After several months of steady activity, Singapore’s HDB resale market cooled slightly in October 2025, as both prices and transaction volumes eased. Yet, despite the slowdown in deals, prices remained largely resilient, supported by continued demand for spacious, well-located homes.

Table of contents

- Modest dip in October after a new price peak

- Transaction volume eases following a robust quarter

- 87 million-dollar flats changed hands in the month

- HDB resale market outlook

Modest dip in October after a new price peak

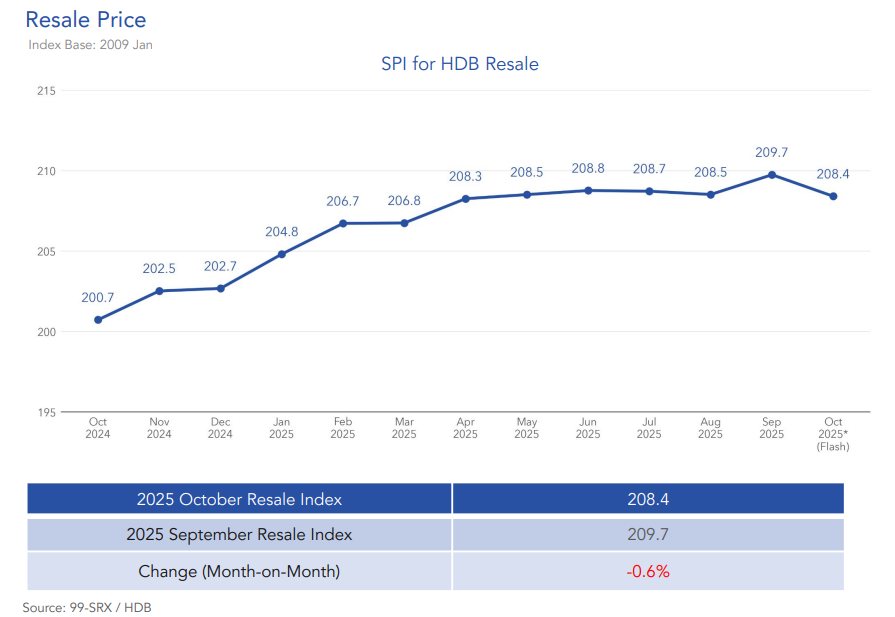

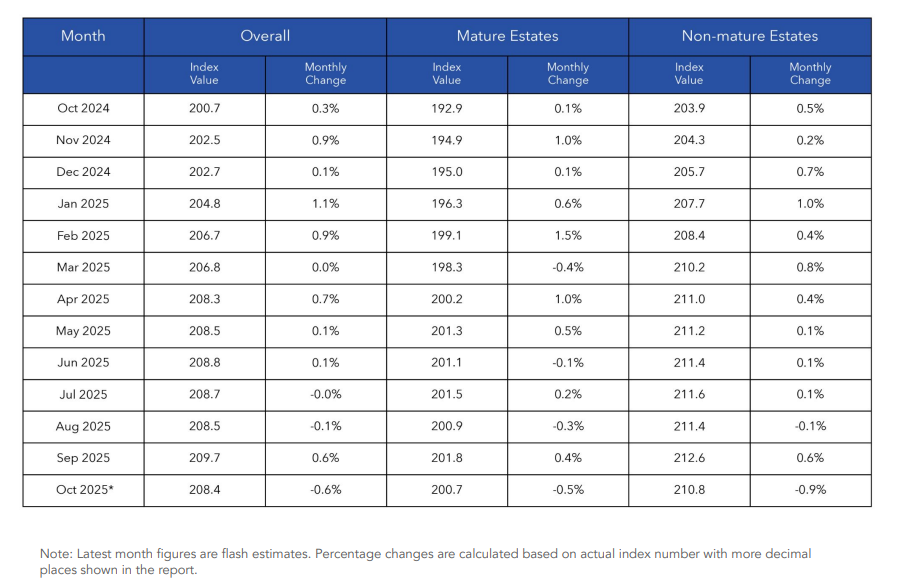

According to 99.co flash report, HDB resale prices slipped 0.6% month-on-month. The resale price index fell to 208.4 in October from 209.7 in September, where prices reached a new record high.

Prices in Mature Estates edged down 0.5%, while those in Non-Mature Estates declined by a slightly larger 0.9%. The difference suggests that mature town flats — typically located near MRT stations and amenities — continue to hold up better amid shifting buyer sentiment.

