October extended the upward price trend in Singapore’s condo resale market, even as transaction volumes eased slightly from the previous month. This combination of rising values and moderating activities points to a market that remains fundamentally supported by strong demand, but is also becoming more selective as price levels climb.

Table of contents

- Resale price trends: New highs, led by city fringe demand

- Resale volumes: Modest pullback from September

- Upgraders and high-end buyers strongly support the market

- Rising sub-sale share points to shifting investor behaviour

- Condo capital gains and unlevered returns

- Highest condo resale transactions in October 2025

Resale price trends: New highs, led by city fringe demand

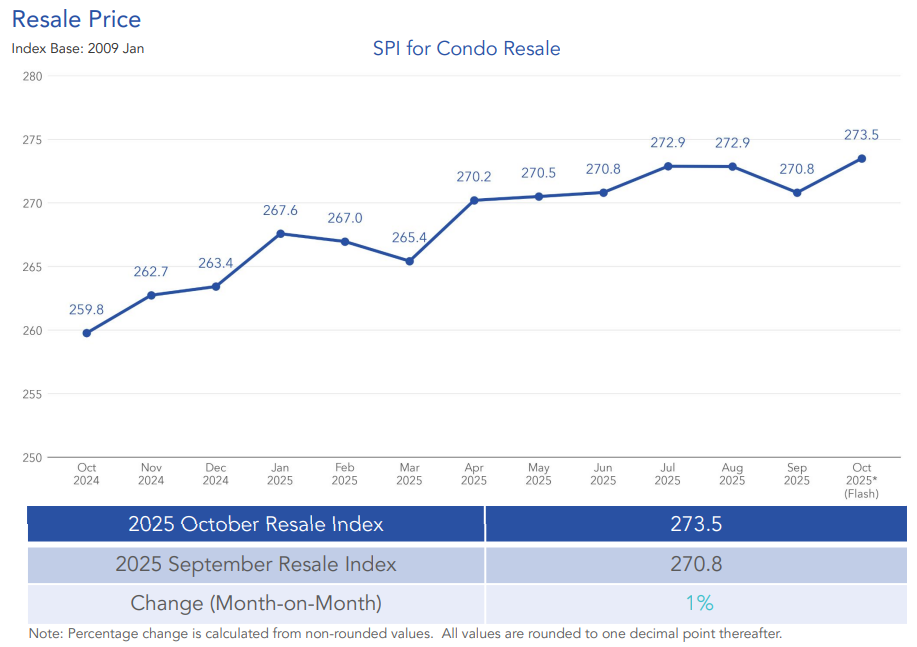

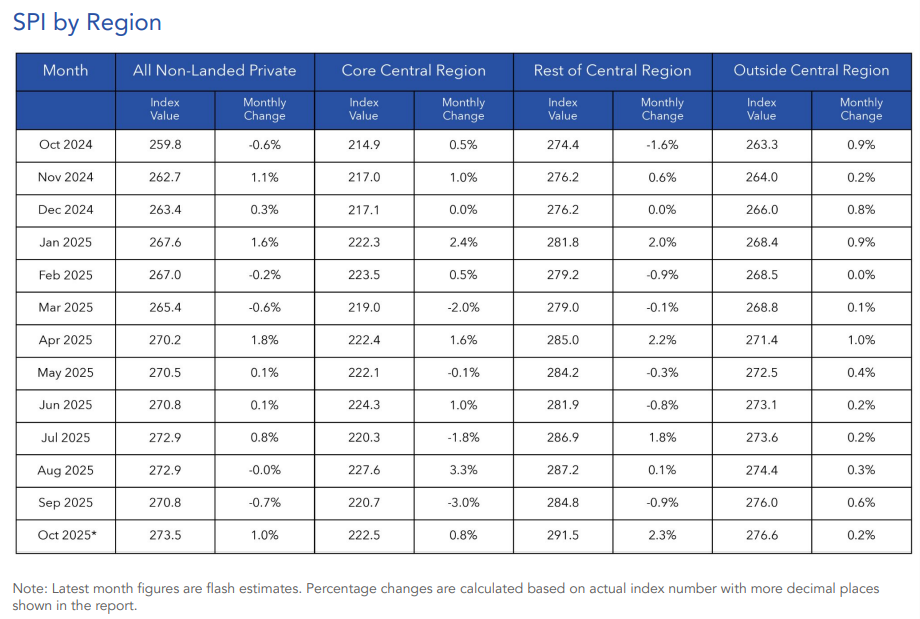

Resale condo prices continued to strengthen in October. The price Index rose by 1% month-on-month, from 270.8 in September to 273.5 in October. On a year-on-year basis, prices were up 5.3% compared to October 2024.

