The Government Land Sales (GLS) programme saw a double tender close on September 11, with developers putting in billion-dollar bets for a landmark mixed-use site at Chencharu Close in Yishun and a more measured contest for an executive condominium (EC) plot in Sembawang. Both sites were officially awarded to the top bidders on September 26, 2025.

Here’s all you need to know about these two sites and what to expect from the upcoming projects.

Table of contents

- Chencharu Close draws S$1.01 billion top bid

- First mixed-use site in new Chencharu Town

- Comparisons with other mixed-use sites in the OCR

- Oriental Pacific secures Sembawang EC site

- EC demand remains resilient

Chencharu Close draws S$1.01 billion top bid

The first GLS tender for a mixed-use site at Chencharu Close in Yishun has attracted three bids. A consortium led by Evia Real Estate, together with Gamuda Land and Ho Lee Group, was officially awarded the site on September 26, after emerging as the top bidder with an offer of S$1.012 billion, translating to S$980 per square foot per plot ratio (psf ppr).

The second-highest bid came from a Frasers Property-led consortium with Mitsubishi Estate and Lum Chang Building Contractors, at S$845 million (S$818 psf ppr). The third, from Sim Lian Group, was significantly lower at S$692.4 million (S$670 psf ppr).

The top bid was 19.8% above the second bid and 46.2% higher than the third, underscoring how differently developers view the prospects of the new Chencharu housing estate.

At a land rate of S$980 psf ppr, Wong Siew Ying, Head of Research and Content at PropNex, estimates the eventual selling price of private homes on the site to average above S$2,300 psf, which would bring it close to the range seen at other large Outside Central Region (OCR) projects.

First mixed-use site in new Chencharu Town

Spanning about 317,000 sqft with a plot ratio of 3.26, the 99-year leasehold site can yield around 875 private homes alongside 135,627 sqft of commercial space. Of the commercial component, 37,674 sqft is earmarked for a hawker centre, while 58,125 sqft is allocated for a bus interchange to be integrated with the project.

The site is within a five-minute walk of Khatib MRT station and enjoys proximity to community facilities such as Yishun Stadium, Yishun Sports Centre, and Lower Seletar Reservoir Park. Several schools, including Peiying Primary School, Naval Base Primary and Secondary, Chung Cheng High (Yishun), Orchid Park Secondary and Yishun Innova Junior College, are also nearby.

This is the first GLS mixed-use project in the 70-hectare Chencharu Town, a new residential precinct within Yishun. PropNex’s Wong noted that there have been no new condo launches near the Chencharu Close site since The Estuary was launched in 2010; The Wisteria, which is slightly further from the site, was put on the market in 2016.

Comparisons with other mixed-use sites in the OCR

While the top bid of S$980 psf ppr is below some recent OCR land tenders, market watchers note that the difference reflects site-specific requirements. The need to integrate a hawker centre and bus interchange adds complexity and cost, setting it apart from other parcels.

In July 2023, a mixed-use site at Tampines Avenue 11 was awarded at S$885 psf ppr to a UOL–CapitaLand joint venture. CBRE’s head of research for South-east Asia, Tricia Song, noted that it is the most recent comparable site to Chencharu Close. That project, now known as Parktown Residences, launched in February 2025 and achieved strong take-up, with 87% of its 1,193 units sold at an average of S$2,360 psf.

More recently, in September 2024, a smaller mixed-use site at Tampines Street 94 was awarded at S$1,004 psf ppr to Hoi Hup Realty and Sunway Developments. Unlike Chencharu Close, however, that site does not carry the added obligation of transport and community facilities.

The recent award confirms that developers remain prepared to commit sizeable sums for integrated projects in well-located estates, even as construction and financing costs remain a consideration.

