December 2025 saw a clear rebound in Singapore’s rental market after a softer November, driven mainly by a rise in leasing activity across both private condominiums and HDB flats. Commenting on the latest figures, Mr. Luqman Hakim, Chief Data & Analytics Officer at 99.co, noted that year-end typically brings renewed momentum, “as expatriates arrive ahead of January work commencements, tenants secure homes before the new school term, and companies wrap up relocation arrangements”.

Table of contents

- Condo rental market: 13.4% increase in volumes

- HDB rental market: 12.9% increase in volumes

- Market outlook: A more balanced rental landscape entering 2026

Condo rental market: 13.4% increase in volumes

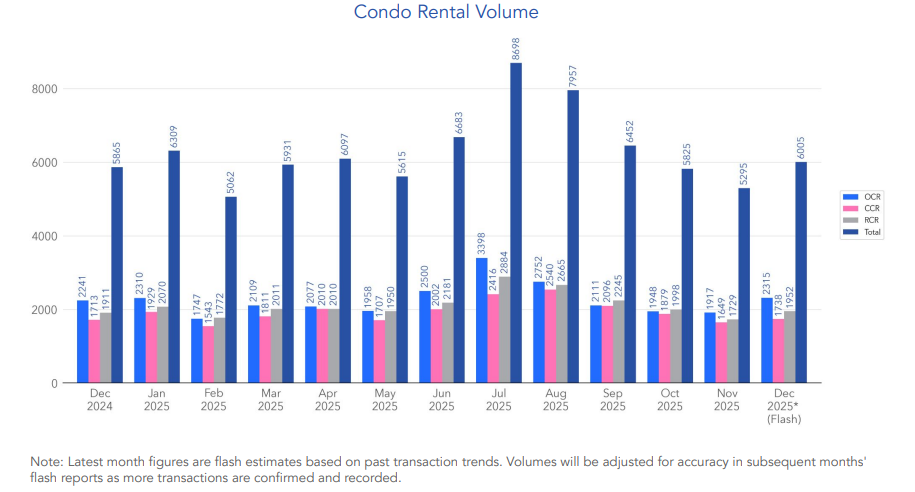

An estimated 6,005 condo units were leased in December, representing a sharp 13.4% month-on-month increase from November’s 5,295 units. Volumes were also 2.4% higher than a year ago, although they remained 8.6% below the five-year December average.

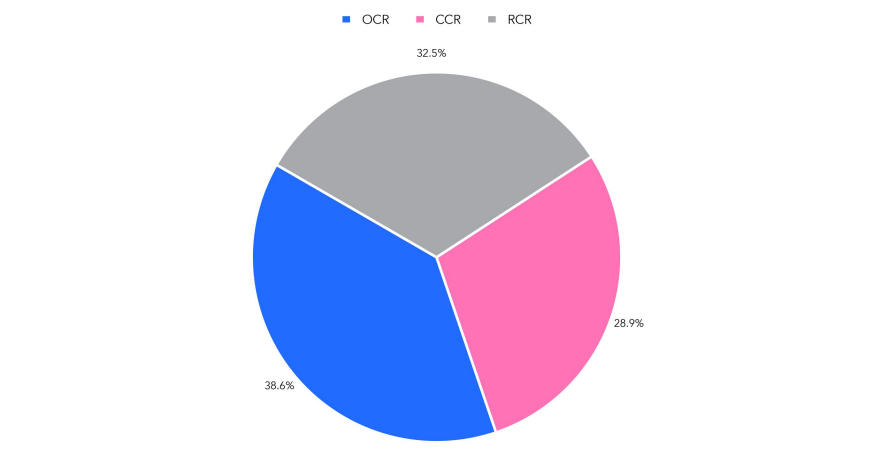

Outside Central Region (OCR) continued to anchor leasing demand, accounting for 38.6% of all condo rental transactions in December. The Rest of Central Region (RCR) followed with 32.5%, while the Core Central Region (CCR) made up the remaining 28.9%. This distribution highlights the continued preference for relatively more affordable rental options amid stabilising rent levels.