All market segments recorded gains, although the pace varied. The Rest of Central Region (RCR) led with a 2.3% increase, highlighting sustained demand for city fringe homes.

The Core Central Region (CCR) followed with a 0.8% rise, while the Outside Central Region (OCR) saw a milder 0.2% growth. Year-on-year, RCR again outperformed with prices up 6.2%, compared with 5% in OCR and 3.6% in CCR.

This pattern underscores the continued appeal of city-fringe projects. Buyers appear increasingly drawn to locations that offer a balance of centrality, connectivity, and relative affordability, especially as prime district pricing remains more volatile and suburban prices start approaching psychological ceilings in certain micro-markets.

Resale volumes: Modest pullback from September

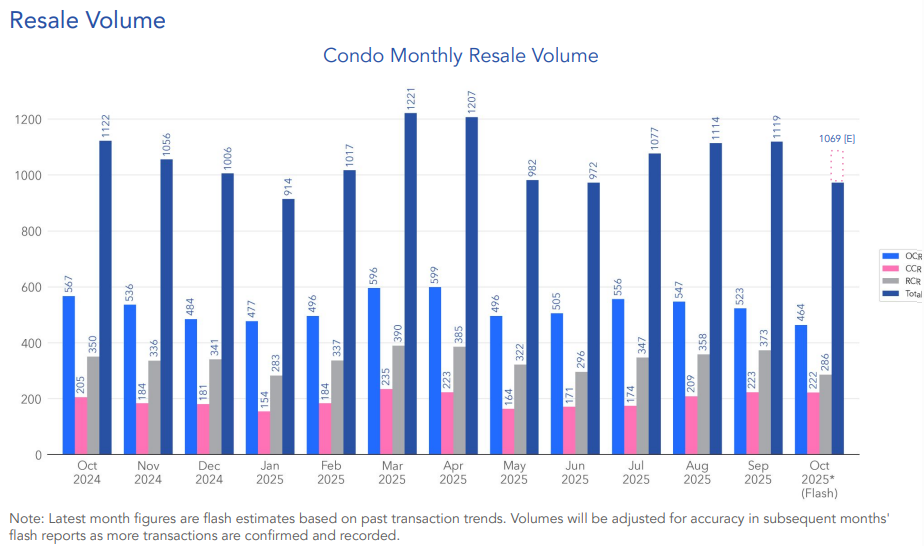

An estimated 1,069 condo resale transactions were recorded in October, a 4.5% decline from the 1,119 units in September. Volumes were also 4.7% lower compared to October 2024 and 1.6% below the five-year October average.

According to Mr. Luqman Hakim, Chief Data & Analytics Officer at 99.co, this softening in activity does not necessarily reflect weakening demand, but rather a temporary shift in buyer focus. He noted that “the timing of the month’s BTO launch likely diverted a segment of buyers toward public housing, easing some demand in the private resale market.”

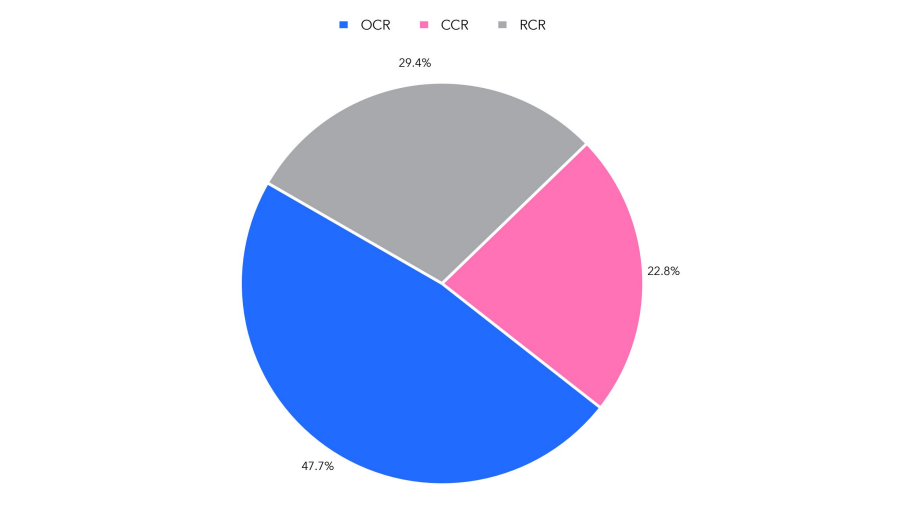

Even with this dip, resale activity stayed broad-based geographically. OCR made up 47.7% of all resale transactions, followed by RCR at 29.4% and CCR at 22.8%. This distribution continues to show that mass-market and city fringe condos remain the main volume drivers, while prime deals, although fewer, still play a role in shaping price movements.

