Singapore’s rental market entered its year-end cool-down phase in October 2025, with both private condo and HDB rental volumes slipping for the third consecutive month. Despite this slowdown in activity, overall rental prices remained largely steady, reflecting a market that has normalised rather than weakened.

According to Mr. Luqman Hakim, Chief Data & Analytics Officer at 99.co, this pattern aligns closely with typical leasing cycles: “This is fairly typical for this part of the year, as the peak expat movement and renewal period is now behind us and the leasing season naturally tapers off heading into the year-end.”

Even with the monthly slowdown, rental demand remains healthy on an annual basis — an important signal that the fundamentals remain intact.

Table of contents

- Condo rental market: Prices hold steady, leasing activity slows sharply

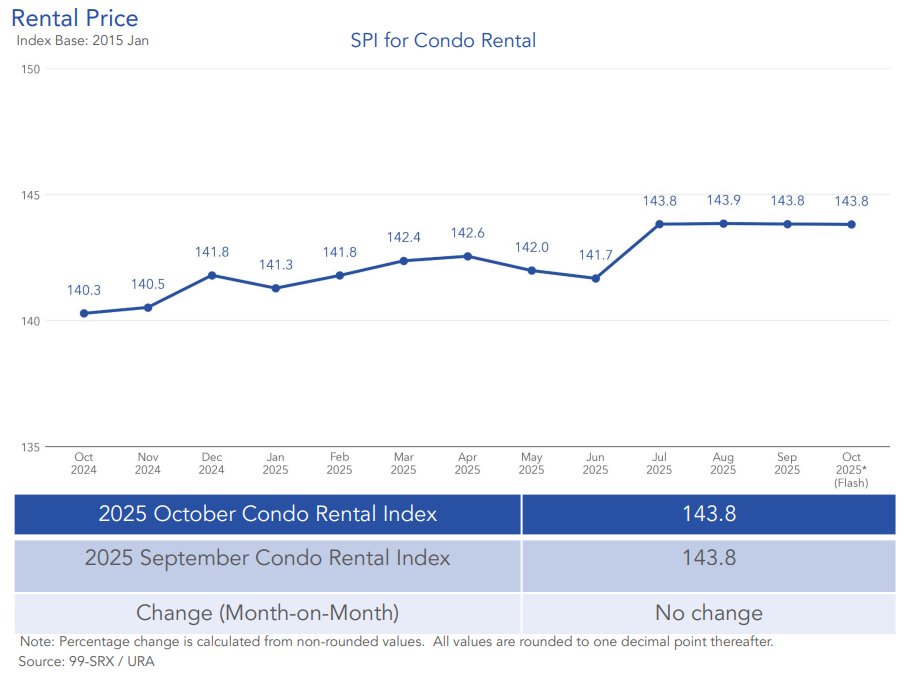

- Rental price: No change from September

- Rental activity: -9.7% month-on-month

- HDB rental market: Year-on-year demand remains strong despite monthly declines

