Singapore’s condo resale market continued to show price strength in November 2025, even as transaction volumes softened further amid the year-end slowdown. While resale activity declined compared to both the previous month and historical averages, prices edged higher across all regions, suggesting that underlying demand remains supportive despite fewer transactions being completed.

Table of contents

- Resale prices rise across CCR, RCR, and OCR

- Resale activity falls below long-term averages

- Median capital gains remain substantial

- Unlevered returns: 53.9% for District 21

- High-value resale deals persist despite slower activity

Resale prices rise across CCR, RCR, and OCR

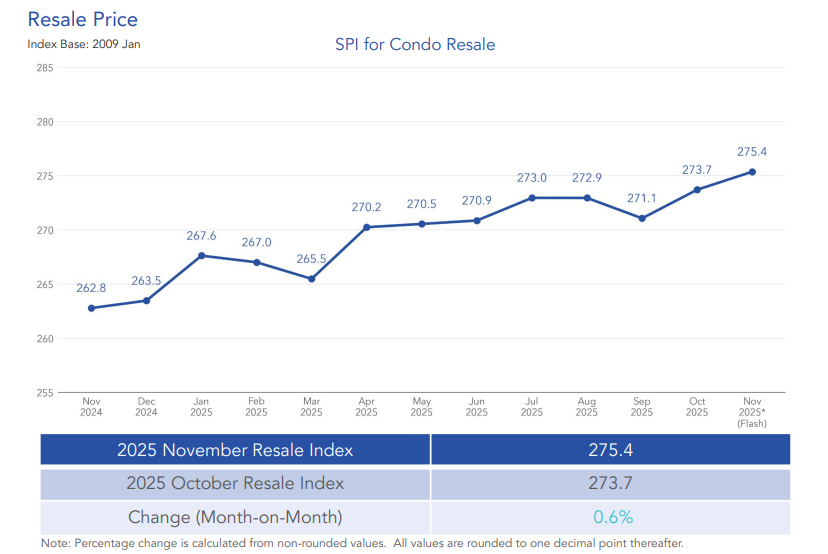

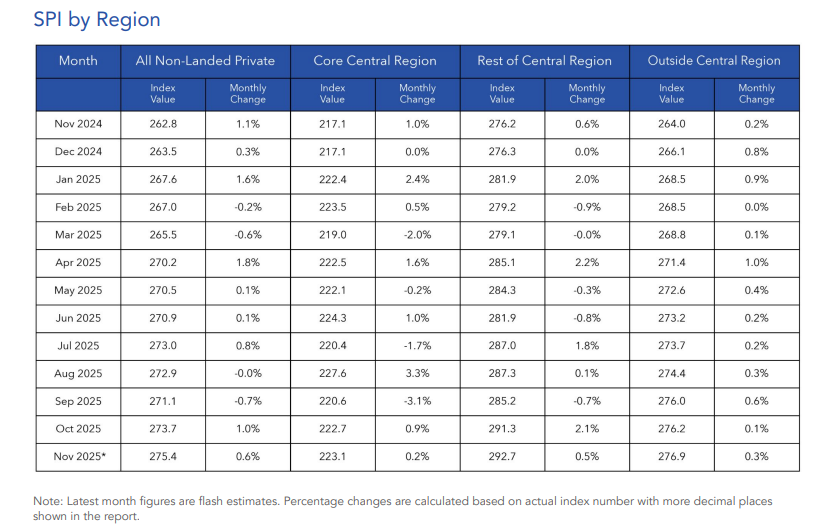

After hitting a new price high in October, the overall index for condo resale prices increased again by 0.6% month-on-month. Price gains were recorded across all market segments in November 2025.

Mr. Luqman Hakim, Chief Data & Analytics Officer at 99.co, noted that prices have continued to find support. “Prices recorded modest gains across the CCR, RCR, and OCR, indicating that price movements remained supported despite lower transaction activity.”

The Core Central Region (CCR) posted a 0.2% monthly increase, while prices in the Rest of Central Region (RCR) rose 0.5%. The Outside Central Region (OCR) also recorded a 0.3% increase, reinforcing the continued price resilience of suburban resale markets.

On a year-on-year basis, the price trend remains firm. Overall condo resale prices were 4.8% higher than in November 2024. Among the regions, the RCR led annual growth with a 6% increase, followed by the OCR at 4.9%, while the CCR recorded a more moderate 2.8% rise. The stronger growth in the RCR and OCR reflects sustained demand for comparatively more affordable resale options outside the prime core.