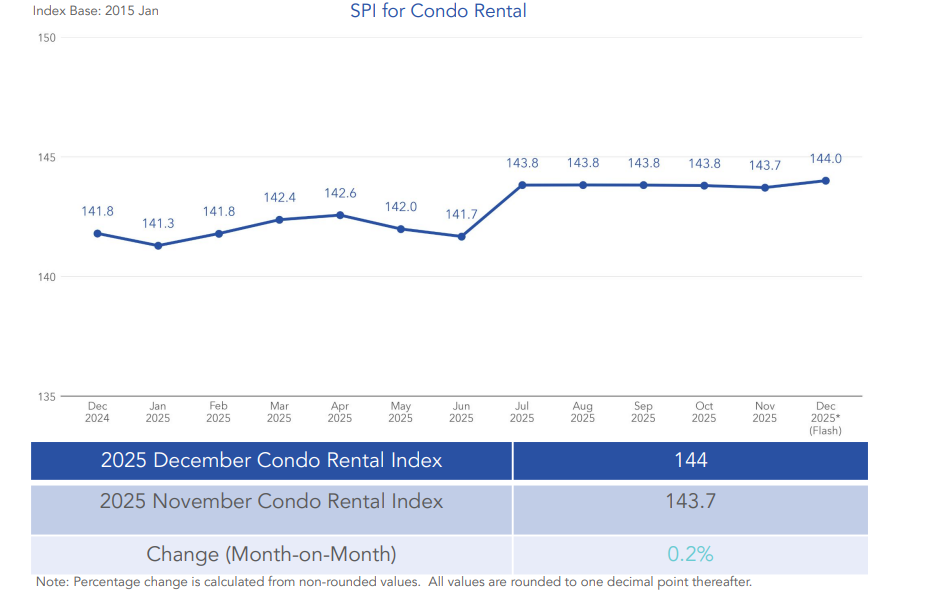

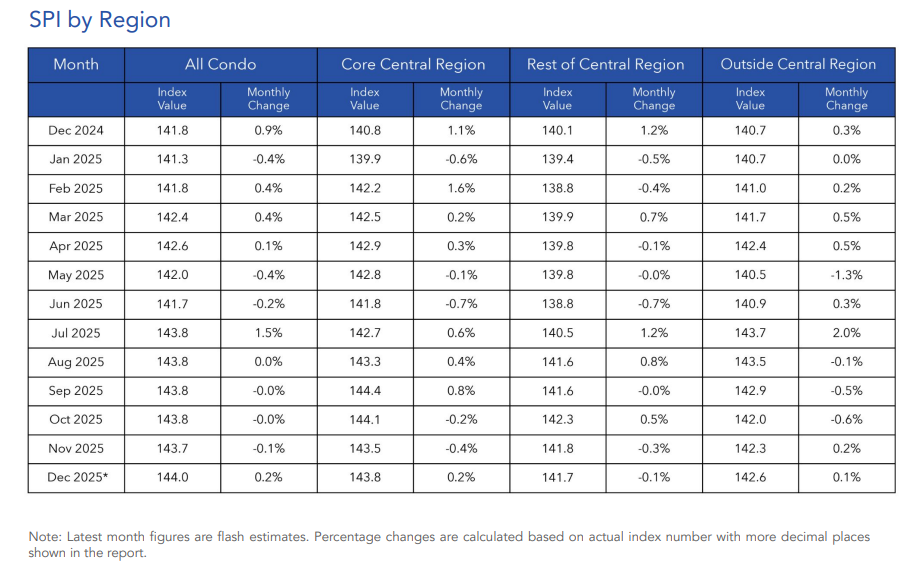

Despite the surge in activity, month-on-month rental price growth remained modest. Overall condo rental prices rose by 0.2% in December 2025, bringing the rental price index to 144, up from 143.7 in November. Compared to a year ago, condo rental prices were 1.6% higher than in December 2024.