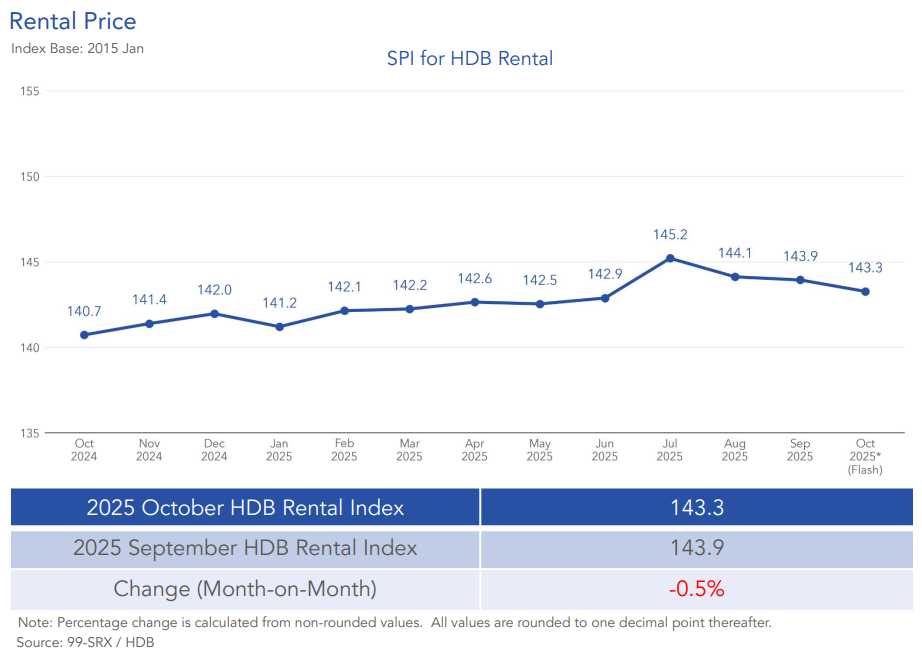

- Rental price: -0.5% month-on-month

- Rental activity: -5.8% month-on-month

Condo rental market: Prices hold steady, leasing activity slows sharply

Rental price: No change from September

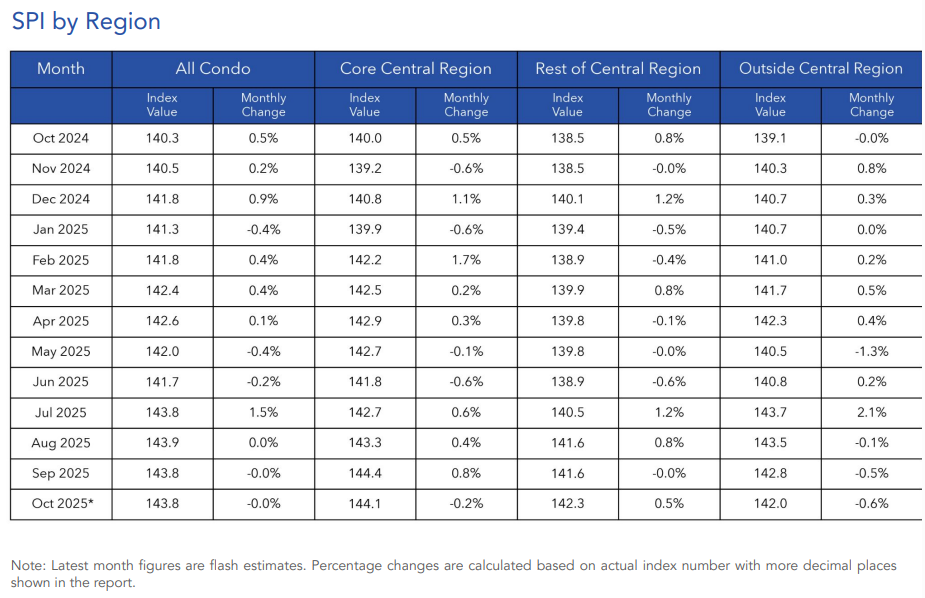

October saw private condo rental prices hold at an index of 143.8, identical to September’s report. Beneath this flat headline figure were slight shifts across regions: the Core Central Region (CCR) experienced a small 0.2% dip, the Outside Central Region (OCR) slipped by 0.6%, while the Rest of Central Region (RCR) recorded a mild 0.5% uptick. These small movements balance out into an overall picture of stability.

Compared to a year ago, however, rental prices were still higher across the board. Condo rental prices climbed 2.5% year-on-year, with CCR rising 2.9%, RCR up 2.7% and OCR gaining 2.1%. This suggests that although monthly movements have been modest, rents continue to reflect a steady year-on-year increase.

