Singapore’s shophouse market saw a notable rebound in activity during Q3 2025, according to PropNex’s latest report, driven by improving buyer sentiment, a more stable interest rate environment, and a brighter outlook for the economy and tourism sector. With more deals transacted and higher sales value achieved, this quarter reflected renewed confidence among investors, family offices, and high-net-worth individuals looking to re-enter the market.

Table of contents

- Sales momentum rebounded strongly

- More buyers returning to the market

- Big-ticket deals and district highlights

- Leasing market stayed stable

- Investment sentiment improving

- What to expect moving forward

Sales momentum rebounded strongly

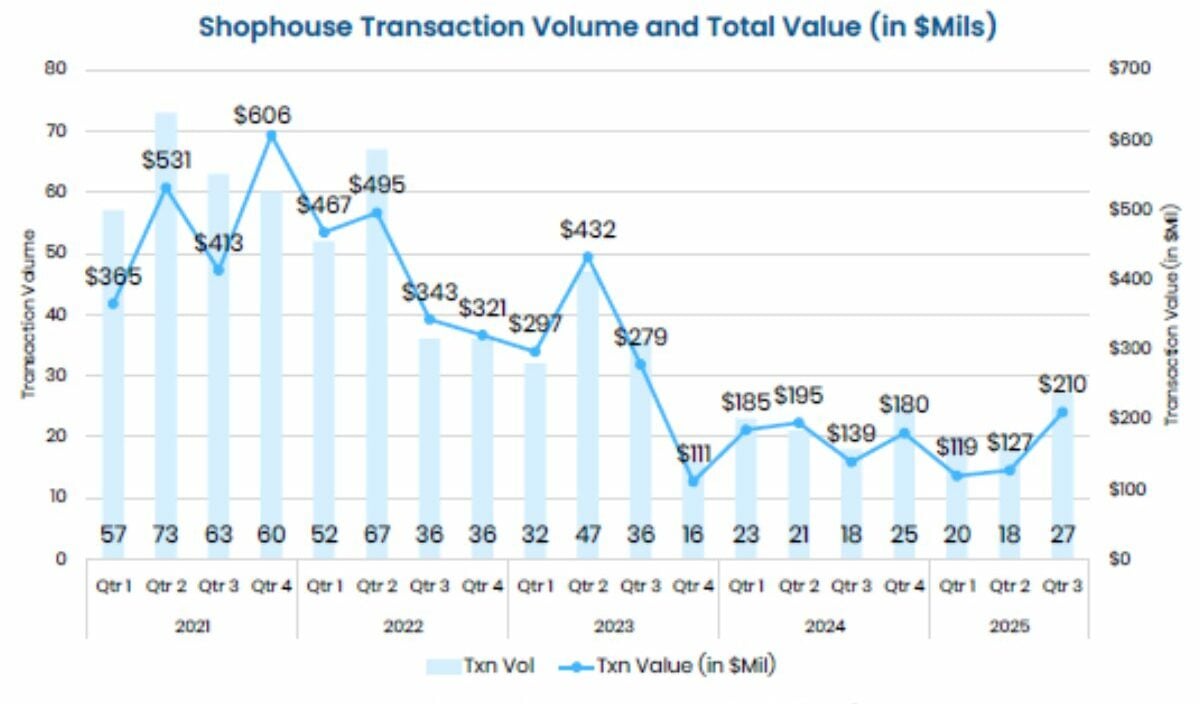

Sales momentum picked up significantly in Q3 2025, marking one of the most active quarters for shophouses in the past two years. Based on caveats lodged, 27 transactions were recorded in the quarter – up by 50% quarter-on-quarter (QoQ) from 18 deals in Q2 2025. Compared to the same period a year ago, sales volume also rose by 50% year-on-year (YoY) from 18 transactions in Q3 2024.

In total, these 27 deals amounted to S$210 million, representing a 65.3% increase in value from the previous quarter’s S$127 million and a 51.3% jump YoY from S$139 million in Q3 2024. This was the highest quarterly transaction volume since 2023, suggesting that market confidence is slowly returning.

It’s worth noting that some shophouse sales may not have been caveated yet, meaning the final numbers for the quarter could be even higher.

