Launching on 18 October 2025, Penrith joins the spotlight as one of the most anticipated new launches this month — debuting on the same weekend as Faber Residence in Clementi, both jointly developed by GuocoLand and Hong Leong Holdings.

With an indicative starting price of S$2,437 psf, this Queenstown project reopens the new launch market after a seven-year pause for the area. The question now is how Penrith’s price stacks up in today’s market. Is the price tag really worth its value?

Key takeaways

💰 Compact layouts keep prices accessible

👨👩👧 Strong appeal to families and upgraders

💎 4-bedders offer best value in segment

📊 Limited supply supports price stability

🚇 5-minute walk to Queenstown MRT

Table of contents

- Penrith – Project overview

- S$2,437 psf: 3.5% above the Queenstown average

- Comparison with nearby projects in District 3

- Supply shortage for family-friendly layouts in the area

- The million-dollar HDB neighbours

- ⚖️ Our final take on Penrith

Penrith – Project overview

| Developer | Hong Leong Holdings, Hong Realty, and GuocoLand |

| Location | Margaret Drive, Queenstown (District 3) |

| Tenure | 99 years |

| Site Area | 102,498 sqft |

| No. of Units | 462 (two 40-storey towers) |

| Unit Types | 2 to 4 bedrooms |

| Launch Date | 18 October 2025 |

| Starting Price | From S$1.495 million |

| TOP (Estimated) | April 2029 |

Since its preview on 3 October, Penrith has drawn strong attention from prospective buyers. As of 15 October, it had reportedly received 1,905 cheques as expressions of interest. With just 462 units available, the development is roughly 4.1 times oversubscribed. This response is unsurprising, given that it’s the first new launch in Queenstown since 2018.

This strong interest also reflects confidence in the developers, who have a track record of delivering quality projects with stellar launch performances. Springleaf Residence, for instance, achieved a 92% take-up during its opening weekend earlier in August.

Make sure you know everything Penrith has to offer — Read our full new launch review

here

S$2,437 psf: 3.5% above the Queenstown average

Penrith enters the market with a starting price of S$1.495 million, or S$2,437 psf, for the 2-bedroom units, ranging from 614 to 678 sqft. At this price point, Penrith is priced roughly 3.5% above the Queenstown average.

| Unit Type | Size (sqft) | No. of Units | % of Mix | Starting Price | Indicative PSF |

|---|---|---|---|---|---|

| 2-Bedroom | 614 – 678 | 154 | 33% | S$1.495 M | S$2,437 |

| 3-Bedroom | 786 – 1,066 | 194 | 42% | S$1.973 M | S$2,511 |

| 4-Bedroom | 1,173 – 1,281 | 114 | 25% | S$3.078 M | S$2,623 |

According to URA Realis, average prices for leasehold condos in Queenstown stand at about S$2,353 psf in 2025. Yet, this average covers a large and diverse planning area. When narrowing the focus to Margaret Drive and its immediate surroundings, Penrith’s pricing looks more reasonable — especially considering its 5-minute walk to Queenstown MRT station and the newer lease advantage it holds.

In a wider market view, Penrith’s pricing actually sits below several other 2025 new launches. Take ELTA in Clementi, which has already crossed the S$2,500 psf mark this year for the Outside Central Region (OCR) segment. This is noteworthy because it means buyers who once looked toward suburban projects now have the chance to own a city-fringe home in District 3, within the Rest of Central Region (RCR), at a comparable entry point.

Comparison with nearby projects in District 3

| Project | TOP | No. of Units | Location | Avg. PSF 2025 |

|---|---|---|---|---|

| Commonwealth Towers | 2019 | 845 | Commonwealth Avenue | S$2,218 |

| Queens Peak | 2020 | 736 | Dundee Road | S$2,212 |

| Margaret Ville | 2021 | 309 | Margaret Drive | S$2,200 |

| Stirling Residences | 2022 | 1,259 | Stirling Road | S$2,382 |

| Penrith | 2029 | 462 | Margaret Drive | Starts from S$2,437 |

At first glance, Penrith seems the priciest in the area, coming in 3–10% higher than neighbouring resale projects. But given the seven-year gap since the last launch, this premium reflects a natural lease difference and updated construction standards.