Resale activity falls below long-term averages

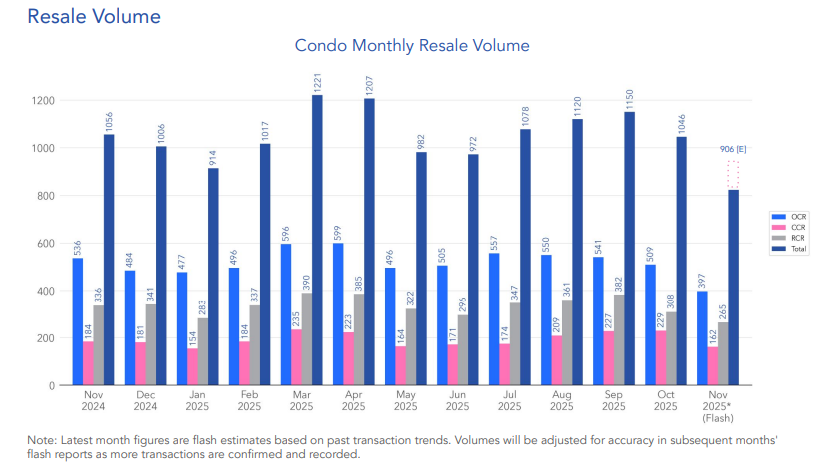

Transaction volumes moderated further in November. An estimated 906 resale units were transacted during the month, marking a 13.3% decline from October’s 1,046 units.

The slowdown was also evident on an annual basis, with resale volumes 14.2% lower than in November 2024. Compared to historical trends, November’s activity fell short of typical levels. Resale volumes were 11.2% below the five-year average for November.

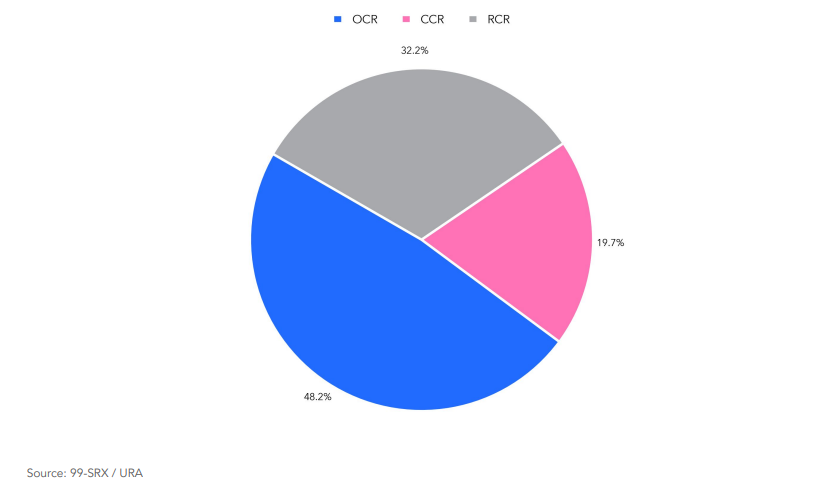

By region, the OCR accounted for the largest share of transactions at 48.2% in November 2025, reflecting its continued role as the primary driver of resale activity. The RCR contributed 32.2% of total resale transactions, while the CCR made up 19.7%.

The trend highlights the concentration of resale demand in suburban and city-fringe locations, where price points remain more accessible to owner-occupiers and upgraders.

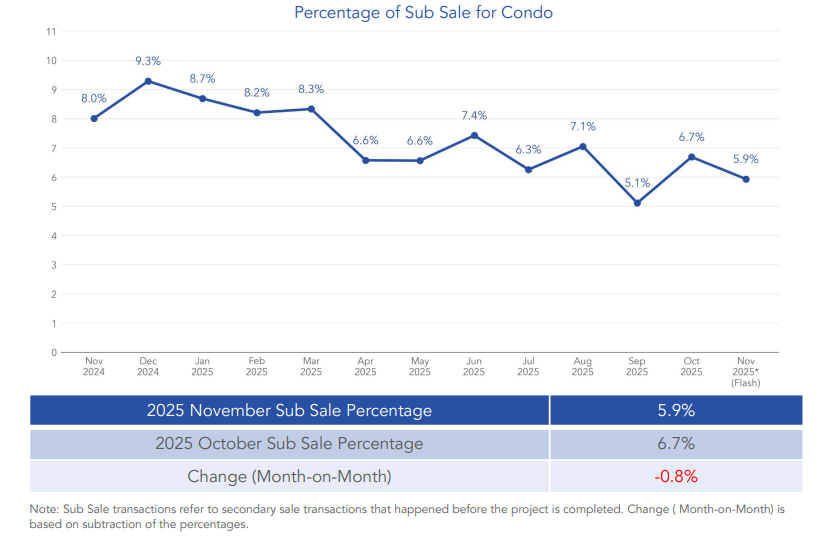

Sub-sale transactions continue to taper

Sub-sale transactions, which involve secondary sales of units before project completion, made up 5.9% of total secondary transactions in November 2025. This was down from 6.7% in October, representing a 0.8% decline month-on-month.