More buyers returning to the market

This renewed activity can be attributed to several key factors. Firstly, the moderation in interest rates has encouraged more investors to re-engage with the market. Secondly, Singapore’s economy continued to show resilience – expanding by 1.3% QoQ in Q3 2025, according to the Ministry of Trade and Industry (MTI).

Additionally, optimism about easing US–China trade tensions and a strong tourism recovery have also contributed to improved sentiment. As a result, both buyers and sellers became more confident in transacting again, particularly those seeking long-term, stable assets like shophouses.

Big-ticket deals and district highlights

District 15, which covers Katong and Joo Chiat, was the star performer in Q3 2025. It recorded eight transactions valued at S$47.9 million, the highest among all districts. This reflects continued interest in city-fringe and heritage-rich areas that balance accessibility with character.

There were also several high-profile deals during the quarter. One of the largest involved a portfolio sale of six conservation shophouses along Stanley Street, reportedly transacted for over S$82 million. The buyer was understood to be affiliated with Clifton Partners, a Singapore-based real estate investment firm, while the seller was Anpora Real Estate.

Another major transaction, according to URA Realis data, was the sale of three adjoining freehold shophouses in Jalan Besar’s Desker Road Conservation Area for S$36.5 million in September 2025. Based on a land area of 6,378 sqft, this worked out to about S$5,723 per sqft (psf) on land area.

Elsewhere, a Club Street conservation shophouse changed hands for S$21 million, translating to around S$3,889 psf based on an estimated gross floor area of 5,400 sqft. The property, previously owned by JL Family Office, was purchased by Asia Success Management, a Singapore-incorporated entity.

These big-ticket deals highlighted a shift in buyer appetite towards higher-value assets. More than half of the transactions in Q3 2025 (59%) were priced above S$5 million, while 41% were below that threshold.

Table 1: Price range of shophouses sold by quarter

| Price range | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

| Under S$2.5 million | 0 | 1 | 1 | 1 | 5 |

| S$2.5 million to < S$5 million | 4 | 9 | 10 | 3 | 6 |

| S$5 million to < S$10 million | 10 | 8 | 6 | 12 | 10 |

| Above S$10 million | 4 | 6 | 3 | 2 | 6 |

| Total transactions | 18 | 24 | 20 | 18 | 27 |

Source: PropNex Research, URA Realis

As the table shows, the proportion of lower-priced shophouses under S$2.5 million rose in Q3, but the majority of activity still occurred in the mid- to upper-tier range. This reflects a market that remains attractive to affluent investors and family offices seeking long-term value and capital preservation.

