In Singapore’s Core Central Region (CCR), pricing has often been a contest of prestige. It has long been a stage where developers test the limits of what buyers will pay for proximity and polish. Yet, buyers today are more measured, with their focus shifting from status to substance, from spectacle to sense. Amid this recalibrated landscape, Skye at Holland enters the picture as a reflection of changing priorities.

By pairing a prime address with grounded pricing, it raises an overdue question about what value really means in this prime region. And in doing so, it might just be the most sensible CCR launch we have seen in years.

Key takeaways

🏗️ Strong developer consortium

🛡️ Defensive investment profile

📈 High potential for capital upside

🚇 Prime location and accessibility

🏡 Balanced lifestyle appeal

Table of contents

- Skye at Holland’s sales performance

- Sensible pricing in an inflated market

- Comparative value against nearby launches in District 10

- District 10 performance and growth potential

- Investor insight: How professionals might view Skye at Holland

- ⚖️ Our final take on Skye at Holland

Skye at Holland’s sales performance

Since its preview on 26 September, Skye at Holland has attracted keen interest from buyers. By 8 October, the consortium behind the project had reportedly received 2,151 cheques as expressions of interest. With just 666 units available, the development is roughly 3.2 times oversubscribed.

This strong response leads to a near sell-out at launch. During its weekend launch (11-12 October), developers moved 658 units, or 99% of the total, at an average price of S$2,953 per square foot (psf). According to UOL and CapitaLand Development (CLD), nearly all buyers were Singaporeans and permanent residents, underscoring the strong local appetite for well-priced homes in prime districts.

Skye at Holland, the tallest residential project in Holland Village, now marks the strongest new project performance of 2025 so far. It also set a record milestone for the CCR.

Project overview

| Developer | CapitaLand, UOL Group, SingLand, and Kheng Leong |

| Location | 2 & 6 Holland Drive, District 10 |

| Tenure | 99-year leasehold |

| Site Area | 133,343 sqft |

| Total Units | 666 (2- to 5-bedroom layouts) |

| Launch Date | 11 October 2025 |

| Expected TOP | 2029 |

| Expected Completion | 2032 |

| Nearest MRT | Holland Village (CC21) – Approx. 6 minutes walk |

| Primary Schools (within 2km) | Nanyang Primary, Henry Park Primary, New Town Primary, Fairfield Methodist Primary |

The robust launch performance comes as little surprise, given that the well-regarded consortium has collectively delivered quality developments such as The Tre Ver, Avenue South Residence, and MeyerHouse. The most recent projects include LyndenWoods, which launched earlier in July and achieved 94.5% take-up.

Make sure you know everything Skye at Holland has to offer — read our full new launch review

here

Sensible pricing in an inflated market

With prices starting from S$2,598 psf, the development immediately sits below the recent CCR median. In 2025, earlier launches such as The Robertson Opus, UpperHouse at Orchard Boulevard, and River Green all fetched prices above the S$3,000 psf mark. Meanwhile, in the Rest of Central Region (RCR), older launches have already crossed the S$2,400 psf mark in the secondary market.

Against this backdrop, Skye at Holland brings fresh air to the price-sensitive segment.

| Unit Type | Size (sqft) | Starting Price | Indicative PSF |

|---|---|---|---|

| 2-Bedroom | 581–743 | From S$1.51M | S$2,598 psf |

| 3-Bedroom | 915–1,076 | From S$2.40M | S$2,623 psf |

| 4-Bedroom | 1,238–1,464 | From S$3.34M | S$2,698 psf |

| 5-Bedroom | 1,765 | (Available upon request) | (Available upon request) |

The strategic advantage lies in its quantum accessibility. By optimising layouts and avoiding inflated psf premiums, Skye at Holland makes the CCR attainable to a wider pool of buyers. A 2-bedroom unit priced around S$1.5 million draws interest from professionals and young couples who previously looked only in fringe areas. A 3-bedroom unit in the S$2.4 million range appeals to families seeking to move into a more established neighbourhood.

Additionally, for those curious about upkeep, Skye at Holland’s indicative maintenance fees start from S$390 for 2- to 3-bedroom premium units, S$455 for 4-bedroom units, and S$520 for 5-bedroom units.

The pricing strategy was also enabled by a favourable land acquisition cost. The developers secured the site for roughly S$1,285 psf per plot ratio (ppr), around 30% lower than the rates for nearby parcels acquired between 2021 and 2023. This lower cost base allows them to maintain competitive pricing without eroding profitability.

After several high-end projects struggled to maintain momentum this year, developers have realised that pricing discipline can be a selling point in itself. By arriving at a sensible psf range and measured unit quantum, Skye at Holland manages to sound less like an indulgence and more like an opportunity.