On a year-on-year basis, Mr. Luqman noted that prices continued to edge higher, but at a much slower pace than in 2023 and 2024. “This suggests that the condo rental market has largely settled into a more balanced and stable phase,” he added.

By region, price movements remained uneven. CCR and OCR both recorded modest month-on-month increases of 0.2% and 0.1%, respectively, while rents in the RCR dipped slightly by 0.1%. Despite this, all three regions still posted year-on-year growth, led by CCR at 2.1%, followed by OCR at 1.3% and RCR at 1.1%.

HDB rental market: 12.9% increase in volumes

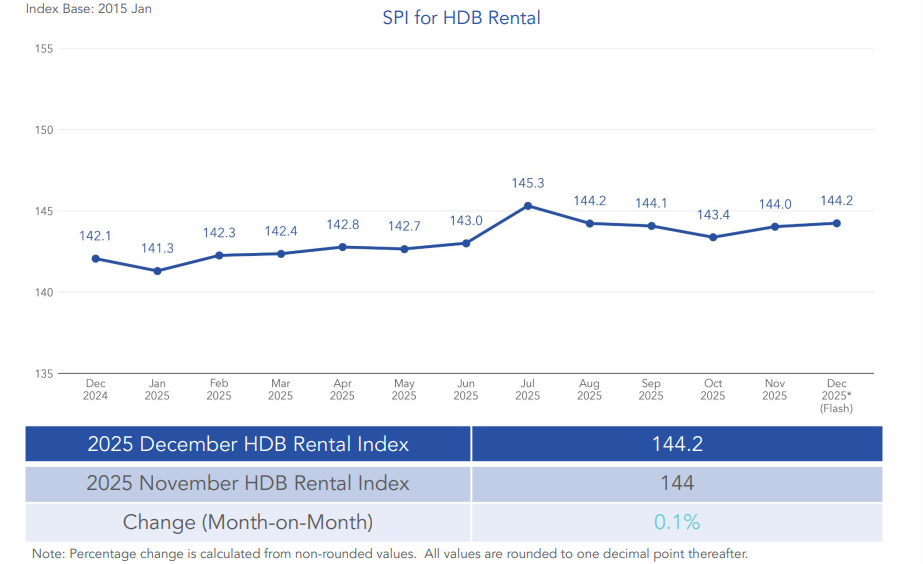

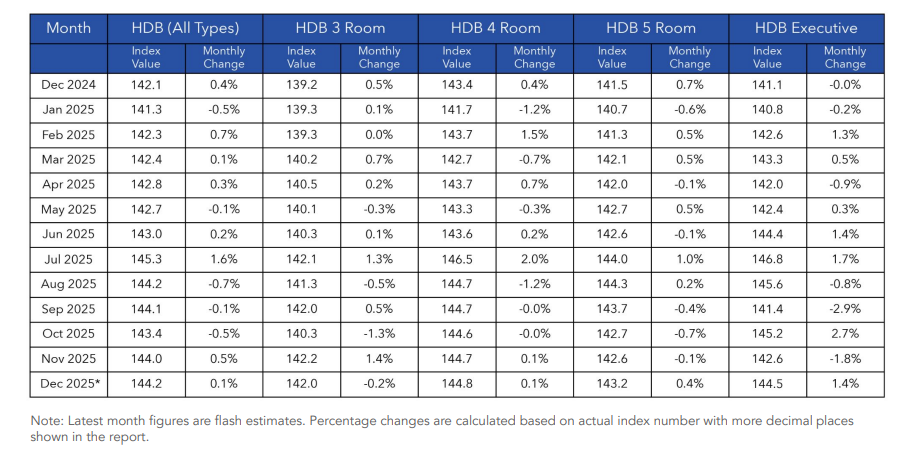

A similar pattern played out in the HDB rental market, with volumes showing a more pronounced rise compared to prices. Overall HDB rental prices in December edged up by just 0.1% month-on-month, with the rental index inching up to 144.2 from 144 in November.

