The Urban Redevelopment Authority (URA) and Housing & Development Board (HDB) have released their Q4 2025 flash estimates, offering a snapshot of how Singapore’s housing market closed out the year. Across both private and public housing segments, the latest figures point to slower price momentum, suggesting that market conditions are becoming more measured after several years of strong growth.

Table of contents

- Private home prices continue to rise, but momentum softens

- HDB resale prices hold flat for the first time since 2020

- A more measured market heading into 2026

Private home prices continue to rise, but momentum softens

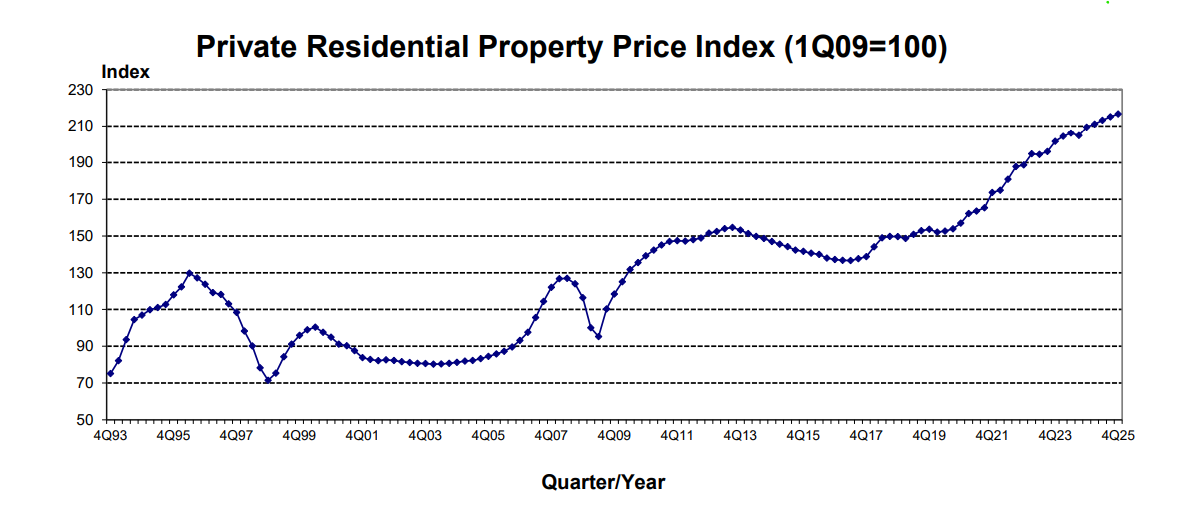

According to URA’s flash estimate, the overall private residential property price index rose by 0.7% quarter-on-quarter in Q4 2025, easing from the 0.9% increase recorded in the previous quarter.

While this marks the fifth consecutive quarter of price growth, the moderation is notable. For the whole of 2025, private home prices rose by 3.4%, down from the 3.9% increase in 2024. Importantly, this was also the smallest annual increase since 2020.

In other words, prices are still rising, but they are doing so at a more measured and sustainable pace. Commenting on the trend, Mr. Luqman Hakim, Chief Data & Analytics Officer at 99.co, said Singapore’s private residential market continued to show resilience in 2025, supported by upgrader demand and a lower interest rate environment. At the same time, the slower pace of price growth compared to 2024 points to more deliberate and measured buying decisions.

Landed homes lead price growth in Q4 2025

A key driver of price growth in the fourth quarter came from the landed housing segment.

URA’s data shows that landed property prices jumped by 3.5% quarter-on-quarter in Q4 2025, a sharp acceleration from the 1.4% increase in Q3. This was also the strongest quarterly rise for landed homes in about two years.

Across the whole of 2025, landed home prices rose by 7.7%, significantly outpacing the 0.9% increase seen in 2024. This divergence highlights how landed properties continue to benefit from structural factors such as limited supply and steady demand from wealthier owner-occupiers.

Even though transaction volumes for landed homes were lower compared to earlier quarters, prices still moved higher. This suggests that sellers remain firm on expectations, while buyers who are active in this segment tend to be less sensitive to short-term market fluctuations.

Non-landed prices dip slightly after a long growth run

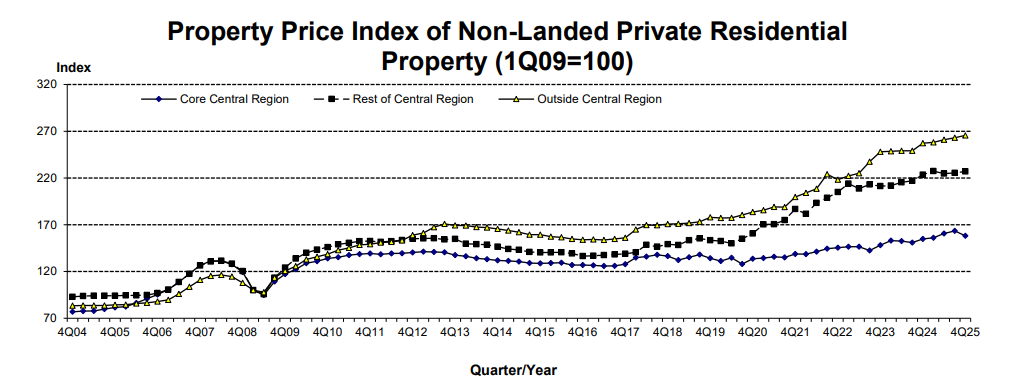

In contrast, non-landed private residential prices edged down by 0.1% quarter-on-quarter in Q4 2025, reversing the 0.8% increase recorded in Q3.

