Leonie Parc View in River Valley is finally seeing light at the end of the tunnel. Once known for its deep price corrections and distress sales, this freehold development has bounced back impressively in 2025 — returning to its launch price levels from 2007.

In this edition of Condo Cash or Crash, we’ll see how timing and holding power play their roles in profitable property transactions.

Table of contents

- Seller at Leonie Parc View made S$1.83M in profit after 4 years

- Million-dollar condo gains at Leonie Parc View in 2025

- Back to its 2007 launch pricing after nearly two decades

- River Valley freehold condo cheaper than leasehold homes

- Condo price growth in District 9 and CCR over the last 5 years

Seller at Leonie Parc View made S$1.83M in profit after 4 years

A resale transaction dated 12 September 2025 saw a spacious 2,250-sqft unit on the 12th floor change hands for S$6.43 million, or S$2,858 psf. This 4-bedroom unit fetched around a 5% premium above the project’s current average of S$2,719 psf. Compared to the wider River Valley area, where freehold condos average around S$2,545 psf, this sale was about 12% above the neighbourhood average.

Don’t guess your selling price – know it. Use

99.co’s Property Value Tool

for a fast, reliable estimate in under a minute, with up to 98% accuracy.

What makes the deal stand out is its relatively short holding period. The owner bought the unit in January 2021 for only S$4.6 million (S$2,045 psf) during the pandemic market lull. The entry price point was roughly 8% below the project average (S$2,223 psf) and 23% lower than River Valley’s freehold average at the time (S$2,657 psf). Four years later, that strategic purchase turned into a S$1.83 million profit, the highest ever recorded at Leonie Parc View.

| Date | Price (S$) | PSF (S$) | Type |

| Jul 2007 | 7,050,000 | 3,134 | New Sale |

| Jan 2021 | 4,600,000 | 2,045 | Resale |

| Sep 2025 | 6,430,000 | 2,858 | Resale |

Million-dollar condo gains at Leonie Parc View in 2025

This year marks a turning point for Leonie Parc View. For the first time since its launch, the project is consistently producing seven-figure profits. Two such transactions were recorded in September alone, and another in March.

| Date | Area (sqft) | Price (S$) | PSF (S$) | Profit (S$) | Years Held |

|---|---|---|---|---|---|

| 28 Mar 2025 | 2,013 | 5,288,000 | 2,627 | 1,118,000 | 4.9 |

| 12 Sep 2025 | 2,250 | 6,430,000 | 2,858 | 1,830,000 | 4.6 |

| 30 Sep 2025 | 2,013 | 5,628,000 | 2,796 | 1,128,000 | 4.2 |

All three sellers entered during the COVID-19 market slowdown and held their units for around four to five years. Buyers who purchased at similar price points in 2020 or 2021 would likely be able to cash out today with healthy gains.

Back to its 2007 launch pricing after nearly two decades

The 44-unit Leonie Parc View, developed by Soilbuild Group, launched in 2007 at an average price of S$2,793 psf, with nearly 30 units sold. Then came the Global Financial Crisis, which sent prices tumbling 18% to around S$2,300 psf by 2009.

The project saw a mild recovery in 2010, with prices rebounding 12% year-on-year. But the momentum faded quickly as government cooling measures — such as the Seller’s Stamp Duty (SSD), lower Loan-to-Value (LTV) limits, and Additional Buyer’s Stamp Duty (ABSD) for foreigners — dampened investor activity. By 2015, prices had fallen by over 23% from 2010.

The lowest psf was recorded at S$1,978 in 2015

An increase in distressed sales was recorded following the cooling measures, including a highly unprofitable transaction in 2015, which set the project’s all-time low at S$1,978 psf. A 2,250-sqft 4-bedder on the 9th floor was sold for S$4.45 million, translating to a S$2.16 million loss from its 2007 purchase price of S$6.61 million.

There is still no record that this particular unit has changed hands again. If it were to be resold today, it could be the next most profitable condo transaction within Leonie Parc View, considering the unit was bought at the project’s lowest point.

Did you know luxury condos like

Marina One Residences

and

Turquoise at Sentosa Cove

are now at their lowest price points? Catch their full stories in our latest

Condo Crash

editions!

Leonie Parc View’s most unprofitable sale: S$2.87 million loss in 2021

The third hit on the market occurred from 2020 to 2021, during the global pandemic. Within this period, Leonie Parc View saw seven unprofitable transactions, with sellers losing between S$965,000 and S$2.87 million.

The S$2.87 million loss is the biggest capital loss ever recorded in Leonie Parc View’s history. A 4-bedroom unit on the 22nd floor, spanning also 2,250 sqft, was sold for S$4.98 million or S$2,214 psf in September 2021. The seller initially purchased the unit back in July 2007 for S$7.85 million or S$3,489 psf. They held onto the property for 14 years before finally exiting at a S$2.87 million Crash.

Prices finally bounced back in 2025, averaging S$2,719 psf

Fast forward to 2025, Leonie Parc View is making a comeback. There have been four resale transactions so far this year, three of which produced million-dollar profits. The project’s average price now stands at S$2,719 psf, effectively returning to its launch price level after 18 long years and several market slowdowns.

The average price at Leonie Parc View has now surged by over 37% compared to the project’s bottom in 2015. Since the late pandemic lull, prices are up again by 29%. In fact, every resale since 2022 has been profitable, with those who sold recently in 2025 fetching seven-figure capital gains.

