A luxury condo along Grange Road has just made headlines with one of the biggest resale profits in 2025. A 4-bedroom unit at Grange Residences was sold for S$10.2 million, netting its seller a staggering S$6 million gain. This record-setting deal not only raised the bar for the development but also underlined how freehold homes in Singapore’s Core Central Region (CCR) continue to attract deep-pocketed buyers despite hefty price tags.

Table of contents

- 4-bedder at Grange Residences sold for S$10.2 million

- The most expensive unit ever transacted at Grange Residences

- Seller made S$6.002M in profit holding long-term

- Capital appreciation at Grange Residences

- Freehold condo price trend in District 10

4-bedder at Grange Residences sold for S$10.2 million

With the official transaction dated on 8 September 2025, this resale deal at Grange Residences involved a spacious 2,852-sqft unit on the 15th floor. At S$10.2 million, or S$3,576 psf, the unit fetched a 4.3% premium above the project’s current average of S$3,428 psf.

Don’t guess your selling price – know it. Use 99.co’s Property Value Tool for a fast, reliable estimate in under a minute, with up to 98% accuracy.

Compared to the broader District 10 (Tanglin/Holland/Bukit Timah) market, where freehold condos are changing hands at about S$2,545 psf, the new owner of the 4-bedder at Grange Residences forked out a price that was around 40% higher than the district average. Clearly, the purchase wasn’t about chasing value but about securing a trophy home in one of Singapore’s most exclusive enclaves.

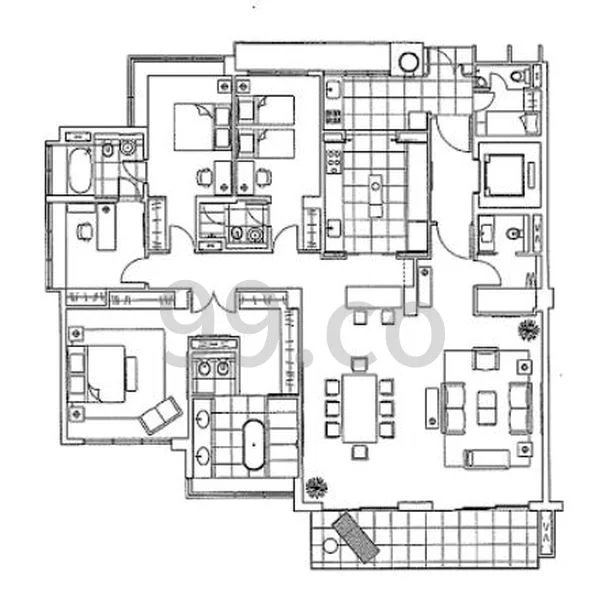

Grange Residences is a freehold development completed in 2004 with just 164 units spread across 18 storeys. Located minutes from Orchard Boulevard MRT, it features large-format 4-bedroom apartments ranging from 2,584 to 2,852 sqft. These luxury homes are designed to appeal to families seeking both privacy and space in the heart of the city.

The most expensive unit ever transacted at Grange Residences

This latest sale has set a new benchmark for Grange Residences, both in absolute price and psf value. It is the first time that a unit has been transacted above the S$10 million mark, with record S$3,576 psf. The previous high was S$9.85 million (S$3,453 psf) achieved in June 2025 for another 2,852-sqft unit on a lower floor.

So far this year, four units of the same layout have changed hands between S$9.72 million and S$10.2 million, averaging S$3,463 psf. The most recent deal was therefore 3.3% higher than this average — showing how quickly prices can escalate within months in an active resale cycle when buyers compete for limited supply.

Good news: A similar 2,852-sqft unit at Grange Residences is currently available on 99.co for under S$10 million!

Seller made S$6.002M in profit holding long-term

The seller in this September transaction walked away with an absolute gain of S$6.002 million, after holding the property for slightly over 20 years. The 4-bedroom unit was initially purchased for S$4.2 million (S$1,472 psf) in 2005. This price point was around 5.3% higher compared to the project average of the time, which was recorded at S$1,398 psf.

However, for the exact same 2,852-sqft layout, the 2005 average was about S$1,529 psf. That means the seller actually entered at a 3.7% lower price compared to others. This slightly lower entry point turned out to be critical, amplifying the eventual S$6 million profit when they exited at today’s record psf.