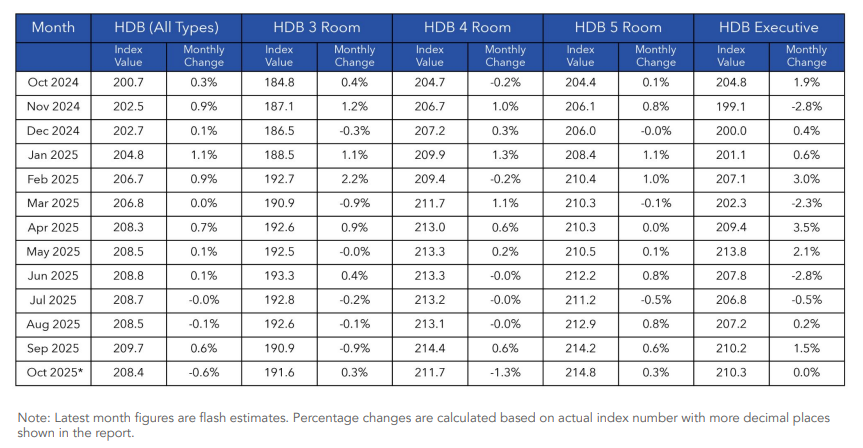

Among different flat types, 3-room and 5-room flats recorded modest 0.3% increases, showing sustained demand from right-sizing households and buyers seeking larger living spaces. In contrast, 4-room flats saw a 1.3% price dip, while Executive flats remained unchanged from September.

Still, on a broader time frame, prices remain in healthy territory. Compared to October 2024, the overall HDB resale price index is up by 3.8% year-on-year. This means that even with a slight softening, prices continue to trend higher across all room categories:

- 3-room flats: +3.7% year-on-year

- 4-room flats: +3.4% year-on-year

- 5-room flats: +5.1% year-on-year

- Executive flats: +2.7% year-on-year

The strongest performers have been 5-room flats, which continue to attract upgraders from smaller units and families seeking larger homes in decentralised locations. Meanwhile, 3-room flats have benefited from younger buyers and small families entering the resale market.

Both Mature and Non-Mature Estates also posted annual gains of 4% and 3.4%, respectively. The data points to sustained price support despite more BTO flats entering the market and a generally slower resale pace.

Transaction volume eases following a robust quarter

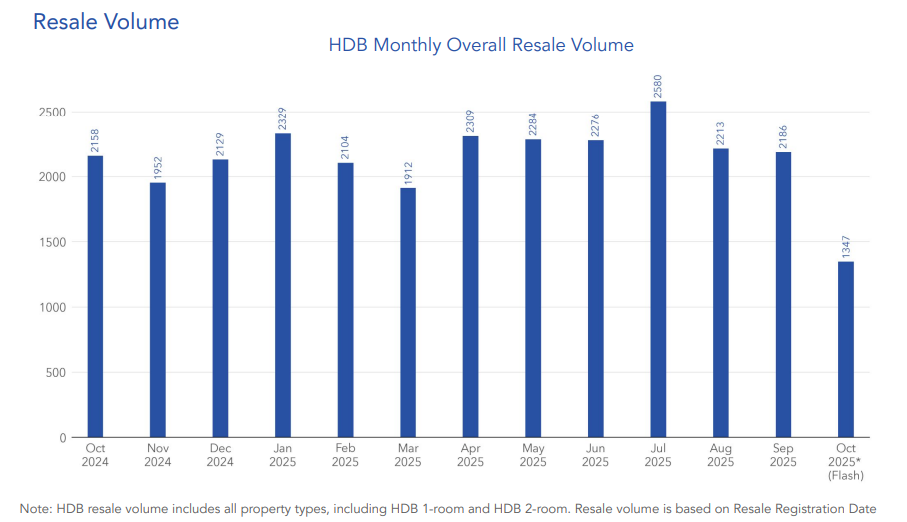

The number of HDB resale transactions fell in October, following heightened activity in the previous months. A total of 1,347 resale flats were sold*, marking one of the quieter months in 2025.