The simple but powerful truth in property investing is that timing and holding power matter more than anything else, especially in the luxury market that tends to be more volatile. Buying during the project’s low points is likely to translate into big capital gains when the market recovers.

River Valley freehold condo cheaper than leasehold homes

At its current average of S$2,719 psf, Leonie Parc View sits at a sweet spot in the River Valley market. It’s now cheaper than both leasehold and freehold new launches in River Valley and the wider Core Central Region (CCR). More importantly, it’s also priced below the overall leasehold average for River Valley — a rare case for a freehold project in this prime location.

However, it still transacts above the overall freehold average within River Valley and across the CCR. This indicates that, despite its relative affordability compared to brand-new launches, Leonie Parc View still maintains its luxury positioning among resale condos in the central region.

| Segment | New Sales Avg PSF (S$) | All Sales* Avg PSF (S$) |

|---|---|---|

| River Valley — 99-year Leasehold | 3,178 | 3,071 |

| River Valley — Freehold | 3,406 | 2,591 |

| CCR — 99-year Leasehold | 3,098 | 2,688 |

| CCR — Freehold | 3,388 | 2,459 |

Current average price psf in 2025, as of 10 October (Source: URA, 99.co Researcher)

Prices at Leonie Parc View are expected to rise further as CCR homes gain momentum through 2025. For instance, an active listing on 99.co already shows a 2,250-sqft unit asking S$6.79 million (S$3,020 psf). The 4-bedder sits on a high floor, offers three en-suites, and enjoys panoramic city views. Notably, this asking price is still about 2% lower than the average 4-bedroom units currently listed on 99.co.

Looking to sell your current home?

Book a FREE consultation with

99 advisors

to maximise your sale.

Recently launched CCR projects

Recent 99-year leasehold projects like River Green (S$3,130 psf) and UpperHouse (S$3,350 psf) have entered the market this year at higher benchmarks. Meanwhile, The Robertson Opus, a 999-year leasehold development launched in July, debuted at S$3,360 psf.

Value-priced Skye at Holland just launched over the weekend at an average price of S$2,953 psf. As the most affordable CCR launch of the year, it was almost sold out on the first day of launch, boding well for other upcoming residential launches in the region.

Leonie Parc View, on the other hand, offers a ready-to-move-in freehold option in the same vicinity at a lower entry price, giving buyers more room for future capital appreciation. With the recent turnaround in performance and renewed interest in CCR homes, this project may see its price gap narrow against newer launches in the coming quarters.

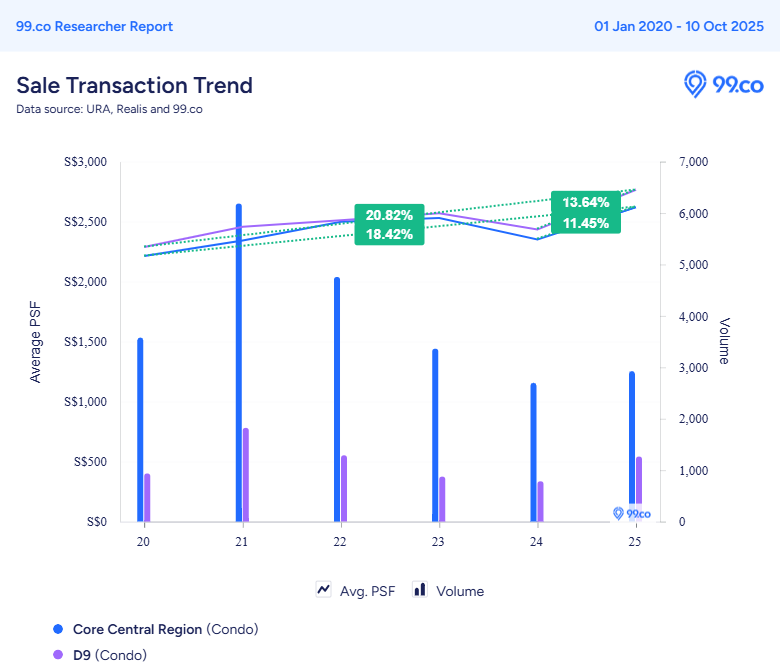

Condo price growth in District 9 and CCR over the last 5 years

Over the past five years, District 9 (Orchard/River Valley) has consistently outperformed the broader CCR. From 2020 to 2025, condo prices in District 9 have risen by about 21%, outpacing the 18% growth seen across the CCR.

Zooming in on more recent performance, since 2024, prices in District 9 have appreciated by roughly 14%, while the CCR overall has grown by around 11%. This consistent edge shows that central, lifestyle-oriented neighbourhoods like River Valley remain more resilient and desirable, even through policy shifts and market slowdowns.

Wrapping up

Leonie Parc View rebound in 2025 is a clear reminder of how market cycles turn — and how well-timed entries can pay off handsomely. Those who bought when market sentiment was low are now reaping seven-figure gains, and with CCR prices regaining strength, this project could continue its steady climb.

Enjoying this in-depth analysis? 99.co Condo Cash or Crash covers notable transactions in Singapore’s private property market.

The post This River Valley condo finally starts making million-dollar profits in 2025 appeared first on .