Capital appreciation at Grange Residences

Interestingly, this S$6 million gain isn’t even the highest profit recorded at Grange Residences. The previous resale unit which fetched S$9.85 million in June 2025 delivered an even bigger capital gain for the seller. They had bought the unit in June 2004 for only S$3.35 million (S$1,173 psf), so they pocketed an absolute profit of S$6.5 million after holding it for over 20 years. This is still the highest resale gain ever recorded in Grange Residences.

In total, five resale transactions have taken place at the development this year. All five turned out to be profitable with gains ranging from S$3 million to the highest of S$6.5 million. Owners who cashed out in 2025 had held their properties between 15 to 21 years, relying on the strength of long-term ownership in freehold CCR projects.

Six resale deals achieved profits above S$5M

On the subject of big gains, this Tanglin condo has seen six resale deals where sellers walked away with profits of over S$5 million. Half of the sales involved the 2,852-sqft units, which have become the star performers of the project.

| Date | Area (sqft) | Selling Price (S$) | Profit (S$) | Years Held |

| 09/2025 | 2,852 | 10,200,000 | 6,002,000 | 20.2 |

| 07/2025 | 2,852 | 9,738,000 | 5,796,000 | 20.6 |

| 06/2025 | 2,852 | 9,850,000 | 6,504,000 | 21 |

| 10/2023 | 2,669 | 8,540,000 | 5,409,000 | 19.5 |

| 05/2023 | 2,669 | 8,880,000 | 5,584,000 | 19 |

| 03/2023 | 2,584 | 8,580,000 | 5,734,000 | 19 |

These resale transactions show an undeniable trend: patience pays. Every one of the S$5M+ profit deals came from owners who held their units for around two decades — or in this case, those who entered during the project’s early days.

Despite differences in floor area, which range from the smallest to the largest layouts, the profits achieved were notably similar. This indicates that buyers at the top end are pricing in the project’s overall prestige and location rather than being overly sensitive to minor differences in size.

Perhaps most telling is the trajectory of deals in 2025. Of the five resale transactions recorded this year, three have already delivered profits above S$5M, suggesting renewed demand for large-format freehold homes. This could be a reflection of buyers seeking stability in land-scarce Singapore, where trophy assets like Grange Residences are seen as long-term wealth preservers.

Notable big gains for short-term held units

However, not all success stories at Grange Residences required decades of patience. The project has also seen spectacular gains in short-term held units. In 2011, for instance, a 2,853-sqft unit was flipped for S$8.1 million (S$2,840 psf), giving its seller a S$1.7 million profit after just two years. That worked out to roughly S$850,000 per year of holding — a staggering figure by any measure.

This kind of outstanding result, of course, depend heavily on timing and market cycles. In this particular case, the seller entered in 2009 during the Global Financial Crisis, when average psf prices for the project had dipped by 15% compared to the previous year. By 2011, the market had rebounded, with values at Grange Residences jumping 22% since 2009. Essentially, this investor capitalised on a low-entry point during a downturn and exited during recovery phases.

Isolated cases of unprofitable resale over the years

While the project is one of the highly regarded freehold condos in the area, not all sellers have been fortunate enough to walk away with profits. Though very minimal, there have been multiple transactions over the years where owners suffered capital losses.

A total of 12 unprofitable transactions has been recorded throughout the project’s history, with losses ranging from S$50,000 to S$800,000. Almost half of these unprofitable sales at Grange Residences occurred in 2017, when the overall private property market had softened, especially in the luxury segment.