The reduction in sub-sale activity suggests a cooling in pre-completion trading and points to a secondary market increasingly driven by completed homes. This shift aligns with a more cautious market environment, where buyers appear to prefer physical inspection and immediate occupation over forward-looking purchases.

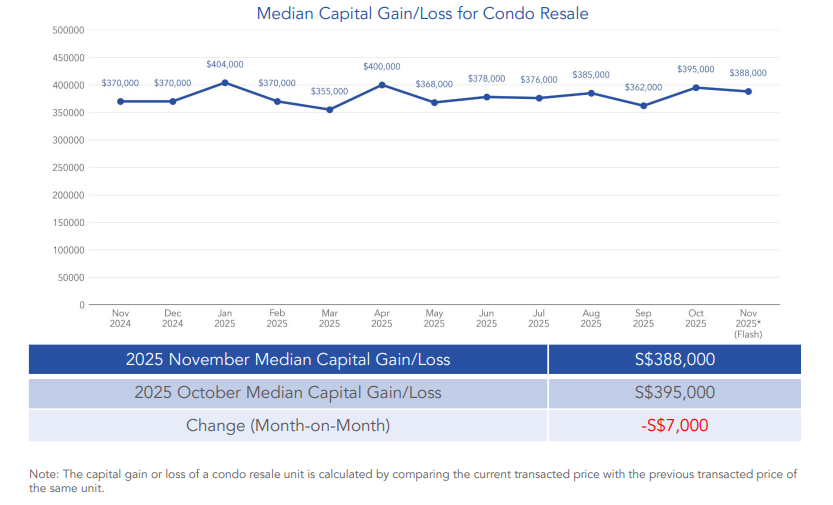

Median capital gains remain substantial

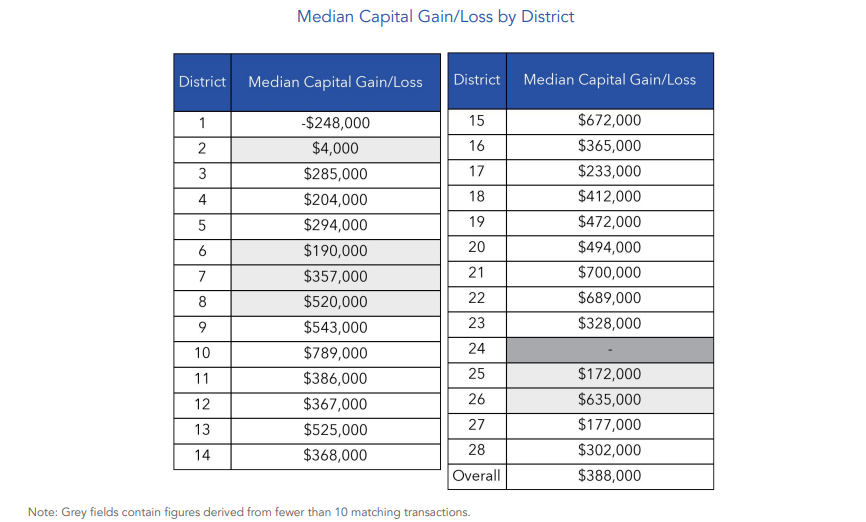

The overall median capital gain for resale condos stood at S$388,000 in November 2025, down marginally from S$395,000 in October. While the monthly figure softened slightly, capital gains remained significant, reflecting the longer-term price appreciation seen across much of the resale market.

At the district level, outcomes varied widely. District 10 (Tanglin / Holland / Bukit Timah) recorded the highest median capital gain at S$789,000, underscoring the strong long-term performance of prime residential locations. In contrast, District 1 (Boat Quay / Raffles Place / Marina) posted the lowest median capital gain at –S$248,000, reflecting greater price volatility in the ultra-luxury segment.

