Singapore’s private property market is about to enter a new phase of tighter regulation, with the Government rolling out enhanced rules to better protect buyers and raise overall industry standards.

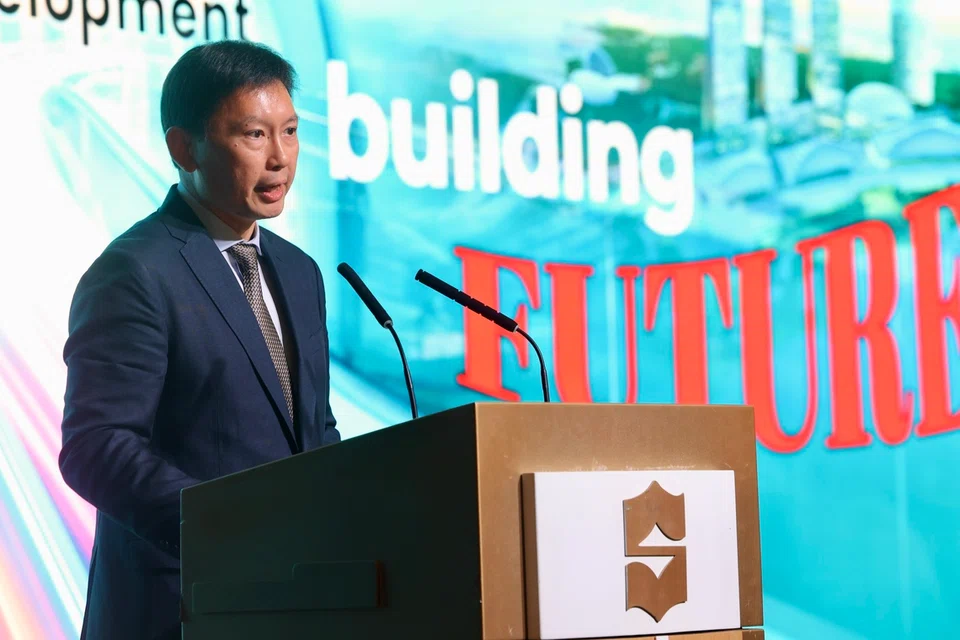

Announced by National Development Minister Chee Hong Tat at the Real Estate Developers’ Association of Singapore (Redas) 66th anniversary dinner on Nov 13, these changes are scheduled to kick in from early 2026. They focus on three core areas: clearer project disclosures, stronger accountability for developers, and more realistic timelines for defect reporting and ownership takeover.

Together, they mark a shift towards a more transparent and buyer-centric private housing market. While the changes clearly strengthen buyer protection, Mr Chee also emphasised that they benefit developers by creating a more level and transparent operating environment.

With clearer requirements across disclosures, quality reporting and defect timelines, developers are no longer competing on ambiguous marketing claims alone. Instead, there is increased emphasis on consistency, quality, and accountability.

Clearer disclosures to reduce buyer-developer disputes

One of the most direct changes is the requirement for developers to provide more detailed information in their sales documents. Under the new rules, developers must mark out structural walls and refuse chambers directly on site plans. This may sound minor, but it addresses a long-standing pain point for many buyers — layout misunderstandings after purchase.

Structural walls affect renovation flexibility, while refuse chambers can influence noise, hygiene, and even resale appeal. By making these features visible upfront, buyers can make more informed decisions instead of discovering these constraints only after collecting keys.

Currently, developers only need to submit scaled floor plans and site plans based on approved building plans at the point of sale. These do not always communicate practical usability or hidden constraints clearly enough. The revised requirements aim to close that information gap.

In practical terms, this also sets higher expectations for developers, especially in how they communicate design features and limitations during the marketing and sales process.

Developer track records to be made transparent for buyers

To further improve buyer decision-making, developers will soon need to disclose their past project quality records, including their CONQUAS ratings.

