The Singapore condo resale market has been experiencing a mid-year lull since May. With school holidays in full swing and new BTO launches, resale activity remained slow even in June 2025.

Market fundamentals, on the whole, remained stable. With interest rates stabilising and inflation easing, buyer sentiment showed cautious optimism, supporting a relatively steady month-on-month performance.

Table of Contents

- Key highlights

- Transaction volume and regional trends

- Price movements

- High-value transactions in June 2025

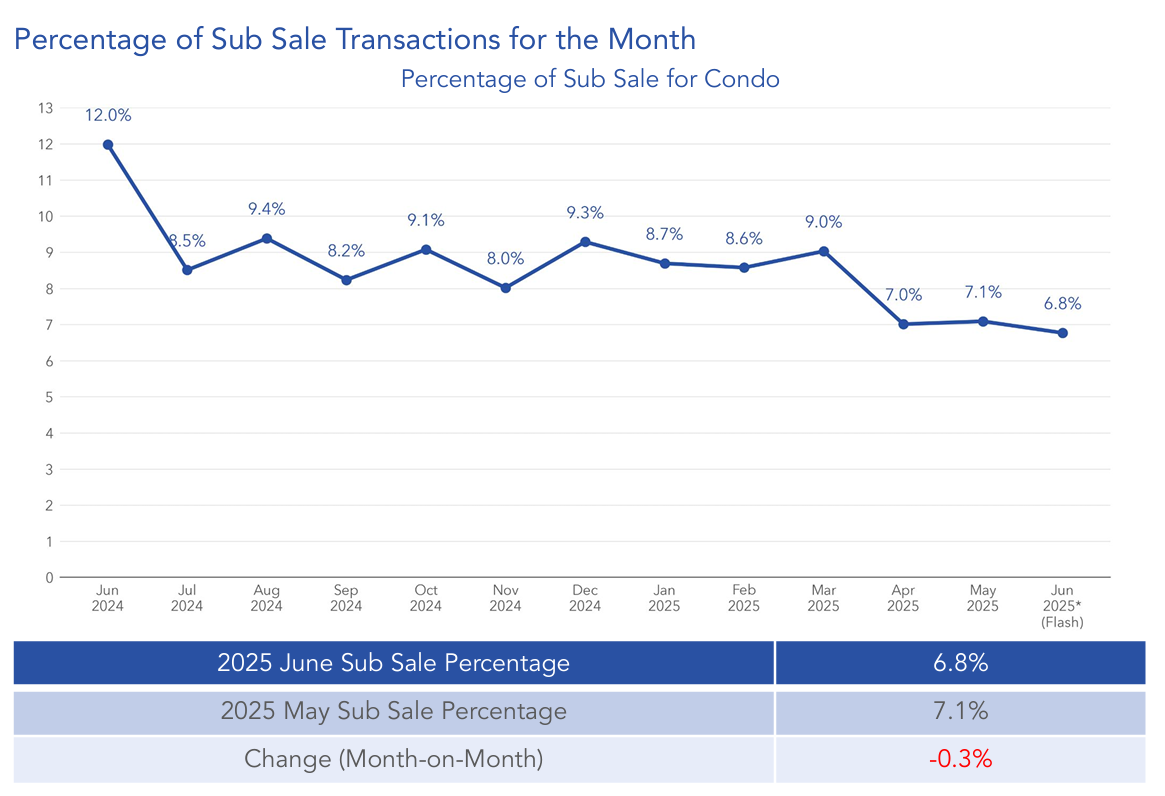

- Sub-sale activity

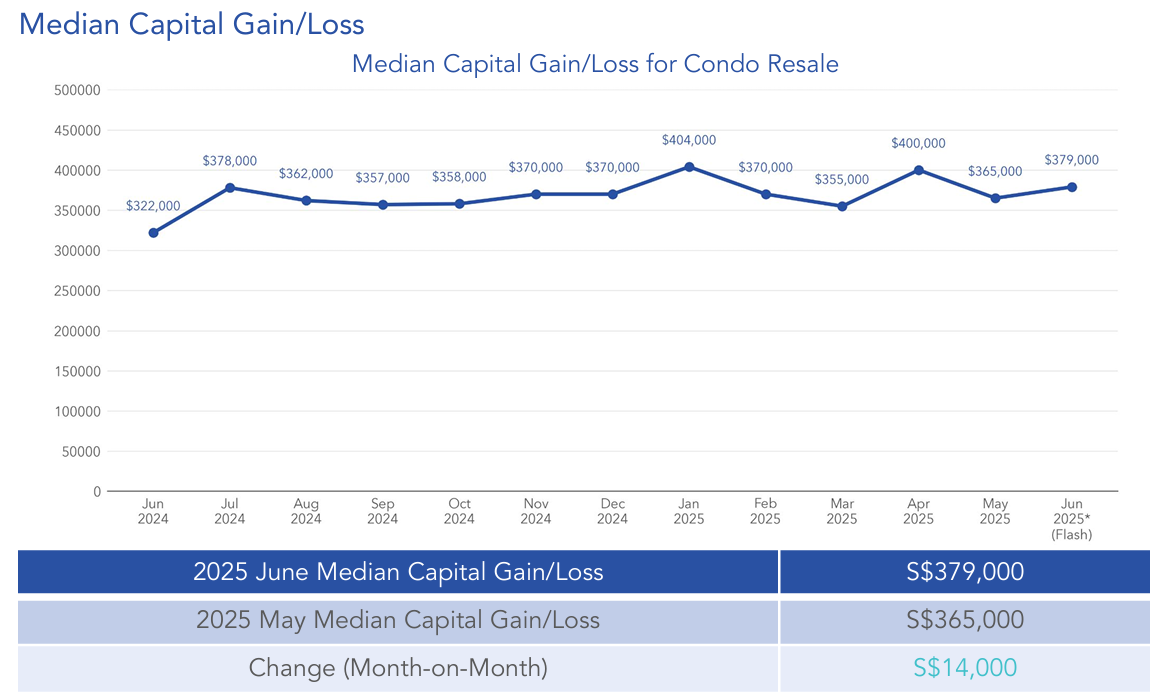

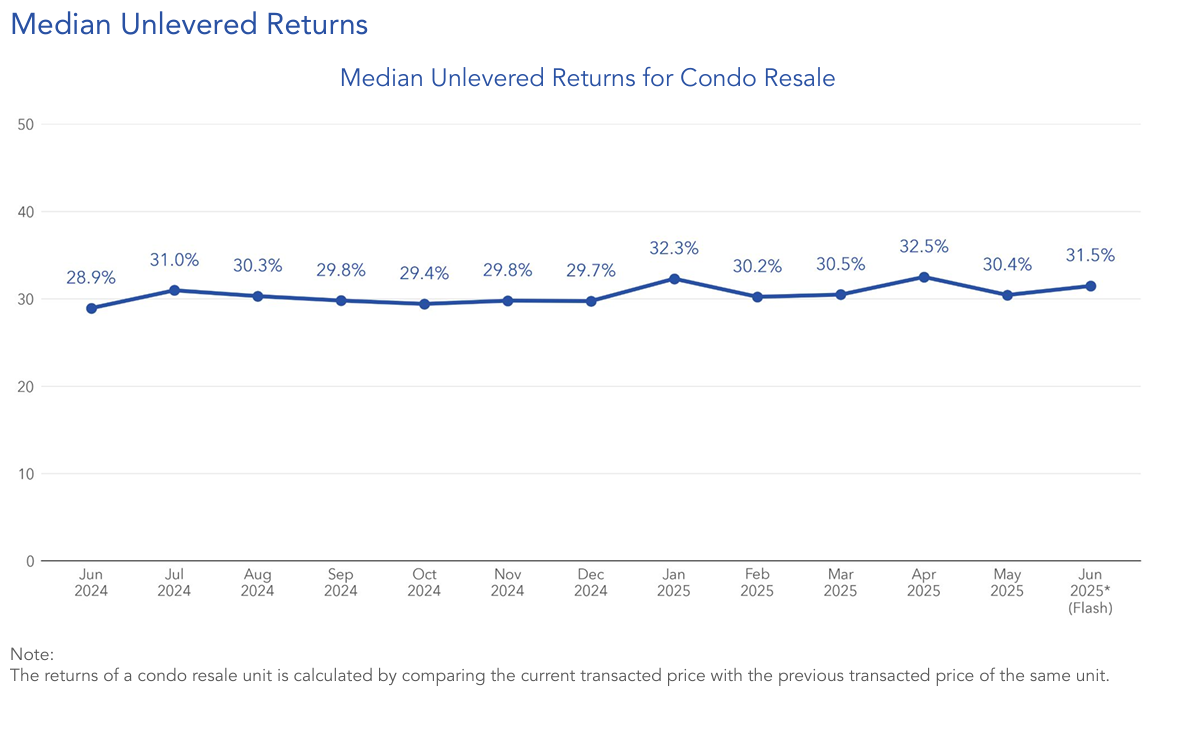

- Capital gains and investment returns

- Outlook

Key highlights

| Indicator | June 2025 | May 2025 | Change |

|---|---|---|---|

| Overall Resale Price Index | 270.4 | 270.3 | +0.04% |

| Total Resale Volume | 955 units | 957 units | -0.2% |