Eyeing a particular new launch? Check if it suits your finances with

99.co’s Progressive Payments Calculator

!

Comparative value against nearby launches in District 10

Skye at Holland is the first major private residential launch in Holland Village since 2019/2020. Placed in context, its pricing strategy undercuts nearby older projects’ current pricing by roughly 15%, while still maintaining a CCR address and similar finish quality. Here’s how Skye at Holland’s value compares with nearby launches in District 10:

| Project | No of Units | Tenure | Launch Year | Current Avg. PSF in 2025 (S$) | Notes |

|---|---|---|---|---|---|

| One Holland Village Residences | 296 | 99 years | 2019 | 3,780* | Integrated development; convenient yet crowded |

| Hyll on Holland | 319 | Freehold | 2020 | 2,695 | Smaller units; caters more to couples and professionals |

| Leedon Green | 638 | Freehold | 2020 | 3,006 | No MRT within walking distance |

When compared to the nearest project, One Holland Village Residences, there’s an important distinction: older developments were launched pre-harmonisation. Their on-paper sizes include non-liveable areas like AC ledges, which makes them appear larger than the more efficiently measured units at Skye at Holland.

Additionally, One Holland Village Residences is a mixed-use development that commands a higher psf due to its retail integration, which also comes with higher strata fees and denser traffic. During its launch in 2019, units were sold between S$2,600 and S$2,900 psf, which highlights how Skye at Holland’s 2025 launch price remains attractively positioned.

Nearby freehold projects Leedon Green and Hyll on Holland, both of which recently TOP-ed, offer additional context. Hyll on Holland caters more to young couples and professionals with its smaller units, while Leedon Green commands a higher quantum, which limits its buyer pool to wealthier investors. Leedon Green’s 3-bedroom units now average S$3.43 million, and 4-bedroom units have been crossing the S$5 million mark.

District 10 performance and growth potential

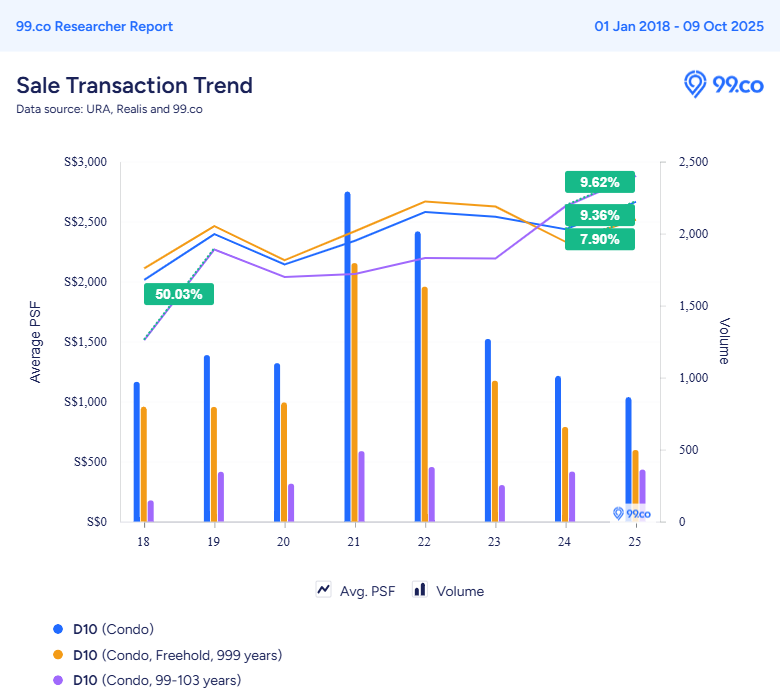

Over the past decade, District 10 has quietly demonstrated what steady, long-term property growth looks like. More interestingly, leasehold projects have started outperforming their freehold counterparts. See the PSF breakdown of the District 10 property market below:

| Year | Non-Landed PSF Avg (S$) | Leasehold PSF Avg (S$) | 999-year / Freehold PSF Avg (S$) |

|---|---|---|---|

| 2015 | 1,862 | 1,610 | 1,925 |

| 2016 | 1,934 | 1,532 | 2,053 |

| 2017 | 1,919 | 1,591 | 1,994 |

| 2018 | 2,014 | 1,511 | 2,109 |

| 2019 | 2,396 | 2,268 | 2,462 |

| 2020 | 2,143 | 2,039 | 2,179 |

| 2021 | 2,340 | 2,064 | 2,419 |

| 2022 | 2,579 | 2,196 | 2,667 |

| 2023 | 2,540 | 2,192 | 2,626 |

| 2024 | 2,436 | 2,628 | 2,332 |

| 2025 (as of 9 Oct) | 2,664 | 2,881 | 2,516 |

| Growth Rate | 43% | 79% | 31% |

Between 2015 and 2018, price growth was steady despite multiple cooling measures, including the Additional Buyer Stamp Duty (ABSD) increase in 2018 that nearly doubled the rate for Singaporeans buying their second home.

