In a year filled with high-profile launches, Zyon Grand is easily one of the most anticipated. It’s the first of its kind in Singapore to combine private residences, long-stay serviced apartments, retail, and direct MRT access into one cohesive vertical community. But with multiple projects now competing for attention in the River Valley area, the real question is whether Zyon Grand’s value proposition can stand out in an already crowded market.

Table of contents

- Zyon Grand – Project overview

- Comparison with other River Valley new launches

- Against the resale condo options in the area

- What SA2 means for buyers and investors

- Resale market outlook for Zyon Grand

- ⚖️ Our final take on Zyon Grand

Zyon Grand – Project overview

| Developer | City Developments Limited (CDL) and Mitsui Fudosan |

| Location | Zion Road |

| District | District 3 (Alexandra / Commonwealth) |

| Neighbourhood | River Valley / Bukit Merah |

| Site Area | 164,450 sqft |

| No. of Units | 706 |

| Unit Type | 1- to 5-bedroom, two penthouses |

| No. of Blocks | Two 62-storey residential towers + one 36-storey serviced-apartment tower |

| Tenure | 99-year leasehold (from 15 July 2024) |

| Nearest MRT | Havelock MRT (TEL), direct link |

| Launch Date | 25 October 2025 |

| Starting Price | From S$1.298 million |

| Expected TOP | 2030 |

Zyon Grand brings together two sleek 62-storey residential towers and a 36-storey serviced-apartment block. At the ground level, Zyon Grand will feature Zyon Galleria, a retail podium with cafés, dining spots, shops, a full-sized supermarket, and an early childhood centre. The project will also enjoy direct access to Havelock MRT station, making it one of the most connected new launches in central Singapore.

Make sure you know everything Zyon Grand has to offer — Read our full new launch review

here

As of 23 October, the upcoming project had reportedly received 1,338 cheques as expressions of interest. With just 706 units available, Zyon Grand is almost two times oversubscribed.

This healthy response is not without reason. While officially located in District 3, Zyon Grand sits right at the fringe of River Valley (District 9). This location gives it a pricing advantage while still offering the same vibrant lifestyle as its luxury neighbours.

Pricing starts from S$2,689 psf

| Unit type | Size (sqft) | Starting Price | Indicative PSF |

| 1-Bedroom + Study | 474 | From S$1.298 million | S$2,738 psf |

| 2-Bedroom | 538 | From S$1.468 million | S$2,729 psf |

| 3-Bedroom | 818 | From S$2.2 million | S$2,689 psf |

| 4-Bedroom Premium (with private lift) | 1,421 | From S$3.968 million | S$2,792 psf |

| 5-Bedroom Supreme (with private lift) | 1,819 | From S$5.988 million | S$3,292 psf |

Other than the two exclusive penthouses, Zyon Grand offers a range of 1- to 5-bedroom units, with prices starting from S$1.298 million for a 1-bedder plus study. Notably, the 3-bedroom units carry the lowest psf among all types. With more than 40% of the unit mix made up of 3-bedders, it’s evident that the developers are deliberately pricing this segment attractively to drive sales momentum.

In contrast, 1-bedroom units make up less than 10% of the total supply, a clear sign that Zyon Grand is designed primarily for own-stay buyers rather than pure investors. This also reflects a shift in River Valley’s profile, as the neighbourhood evolves from an investor-focused enclave to a more family-oriented community.

Still, with multiple launches now clustered around Zion Road, buyers will inevitably compare Zyon Grand against its new launch neighbours — and against what’s already available in the resale market nearby.

Comparison with other River Valley new launches

Zyon Grand enters a highly competitive River Valley market, where buyers are spoilt for choice. Within a few hundred metres, River Green and Promenade Peak have both been launched earlier this year. Currently, River Green averages around S$3,123 psf, while Promenade Peak is hovering at about S$2,974 psf.

In comparison, Zyon Grand’s launch price starts from around S$2,689 psf, with the overall average expected between S$2,800 and S$3,000 psf. This makes it one of the more attractively priced options in the area, which will potentially undercut Promenade Peak in affordability and fall within the value entry for River Green.

When it comes to quantum pricing, Zyon Grand’s 1-, 2-, and 3-bedroom units stand out as notably more accessible than its neighbours. Even its 4-bedroom units, starting from S$3.968 million, are sized identically to Promenade Peak’s but priced about S$800,000 lower. This shows a clear competitive edge for buyers prioritising space and price efficiency.

| Project | 1BR | 2BR | 3BR | 4BR | 5BR |

|---|---|---|---|---|---|

| River Green | S$1.381M (452 sqft) | S$1.611 M (527 sqft) | S$2.440 M (786 sqft) | S$3.137 M (980 sqft) | N/A |

| Promenade Peak | S$1.488 M (527 sqft) | S$1.933 M (657 sqft) | S$2.930 M (1,033 sqft) | S$4.765 M (1,421 sqft) | S$6.584 M (1,884 sqft) |

| Zyon Grand | From S$1.298 million (474 sqft) | From S$1.468 million (538 sqft) | From S$2.2 million (818 sqft) | From S$3.968 million (1,421 sqft) | From S$5.988 million (1,819 sqft) |

Lined up side by side, the distinctions are clear. Promenade Peak offers the largest layouts, while River Green features more compact configurations. Zyon Grand sits comfortably in between, balancing efficient layouts with manageable overall pricing.