| Median Capital Gain | S$379,000 | S$365,000 | +S$14,000 |

| Sub-sale Share of Transactions | 6.8% | 7.1% | -0.3 pts |

Transaction volume and regional trends

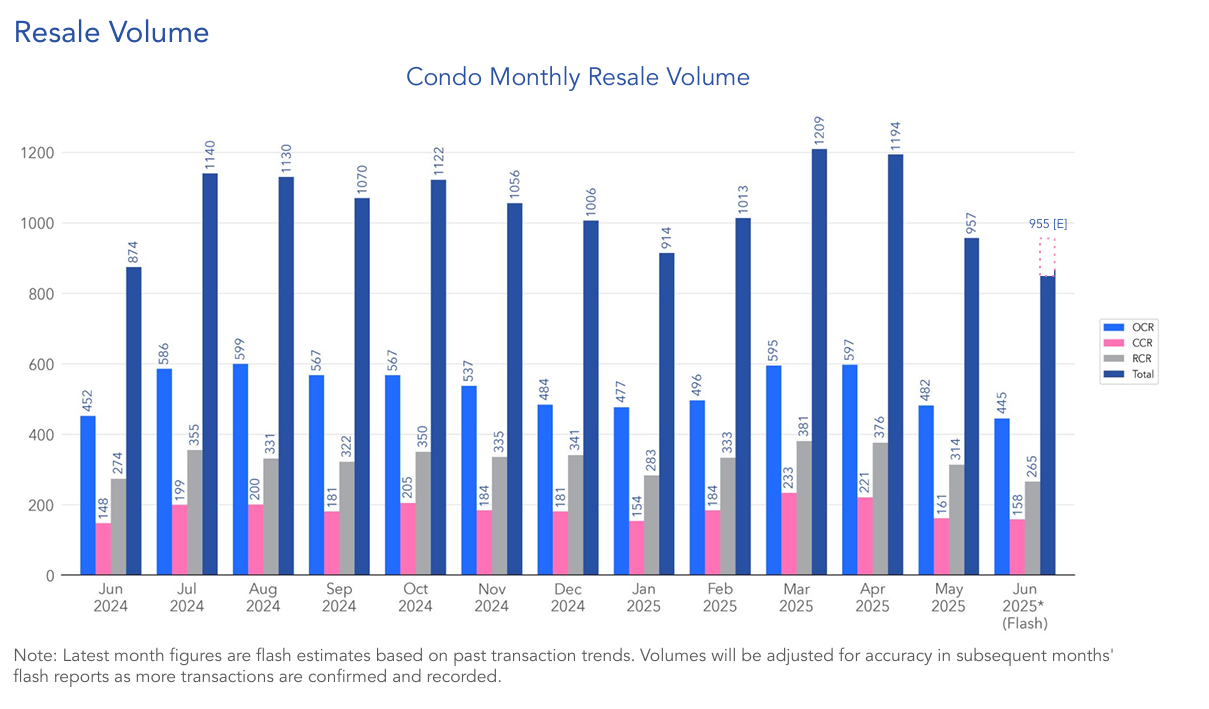

An estimated 955 resale condo units changed hands in June 2025, a marginal 0.2% decline from 957 units in May. Despite the dip, this volume is 9.2% higher than in June 2024 and 10.4% above the five-year average for the month.