Oriental Pacific secures Sembawang EC site

Alongside Chencharu Close, a GLS tender for an executive condominium (EC) site at Sembawang Road also closed on September 11. The plot drew four bids, with Oriental Pacific Holdings — formerly of JBE Holdings — officially securing the site on September 26 after submitting the highest offer at S$198 million (S$692 psf ppr).

The second-highest bid came from TID, a joint venture between Hong Leong Group and Mitsui Fudosan, at S$190 million (S$665 psf ppr), while a consortium involving ABR Holdings, Roxy-Pacific, Macly Capital and LWH Holdings offered S$168 million (S$588 psf ppr). The lowest bid, from Sim Lian Group, came in at S$109 million (S$381 psf ppr).

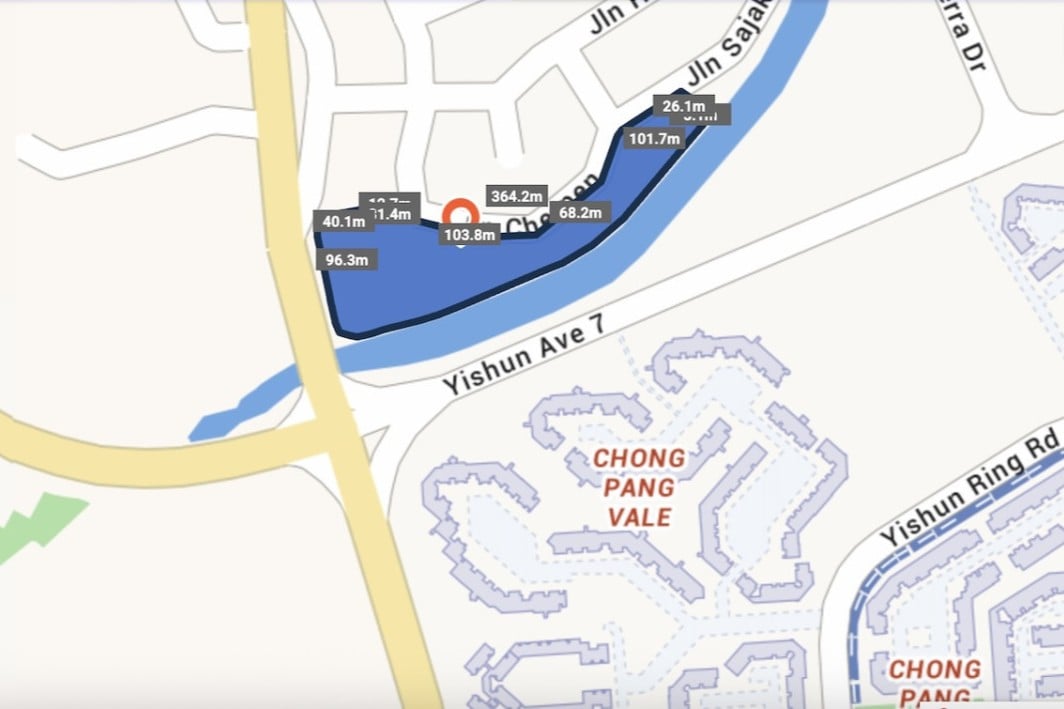

The 204,170 sqft, 99-year leasehold plot has a plot ratio of 1.4 and is expected to yield around 265 units. Located within walking distance of Canberra MRT station, it sits beside a landed enclave and along a waterway, positioning it as Singapore’s first low-rise EC development.

With the award now confirmed, the project is estimated to launch in early 2027 after the 15-month waiting period. Analysts project an eventual selling price above S$1,700 psf, making it competitive against recent EC benchmarks.

Interested in the upcoming EC launches? See the complete 2025/2026 list here!

