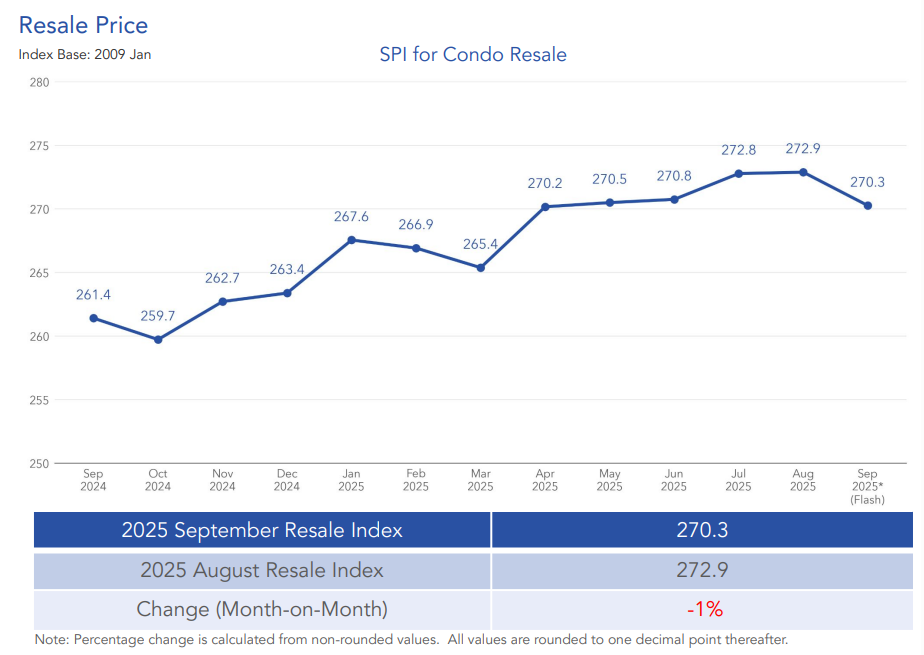

After months of steady gains, Singapore’s condo resale market eased slightly in September 2025. Prices dipped modestly by 1% month-on-month even as resale activity picked up. According to the 99-SRX flash report, resale volumes rose by 1.6% from August, marking the third straight month of growth, while transaction levels remained above both last year’s figures and the five-year average for September.

