A consortium led by UOL Group, together with Singapore Land Group and Kheng Leong Company, has emerged as the top bidder for the Dorset Road private housing site, offering S$524.3 million or S$1,338 per square foot per plot ratio (psf ppr).

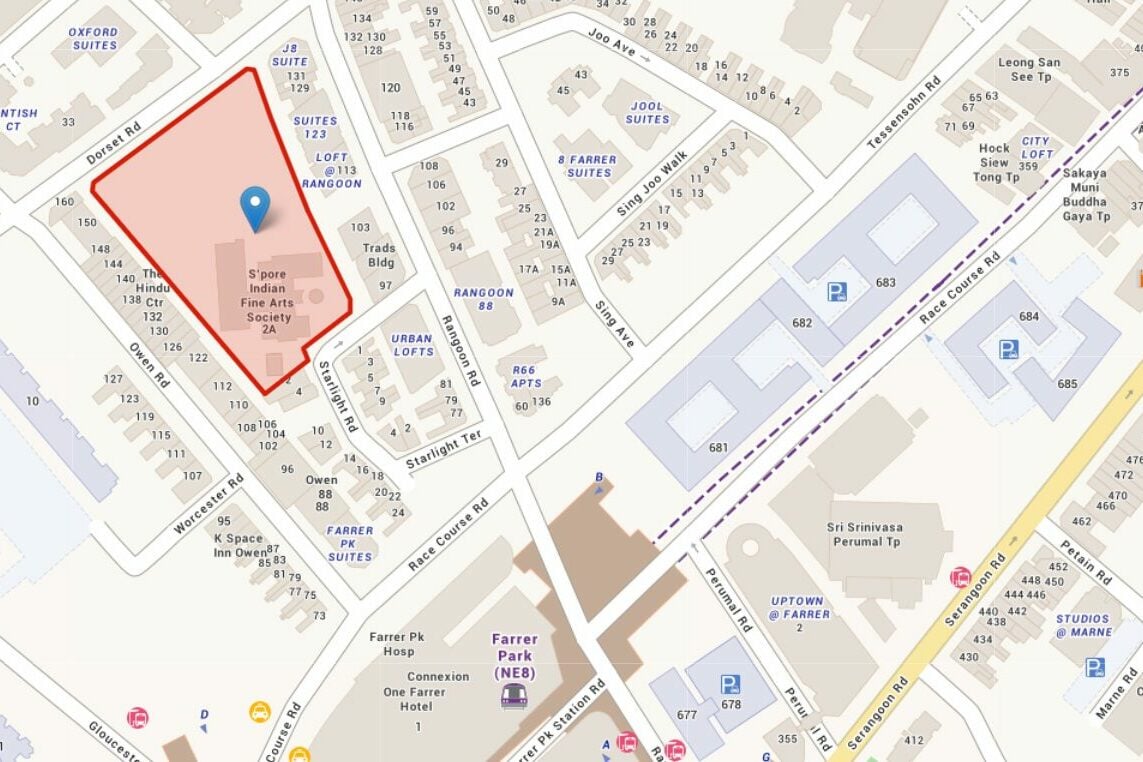

The 99-year leasehold plot, located near Farrer Park MRT station, spans 111,934 square feet and can yield around 425 homes. Tender results released by the Urban Redevelopment Authority (URA) on 9 October show intense competition, with nine bids submitted — a level of participation rarely seen since 2021.

Table of contents

- Tight competition for Dorset Road GLS site

- A centrally connected enclave

- Everyday convenience and neighbourhood charm

- Following in Piccadilly Grand’s footsteps

- Why developers are paying attention to the Dorset Road site

- What to expect from Dorset Road upcoming launch

Tight competition for Dorset Road GLS site

The Dorset Road tender was one of the most hotly contested sites in 2025, tying the Dunearn Road GLS tender earlier this year, which also saw nine bids. In this case, the second-highest offer came from a joint venture between ABR Holdings, LWH Holdings, Macly Capital, Roxy-Pacific Holdings and Wee Hur Holdings, who priced the land at S$518.9 million or S$1,324 psf ppr.

The margin between the top and second-highest bids was narrow, just 1% apart, reflecting how developers share similar price expectations for centrally located plots with strong fundamentals. Even the lowest bid, lodged by Sustained Land, came in at S$1,123 psf ppr, suggesting a relatively tight 19% spread between the top and bottom bids.

Dorset Road GLS tender results

| Rank | Tenderer | Bid Price (S$) | Land Rate (S$ psf ppr) |

|---|---|---|---|

| 1 | United Venture Development (2022) Pte. Ltd. (UOL / SingLand / Kheng Leong) | 524,300,800 | 1,338 |

| 2 | ABR Holdings, LWH Holdings, Macly Capital, RP Ventures, Wee Hur Property | 518,888,888 | 1,324 |

| 3 | Hoi Hup Realty Pte Ltd | 515,180,000 | 1,315 |

| 4 | Kingsford Huray Development Pte Ltd | 513,269,999 | 1,310 |

| 5 | Sim Lian Land & Sim Lian Development | 490,300,000 | 1,252 |

| 6 | COLI (Singapore) Pte. Ltd. | 475,000,000 | 1,213 |

| 7 | CYZ Land 5, SB (Tuaslinc) Investment, UED Bravo | 450,539,966 | 1,150 |

| 8 | GuocoLand (Singapore) & Intrepid Investments | 445,350,336 | 1,136 |

| 9 | SL Capital (9) Pte Ltd (Sustained Land) | 439,998,000 | 1,123 |

The upper cluster bids of around S$1,300 psf ppr reveal how aligned market expectations were. Most bidders appear to have priced in the project’s prime location, connectivity, and mid-size scale — attributes that typically reduce development risk while ensuring strong appeal to end-buyers.