Beyond the psf pricing, Penrith’s overall quantum remains competitive thanks to its compact and efficient layouts. The 2- and 3-bedders sit squarely in the mid-range compared to the project’s neighbours, while 4-bedders are priced at levels that still look accessible by today’s standards.

| Project | 2BR | 3BR | 4BR |

|---|---|---|---|

| Commonwealth Towers | S$1.688 M | S$2.346 M | N/A |

| Queens Peak | S$1.507 M | S$1.994 M | S$3.460 M |

| Margaret Ville | S$1.305 M | S$2.100 M | S$2.604 M |

| Stirling Residences | S$1.525 M | S$2.209 M | S$3.388 M |

| Penrith | From S$1.495 M | From S$1.973 M | From S$3.078 M |

It’s also worth noting that Penrith is a post-GFA harmonisation project. Unlike older developments, its unit sizes are measured more accurately to reflect true livable space. This provides buyers with greater clarity on pricing and the actual space they’ll enjoy.

Taken together, Penrith’s positioning sits comfortably between value and quality. While its psf pricing edges above nearby resale projects, the difference is largely justified. Yet, to understand Penrith’s appeal in full, it’s worth looking at how its developer has performed in the same neighbourhood — Hong Leong Holdings had also launched Commonwealth Towers in 2014.

An older development by Hong Leong Holdings

Despite being the oldest development in the mix, Commonwealth Towers continues to command the highest average prices for its units. Much of this premium stems from the unbeatable location right outside Queenstown MRT, a major advantage for residents and investors alike.

The project was designed primarily for singles and professionals, featuring a high proportion of compact 1- and 2-bedroom units — over two-thirds of its total mix. Larger 4-bedroom layouts, by contrast, make up just 4% of the project, reflecting its investor-driven focus.

Penrith, however, takes a completely different approach. It omits 1-bedroom units entirely and dedicates nearly 70% of its units to bigger 3- and 4-bedders. This deliberate configuration highlights its family-oriented positioning, supported by its prime location right next to Queenstown Primary School.

A closer look at Stirling Residences

As the last project in the area to achieve TOP before Penrith, Stirling Residences serves as its closest comparison. However, with 1,259 units, Stirling Residences is a much larger development. This may translate into denser living and possible overcrowding of facilities, factors that some buyers will want to weigh against the smaller, more exclusive setup of Penrith’s 462-unit development.

From a pricing perspective, resale units at Stirling Residences have been transacting above Penrith’s starting price. This suggests that Penrith could appeal to buyers looking for a similar city-fringe lifestyle at a lower entry quantum.

In fact, Stirling Residences is now among the priciest developments in the broader RCR landscape. Since its launch in 2018, average prices here have risen by over 35%. Among nearby developments, Stirling Residences leads with an annualised capital gain of about 4.4%, underscoring its prime positioning in the resale market.

| Bedrooms | Avg. Profit (S$) | Avg. Annualised Capital Gain (%) | Avg. Holding Period (Years) |

| 1 | 184,758 | 4.0 | 5 |

| 2 | 289,035 | 4.7 | 5 |

| 3 | 511,057 | 6.3 | 4 |

| 4 | 927,714 | 6.6 | 5 |

It’s common for 3-bedroom units to see healthy resale demand, as they often hit the sweet spot for HDB upgraders seeking family-sized homes. What’s striking, though, is the strength of the bigger 4-bedroom resales. Sellers here earn average profits of more than S$900,000 within just five years.

With Penrith’s unit mix dominated by 3- and 4-bedders, it naturally caters to this same buyer segment — families and upgraders looking for efficient layouts in a well-established, city-fringe location. Competing directly with Stirling Residences, Penrith’s newer lease could ultimately give it a stronger edge in the years ahead.