Table of contents

- Resale price trends: Mild correction led by CCR and RCR

- Transaction volumes: 1,109 units resold amid renewed buyer confidence

- Record transactions: S$19.18 million at The Marq on Paterson Hill

- Capital gains: Median profit remains strong at S$357,000

- Returns: Median unlevered yield at 28.5%, led by District 21

- Market outlook: Price consolidation before year-end

Resale price trends: Mild correction led by CCR and RCR

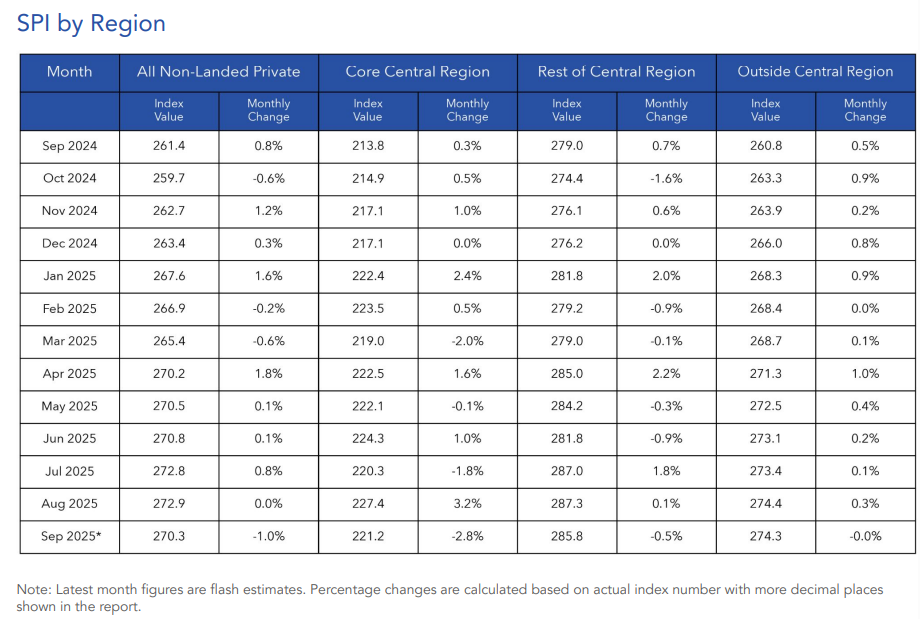

Overall condo resale prices in September slipped by 1% compared to the previous month. This dip was led primarily by declines in the Core Central Region (CCR) and Rest of Central Region (RCR), which saw prices fall by 2.8% and 0.5% respectively. The Outside Central Region (OCR), which typically represents more mass-market housing, remained stable.

The month’s performance broke the short streak of price growth seen through the middle of 2025, reflecting a mild correction as buyers weighed their options amid several new launch previews. Year-on-year, however, the market remains healthy — prices were still up 3.4% compared to September 2024. The CCR and RCR gained 3.4% and 2.4% respectively, while OCR prices climbed a stronger 5.2%.

According to Mr Luqman Hakim, Chief Data & Analytics Officer at 99.co, the cooling in resale prices was largely expected given the timing of new launches in nearby districts.

Transaction volumes: 1,109 units resold amid renewed buyer confidence

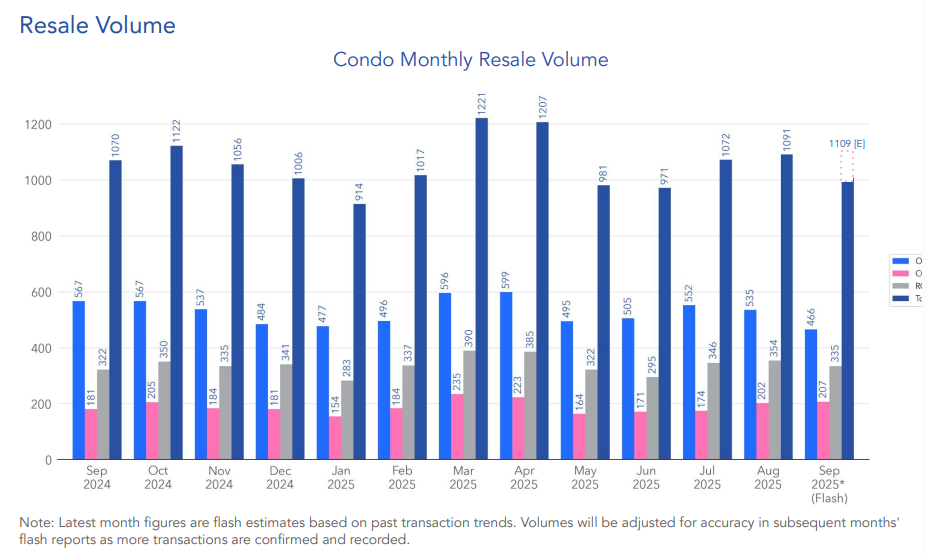

In September 2025, an estimated 1,109 condo resale units were transacted — up from 1,091 in August. “Resale volumes rose by 1.6% month-on-month and 3.6% year-on-year despite the price dip,” said Mr Luqman.

“This modest uptick suggests that buyers took advantage of the price correction to enter the market. Softer prices in the CCR and RCR also created opportunities for some to purchase centrally located properties at more attractive price points.”

Additionally, it also stood 3% above the five-year average for the same month.