A centrally connected enclave

The Dorset Road site sits in a mature residential enclave within the Farrer Park and Pek Kio neighbourhoods — areas known for their accessibility and blend of urban and community character. Farrer Park MRT station, just a short walk away, links directly to the North-East Line (NEL). From there, residents can reach Little India in one stop and Dhoby Ghaut in two, connecting them seamlessly to the North-South Line (NSL) and Circle Line (CCL).

For drivers, nearby roads such as Bukit Timah Road and the Central Expressway (CTE) provide fast access to both downtown and northern Singapore. This degree of connectivity is rare in a residential district that still retains the laid-back appeal of traditional estates.

According to UOL’s Chief Investment and Asset Officer, Shirley Ng, Dorset Road stands out as the only city-fringe GLS site from the 2025 Confirmed List located within the edge of the Core Central Region (CCR). If awarded, the group envisions developing two 27-storey residential towers, housing 428 units.

Ng noted that the project’s “strong locational attributes” and proximity to good schools make it an excellent opportunity to replenish UOL’s land bank. The upcoming project will likely build upon UOL’s track record of timeless, community-oriented developments.

Everyday convenience and neighbourhood charm

Despite being close to the city, Dorset Road retains a familiar, almost nostalgic atmosphere. It is surrounded by established HDB estates, low-rise conservation homes, and heritage shophouses that give the area its distinctive personality.

Everyday needs are easily met with Pek Kio Market & Food Centre nearby, known for fresh produce and traditional hawker fare. Within walking distance are also City Square Mall and Mustafa Centre, offering everything from retail and dining to late-night grocery options. For leisure, residents can unwind at Cambridge Park, Carlisle Oasis, or venture slightly east to the Kallang Sports Hub for sports and recreation.

Families with school-age children are particularly well-served here. Farrer Park Primary School, Hong Wen School, and St. Joseph’s Institution Junior are all within a 1-kilometre radius, while Anglo-Chinese School (Junior), Bendemeer Primary, and St. Margaret’s School fall within 1–2 km. Preschools, enrichment centres, and international options such as Stamford American International School at Woodleigh are also easily accessible — a major plus for expatriate families.

Following in Piccadilly Grand’s footsteps

Dorset Road’s central appeal is reminiscent of the nearby Piccadilly Grand, an integrated development directly connected to Farrer Park MRT. That project, jointly developed by City Developments (CDL) and MCL Land, was awarded in May 2021 at S$1,129 psf ppr. It launched in May 2022 and saw a 77% sell-through rate on its first weekend.

According to URA Realis data, Piccadilly Grand’s 407 units have since been nearly fully sold, at an average of S$2,155 psf. The strong sales demonstrate enduring buyer demand for homes in well-connected city-fringe areas, especially when coupled with strong developer branding and retail integration.

Much like Piccadilly Grand, the Dorset Road site presents an ideal scale for a mid-sized project, large enough to support full lifestyle facilities, yet compact enough to retain a sense of exclusivity. Market watchers expect the eventual project to lean towards the upscale segment, catering to professionals and families who seek the convenience of central living without the premium price tag of Orchard or Newton.

Why developers are paying attention to the Dorset Road site

The strong participation, nine bidders in total, signals that developers remain confident in the city-fringe residential segment. Demand for well-located new homes remains resilient, particularly in established neighbourhoods that balance urban access with a sense of community.

The tender’s level of competition also mirrors that of Dunearn Road GLS, which closed in June 2025 with nine bids and was awarded to Frasers Property, Sekisui House, and CSC Land for S$491.5 million or S$1,410 psf ppr. That site, capable of yielding 380 homes, marks the first GLS project in the Bukit Timah Turf City precinct — a district slated for a long-term transformation featuring 20,000 new homes, park connectors, and community amenities over the next few decades.

Recent trends in the new launch market may have further encouraged developers’ confidence in the Dorset Road plot. According to PropNex’s Head of Research and Content, Wong Siew Ying, sales momentum has picked up sharply this year, with over 7,900 new private homes (excluding ECs) sold as of 28 September 2025, already surpassing the annual totals of the past three years. This recovery in primary market demand appears to have driven a more proactive stance towards land acquisition.

What to expect from Dorset Road upcoming launch

If UOL’s proposal proceeds as planned, the twin-tower development will stand as a new residential landmark that bridges the heritage of Farrer Park with the modern pulse of central Singapore. For homebuyers, it represents the sweet spot between convenience, culture, and capital appreciation potential.

Given the top bid land rate of S$1,338 psf ppr, analysts now project the average selling price for the upcoming Dorset Road condominium to hover above S$2,700 psf. This positions it above Piccadilly Grand’s launch level, but still comfortably within reach of city-fringe buyers seeking quality homes near the core central area.

[Editor’s note: The Dorset Road site has not yet been awarded. This article is based on the publicly released list of tenderers and bid prices on 9 October 2025. It will be updated once the official site awards are announced.]

The post Dorset Road GLS tender draws 9 bidders, UOL-led group emerges on top at S$1,338 psf ppr appeared first on .