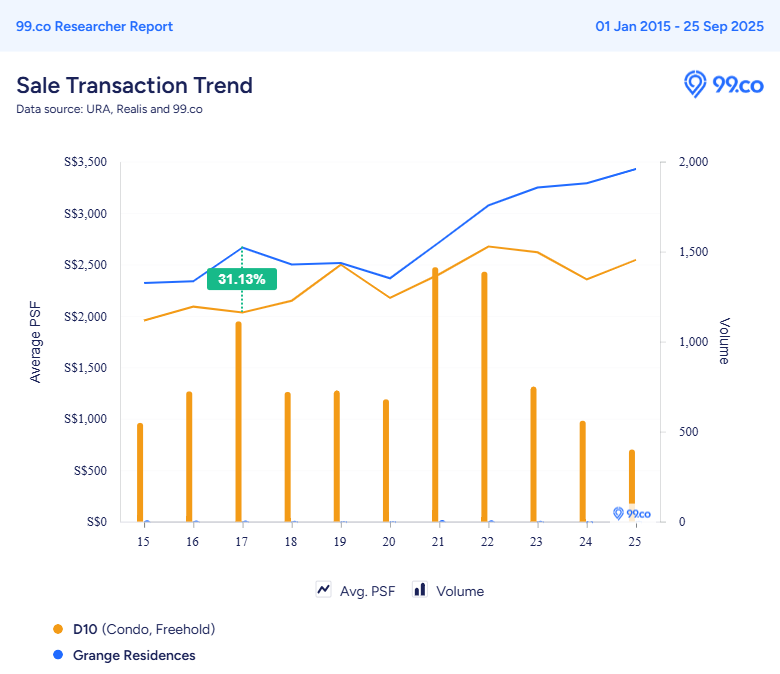

Yet, what’s striking is that even at a loss, units here still fetched well above the market average — Grange Residences maintained a price gap of over 31% against other freehold condos in District 10 at the time. This underlines the resilience of the project’s positioning. Owners who sold in the weak market absorbed some losses, but the development itself consistently held its premium standing relative to its peers.

Freehold condo price trend in District 10

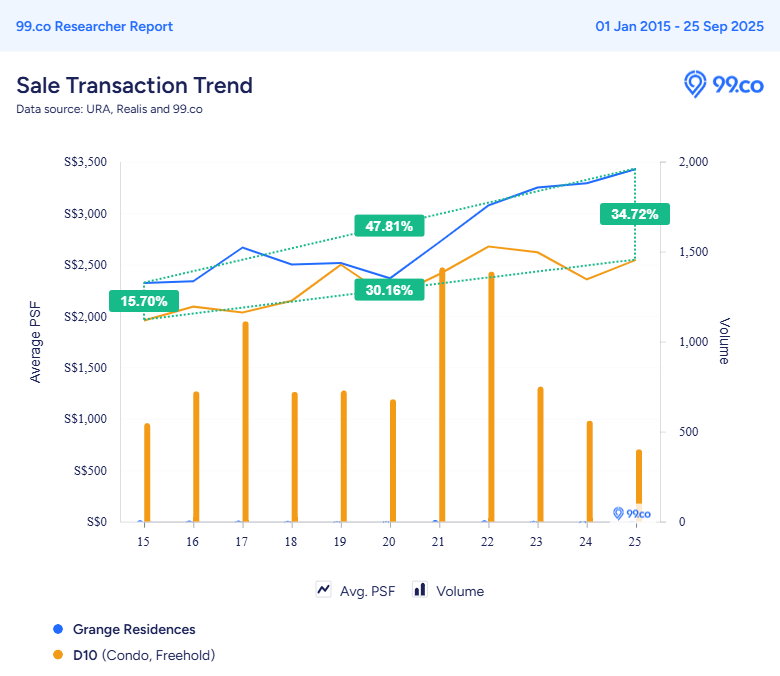

Over the past decade, freehold condo prices in District 10 have climbed about 30%. Grange Residences, however, has surged nearly 48% in the same period. Back in 2015, the price gap between Grange Residences and the district average was only 15.7%. As of September 2025, that gap has more than doubled to almost 35%.

This widening premium reflects how Grange Residences has positioned itself as a blue-chip property play. Owners who bought early and held on have reaped multi-million-dollar rewards, with the project consistently outperforming the broader District 10 market. Even during weaker cycles, it has maintained its price advantage — an indication of both resilience and enduring desirability.

Still, not every buyer is chasing record-breaking trophy homes. While investors continue to prize Grange Residences for its long-term capital appreciation, genuine homebuyers might be drawn instead to the more accessible freehold options nearby.

On 99.co, active listings currently start from S$825,000 for a 1-bedroom unit at RV Edge along Shanghai Road. Buyers looking for something larger yet still relatively affordable can also find options like a 2-bedroom unit at Robin Residences, currently priced at S$1.48 million. Notably, this asking price is about 28% below the average listing price for 2-bedroom condos in District 10 on 99.co

With District 10 freehold condos now averaging S$2,545 psf — still well under Grange Residences’ S$3,428 psf — there remains a clear spectrum of opportunities. For some buyers, the appeal lies in owning a proven, high-performing asset like Grange Residences. For others, the draw is securing a prime location address at a more manageable entry point.

Enjoying this in-depth analysis? 99.co Condo Cash or Crash covers monthly notable transactions in Singapore’s private property market.

The post Grange Road 4-bedder sold for S$10.2M, securing a S$6M profit appeared first on .