Leasing market stayed stable

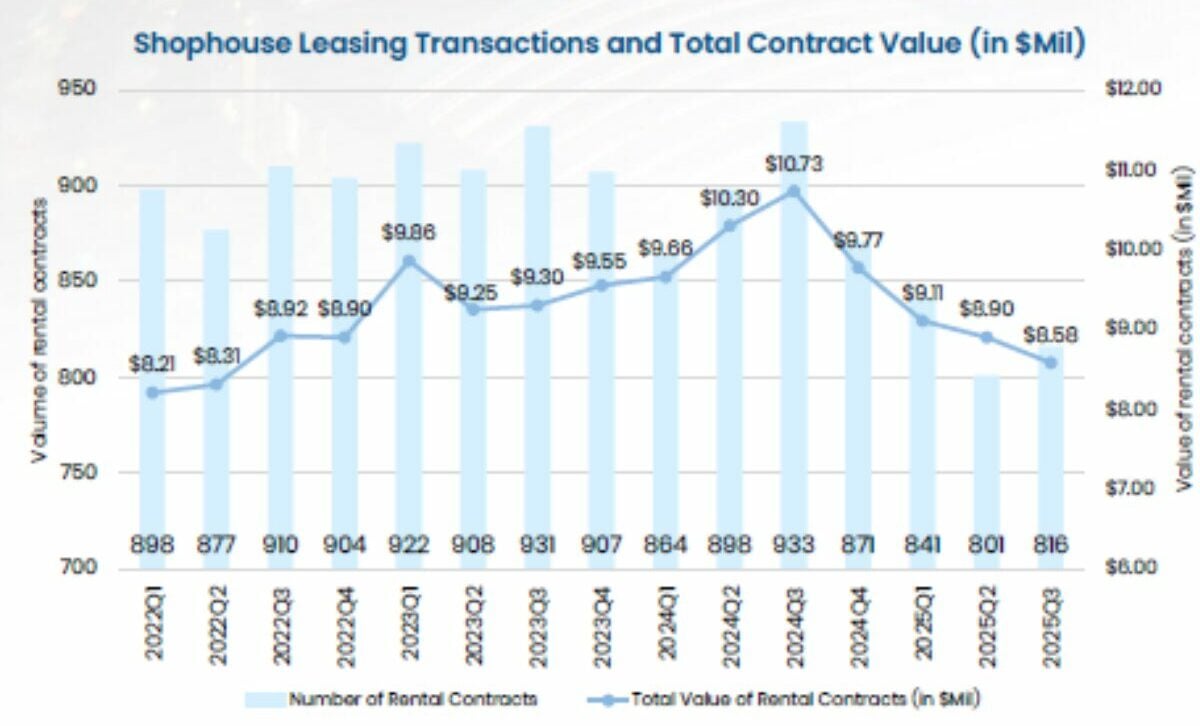

The leasing segment of the shophouse market remained steady in Q3 2025. A total of 816 rental contracts were signed, up by about 2% QoQ from 801 contracts in Q2 2025.

However, the total rental transaction value slipped by 4% to S$8.58 million, compared to S$8.9 million in the previous quarter. On a broader view, about 2,458 rental contracts worth S$26.6 million were signed in the first nine months of 2025, lower than the 2,695 contracts worth S$30.7 million recorded during the same period in 2024.

Table 2: Median shophouse rentals (S$ PSF per month) by selected Districts

| District | Q3 2024 | Q2 2025 | Q3 2025 | QoQ change | YoY change |

| D01 (Raffles Place, Marina) | S$8.35 | S$7.64 | S$6.80 | -11.0% | -11.5% |

| D02 (Tanjong Pagar) | S$8.08 | S$7.97 | S$7.60 | -4.6% | -8.5% |

| D07 (Middle Road, Golden Mile) | S$7.28 | S$6.48 | S$7.06 | +9.0% | -1.4% |

| D08 (Little India) | S$6.60 | S$5.19 | S$5.64 | +8.7% | -10.2% |

| D14 (Geylang, Eunos) | S$5.45 | S$6.05 | S$4.75 | -21.5% | -10.4% |

| D15 (Katong, Joo Chiat) | S$6.22 | S$5.73 | S$5.84 | +1.9% | +0.7% |

Source: PropNex Research, URA Realis

Median shophouse rentals softened slightly to S$6.59 psf per month, reflecting a 1.3% QoQ and 0.8% YoY decline.Districts 7 and 8, covering Middle Road, Golden Mile, and Little India, saw the strongest rental growth during the quarter, rising by 9% and 8.7% respectively. In contrast, rentals in District 14 (Geylang, Eunos) saw the sharpest drop, declining by over 21%. Prime districts such as D1 and D2 also registered moderate declines of 11% and 4.6%.

Investment sentiment improving

As interest rates eased and global economic risks became less pronounced, more investors began exploring shophouses as a defensive asset. Many family offices and institutional investors have re-entered the market, drawn to the safe-haven status and heritage value of these properties.

Unlike residential properties, commercial shophouses are not subject to Additional Buyer’s Stamp Duty (ABSD) or Seller’s Stamp Duty (SSD). The recent revision of SSD for private homes in July 2025 may have also encouraged some investors to shift their attention to the commercial segment.

The US Federal Reserve’s rate cut in September 2025, the fourth since March 2022, also improved liquidity conditions and boosted investment appetite. Analysts expect further cuts by the end of 2025, which could continue to support shophouse demand in the near term.

What to expect moving forward

Looking ahead, you can expect the shophouse market to stay resilient, supported by Singapore’s positive economic trajectory and strong tourism pipeline. Upcoming major events, including sports, entertainment, and MICE (Meetings, Incentives, Conferences, and Exhibitions) activities, will likely sustain both leasing and investment demand.

However, global uncertainties – especially ongoing US–China trade tensions, could still weigh on business confidence and yields. Even so, in uncertain times, investors often look for defensive, tangible assets, and Singapore’s shophouses are well-positioned to benefit from any capital flight-to-safety.

That said, on the leasing front, rising operational costs, particularly for F&B operators, could limit rental growth despite steady tenant demand.

The post Shophouse market rebounds in Q3 2025 with stronger sales and renewed investor confidence appeared first on .