Mr Luqman noted that September tends to be a steady transactional period, as activity rebounds after the mid-year lull and some buyers rush to complete purchases before the typical year-end slowdown in loan processing and legal approvals.

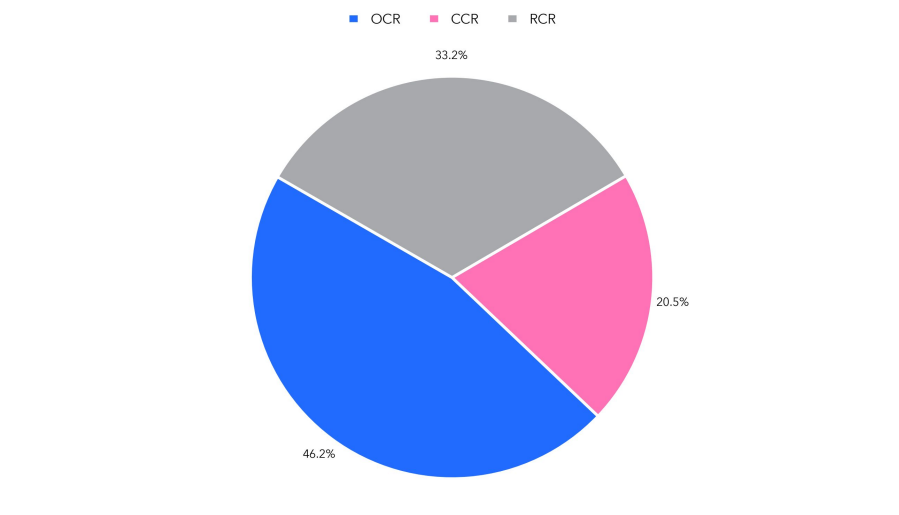

Breaking down by region, 46.2% of all transactions came from the Outside Central Region (OCR), reflecting steady demand from HDB upgraders and family buyers. The Rest of Central Region (RCR) accounted for 33.2%, while the Core Central Region (CCR) made up 20.5%, consistent with the gradual recovery in interest for central and fringe districts.

The overall trend suggests a stable, confidence-driven market. The moderate rise in volume, despite softer prices, implies that buyers were responding rationally to short-term opportunities. For many, the minor pullback in prices presented an ideal entry window before further tightening or new cooling measures could emerge.

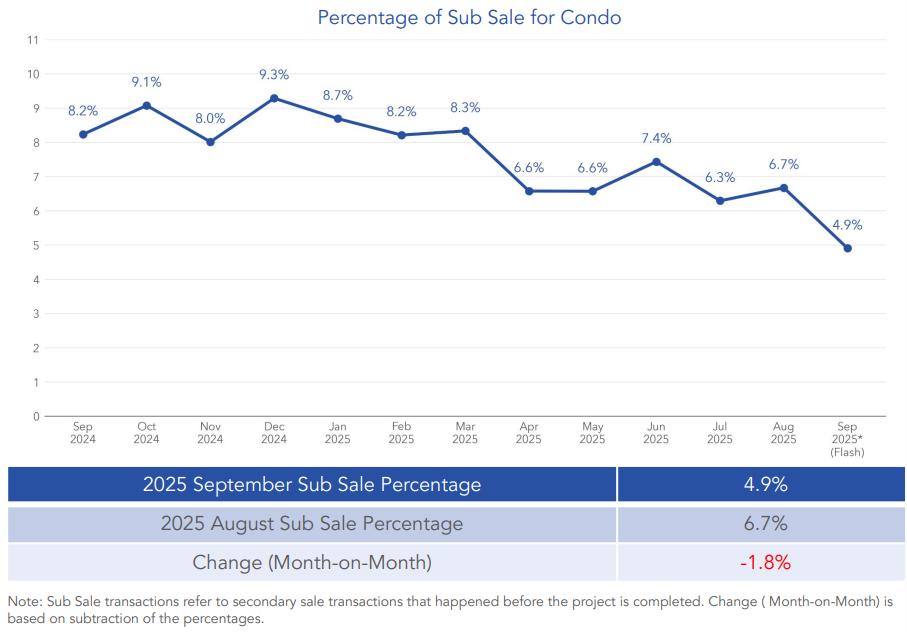

Interestingly, the proportion of sub-sale transactions — or sales of units before completion — dropped to 4.9%, down from 6.7% in August. This points to waning speculative activity and a market increasingly dominated by genuine end-users rather than short-term investors.