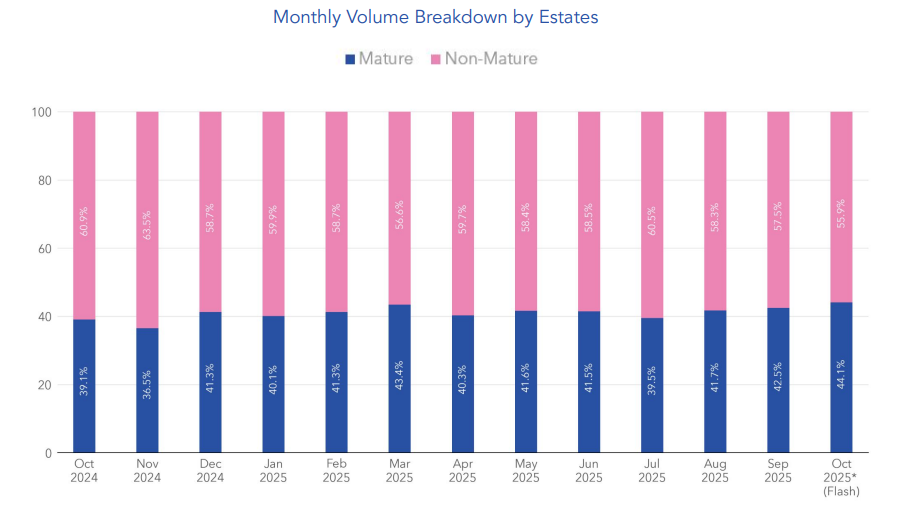

More than half of these deals (55.9%) came from Non-Mature Estates such as Punggol, Yishun, Woodlands, and Sengkang — areas that typically attract price-sensitive buyers and upgraders. The remaining 44.1% were in Mature Estates, including Toa Payoh, Bukit Merah, and Queenstown, where price levels are higher and supply is tighter.

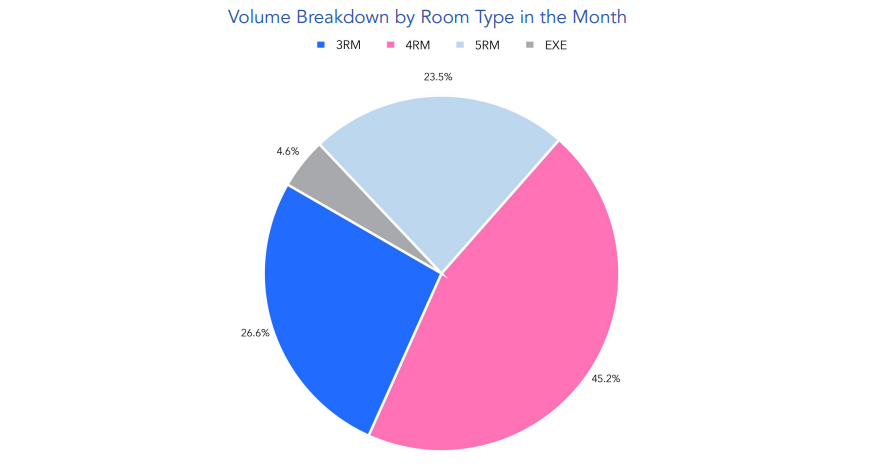

Breaking it down by flat type, 4-room units continued to dominate the market, accounting for 45.2% of all sales, followed by 3-room flats (26.6%), 5-room flats (23.5%), and Executive flats (4.6%).

*Sold transactions are based on the Resale Registration Date. Resale registered applications are generally representative of completed resale transactions.