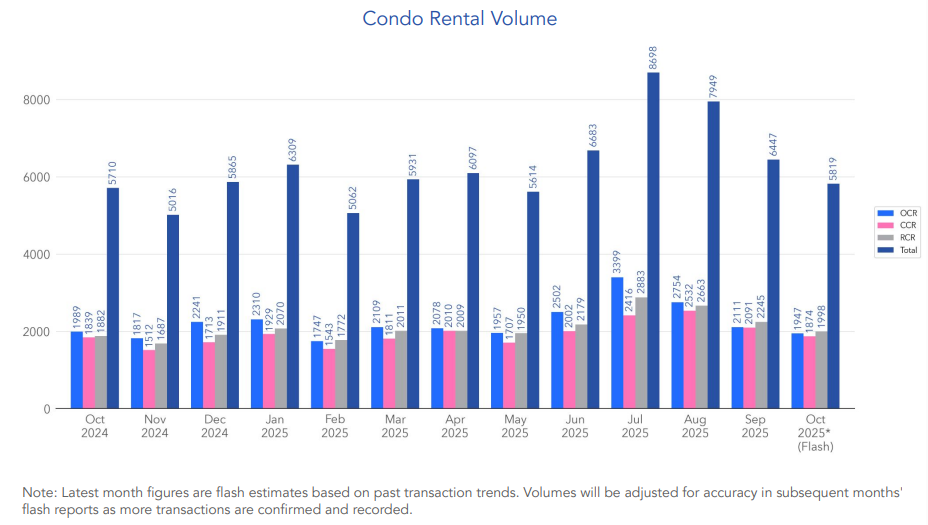

Rental activity: -9.7% month-on-month

Where the private market saw more significant change was in leasing volumes. An estimated 5,819 condo units were rented in October, down from 6,447 in September, marking a 9.7% month-on-month drop. This is the third straight decline since the peak leasing months in mid-2025.

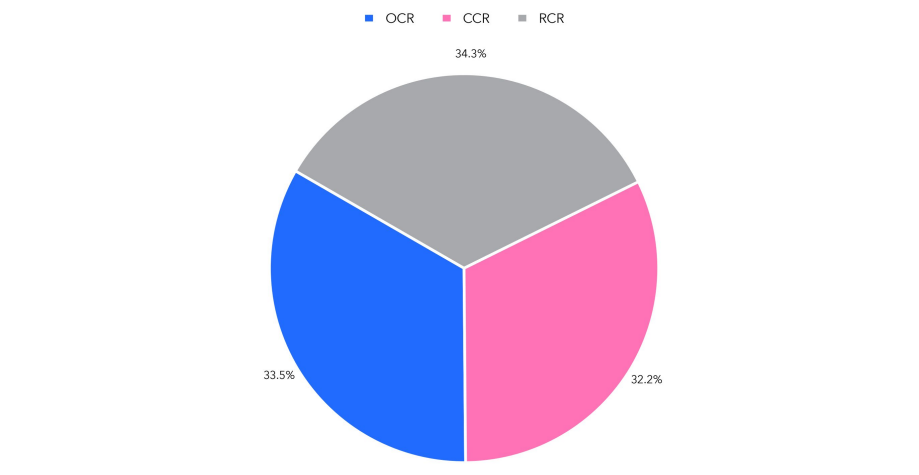

Regionally, rental activity this month was evenly distributed: 34.3% of all transactions came from the RCR, 33.5% from the OCR, and 32.2% from the CCR. When viewed against historical patterns, October’s volume was 3.2% below the five-year average for the month — further evidence that the market is entering its quieter phase.

Still, condo leasing demand remains resilient when compared to last year. Volumes in October 2025 were 1.9% higher than in October 2024. As Mr. Luqman explains, this underlying strength is supported by structural drivers rather than seasonal ones.

“Several factors may be supporting this trend, including a steady inflow of employment pass holders and more households choosing to rent first while monitoring interest rate movements before committing to a purchase.”

HDB rental market: Year-on-year demand remains strong despite monthly declines

Rental price: -0.5% month-on-month

The HDB rental segment followed a similar trajectory, with prices dipping slightly but longer-term figures remaining healthy. The HDB rental index slipped from 143.9 in September to 143.3 in October, a 0.5% month-on-month decrease.

