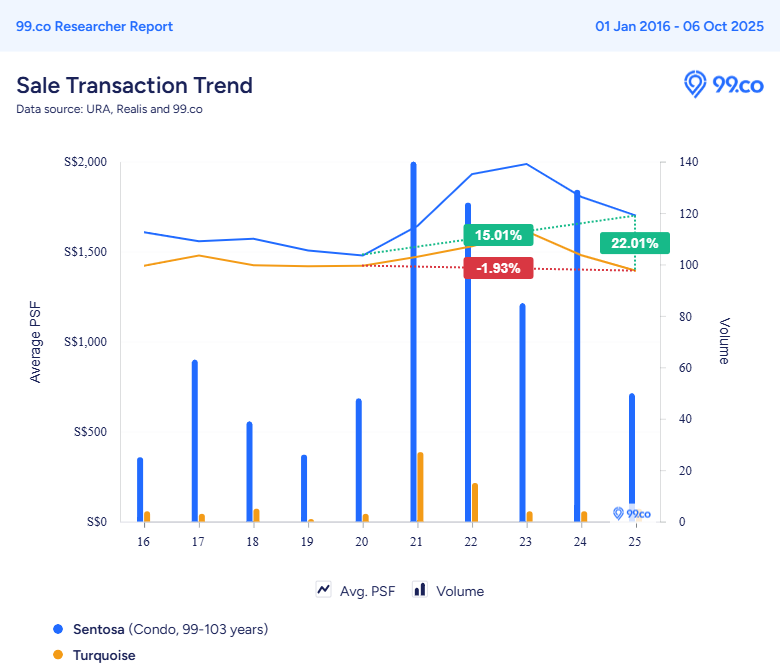

Following a market bottom in 2020, when leasehold condos in Sentosa averaged a record low of S$1,478 psf, buyer confidence gradually returned about a year into the Covid-19 pandemic. Low interest rates and renewed demand for luxury homes helped revive activity across the island’s prime waterfront district.

Against this backdrop, 2021 marked a brief resurgence for Turquoise. Around 25 transactions were recorded that year at an average of about S$1,500 psf, mirroring the broader uptick in Sentosa’s transaction volume. Yet, even during this recovery phase, Turquoise saw one of its steepest losses — a 4-bedroom unit sold for S$4.702 million (S$1,259 psf), resulting in a S$4.43 million capital loss after 13 years.

Since the major drop, prices at Turquoise have been stabilised, averaging S$1,393 psf in 2025. Over the past five years, Turquoise’s average psf has declined by about 2%, while the broader Sentosa leasehold market has risen by more than 15%.

In 2020, when Sentosa hit its all-time low, both segments were almost level — Turquoise at S$1,421 psf versus Sentosa’s average of S$1,478 psf. By 2025, however, the gap has widened to over 22%, as the overall Sentosa leasehold market now sits at S$1,700 psf.

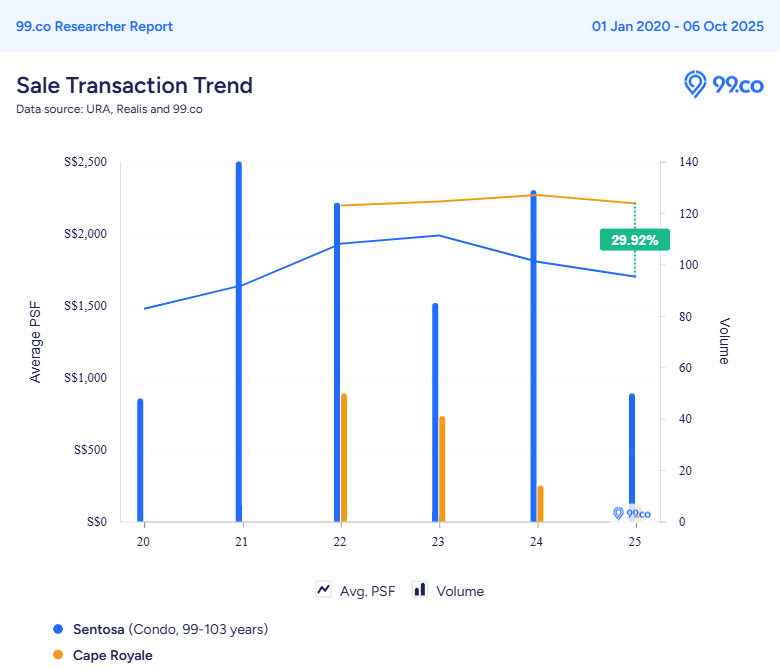

The high-value transactions this year are largely dominated by Cape Royale, which commands prices above S$2,200 psf on average, or about 30% higher compared to the current market norm.