Record transactions: S$19.18 million at The Marq on Paterson Hill

Despite the overall price dip, the high-end segment continued to show resilience. The highest recorded resale transaction in September was S$19.18 million for a unit at The Marq on Paterson Hill — a luxury freehold project in District 9 known for its exclusivity and ultra-large layouts.

In the RCR, Reflections at Keppel Bay achieved the top resale at S$6.4 million, showcasing continued demand for waterfront living and architecturally distinctive developments. Meanwhile, in the OCR, Southaven II in Bukit Timah topped the chart with a resale of S$5.38 million, a notable figure for a non-central project.

These headline transactions demonstrate that, despite broader market normalisation, Singapore’s luxury property segment remains active. High-net-worth buyers continue to see luxury resale units as long-term assets, especially in established prime locations with limited new supply.

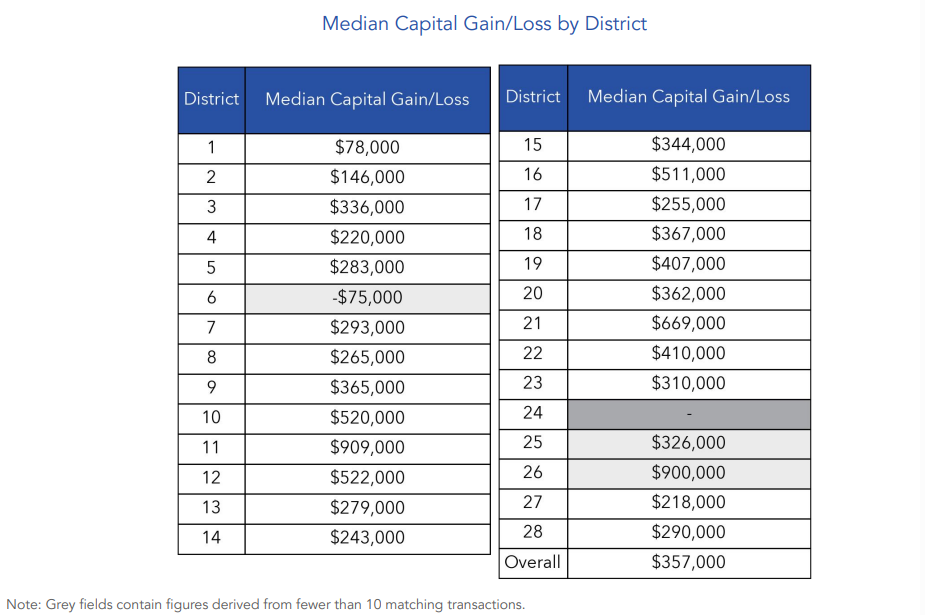

Capital gains: Median profit remains strong at S$357,000

The median capital gain from condo resale transactions fell slightly to S$357,000 in September, down from S$380,000 in August. This decline mirrors the overall easing in resale prices but still reflects healthy profitability for most sellers.

Sellers in District 11 (Newton / Novena) recorded the highest median capital gain of S$909,000, highlighting the enduring appeal of city-fringe properties near major healthcare hubs and the upcoming North-South Corridor.

On the other hand, sellers in District 1 (Boat Quay / Raffles Place / Marina) saw the lowest median gain at S$78,000, likely due to higher purchase prices during earlier market peaks and the niche investor-driven nature of the downtown market.