Mr. Luqman highlighted that “rental prices were broadly stable in December, with only a marginal increase recorded,” adding that while annual growth remained positive, it was contained. Compared to December 2024, HDB rental prices were 1.5% higher.

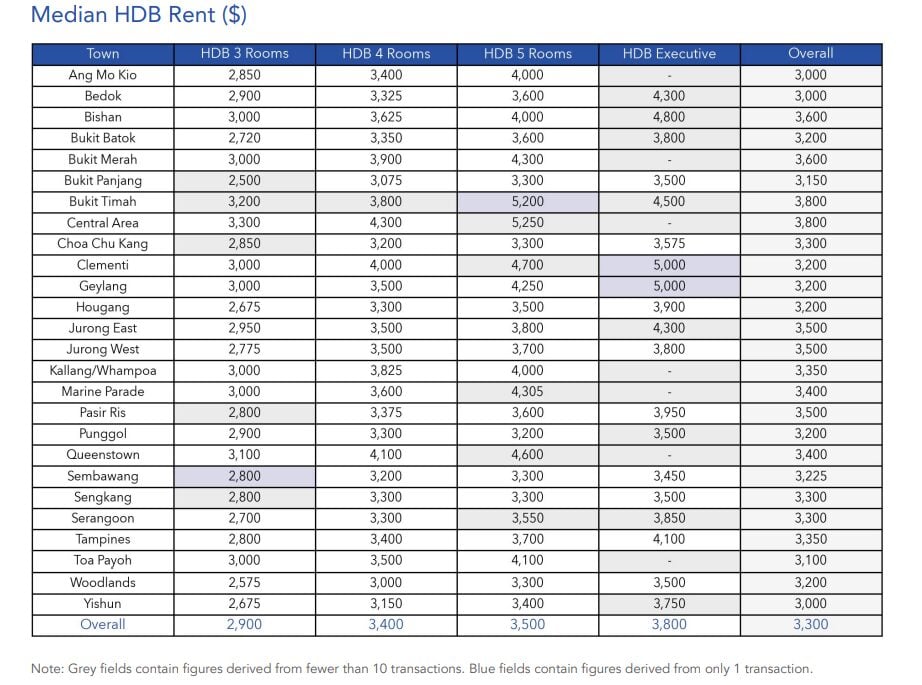

The median HDB rental price in December 2025 is as follows:

Price movements varied across towns and flat types. Rental prices in Mature estates rose by 0.4% month-on-month, while Non-Mature estates saw no change. By flat type, 3-room rents dipped slightly by 0.2%, while 4-room, 5-room and Executive flats recorded increases of 0.1%, 0.4% and 1.4% respectively.

On a year-on-year basis, rental prices increased across all flat types, led by Executive flats at 2.4%, followed by 3-room flats at 2%, 5-room flats at 1.2%, and 4-room flats at 1%. Mature estates also continued to outpace Non-Mature estates in annual price growth, rising 2.1% compared to 0.9%.

