In July, both condo resale prices and transaction volumes showed an uptick. That positive trend carried into August, although the pace was a little slower. The market remained active with price gains, more transactions, and strong capital returns across several regions.

Table of contents

- Condo resale prices kept rising in August 2025

- Resale volumes rose but stayed below last year’s levels

- High value condo resale transactions in August

- Capital gains grew stronger

- Unlevered returns reached nearly 30%

- What to expect in the upcoming months

Quick summary

- ✨ Prices: Condo resale prices climbed in August 2025, with CCR rising 3.7%, while RCR and OCR grew 0.4% each.

- 📊 Sales volume: About 1,088 resale units were sold, up 5% from July.

- 🏠 Standout deals: The priciest unit was a S$15.8M condo in Geylang. In the CCR, Boulevard 88 saw the top resale at S$11.08M, while Elliot at East Coast led OCR at S$5.02M.

- 💵 Capital gains: Median gain rose to S$390,000, with Jurong (D22) leading at S$663,000.

- 📈 Returns: Median unlevered return stood at 29.6%. Jurong posted the strongest returns at 48.5%.

Condo resale prices kept rising in August 2025

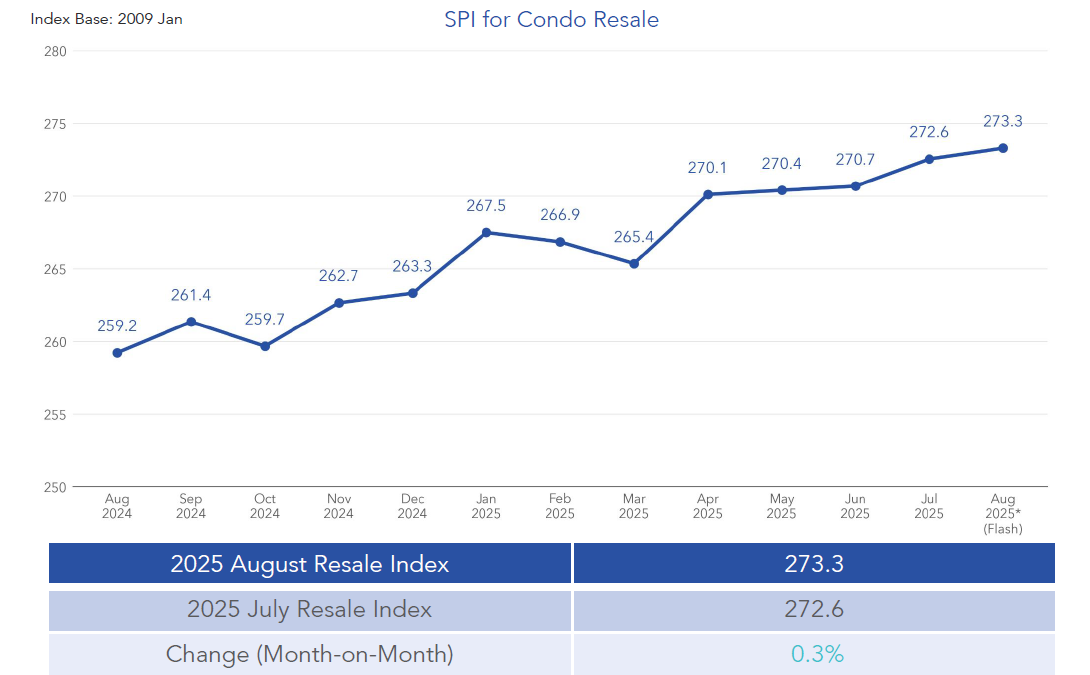

When you look at condo resale August 2025 figures, prices across all three regions pushed upward. In the Core Central Region (CCR), prices jumped 3.7%, while both the Rest of Central Region (RCR) and Outside Central Region (OCR) posted smaller gains of 0.4%.

Month-on-month, overall resale condo prices were up by 0.3%. When compared to the same period last year, prices climbed 5.4% across Singapore. Year-on-year growth was also steady within each region – CCR rose 7.1%, RCR went up 4.1%, and OCR advanced by 5.8%.