More importantly, among the three new launches, Zyon Grand stands out as the only integrated development, complemented by a retail podium and a direct link to Havelock MRT station. This integration adds convenience and lifestyle appeal, even if it comes with slightly higher foot traffic within the compound — a fair trade-off in today’s urban-centric living.

Interested in New Launches? Calculate your payments with 99.co’s

Progressive Payments Calculator

Zyon Grand vs. Promenade Peak

Promenade Peak, launched in August 2025, sits right next door and naturally becomes the clearest benchmark for buyers weighing between the two. While Promenade Peak focuses on larger, more premium layouts aimed at the luxury segment, Zyon Grand adopts a more investor-friendly approach with compact, efficient units and lower entry prices.

Within a budget of S$1.5 million to S$2.5 million, buyers at Zyon Grand can comfortably afford 2-bedroom and even selected 3-bedroom units — something that would be out of reach at Promenade Peak. This lower quantum offers a compelling entry point for both investors and young families looking for a foothold in the River Valley area.

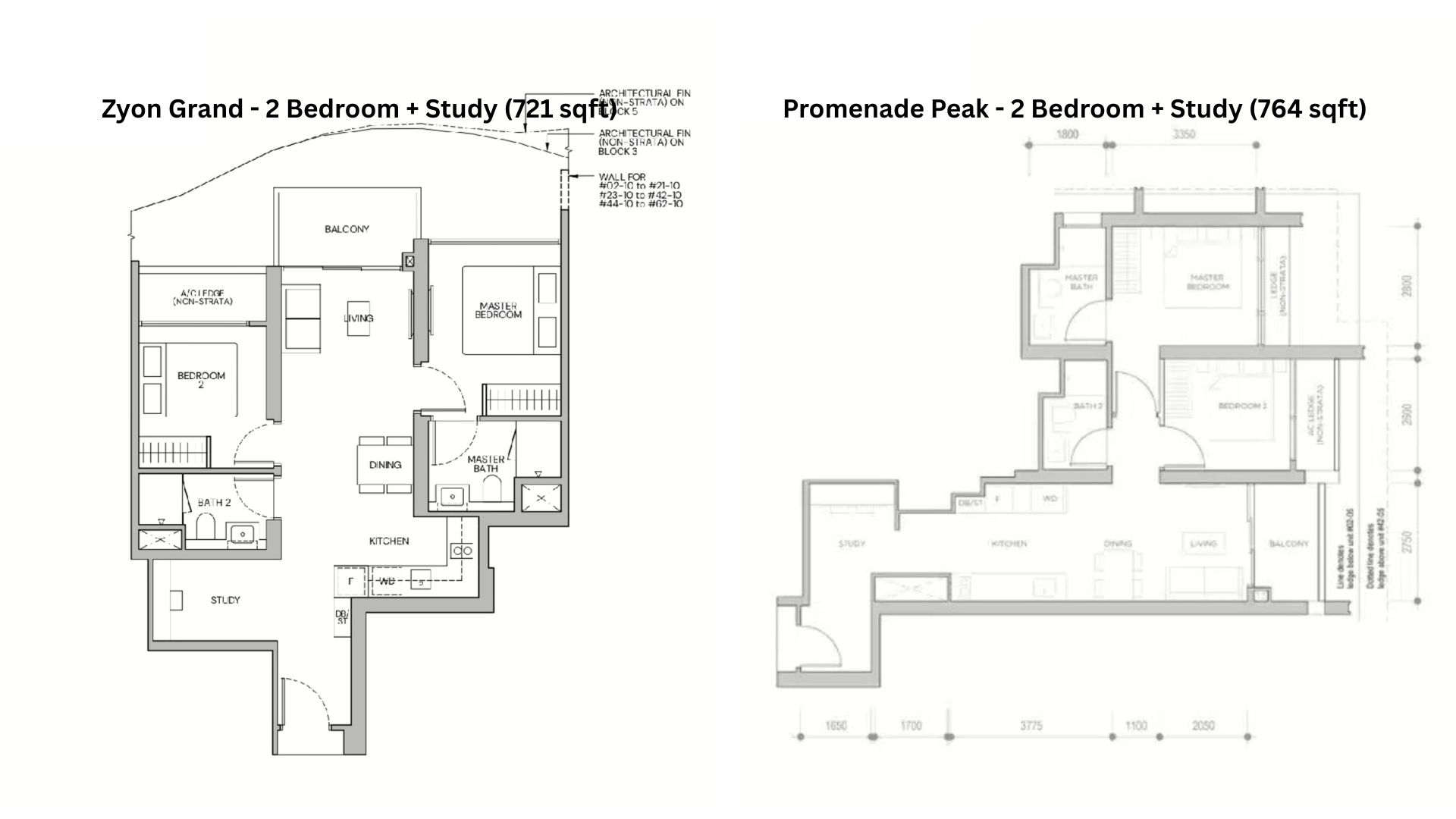

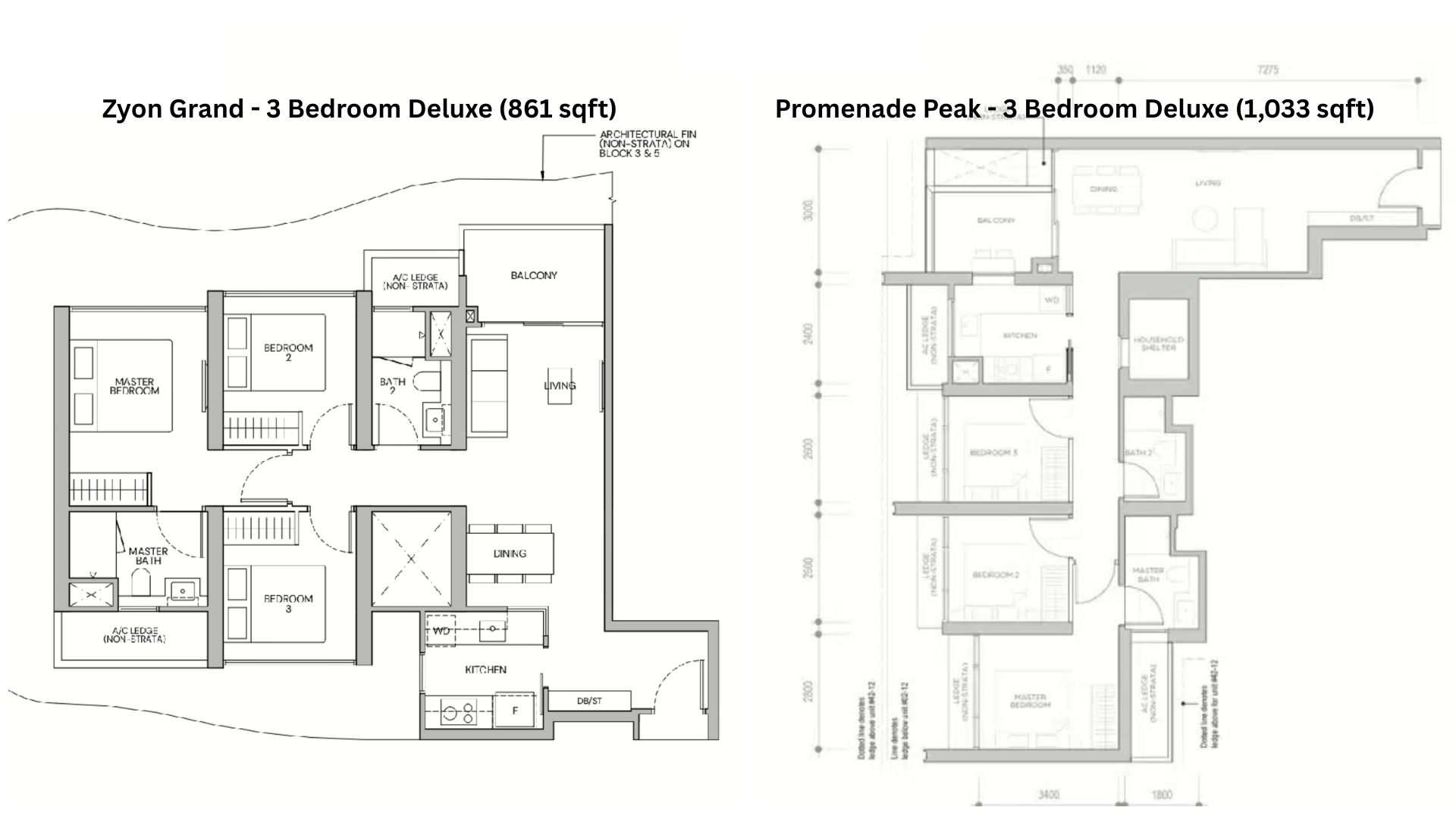

Layout comparison

Layout efficiency is another area where Zyon Grand quietly excels. Although Promenade Peak has marginally larger interiors, some smaller units feature less conventional L-shaped layouts, creating rectangular living areas with bedrooms positioned side by side and facing the bathrooms. This design choice likely stems from a floorplate optimised for the larger, premium units.