Supply shortage for family-friendly layouts in the area

3-bedroom units

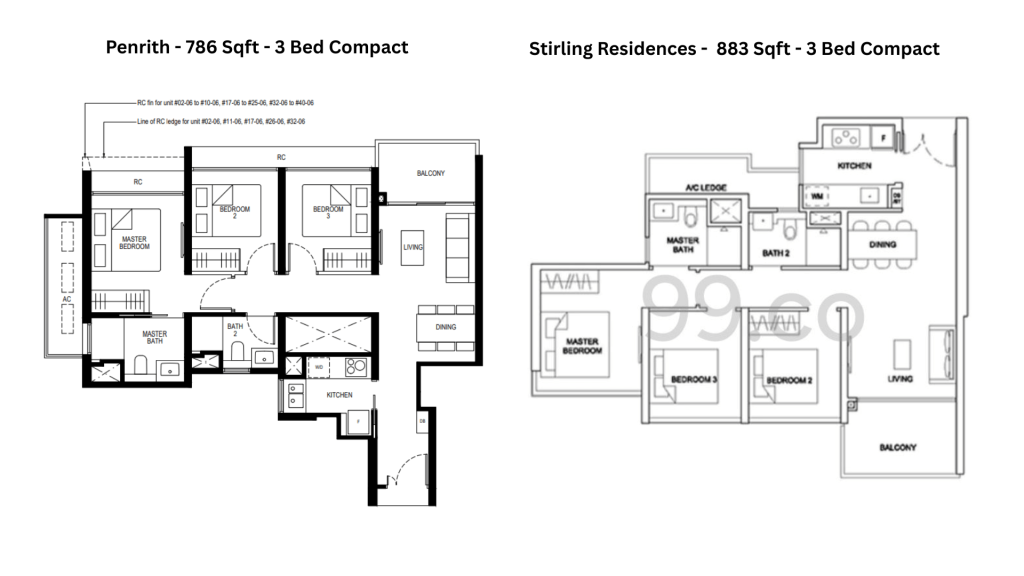

While resale demand for 3-bedroom units in Queenstown remains strong, available supply is limited. This reflects persistent upgrader interest from both HDB and private condo owners. Against this backdrop, Penrith’s 3-bedroom units, priced from S$1.973 million, present a compelling option with a compact yet efficient layout.

Compared to similar units at Stirling Residences, Penrith’s 3-bedders are slightly smaller but retain all the key features buyers likely prioritise — an enclosed kitchen, comfortably sized bedrooms, and a regular-shaped balcony that strikes the right balance without wasting space.

One minor possible trade-off from this 786-sqft layout at Penrith is the prolonged corridor walkway, leading from the entrance to the kitchen and living area. This could slightly reduce space efficiency. However, it can be easily optimised with custom cabinetry or built-in storage along the corridor, enhancing functionality without compromising flow.

4-bedroom units

Even rarer than the 3-bedders, 4-bedroom units are especially scarce in Queenstown, particularly around the Queenstown MRT area. To put things in perspective, active listings on 99.co show only a handful of 4-bedroom resale units, coming from either Margaret Ville or Queens Peak. This highlights how limited the supply truly is.

For the record, recent 4-bedroom transactions at Queens Peak have averaged around S$3.46 million, even higher than those at Stirling Residences. This higher quantum price is due to their larger 1,507-sqft layouts, the most spacious 4-bedders among nearby projects.

With supply still lagging behind upgrader demand, Penrith has one of the healthier setups in the district, offering a strong selection of newer, family-sized homes that cater directly to this segment.

Its 4-bedroom units, starting from S$3 million, present some of the best value in today’s market. And while the psf figure may appear high, the efficient layouts help keep overall quantum prices manageable — making these larger units more attainable for a broader pool of family buyers seeking long-term homes in Queenstown.

The million-dollar HDB neighbours

Queenstown’s private housing demand is deeply intertwined with its HDB market strength. The area has long been a hotspot for million-dollar resale flats, with SkyTerrace @ Dawson still holding the national record — S$1.658 million achieved in June 2025, just across the block from Penrith.

For many upgraders, these record HDB transactions act as a natural stepping stone toward private ownership. When a Dawson flat sells above S$1.5 million, it frees substantial equity for owners to move into a private condo while maintaining manageable loan commitments.

At the same time, some potential buyers might weigh whether the premium for private housing in Queenstown is justified compared to the newly MOP-ed HDB flats nearby. For those valuing space and central convenience, the argument can swing both ways. But Penrith positions itself as the next logical move — offering newer private home living and facilities that public housing can’t replicate, all within the same familiar neighbourhood.

Beyond Queenstown, upgrader demand also extends from nearby towns like Clementi and Bukit Merah, both known for their own clusters of million-dollar HDBs. This adds to the pool of potential buyers, further supporting Penrith’s appeal to families seeking a long-term home.

⚖️ Our final take on Penrith

At S$2,437 psf, Penrith sits at a premium above its neighbours, but the appeal lies in its combination of efficient layout, family orientation, and fresh lease value. The 2-bedroom units will likely attract first-time homebuyers or investors seeking city-fringe access with strong rental prospects. Meanwhile, the 3- and 4-bedroom layouts cater to families and HDB upgraders from the surrounding estates.

Given that Queenstown’s transformation is largely complete, major new catalysts are limited — only two plots nearby remain “subject to detailed planning” under URA’s land reserve. These plots may eventually refresh the housing supply and set new price benchmarks in the area. Until then, Penrith is set to stand firm as one of the most balanced value propositions in District 3: a new-lease, family-centric development in one of Singapore’s most enduring and desirable city-fringe neighbourhoods.

Stay updated with the latest news and insights on Singapore’s new launch market here.

The post Is Penrith worth its S$2,437 psf price tag? Here’s our take on its real value appeared first on .