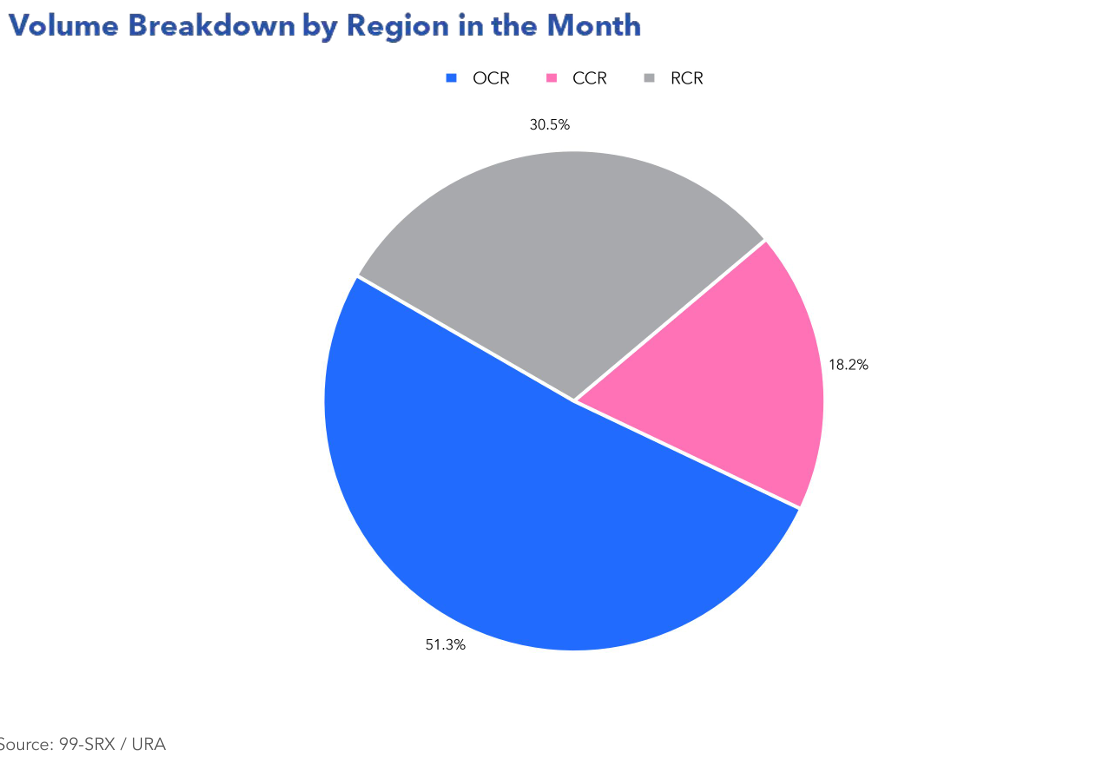

Regionally, OCR remained the most active market, accounting for 51.3% of resale transactions. RCR contributed 30.5%, while CCR made up 18.2%. The dominance of OCR highlights ongoing affordability considerations among buyers, who are gravitating towards more spacious and cost-effective homes in suburban locations.