In contrast, Zyon Grand’s 2-bedder + study and 3-bedder deluxe layouts are more traditional and efficient, with straightforward layouts that appeal to tenants and owner-occupiers alike. From a resale and rental perspective, such efficiency often translates to stronger long-term demand.

Against the resale condo options in the area

| Project | TOP | Average PSF |

| Irwell Hill Residences | 2024 | S$2,941 |

| Rivière | 2023 | S$2,814 |

| Martin Modern | 2021 | S$2,727 |

Among nearby 99-year leasehold resale developments, Zyon Grand’s pricing remains attractive. With an average psf of around S$2,900, Irwell Hill Residences is already priced almost on par with the latest new launches. This narrow gap makes resale units less appealing to buyers who tend to favour projects with longer leases, modern designs, and newer facilities.

Recent resale transactions from these nearby developments also reveal the current market benchmarks:

- 1-bedroom unit: Around S$1.38 million

- 2-bedroom unit: Between S$1.94 million and S$2.24 million

- 3-bedroom unit: Between S$2.61 million and S$3.25 million

By offering more efficient layouts, Zyon Grand manages to keep overall quantum prices within easier reach, even if its psf rates may appear slightly higher. This approach ensures accessibility to a broader buyer pool without compromising on prime location or quality.

And if recent launches are any indication, buyers today are less focused on finding the lowest psf. What matters more is the total outlay, whether the price feels manageable, and whether the layout is practical. This is why smaller, well-priced units at nearby projects like River Green were the first to sell, reflecting the market’s growing emphasis on affordability and functionality.

What SA2 means for buyers and investors

The 36-storey long-stay serviced apartments (SA2) tower within Zyon Grand operates under a unique setup — it is entirely managed by the developer under single ownership, meaning none of its units are available for individual sale. In essence, it functions much like a high-end hotel, complete with its own private facilities and management team, entirely separated from the condominium’s residential blocks.

This arrangement works in favour of Zyon Grand’s private homeowners. The serviced apartment component caters to a different market segment, typically commanding much higher rates than conventional condo rentals. As a result, it poses little competition to the private rental market, ensuring that landlords here retain strong leasing demand.

From a long-term investor’s point of view, SA2’s presence can actually be beneficial. It naturally generates a pipeline of potential buyers — expatriates or professionals who may start off staying in the serviced apartment before seeking permanent accommodation nearby. Having already experienced the River Valley lifestyle and the convenience of direct MRT access, many could even transition into purchasing within the same neighbourhood.

That said, the greater concern for investors lies instead in the large influx of units from neighbouring launches, such as Promenade Peak and River Green, along with existing stock from older developments in River Valley.

Still, the developer’s decision to separate the serviced apartment tower from the private residences is a thoughtful one. It preserves a sense of exclusivity and privacy for homeowners, ensuring that Zyon Grand retains its premium image and resale appeal within an integrated, high-density development.

Resale market outlook for Zyon Grand

Focusing more on the local buyers, the River Valley resale market tends to be dominated by private condo upgraders rather than first-time buyers. Caveat data from recent TOP-ed projects like Irwell Hill Residences and Martin Modern confirms this trend — most buyers are upgrading from other private homes instead of HDB flats.

This means that Zyon Grand’s eventual resale demand will hinge on how well its unit mix appeals to these upgraders. Investors or buyers with resale concerns in the future can pick from compact 2-bedroom units that may attract affluent singles or couples, or 3-bedroom types that will likely appeal to young families seeking newer and better layouts.

Historically, resale performance in the area has been stable. Martin Modern, for example, has achieved an annualised capital gain of 2.6%, while Irwell Hill Residences sits at around 2% since its initial launch. These figures suggest that well-located, new developments in the area tend to retain value, provided they are priced right and have a clear market position.

⚖️ Our final take on Zyon Grand

Zyon Grand enters a fiercely competitive market but brings a clear strategy to the table — offering strong connectivity, a mixed-use lifestyle concept, and well-priced units in a prime location. Its integrated status and direct MRT access set it apart from nearby launches, while its compact layouts and lower quantum prices make it accessible to both first-time investors and home upgraders.

The next-door Promenade Peak, of course, may still appeal to those seeking larger, more luxurious homes, but Zyon Grand is the more pragmatic choice for value-conscious buyers who want central convenience without having to cross the S$3,000 psf threshold.

Stay updated with the latest news and insights on Singapore’s new launch market here.

The post Evaluating Zyon Grand’s real value against the crowded River Valley market appeared first on .