Upgraders and high-end buyers strongly support the market

Mr. Luqman also highlighted that upgrading households continues to underpin price resilience, especially outside the prime core. He shared that “a likely key driver is the continued participation of HDB upgraders, many of whom entered the market with substantial proceeds from recently MOP-ed flats. Their purchasing power helped underpin demand, particularly in the RCR and OCR, where the supply of move-in-ready units has remained tight.”

This explains why price growth remains firm despite softer volumes. Many upgraders are entering the market with strong balance sheets, which allows them to compete effectively for newer or well-located resale units. At the same time, tight resale supply, especially for younger and well-maintained projects in mature estates, continues to support higher transaction prices.

Beyond upgrader demand, high-value transactions in the prime segment also played a role in lifting overall indices. As Mr. Luqman further noted, “High-value transactions in prime projects such as Nassim Lodge and Aalto lifted the overall price index, signalling that buyers at the upper tiers are still prepared to transact when the right units surface.”

This shows how demand now operates on two fronts, where both mass-market upgraders and ultra-high-net-worth buyers are contributing to price momentum, though in very different segments.

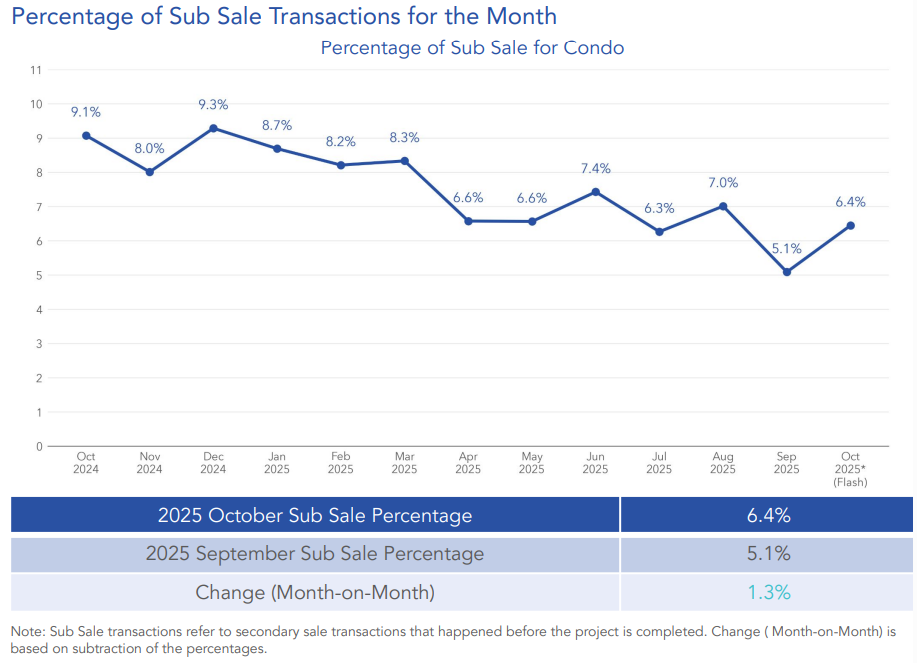

Rising sub-sale share points to shifting investor behaviour

Sub-sale transactions, which refer to secondary sales before project completion, made up 6.4% of all secondary sale transactions in October. This was up from 5.1% in September, representing a 1.3% increase month-on-month. While still a relatively small share of the market, the rising sub-sale proportion may reflect growing confidence, especially amid rising new launch prices and improving resale valuations.