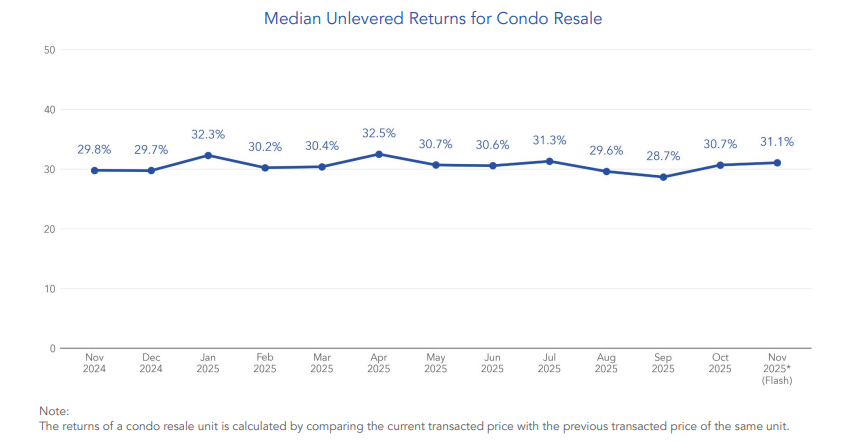

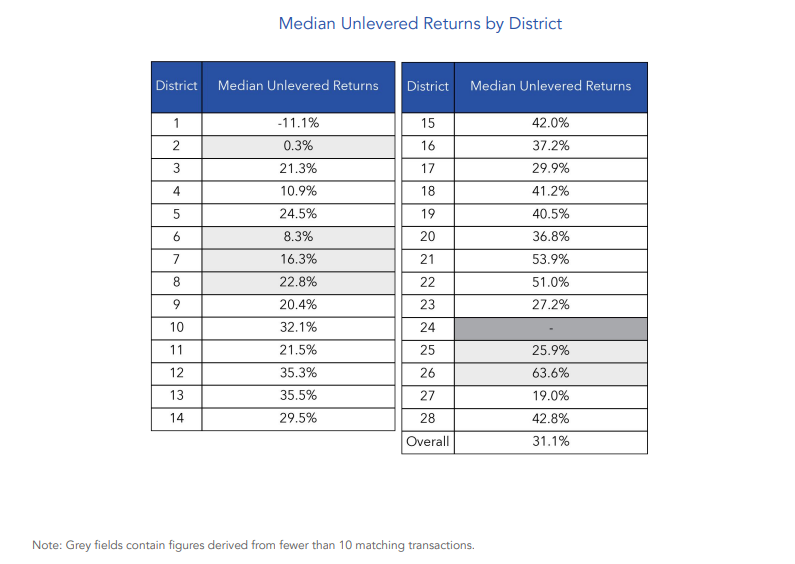

Unlevered returns: 53.9% for District 21

Median unlevered returns across all resale condos came in at 31.1% in November 2025. This indicates that, on average, resale sellers continue to realise healthy returns relative to their previous purchase prices.

Performance, however, varied significantly by district. District 21 (Clementi Park / Upper Bukit Timah) posted the highest median unlevered return at 53.9%, reflecting strong price appreciation over time. At the other end of the spectrum, District 1 recorded a median unlevered return of –11.1%.

It is worth noting that districts with fewer than 10 matching transactions were excluded from these rankings, ensuring that the figures reflect more established resale trends rather than isolated deals.

High-value resale deals persist despite slower activity

Even as overall volumes declined, high-value resale transactions continued to be recorded in November. The highest transacted resale price during the month was S$20 million for a unit at Sculptura Ardmore. The project is an iconic freehold residence in the exclusive Ardmore Park enclave. Rising 36 storeys with just 35 luxury apartments of spacious 4- and 5-bedders, it sets a benchmark for luxury living within the CCR.

In the RCR, the most expensive resale transaction was a unit at The Waterside, which changed hands for S$5.53 million. Meanwhile, the OCR saw a unit at Seaside Residences resold for S$4.4 million, highlighting the increasing presence of large-ticket transactions outside the prime core.

Wrapping up

Overall, November’s data paints a picture of a condo resale market that is easing in activity but holding firm on prices. Transaction volumes have fallen below both month-ago levels and historical norms, yet price indices continue to edge higher, supported by demand for completed units and sustained interest in resale homes across the RCR and OCR.

As the market moves through the year-end festive period, resale activity is likely to remain subdued. Clearer signals on buyer sentiment and pricing momentum are expected to emerge in early 2026, when seasonal effects fade, and broader economic and interest-rate expectations become clearer.

The post Condo resale prices continue to increase as volumes decline in November appeared first on .