Price movements

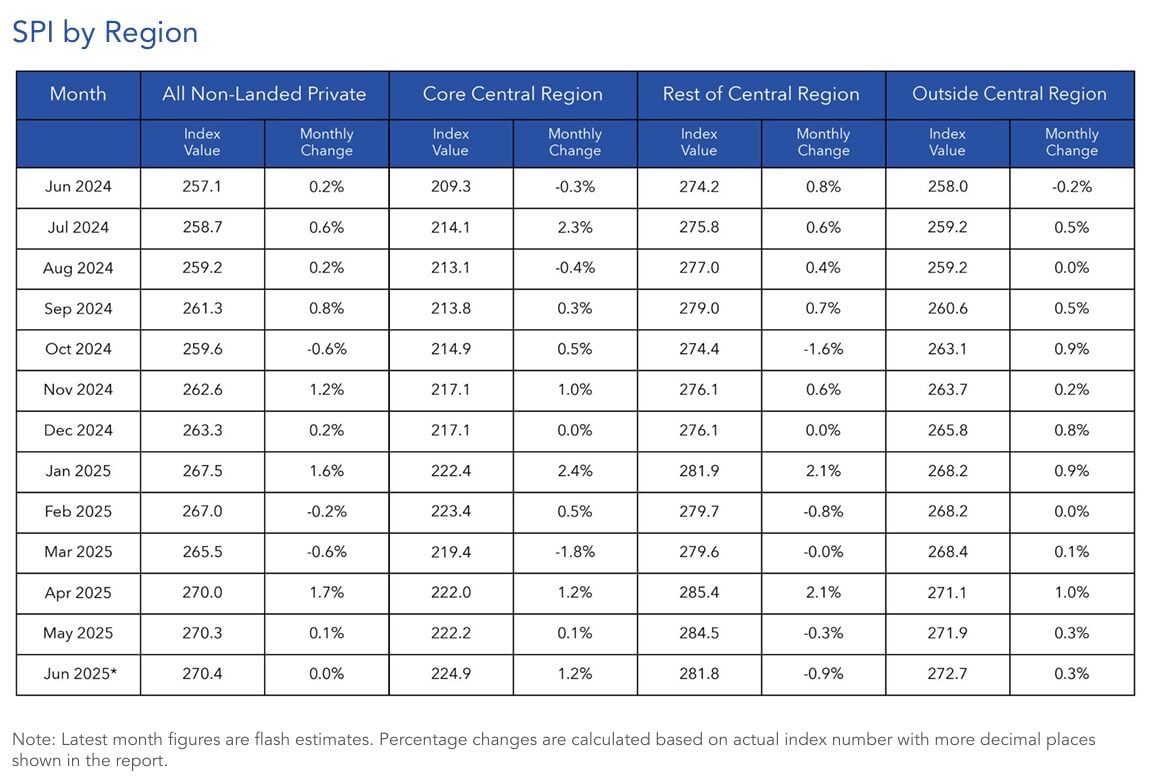

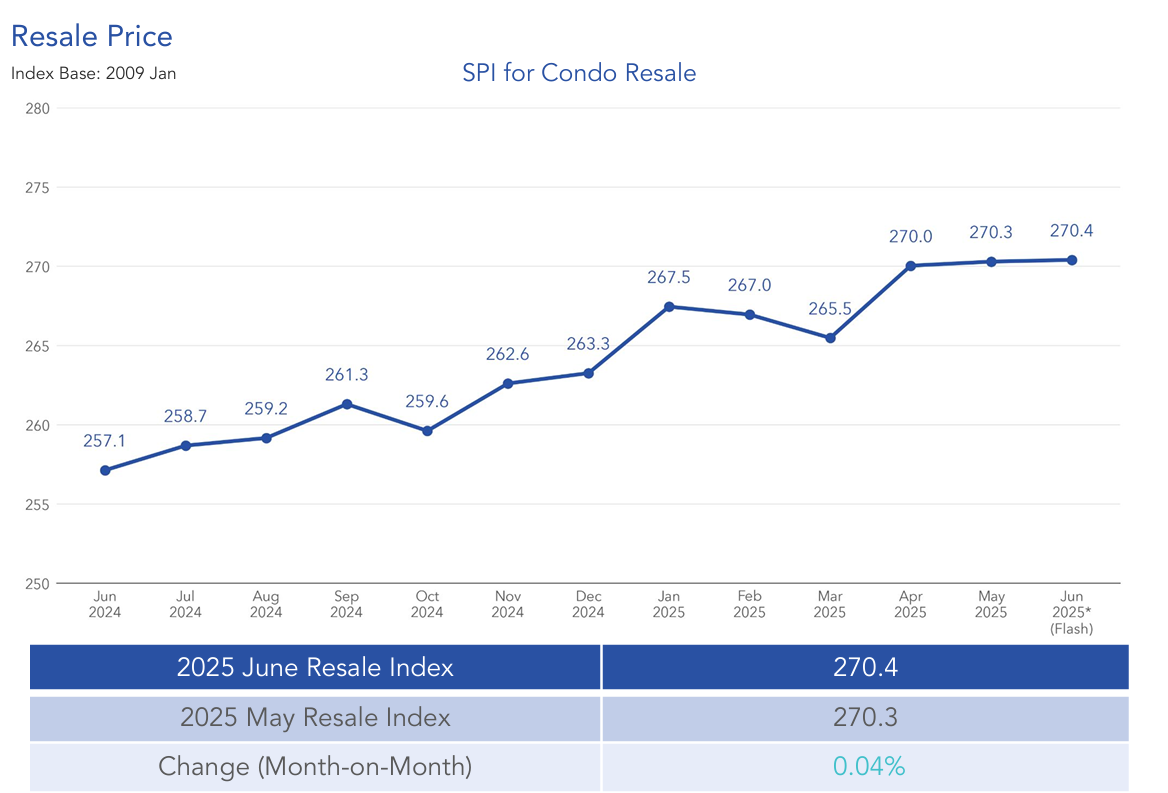

Resale condo prices remained largely unchanged month-on-month, rising a marginal 0.04% in June 2025. Regionally, the Core Central Region (CCR) saw a 1.2% increase, while the Outside Central Region (OCR) rose by 0.3%. In contrast, the Rest of Central Region (RCR) dipped by 0.9%.

On a year-on-year basis, prices showed stronger growth, climbing 5.2% overall. CCR led with a 7.4% increase, followed by OCR at 5.7% and RCR at 2.8%. These figures indicate steady long-term value appreciation in spite of monthly fluctuations.

High-value transactions in June 2025

The most expensive resale transaction in the month was recorded at Sculptura Ardmore in the CCR, with a sale price of S$20 million. Known for its ultra-exclusive design by renowned architect Carlos Zapata, Sculptura Ardmore commands some of the highest prices in Singapore’s luxury segment.

Its appeal lies in its dramatic cantilevered balconies, panoramic views over the Orchard skyline, and a private lift lobby for each residence. With just 34 units in the entire development and a location nestled in the prestigious Ardmore Park enclave, it continues to attract ultra-high-net-worth buyers looking for privacy, prestige, and architectural flair.

In the RCR, a unit at Camelot By-The-Water fetched S$5 million. Located in Tanjong Rhu, this development is prized for its large-format units and resort-style facilities. Residents enjoy tranquil waterfront views, access to recreational amenities like the Geylang Park Connector and Marina Bay, and excellent connectivity to the CBD via the upcoming Katong Park MRT station.

The neighbourhood has become increasingly desirable thanks to the nearby Kallang Alive! development, which is transforming the area into a sports and entertainment hub.

Meanwhile, in the OCR, Ocean Park saw its highest transaction at S$4.2 million. This freehold project along East Coast Road has long been valued for its generously sized units, many of which exceed 2,000 sqft, making it an attractive option for multi-generational families or those upgrading from HDB flats.