The narrowing gap between capital gains across districts also hints at a more balanced performance nationwide. Suburban and fringe areas continue to deliver consistent, if modest, returns, while the central districts fluctuate more depending on timing and holding period.

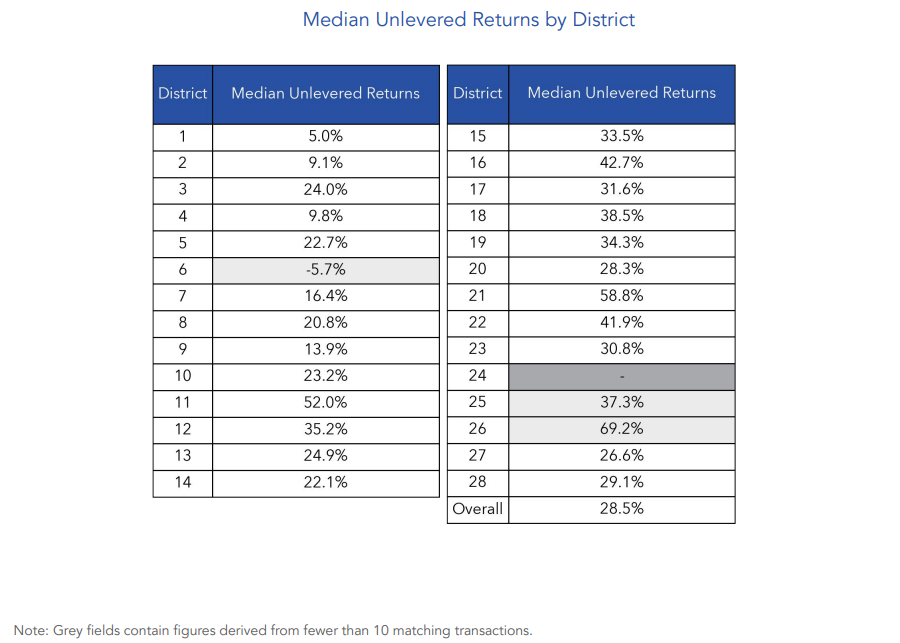

Returns: Median unlevered yield at 28.5%, led by District 21

For investors, resale performance remained rewarding. The median unlevered return — calculated by comparing current and previous transacted prices for the same unit — stood at 28.5% in September 2025.

District 21 (Clementi Park / Upper Bukit Timah) posted the highest median unlevered return at 58.8%, buoyed by long-term appreciation and the enduring popularity of family-sized homes in green, low-density estates. Conversely, District 1 recorded the lowest return at 5%, likely due to its concentration of investor-owned apartments with slower resale momentum.

While the prime city core sees cyclical fluctuations, outer and fringe districts have become reliable growth pockets for both homebuyers and investors seeking stability and long-term appreciation.

Market outlook: Price consolidation before year-end

Looking ahead, market watchers anticipate that October and November will see continued price stabilisation, especially with several major launches entering the market. Projects such as Skye at Holland, Faber Residence, Penrith, and Zyon Grand have introduced new supply with fresh lease terms, refined layouts, and enhanced communal amenities — features that appeal strongly to buyers comparing options between new and resale stock.

Mr Luqman Hakim added that these launches likely pulled some demand away from older resale projects, prompting sellers to adjust their pricing strategies.

“These launches offered new lease terms, updated designs, and modern facilities, drawing buyer attention away from older resale projects,” he explained. “This likely exerted downward pressure on resale prices as sellers adjusted their asking prices to remain competitive.”

Still, fundamentals remain sound. Transaction volumes are holding up, and profitability levels remain healthy. As buyers become more selective, we can expect price movements to stay range-bound for the rest of 2025, supported by a strong employment market and stable interest rates.

With many buyers choosing to secure their homes before the festive period and possible policy changes in early 2026, the market is poised for a calm but active close to the year.

The post Condo resale in September: Prices slipped 1% as more buyers entered the market appeared first on .