Resale volumes rose but stayed below last year’s levels

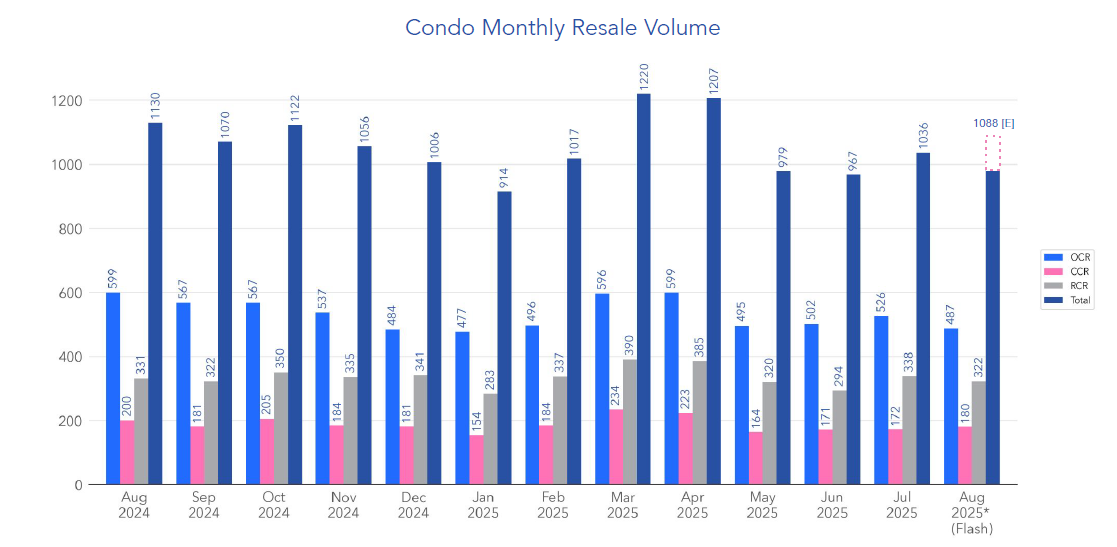

In August 2025, an estimated 1,088 resale condo units changed hands.

This was 5% more than the 1,036 units sold in July. Even so, volumes were still 3.7% lower compared to August 2024. On the bright side, resale numbers lined up closely with the five-year average for the month, showing that the market is maintaining a healthy rhythm.

Mr. Luqman Hakim, Chief Data & Analytics Officer at 99.co, shared that “August is usually a slower month for the property market, with school holidays and the Hungry Ghost month holding back some buyers. Once that period passes, activity usually tends to bounce back.”

Looking at the breakdown by region, the OCR dominated with 49.2% of resale deals, while the RCR and CCR made up 32.6% and 18.2%, respectively.