Its location offers direct access to East Coast Park, the upcoming Marine Terrace MRT station, and a thriving food scene. Coupled with its proximity to reputable schools such as Tao Nan School and CHIJ Katong, Ocean Park continues to stand out in the resale market.

Sub-sale activity

Sub-sale transactions represented 6.8% of total secondary sales in June 2025. This marks a slight decline from May’s 7.1%, suggesting a softening in speculative activity. We may see sub-sale activity dip even further in the coming months in light of recent SSD policy changes.

Capital gains and investment returns

The median capital gain for condo resale units in June was S$379,000, a S$14,000 increase from May. District 10 (Tanglin / Holland / Bukit Timah) recorded the highest median capital gain at S$841,000. At the other end of the spectrum, District 1 (Boat Quay / Raffles Place / Marina) saw the lowest median capital gain at -S$25,000.

When it comes to investment performance, the median unlevered return stood at 31.5%. District 16 (Bedok / Upper East Coast) posted the highest return at 46.1%, while District 1 again ranked lowest with a return of -2.3%. These figures are calculated by comparing the most recent transacted price of a unit with its previous sale price.

When it comes to investment performance, the median unlevered return stood at 31.5%. District 16 (Bedok / Upper East Coast) posted the highest return at 46.1%, while District 1 again ranked lowest with a return of -2.3%. These figures are calculated by comparing the most recent transacted price of a unit with its previous sale price.

Condo resale market outlook

Despite a seasonal slowdown due to the June holidays and global macroeconomic changes, the condo resale market has remained impressively steady. Buyers are continuing to explore resale options, buoyed by signs of economic stability, lower inflation, and more predictable interest rates.

While short-term dips in volume are expected during quieter periods, long-term trends suggest sustained resilience in the condo resale segment.

Stay tuned to 99.co Insider for upcoming monthly market insights and property news.

The post Condo resale market remains steady in June amid mid-year pause appeared first on .