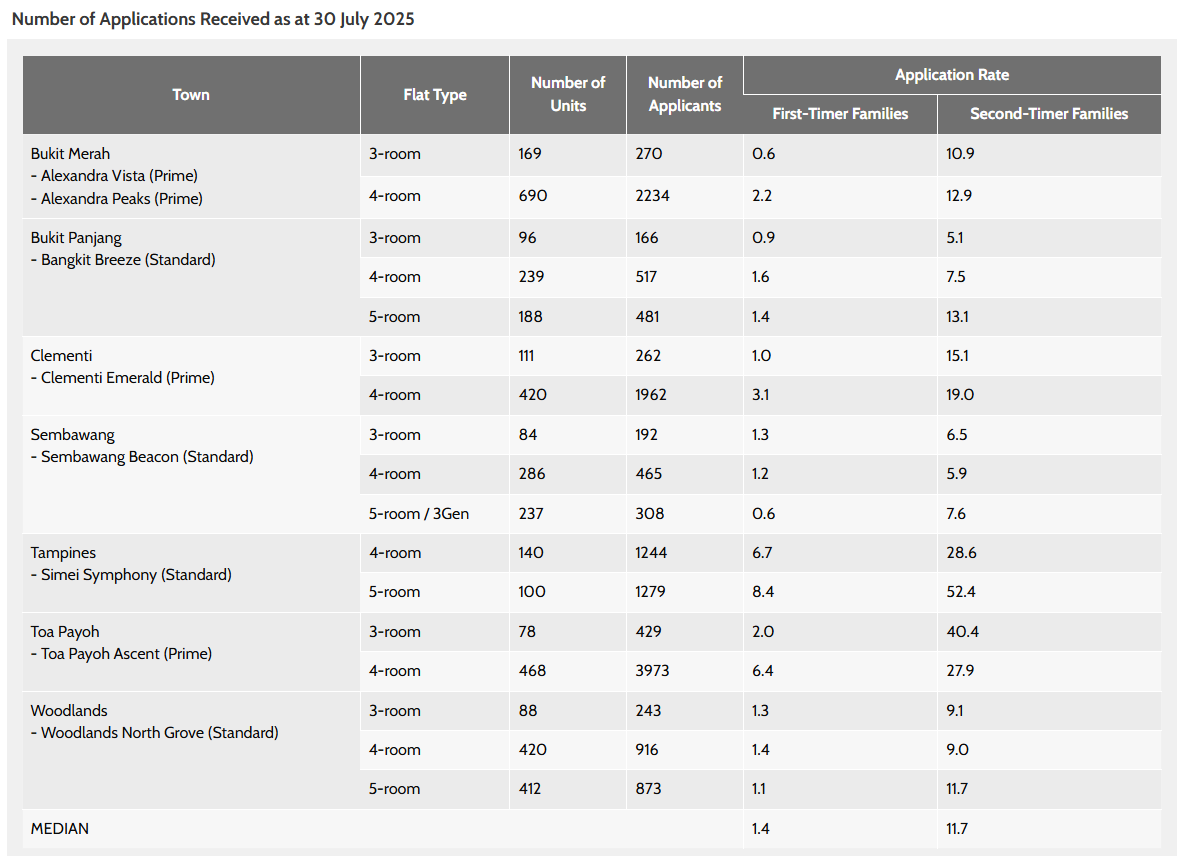

The HDB July BTO exercise has now officially closed. According to the latest numbers, 20,994 applications were received for the 5,547 flats on offer.

These figures reflect continued strong demand across a range of flat types, particularly in centrally located towns such as Toa Payoh, Clementi, and Simei. The exercise also marked the first rollout of the new Family Care Scheme, designed to give singles and families priority when applying to live near parents.

Together with the Deferred Income Assessment and increased second-timer quotas, these changes have begun to shape both application patterns and demand.

Table of Contents

- TL;DR: Key takeaways

- Demand remains high for 2-room Flexi flats

- Larger flat types in Toa Payoh and Simei in highest demand

- Modest demand among other areas

TL;DR: Key takeaways

- Simei Symphony saw the highest demand for 2-room Flexi flats among first-timer singles, with 38.7 applicants per unit.

- Toa Payoh Ascent 3-room flats saw the second-highest second-timer rate, at 40.4 per unit.

- 2-room Flexi demand remained strong, with 43.9 first-timer singles per unit at Simei.

- Clementi Emerald and Toa Payoh Ascent also drew heavy competition for 4-room flats from second-timer families.

- Demand in non-mature towns remained moderate, keeping them viable for budget-conscious buyers.

Demand remains high for 2-room Flexi flats

2-room Flexi flats, designed primarily for seniors, saw consistent demand. Seniors aged 55 and above often downsize from larger flats to monetise their existing homes and unlock retirement income. These units are offered with flexible leases ranging from 15 to 45 years, which makes them significantly more affordable than the typical 99-year lease.