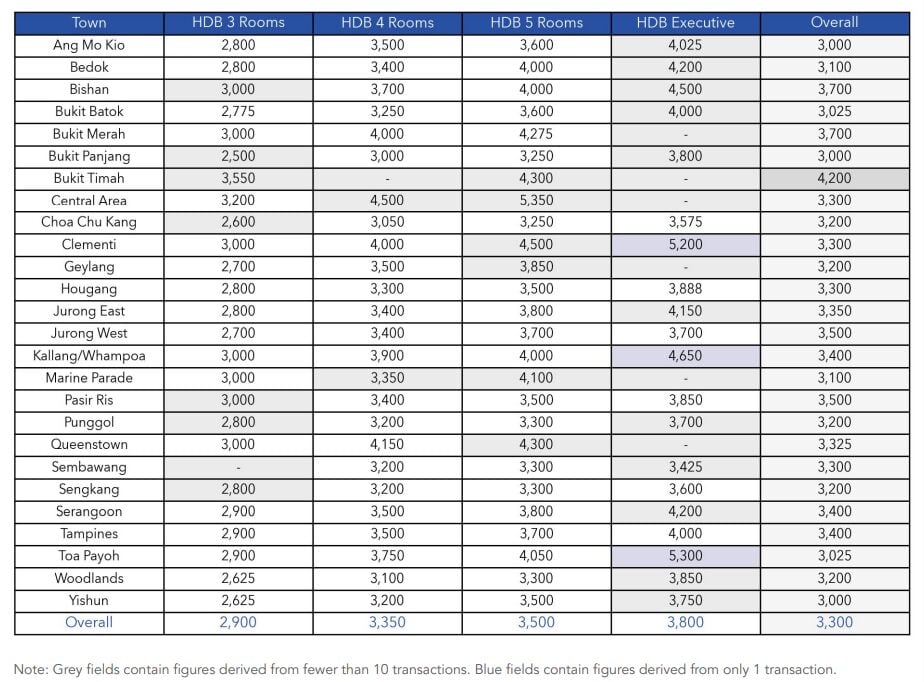

The median HDB rental price in October 2025 is as follows:

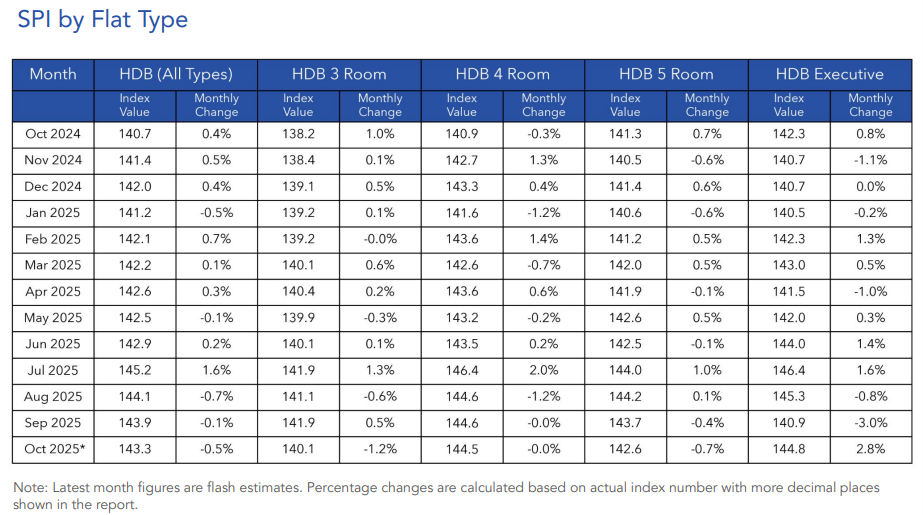

Within this, mature estates saw rental prices ease by 0.4%, while non-mature estates dipped by 0.5%. Rental performance across flat types varied: 3-room flats posted a more noticeable decline of 1.2%, 5-room flats fell by 0.7%, and 4-room rents held steady. Executive flats moved in the opposite direction, climbing 2.8% for the month — likely due to fewer transactions and greater variability in this smaller segment.

Year-on-year, however, the HDB rental index still registered a 1.8% increase. Mature estates saw rental prices rise 2.1% from a year earlier, while non-mature estates were up 1.5%. All flat types recorded annual gains, with 4-room flats leading at 2.6%.