The current most expensive condo in Sentosa

Cape Royale (TOP 2013), a 99-year leasehold project launched in 2022, now holds the title of Sentosa’s most expensive condominium. Its developer, which is also Ho Bee Land, chose to lease out the units instead of launching them for sale back in 2013 due to the cooling measures that dampened luxury demand. That decision paid off — when launched nearly a decade later, market conditions had recovered enough for Cape Royale units to fetch record prices.

In fact, the most expensive condo in Sentosa Cove today is priced on par with newer launches in the Outside of Central Region (OCR). For instance, Parktown Residence in Tampines debuted at S$2,360 psf earlier this year, while ELTA entered at S$2,537 psf. This shift shows how Sentosa’s prime waterfront homes have become relatively more accessible compared to newer suburban launches.

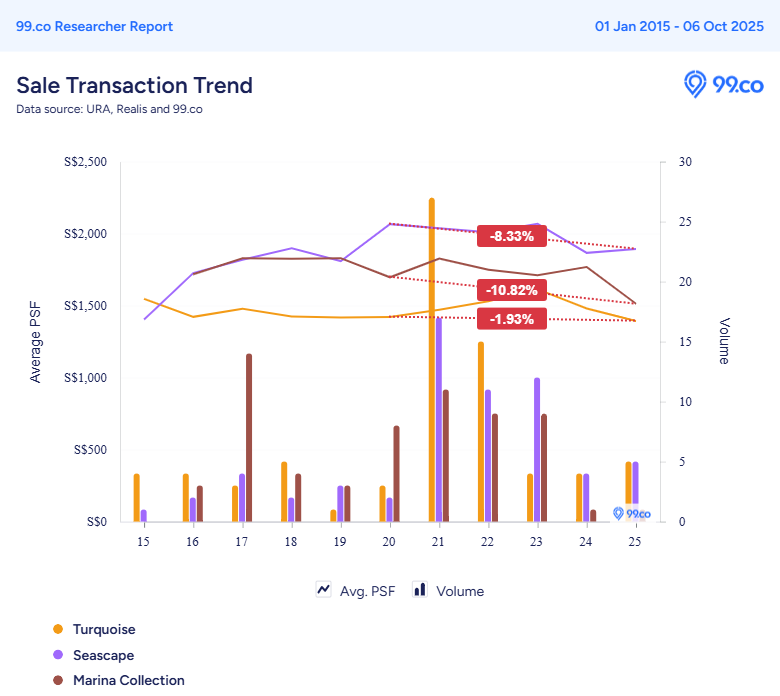

Turquoise / Seascape / Marina Collection

Within a 500-metre radius of Turquoise are three key developments: Cape Royale, Seascape, and Marina Collection. All are 99-year leasehold projects with leases starting in 2007 (except Cape Royale, which lease began in 2008).

Comparing Turquoise to Seascape (TOP 2011) and Marina Collection (TOP 2011), Turquoise has actually been the most resilient, down just 2% over the last five years. Seascape and Marina Collection, on the other hand, have dropped 8% and 11%, respectively.

In 2025, the average psf prices of the three projects are as follows:

- Turquoise: S$1,393 psf

- Seascape: S$1,894 psf

- Marina Collection: S$1,513 psf

In terms of price psf, Turquoise is currently the lowest, hence the most affordable compared to its neighbours. Notably, the Marina Collection’s 2025 psf figure is based on a single transaction — a 3,272-sqft ground-floor unit was sold in July for S$4.95 million, resulting in a S$3.675 million loss.

Looking at the price trend over the past years, Seascape and Marina Collection are likely to face further price corrections ahead, while Turquoise’s prices appear to have stabilised. Although Turquoise is currently at its lowest point at S$1,393 psf, its 10-year trend (see previous graph) has been noticeably less volatile compared to neighbouring projects, suggesting that the development has already reached a steady price floor.

Wrapping up

The steep losses at Turquoise may sound alarming at first glance, but they could also signal a turning point. For buyers, these prices represent a rare chance to enter the Sentosa market at multi-year lows. Entering at this stage means a higher potential for capital appreciation when sentiment improves.

Looking to sell your current home to upgrade?

Book a FREE consultation with

99 advisors

to maximise your sale.

For genuine homebuyers who were once priced out of Sentosa Cove’s luxury segment, Turquoise now offers attainable waterfront living without the premiums seen in Cape Royale. While the headline may highlight seller losses today, it could well mark the start of a quiet Cash story for buyers tomorrow.

Enjoying this in-depth analysis? 99.co Condo Cash or Crash covers monthly notable transactions in Singapore’s private property market.

The post Over S$5 million loss across two Turquoise condo sales in September appeared first on .