EC demand remains resilient

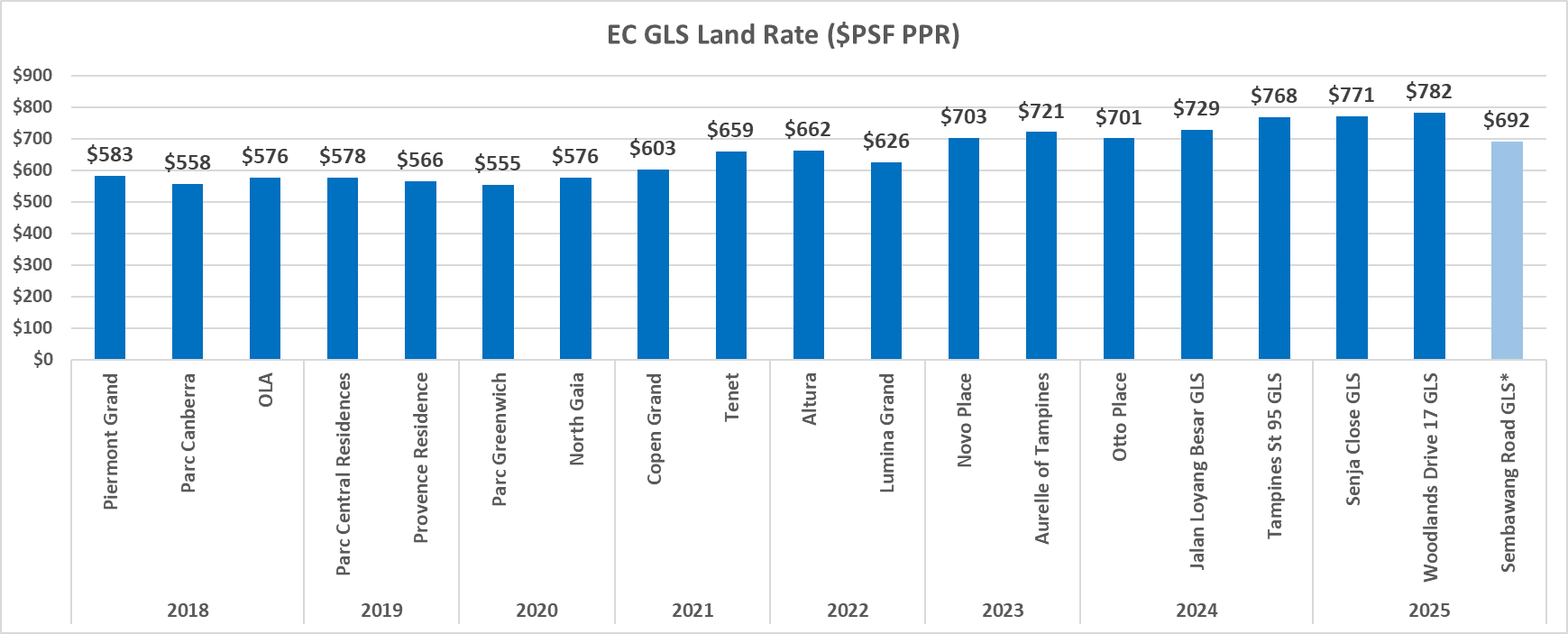

The tender outcome marked the first time since September 2022 that an EC GLS plot attracted a top bid below S$700 psf ppr. The last instance was at Bukit Batok’s Lumina Grand site, awarded to CDL at S$626 psf ppr. That project launched in January 2025 at an average of S$1,464 psf and achieved brisk sales.

Sembawang itself has precedent for healthy EC demand. In 2019, MCC Land acquired the Canberra Link site for S$566 psf ppr and later launched it as Provence Residence in 2021, where more than half of its 413 units were sold during the launch weekend. The project has since fully sold out.

Recent EC launches, including Otto Place and Lumina Grand, have also seen strong take-up, with some moving over 90% of units during launch. This reflects continued buyer appetite for ECs as a relatively affordable upgrade path for HDB upgraders, especially in mature towns.

The post Chencharu Close plot officially goes for S$1.01B; Oriental Pacific wins Sembawang EC site appeared first on .