The mixed-use Government Land Sales (GLS) site at Hougang Central has closed with a top bid of about S$1.5 billion, or S$1,179 per square foot per plot ratio (psf ppr). Located directly above Hougang MRT station, the 99-year leasehold plot is zoned for both residential and commercial use. Once completed, the mega project is expected to yield roughly 835 private homes, alongside over 430,000 sqft of retail hub that could reshape Hougang’s town centre.

Table of contents

- Hougang Central GLS tender result: S$1,179 psf ppr

- A first-of-its-kind integrated development for Hougang

- Pent-up demand after years of limited private supply

- What the land rate implies for future pricing

Hougang Central GLS tender result: S$1,179 psf ppr

| Ranking | Tenderer | Bid Price (S$) | Land Rate (S$ psf ppr) |

|---|---|---|---|

| 1 | Horizon Residential Pte. Ltd. and Horizon Commercial Trustee Pte. Ltd. | 1,500,738,338 | 1,179 |

| 2 | Sim Lian Land Pte. Ltd. & Sim Lian Development Pte. Ltd. | 1,470,500,000 | 1,155 |

| 3 | ABR Holdings Phoenix Property 1 Pte. Ltd. and Phoenix Property 2 Pte. Ltd. | 1,400,969,888 | 1,101 |

The tender closed on 16 December and drew interest from three developer groups. The highest bid was submitted by Horizon Residential (comprising CapitaLand Development, UOL, Singapore Land, and Kheng Leong) and Horizon Commercial (CapitaLand Integrated Commercial Trust) at around S$1.5 billion or S$1,179 psf ppr.

Sim Lian Group came in second with a bid of S$1.47 billion (S$1,155 psf ppr), while the third bid of about S$1.4 billion (S$1,101 psf ppr) was lodged by a Frasers Property–led consortium that included Sekisui House and Lum Chang.

The difference between the top two bids works out to just over 2%, a relatively narrow gap for a GLS tender of this magnitude. Such pricing proximity suggests shared confidence among developers in the fundamentals of the Hougang Central site — including its transport integration, commercial component, and positioning as a future civic hub for the town.

Large GLS plots with land prices exceeding S$1 billion often attract fewer bids due to the capital commitment involved. For comparison, the Chencharu Close mixed-use site, awarded for about S$1.01 billion in September 2025, also received three bids, while Zion Road Parcel A (Zyon Grand), awarded for about S$1.11 billion in April 2024, attracted just a single bid. Against this backdrop, the level of interest in the Hougang Central site underscores its appeal despite the size of the investment.

How the land rate compares with recent GLS benchmarks

In terms of GLS history, it has been over a decade since a private residential GLS site of this scale was released in Hougang. The last nearby GLS residential plot at Upper Serangoon Road was awarded at S$845 psf ppr and later developed into the 390-unit Stars of Kovan, completed in 2019.

At S$1,179 psf ppr, the Hougang Central land rate sits above several recent mixed-use GLS sites. These include the Chencharu Close site, which land rate translates to S$980 psf ppr; Tampines Street 94 (Pinery Residences), which fetched S$1,004 psf ppr in October 2024; and Tampines Avenue 11 (Parktown Residence), awarded at S$885 psf ppr in July 2023.

Viewed over time, the progression suggests that land prices for integrated developments have been edging up. However, many observers also note that the Hougang Central bid should not be seen as overly bullish. In recent months, some purely residential GLS plots in the Outside of Central Region (OCR) — without any commercial component — have crossed the S$1,300 psf ppr mark.

A first-of-its-kind integrated development for Hougang

If awarded, UOL Group and CapitaLand Development will jointly develop the residential component for sale, while CICT will develop and retain full ownership of the commercial portion.

The commercial component is expected to comprise about 300,000 sqft of net lettable area, potentially making it the largest mall in Hougang upon completion. Beyond retail, the development is envisioned as a broader civic hub, featuring sheltered public spaces, food-and-beverage offerings, and a town plaza designed for community activities and events.