This marks the first quarterly decline in non-landed prices since Q2 2023, following a prolonged period of steady growth. However, the pullback was uneven across regions, pointing to differing dynamics within the market.

For the full year, non-landed home prices still rose by 2.4%, although this was slower than the 4.7% increase in 2024. This slowdown reflects growing price resistance among buyers, particularly in higher-priced segments.

Sharp divergence across market regions

When broken down by region, price movements in Q4 2025 showed clear divergence.

- Core Central Region (CCR) prices fell by 3.2% quarter-on-quarter, snapping a four-quarter growth streak.

- Rest of Central Region (RCR) prices rose by 0.7%, improving on the 0.3% increase in the previous quarter.

- Outside Central Region (OCR) prices increased by 1.0%, slightly higher than the 0.8% rise in Q3.

Mr. Luqman noted that the softer non-landed performance was largely due to shifting demand patterns, with buyer interest flowing towards selected new launches instead of the resale segment.

He highlighted that pricing in the CCR was affected by the introduction of The Skye at Holland in District 10, which was well received by buyers. The project saw 662 units transacted at a median price of around S$2,948 psf, underscoring continued demand for well-located new launches despite overall price moderation.

New launch activity helped support overall market sentiment

Despite the softer price growth, new home sales activity remained robust in Q4 2025, providing underlying support to the private residential market.

Several projects launched during the quarter saw strong take-up rates, reflecting sustained buyer interest when pricing and location align with expectations. Across the year, developers sold over 10,000 new private homes, marking the strongest annual performance since 2021.

This strong primary market activity suggests that demand has not disappeared. Instead, buyers are focusing on projects they perceive as offering clearer value, particularly in an environment where interest rates have eased from earlier highs.

Government maintains strong supply through GLS programme

To continue supporting housing demand and prevent excessive price pressure, the Government has kept a firm focus on supply.

Under the Confirmed List of the first half 2026 GLS Programme, 4,575 private residential units will be put up for tender. This figure is about 50% higher than the average Confirmed List supply per GLS programme over the past decade.

In addition, a further 4,610 units are available under the Reserve List. Taken together, this brings the total potential supply for the first half of 2026 to nearly 9,200 units, which is broadly comparable to the supply released in the second half of 2025.

This sustained pipeline plays an important role in anchoring market expectations. By ensuring a steady flow of new sites, policymakers are signalling a commitment to long-term stability rather than short-term intervention.

HDB resale prices hold flat for the first time since 2020

Alongside the private housing data, HDB also released its flash estimate for the Q4 2025 Resale Price Index (RPI), offering important insights into the public housing market.

Based on the flash estimate, the RPI came in at 203.6, largely unchanged from 203.7 in Q3 2025. This marked the first time HDB resale prices have remained flat since Q1 2020.

This outcome followed four consecutive quarters of slower price growth, with the last three quarters of 2025 each recording increases of under 1%. For the full year, resale flat prices rose by 2.9%, a sharp moderation from the 9.7% increase in 2024, and the slowest annual growth since 2019.

Taken together, the data points to a resale market that has reached a more stable phase after several years of rapid price appreciation.

Resale volumes continue to soften

Resale activity also weakened toward the end of the year. In Q4 2025, about 5,129 resale flats were transacted, representing an 18.8% year-on-year decline compared to the same period in 2024. This was the second consecutive quarter to see a double-digit year-on-year drop in resale volume.

For the full year up to 30 December 2025, total resale volume came in at 26,042 units, down 9.8% from 2024. This marked the first annual decline in resale transactions since 2023, and the magnitude of the drop was more pronounced than in previous downturns.

Several factors likely contributed to this slowdown, including greater buyer price sensitivity, a steady pipeline of new flats drawing demand away from the resale market, and the typical year-end lull in transaction activity.

Million-dollar flats persist despite softer overall conditions

Even as overall resale prices stabilised, certain segments continued to see strong demand. In particular, high-end resale flats remained active, with a growing number of transactions crossing the million-dollar mark in 2025.

This trend reflects ongoing demand for larger units in mature estates, especially among households prioritising space and location. While these transactions remain a small share of the overall market, they continue to influence headline narratives and highlight the uneven nature of demand within the resale segment.

Upcoming BTO supply provides additional support

Looking ahead, supply in the public housing market will remain robust. In February 2026, HDB is expected to launch around 4,600 new BTO flats across Bukit Merah, Sembawang, Tampines, and Toa Payoh. In addition, a concurrent Sale of Balance Flats (SBF) exercise will offer about 3,000 units.

This steady supply pipeline is likely to continue shaping buyer behaviour, particularly among first-time buyers weighing new flats against resale options.

A more measured market heading into 2026

The URA and HDB flash estimates suggest that Singapore’s housing market is entering a more balanced phase. Price growth in both private and public housing has slowed, resale activity has softened, and supply remains firmly in focus.

According to Mr. Luqman, private residential prices in 2026 are expected to register moderate growth, supported by relatively low borrowing costs. However, affordability constraints and slower HDB resale price growth could steer buyers towards more selective, value-focused purchasing decisions.

Taken together, the Q4 2025 flash estimates from URA and HDB point to a housing market that is no longer accelerating, but one that remains underpinned by stable demand, improving supply conditions, and more disciplined buyer behaviour.

The post URA and HDB Q4 2025 flash estimates point to a slower, more stable housing market appeared first on .