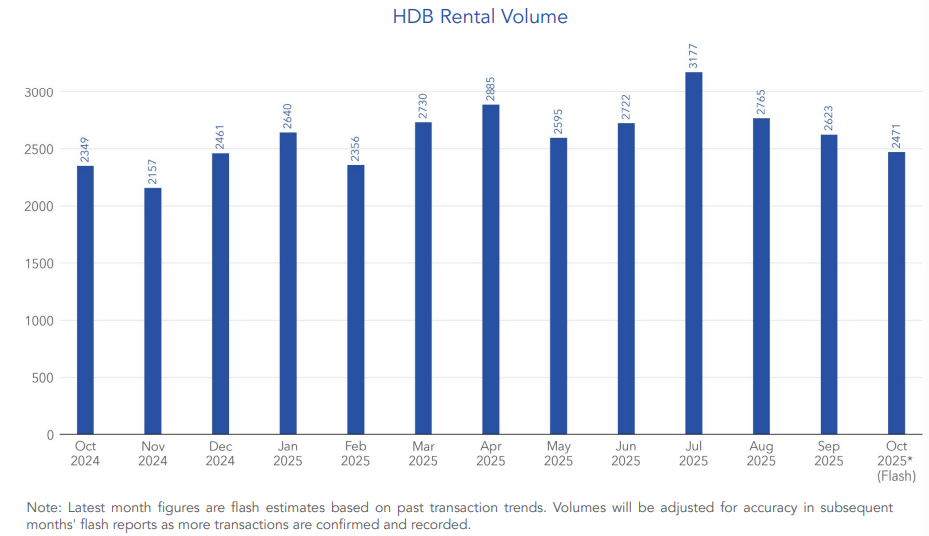

Rental activity: -5.8% month-on-month

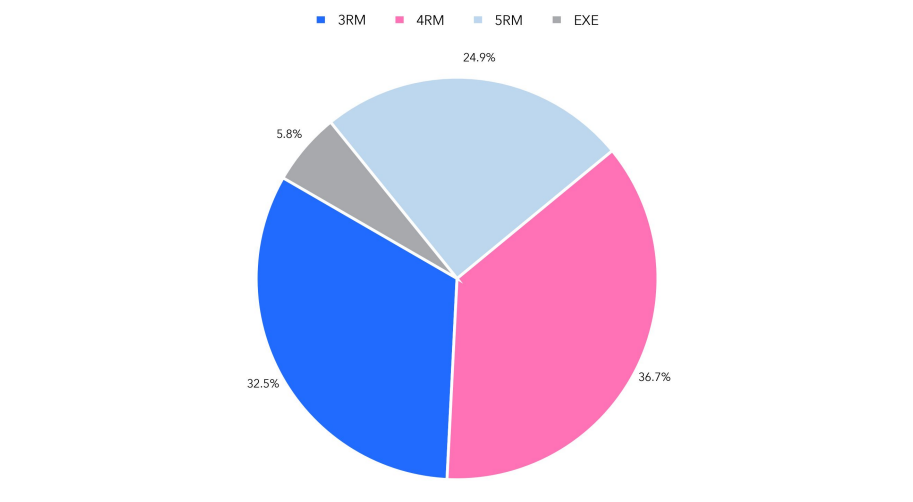

Leasing volumes also eased. Approximately 2,471 HDB flats were rented in October, down from 2,623 in September, representing a 5.8% month-on-month decline. The composition of rentals remained similar to prior months, with 4-room flats accounting for the largest share of activity at 36.7%, followed by 3-room flats at 32.5%, 5-room at 24.9%, and executive flats at 5.8%.

Yet again, annual numbers tell a different story. Though rental volumes were 2.4% lower than the 5-year average for October, the numbers are still 5.2% higher than in October 2024, continuing a year-long uptrend. As Mr. Luqman notes, this resilience mirrors what’s happening in the condo market: “This indicates that despite monthly fluctuations, underlying demand has stayed firm over the past 12 months. ”

The post Rental activity eases for the third consecutive month, but prices hold steady in October 2025 appeared first on .