CONQUAS (Construction Quality Assessment System) is Singapore’s national benchmark for construction quality. It evaluates projects based on workmanship and finishing standards, and is typically applied to larger developments with contract values above S$5 million, including most private condominiums.

The assessment is carried out across three key components:

- Internal finishes

- Installation methods and functional tests

- External finishes

By making this track record accessible to buyers, the Government is effectively introducing a quality reference point for private developers. Over time, this could influence how buyers perceive different developers, especially for those choosing between multiple new launches in the same area or price range.

It also creates a subtle but important competitive pressure. Developers with consistently high-quality builds stand to benefit, while others may need to rethink their construction standards and after-sales quality control.

Longer defect liability window for buyers

Another significant change involves the defects liability period and when certain homeowner responsibilities begin. Currently, the one-year defects liability period and maintenance charge obligations start either:

- On the date of vacant possession, or

- 15 days after the progress payment notice is issued at the Temporary Occupation Permit (TOP) stage, whichever is earlier.

From early 2026, that 15-day lead time will be extended to 35 days.

What’s the reasoning behind this? Developers have up to 21 days after receiving the progress payment to deliver vacant possession. Under the current system, parts of the defects liability period might already be counting down even before buyers physically receive their keys.

By shifting the timeline to 35 days, the Government is aligning the start of the defects period more closely to when buyers actually get access to their homes. This gives owners more realistic time to inspect their units thoroughly and report issues, especially those that are not immediately visible.

In the long run, this can encourage more complete and fair defect rectification processes, reducing friction between buyers and developers during the handover stage. This might also gradually shape industry behaviour, with more players focusing not just on design and pricing, but also on post-completion reputation.

Housing supply to remain elevated despite slight moderation

Alongside regulatory changes, the Government also reiterated its commitment to maintaining a strong housing supply to meet demand and manage price pressures. Between 2025 and 2027, around 55,000 Build-To-Order flats will be launched, which is higher than the earlier target of 50,000 units. On the private side, more than 25,000 residential units will be released through the GLS programme over the same period.

For H2 2025, the confirmed list under the GLS programme offers sites for 4,725 private homes, a 6.1% drop from the 5,030 units in H1 2025. While this looks like a pullback on paper, analysts point out that supply levels remain significantly higher than what the market saw between 2015 and 2023.

In H1 2026, the confirmed list will include land for about 4,500 new private residential units. This forms part of a gradual moderation strategy after several years of aggressive supply ramp-up to cool the market.

Interested in New Launches? Calculate your payments with 99.co’s

Progressive Payments Calculator.

Market impact and what comes next

Recent private home price growth has started to moderate, supported by increased new launch supply and shifting interest rate conditions. According to the Urban Redevelopment Authority (URA), private home prices inched up 0.9% Q-o-Q in the third quarter of 2025. This marks a slight slowdown from the 1.0% rise in Q2.

However, easing borrowing costs could bring more buyers into the market and possibly drive prices upward, especially with several highly anticipated launches with strong locations lining up.

Pinery Residences and River Modern are among the upcoming projects expected to enter the market in early 2026. Developed by Hoi Hup-Sunway, Pinery Residences is a mixed-use development located a stroll away from the Tampines West MRT station. River Modern by GuocoLand, on the other hand, is adjacent to River Green, which launched earlier this year with a strong take-up, leaving only a handful of units unsold by now.

This puts the Government in a careful balancing act — maintaining sufficient supply to manage prices, while allowing the market to adjust organically as sentiment and financing conditions change.

For buyers, the upcoming changes signal a more structured and transparent buying environment. While they won’t eliminate all risks, they do tilt the playing field more firmly towards informed decision-making and fairer protection. As these policies unfold in 2026, they could reshape how buyers evaluate new launches, how developers position their projects, and how quality becomes a stronger differentiator in an increasingly competitive market.

Looking to sell your current home to upgrade? Book a FREE consultation with

99 advisors

to maximise your sale.

The post New private housing regulations offer stronger safeguards for homebuyers appeared first on .