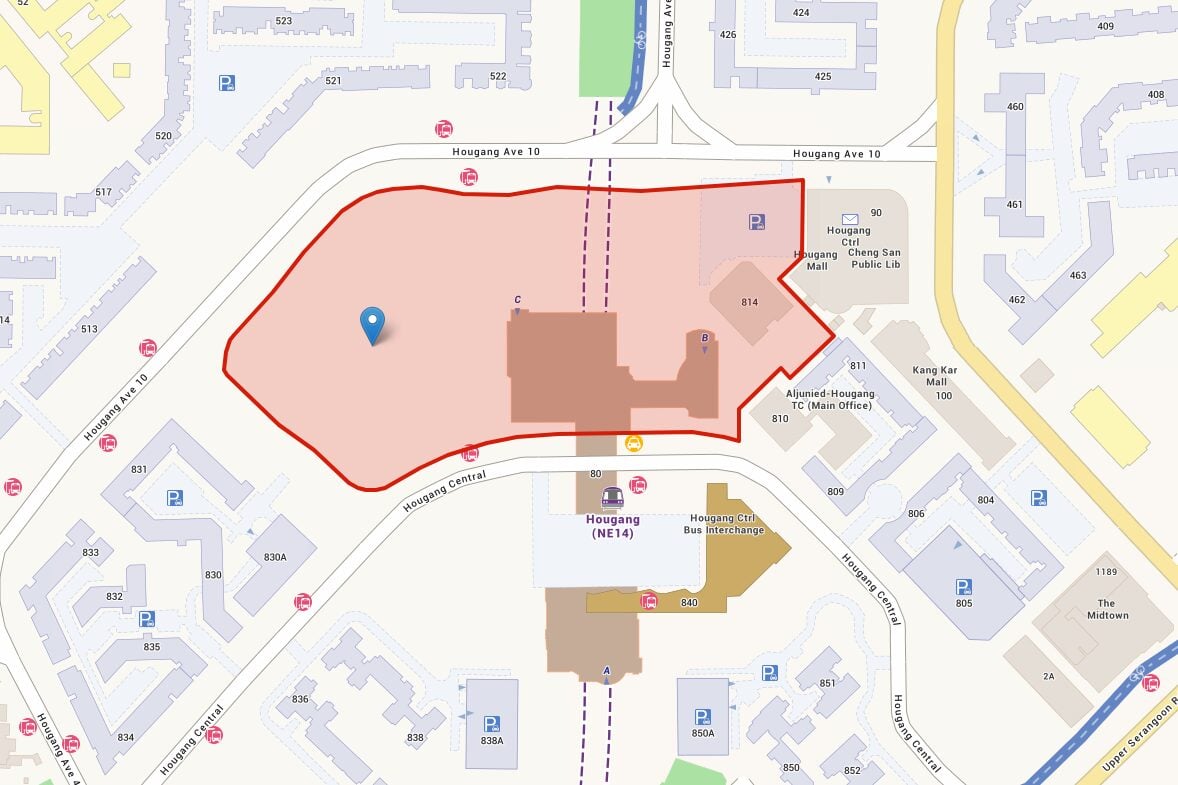

The site sits directly above Hougang MRT station on the North-East Line, which is slated to become an interchange with the Cross Island Line by 2030. The project will also integrate with the bus interchange, effectively positioning it as a key transport node for the wider Hougang area.

This level of integration is relatively rare in the neighbourhood. It will be the first mixed-use development in Hougang fully integrated with both rail and bus infrastructure, reinforcing its status as a natural focal point for daily activity in the town.

Established amenities and strong family appeal

Beyond connectivity, the Hougang Central site benefits from an established amenity base. Hougang Stadium, Hougang Sports Centre, Punggol Park, and Punggol Community Club are all within close proximity, offering recreational options that appeal to families and long-term owner-occupiers.

Schools further strengthen the site’s appeal. Montfort Junior School sits directly across the site, while schools like CHIJ Our Lady of the Nativity and Holy Innocents’ Primary School are located within 1km. This concentration of primary schools is likely to resonate with family buyers, particularly those upgrading from nearby HDB estates.

From a planning standpoint, the project is also expected to benefit from the broader transformation of Hougang Central. As an integrated transport hub with a major commercial anchor, the development could act as a catalyst for further rejuvenation of the town centre.

Pent-up demand after years of limited private supply

One of the key demand drivers for the Hougang Central GLS site is the prolonged gap in major private residential launches in the area. The last large-scale projects were Riverfront Residences (1,472 units, launched in 2018) and The Florence Residences (1,410 units, launched in 2019). Both developments are now fully sold.

Since then, new supply in Hougang has been limited to boutique projects such as Jansen House and Kovan Jewel, which are small in scale and cater to a narrower buyer segment. This has left buyers seeking a modern, full-facility private condominium in Hougang with few options in recent years.

At the same time, HDB resale prices in Hougang have risen meaningfully. Over the first 11 months of 2025, median resale prices for newer 4-room flats reached about S$675,000, while 5-room flats hit around S$830,000. These price levels suggest a sizeable pool of HDB upgraders who may be financially positioned to consider private housing.

With close to 60,000 HDB dwelling units in the town, the upgrader base is substantial. A centrally located, integrated private development could therefore unlock pent-up demand not just from Hougang residents, but also from nearby towns such as Sengkang and Punggol.

What the land rate implies for future pricing

At a top bid land rate of about S$1,179 psf ppr, most market estimates place the future project’s average selling price at above S$2,500 psf, with some expectations clustering in the S$2,500 to S$2,600 psf range.

This would mark a new price benchmark for Hougang, but it would not be out of line with recent buyer behaviour. Integrated developments with direct MRT access have consistently performed well at launch. Recent examples include Parktown Residence, which recorded a strong initial take-up rate of 87% in its first launch weekend.

Parktown Residence is particularly relevant as a reference point. Developed by the same CapitaLand–UOL partnership, the Tampines project launched earlier this year and is over 90% sold at an average price of around S$2,359 psf. While Hougang and Tampines differ in character, the comparison highlights buyers’ willingness to pay a premium for convenience, integration, and scale.

For homebuyers, the future Hougang Central development is shaping up to be a defining project — one that could reset private housing benchmarks in Hougang while reshaping the town centre for years to come.

Stay updated with the latest news and insights on Singapore’s new launch market here.

The post Hougang Central GLS plot attracts S$1.5 billion top bid from CapitaLand-UOL consortium appeared first on .