Singles aged 35 and above, also subscribed heavily to 2-room Flexi units as it remains the best way for them to get a brand new BTO unit. Since October 2024, this group can apply for such flats across all estate types—Standard, Plus, and Prime—which has considerably broadened their options.

Among all towns, Simei Symphony stood out with 43.9 first-timer single applicants per unit, the highest ever recorded, surpassing Toa Payoh Ascent (34.4). Bangkit Breeze (33.6) and Clementi Emerald (29.6) also saw elevated application rates from singles.

For comparison, the last time demand reached similar levels was during the October 2024 BTO launch, when 2-room Flexi flats in Bukit Batok drew 33.4 applicants per unit, followed by Kallang/Whampoa at 27.7.

Simei Symphony is located adjacent to Upper Changi MRT Station on the Downtown Line, with Exit D leading directly to the project. All blocks are within a short walk from the station.

Toa Payoh Ascent is within a 10-minute walk of both Caldecott MRT (Circle and Thomson-East Coast Lines) and Braddell MRT (North-South Line). These transport links, combined with their location in mature estates, enhance their appeal to both younger buyers and seniors. Most importantly, this project has a relatively shorter wait time of 41 months which adds to its appeal.

Starting prices for 2-room Flexi flats begin at S$212,000 at Toa Payoh Ascent and S$193,000 at Simei Symphony. In the other projects, 2-room Flexi units can range from S$148,000 at Sembawang Beacon to S$214,000 at Clementi Emerald.

Larger flat types in Toa Payoh and Simei in highest demand

4- and 5-room flats in Toa Payoh and Simei emerged as the most competitive in this launch, with Simei taking the top spot overall.

At Simei Symphony, the 5-room flats saw 1,161 applications for just 100 units. First-timers submitted 7.5 applications per unit, while second-timers hit a remarkable 52.4 applicants per unit. This is the highest application rate across all categories!

One possible reason for this high demand could be that Simei Symphony does not offer 3-room flats, so buyers may be shifting their interest to the larger units. Despite the absence of a primary school within a 1km radius, many applicants appear willing to overlook this in favour of the project’s proximity to an MRT station.

At Toa Payoh Ascent, the 4-room flats attracted 2,361 applications for 375 units. For first-timers, the application rate was 6.4 applicants per unit, while second-timer application rate stood at 27.9 applicants per unit.

Toa Payoh Ascent’s 3-room flats also saw high demand, with 5.4 applicants per unit among senior quota, and 40.4 applications per unit among second-timers.

Meanwhile, Clementi Emerald’s 4-room units (a Prime estate) drew notable demand from first-timers (3.4 per unit) as well as second-timers (19.0 per unit).

Larger units at Toa Payoh Ascent and Simei Symphony start at approximately S$528,000 and S$603,000 respectively. While these prices are higher than those in northern estates like Woodlands or Sembawang, applicants appear willing to pay a premium for centrality and long-term value.

Modest demand among other areas

| Project | Flat Type | First-timer Rate | Second-timer Rate |

|---|---|---|---|

| Sembawang Beacon | 4-room (Standard) | 1.2 | 1.2 |

| Woodlands North Grove | 4-room | 1.3 | 1.2 |

| Bangkit Breeze | 4-room (Standard) | 1.6 | 1.1 |

| Sembawang Beacon | 5-room (Standard) | 0.7 | 0.5 |

| Sembawang Beacon | 3Gen (Standard) | 0.2 | – |

| Woodlands North Grove | 5-room | 0.6 | 0.4 |

While demand remained red-hot in central locations, northern towns like Woodlands, Bukit Panjang, and Sembawang saw more modest application rates. This was likely due to a combination of factors such as longer projected wait times, fewer nearby MRT stations, and less established neighbourhood amenities compared to mature estates. Additionally, younger families or first-time buyers may prioritise proximity to workplaces and schools, which tends to favour central or city-fringe locations.

These estates may appeal more to buyers seeking affordability, more flexible lease options, or those willing to wait longer in exchange for more spacious layouts and quieter surroundings.

Broader trends

The July 2025 launch saw higher application rates than February’s exercise, rising from 3.2 to 3.9 applicants per unit. This spike suggests renewed demand for public housing, likely driven by rising resale flat prices and policy changes, including increased allocation for second-timers and the rollout of the Family Care Scheme.

Compared to the Sale of Balance Flats (SBF), BTO flats drew more attention, especially in high-demand locations such as Bukit Merah, Clementi, Toa Payoh, and Tampines. This is likely due to more predictable completion timelines and eligibility benefits tied to new launches.

Notably, Prime Location Housing remained competitive despite stricter resale conditions and subsidy recovery rules. Over 12,000 applicants vied for PLH flats, the highest since November 2022.

The July 2025 BTO results confirm that location, estate type, and eligibility schemes are shaping demand more than ever. With second-timer competition intensifying, and singles increasingly active in the market, the next few launches will likely continue to reflect these trends.

The post July 2025 BTO Application rates soar as Simei Symphony’s 5-room flats see highest demand appeared first on .