Condo capital gains and unlevered returns

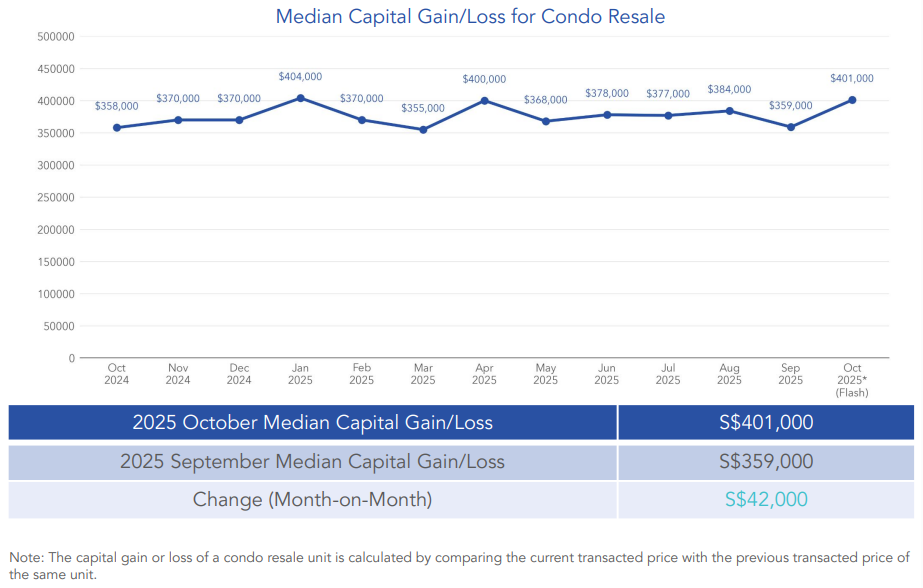

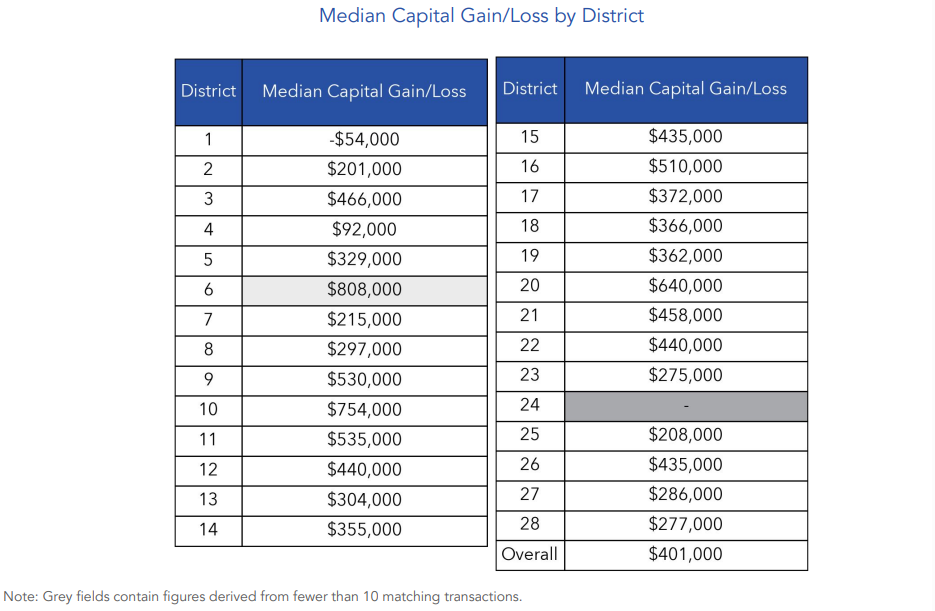

Resale condo sellers continued to enjoy healthy price outcomes in October. The overall median capital gain stood at S$401,000, up from S$359,000 in September, representing a month-on-month increase of S$42,000

However, gains varied sharply across districts. District 10, which covers Tanglin, Holland, and Bukit Timah, recorded the highest median capital gain of S$754,000. In contrast, District 1, spanning areas like Boat Quay, Raffles Place, and Marina, posted a median capital loss of S$54,000.

These differences reflect how entry price, timing and localised demand cycles influence seller outcomes. In prime financial districts, higher entry costs and slower capital recovery often translate into weaker resale gains, especially for owners with shorter holding periods.