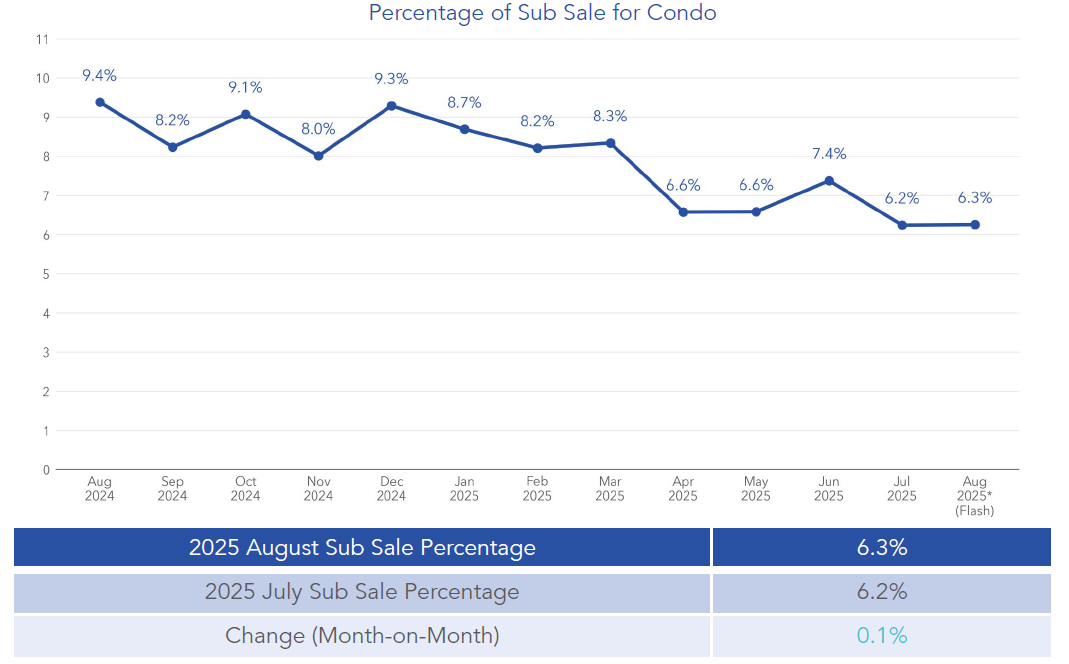

Another detail worth noting is the share of sub-sales, which are secondary transactions made before a project’s completion. In August 2025, sub-sales made up 6.3% of total secondary transactions, a slight increase from July.

High value condo resale transactions in August

Every month, a few standout transactions grab attention, and August was no exception. The priciest resale condo went for S$15.8 million in Geylang.

In the CCR, the top deal was a unit at Boulevard 88 that resold for S$11.08 million. This project also had the highest transaction in July at S$13 million.

Meanwhile, in OCR, the most expensive transaction came from Elliot at the East Coast, with a unit reselling for S$5.02 million. Completed in 2013, Elliot is a freehold development with 119 units spread across nine mid-rise blocks. You’ll find a mix of 1- to 4-bedroom apartments in the development, with sizes ranging from about 506 to 2,766 square feet. Residents here enjoy a wide range of facilities, including pools, a jacuzzi, a clubhouse, BBQ pits, fitness corners, and even function rooms. It’s also close to lifestyle spots like Bedok Mall, Parkway Parade, 112 Katong, and the East Coast Lagoon Food Village. For daily needs, you’ll find medical clinics, schools, and plenty of eateries nearby. Transport links are strong too, with Bedok, Kembangan, Tanah Merah, and Siglap MRT stations within reach, including easy access to East Coast Park.

Capital gains grew stronger

The median capital gain rose to S$390,000, which is S$15,000 more than in July.

Among the different districts, Jurong/Tuas/Boon Lay (District 22) posted the highest median capital gain at S$663,000. On the other end of the spectrum, the Marina/Boat Quay/Raffles Place area (District 1) recorded the lowest, with a negative median capital gain of -S$124,000.

Unlevered returns reached nearly 30%

The overall median unlevered return stood at 29.6%. District 22 once again led the way, with returns hitting 48.5%. Meanwhile, District 1 posted the weakest showing with a median return of -6%.

It’s important to note that these figures are based on matched transactions of the same unit, comparing its current resale price against its previous purchase price. To ensure accuracy, only districts with at least ten matching transactions were considered.

What to expect in the upcoming months

According to Mr. Luqman Hakim, “buyers over the next few months may be keeping an eye on the new launch market. With about five new launches, including The SEN, Zyon Grand, and Skye at Holland, possibly previewing between late September and October, some buyers may prefer to hold off the resale market until then.”

Beyond that, he pointed out that some buyers could also be monitoring SORA interest rates before making decisions. If new launches end up priced too high, the resale market may see more activity as buyers look for better value. On the other hand, if developers manage to price their units competitively, resale demand might soften. In short, upcoming launches and financing conditions are likely to create more fluctuations in the resale market over the next few months.

The post Condo resale market gains slight momentum in August 2025 with higher prices and sales appeared first on .