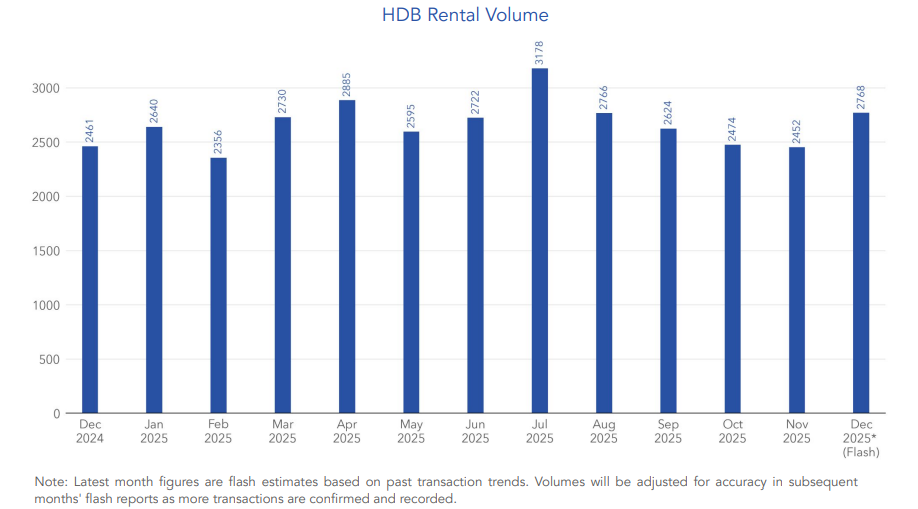

Similar to the activity surge seen in the private market, an estimated 2,768 HDB flats were rented in December, up 12.9% from November’s 2,452 units. Mr. Luqman also pointed out that the rise in volumes was likely supported by deferred November transactions being completed, year-end household moves, and continued demand from families waiting for their BTO flats to be completed.

This month’s figure was also 12.5% higher than December 2024 and notably 2.9% above the five-year December average, indicating resilient and sustained demand for public housing rentals.

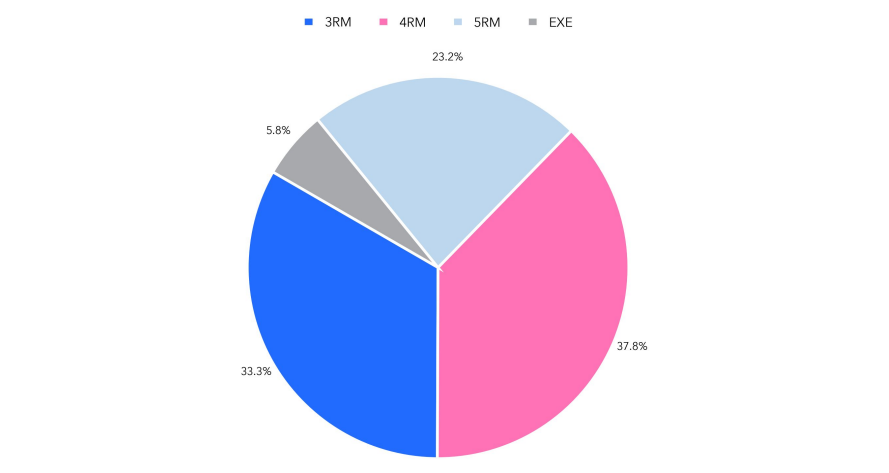

In terms of unit mix, 4-room flats made up the largest share of transactions at 37.8%, followed by 3-room flats at 33.3%. 5-room flats accounted for 23.2%, while Executive flats formed the remaining 5.8% of total rental volume.

Market outlook: A more balanced rental landscape entering 2026

Taken together, December’s data reinforces the view that Singapore’s rental market has transitioned away from the volatility of the past two years. Both condo and HDB segments experienced a clear year-end rebound in leasing activity, yet rental prices showed little urgency to move sharply higher.

Notably, HDB rental volumes exceeding the five-year December average suggest that public housing continues to absorb tenant demand that might otherwise spill over into entry-level condominium units. As Mr. Luqman observed, this trend indicates that HDB rentals remain a key pressure valve in the broader rental ecosystem.

Heading into early 2026, leasing demand is likely to stay supported by seasonal factors, including expatriate arrivals and household transitions. However, with price growth moderating across both markets, tenants may find conditions more predictable, while landlords may need to remain realistic in their rental expectations.

The post Year-end leasing drives strong condo and HDB rental rebound in December 2025 appeared first on .