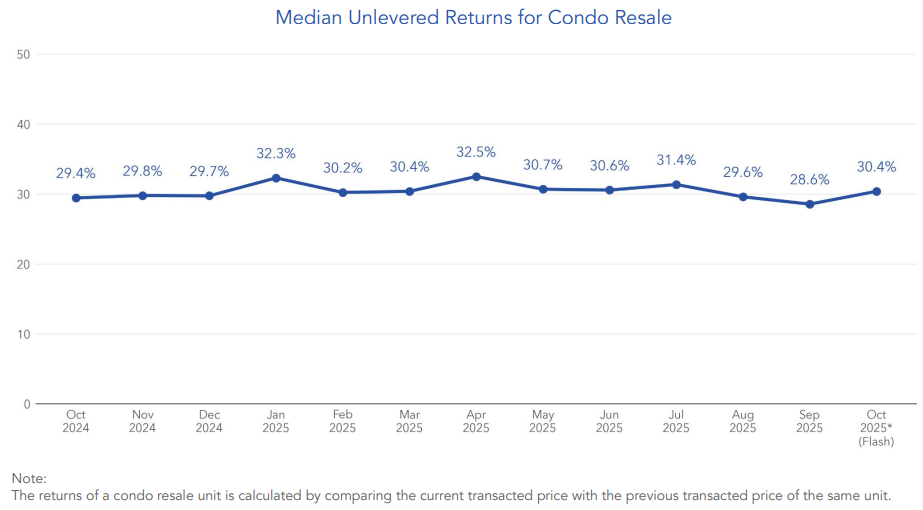

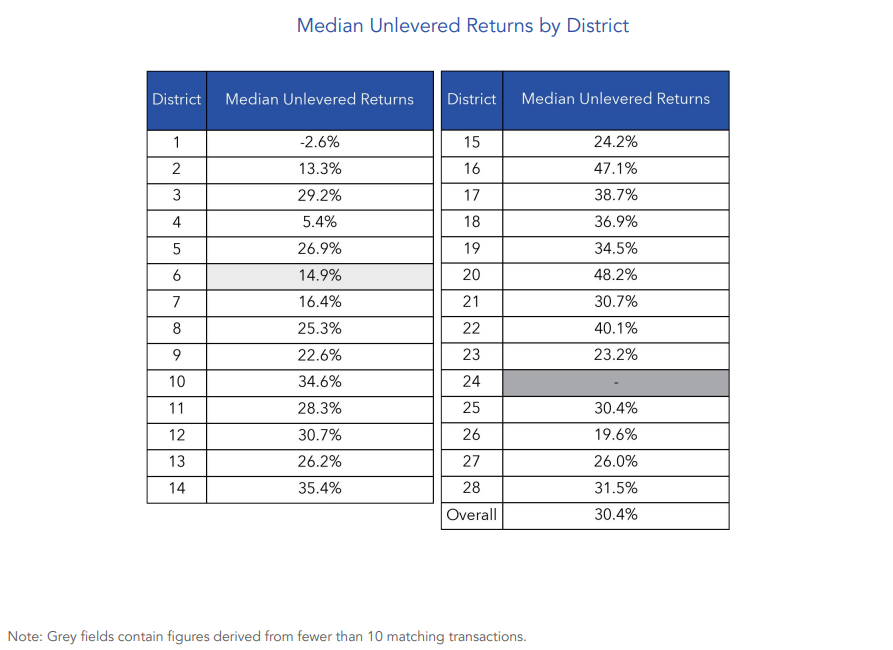

In terms of unlevered returns, which compare current resale prices to previous purchase prices without considering financing, the overall median return reached 30.4% in October. This points to sustained long-term price appreciation for many condo owners.

District 20, covering Ang Mo Kio, Bishan and Thomson, recorded the highest median unlevered return at 48.2%. Conversely, District 1 recorded a median unlevered return of –2.6%. This reflects a recurring theme in recent years, where suburban and city fringe districts often deliver more consistent capital appreciation compared to the more volatile prime core.

Highest condo resale transactions in October 2025

The most expensive resale deal was recorded at Nassim Lodge in the CCR, where a unit sold for S$14.5 million. The seller of the 4,176 sqft unit took home a record profit of S$11.5 million, as the unit was previously purchased for only around S$3 million (S$799 psf) in May 1998.

Completed in 1984, Nassim Lodge is a freehold condo located at 7 Nassim Road in prime District 10. The 8-unit boutique development, formerly known as Seven Nassim, is synonymous with old-world luxury and generational wealth. Its appeal lies not only in its address but also in its privacy, large unit sizes, and low-density environment, factors that continue to attract ultra-high-net-worth buyers and legacy owners.

For this ultra-luxury segment, price sensitivity remains lower, with buyers often prioritising prestige, land value, and long-term asset preservation over short-term market fluctuations.

RCR and OCR segments

In the RCR segment, the highest resale transaction was at Aalto, which achieved a S$5.15 million resale price. Being a freehold project along Meyer Road overlooking the East Coast, its appeal comes from a combination of low density, contemporary architecture, and coastal living not commonly found within city fringe locations.

Meanwhile, in the OCR, the top resale for October was recorded at Citylife@Tampines, with a unit selling for S$3.58 million. It is a 99-year leasehold development with proximity to the Tampines MRT interchange and shopping malls. The high resale price reflects growing willingness among upgraders and higher-income households to pay a premium for suburban living that does not compromise on amenities, connectivity, or lifestyle convenience.

The post Condo resale prices hit new highs in October 2025 despite fewer activities appeared first on .