The real jump came in 2019, largely because several new projects reset market expectations. One Holland Village Residences, now Skye at Holland’s closest neighbour, helped drive a sharp rise as leasehold prices in District 10 jumped over 50% year-on-year.

The momentum was briefly interrupted by the 2020 pandemic slowdown, but the district quickly regained footing in 2021 and 2022 as market confidence returned. Since then, District 10 has shown remarkable resilience. Even amid global inflation and rate hikes, prices held steady through 2023-2024. As of October 2025, the average psf in the district is up another 9.4% since last year, with leasehold properties leading at a 9.6% rate, while freehold trails at around 8%.

Why District 10’s leasehold properties thrive

It might surprise some that 99-year leasehold properties in D10 have outpaced freehold ones, but there are key reasons behind this trend. First, they start from a lower base, leaving more room for proportional growth. Second, buyer demographics have evolved — Holland-Bukit Timah now draws professionals from nearby One-North, Mediapolis, and Biopolis. These younger, career-driven residents favour newer, well-managed projects with superior connectivity over ageing freehold stock.

To put it in numbers, the average leasehold price in District 10 now stands at S$2,881 psf in 2025, notably higher than Skye at Holland’s launch price of about S$2,598 psf. It means Skye at Holland buyers are essentially entering below the current market benchmark, which will create natural headroom for appreciation.

Further evidence of this trend can be seen next door at One Holland Village Residences, which has appreciated by over 40% since its 2019 launch. This robust performance was seen against a softer backdrop, where the overall District 10 recorded only around 11% upside within the same period.

Investor insight: How professionals might view Skye at Holland

From an investor’s lens, entry advantage is the first key strength. Launching near the 2024 District 10 leasehold average gives buyers a built-in safety margin. It allows them to enter below prevailing benchmarks, leaving room for capital appreciation once buyers’ confidence improves. This measured entry point also protects downside exposure, which is increasingly valuable in today’s cautious climate.

Liquidity is another point that plays in its favour. Units priced under S$2 million remain highly tradeable — both in the resale and rental segments — appealing to a broad mix of buyers, from young couples to seasoned investors. Such an accessible quantum ensures the project retains exit flexibility even if market conditions tighten.

On rentability, the location speaks for itself. Holland Village remains one of Singapore’s most consistent rental micro-markets, fuelled by professionals from One-North, NUH, NUS, and the surrounding biomedical and tech corridors. The area’s mix of charm and convenience continues to attract expatriates and locals alike, keeping rental yields stable even in periods of economic uncertainty.

Overall, it is ideal for investors seeking steady compounding rather than quick flips. Of course, investors should stay mindful of a few realities. The 99-year lease means eventual depreciation beyond the 25-year mark, though District 10’s leasehold segment has been the fastest-growing over the past decade.

In Singapore’s dynamic property landscape, certain market conditions can moderate sales momentum in the future. However, the lower entry price will provide an extra cushion for when it happens. Additionally, every price correction in D10 over the last ten years has been followed by a full recovery within one to two years only.

⚖️ Our final take on Skye at Holland

Skye at Holland’s starting price opens doors that were previously shut for most aspiring CCR homeowners. With more HDB upgraders sitting on substantial equity gains from million-dollar flats, a S$1.5 million entry into Holland Village is no longer far-fetched. Such an accessible price expands the CCR buyer base beyond the traditional elite, injecting diversity and volume into future resale demand.

This entry range also resonates with younger professionals seeking a central lifestyle with room to grow financially. Instead of settling for fringe or suburban condos, they can now own a home in an established, connected neighbourhood where pricing finally makes sense.

In many ways, Skye at Holland sits at the sweet spot between luxury and livability. Units under S$2 million remain highly liquid, catering to both homeowners and investors. The mid-size mix, on the other hand, ensures affordability while attracting families who value good schools and connectivity.

For homebuyers, it’s a genuine opportunity to live in a prime address without overreaching financially. For investors, this middle-ground positioning makes Skye at Holland less vulnerable to market extremes. It offers a defensible entry into the CCR with high potential for capital appreciation and steady yield.

Stay updated with the latest news and insights on Singapore’s new launch market here.

The post 99% sold at launch – Why Skye at Holland might be the most sensible CCR launch in years appeared first on .