87 million-dollar flats changed hands in the month

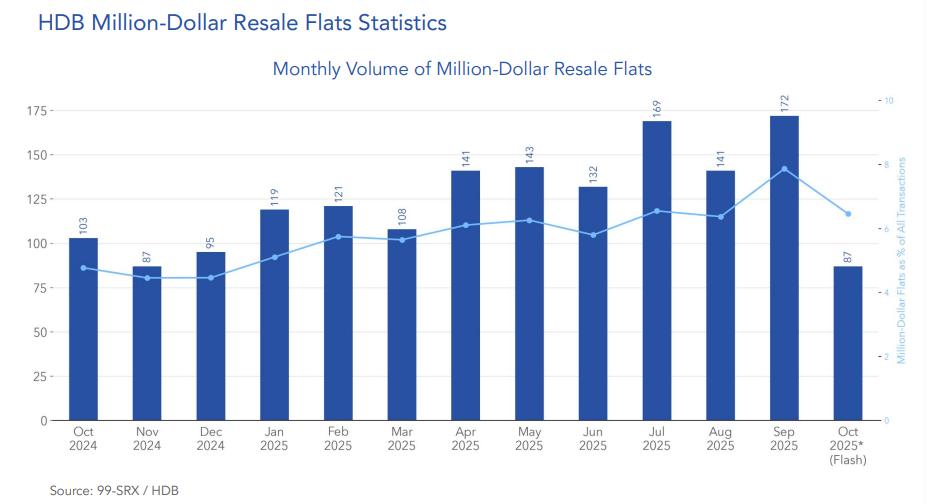

The number of million-dollar HDB resale flats fell to 87 in October, down from 172 in September. These transactions accounted for 6.5% of total sales, signalling a clear slowdown from September, when such flats accounted for the highest monthly proportion ever recorded.

The highest-priced resale flat in October was a 5-room unit at Boon Keng Road, which fetched S$1.55 million. In the Non-Mature Estates, the priciest deal was an Executive flat in Woodlands Street 82 that sold for S$1.27 million — reflecting that even suburban locations are capable of commanding premium prices for rare, spacious units.

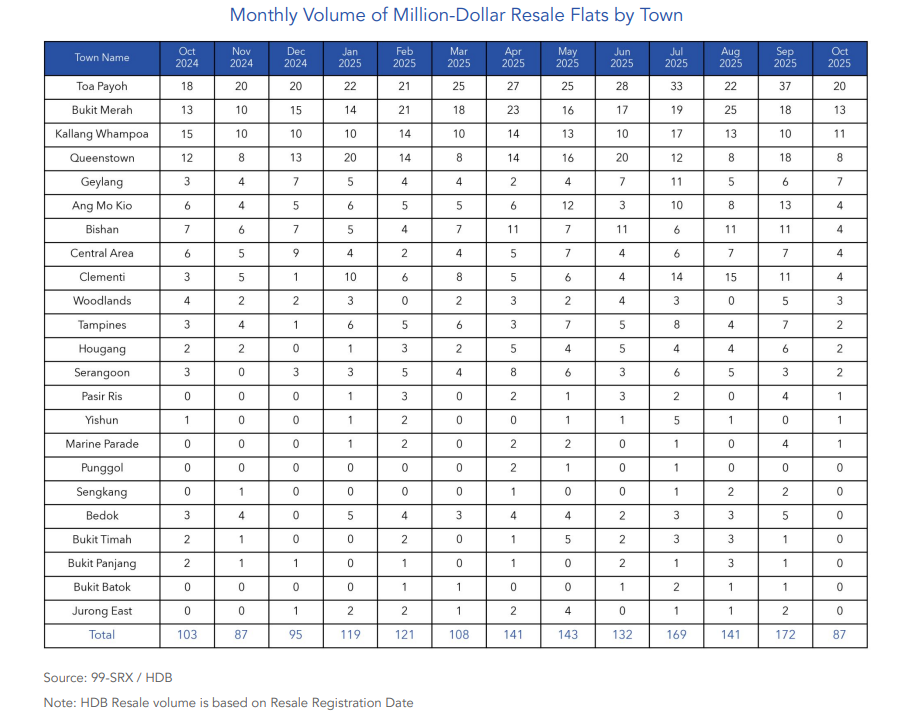

Toa Payoh continued to lead in million-dollar flat sales, with 20 transactions in October. It was followed by Bukit Merah (13 units) and Kallang/Whampoa (11 units). Other towns with million-dollar deals included Queenstown, Geylang, Ang Mo Kio, Bishan, Central Area, Clementi, Woodlands, Tampines, Hougang, Serangoon, Pasir Ris, Yishun, and Marine Parade.

The distribution of million-dollar transactions shows that buyer appetite for centrally located and premium flats remains stable. These deals are increasingly concentrated in mature estates and newer flats with long remaining leases, as buyers seek both convenience and asset longevity.

HDB resale market outlook

As 2025 enters its final two months, the HDB resale market is likely to remain steady, though quieter, in line with traditional year-end patterns. Prices could hover within a narrow range, as buyer confidence stays firm but sellers adjust expectations to match the slower transaction pace. Still, HDB resale activity is likely to be backed up by interest rate cuts, which may boost affordability for bank loan buyers.

The post Resale HDB prices remain resilient despite fewer transactions in October appeared first on .